High Throughput Screening Market Size, Share, Trends, Industry Analysis Report

: By Offerings (Consumables, Instruments, Services, Software), By Technology, By Application, By End User, and By Region – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5087

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

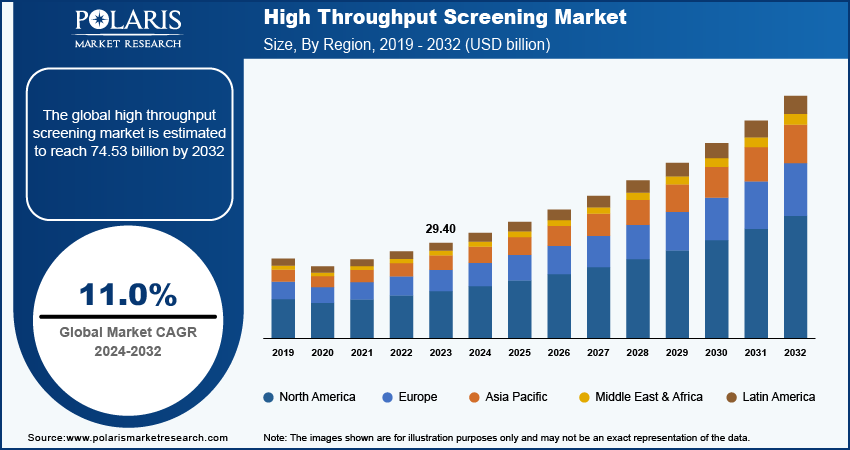

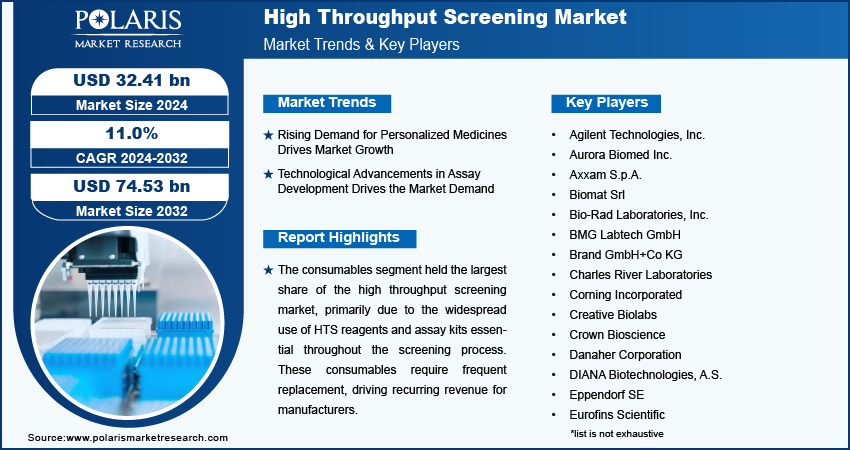

The high throughput screening market was valued at USD 33.13 billion in 2024, growing at a CAGR of 11.01% during 2025–2034. The widespread use of high throughput screening (HTS) in drug discovery and research for testing genes, chemicals, and antibodies is a key factor fueling market growth.

Key Insights

- The consumables segment dominated the market in 2024, owing to the widespread use of HTS reagents and assay kits essential throughout the screening process.

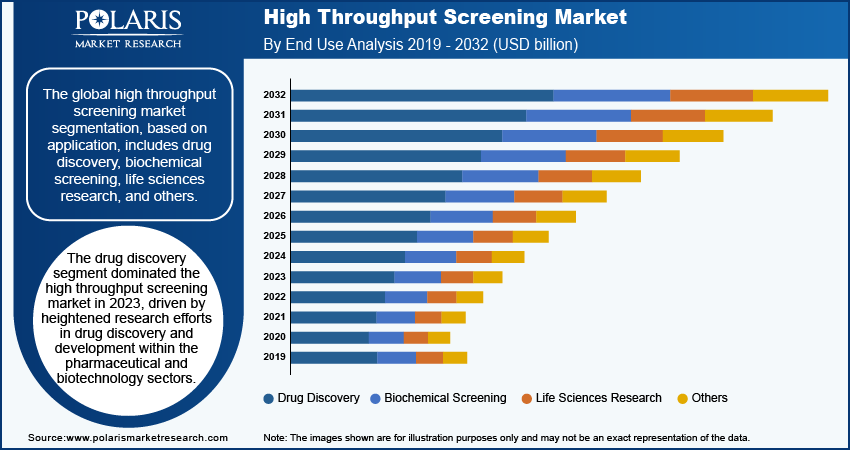

- The drug discovery segment accounted for the largest market share in 2024. The segment’s dominance is primarily attributed to increased research efforts in drug discovery and development within the biotechnology and pharmaceutical sectors.

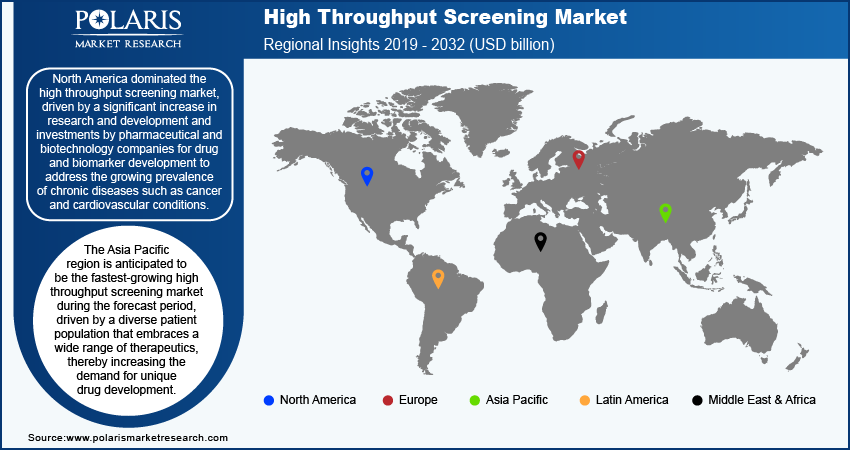

- North America led the market in 2024, primarily driven by a significant surge in R&D and investments by pharmaceutical and biotechnology companies for biomarker and drug development.

- Asia Pacific is projected to register the fastest CAGR due to the region’s diverse patient population embracing a wide range of therapeutics.

Industry Insights

- The shift towards personalized medicine is driving the demand for HTS, as it allows for the rapid identification of biomarkers associated with diseases and treatment processes.

- Technological advancements in assay development, including the miniaturization of assays, is fueling market expansion.

- The rising demand for HTS consumables is expected to create several market opportunities in the coming years.

- Data management and analysis challenges may hinder market growth.

Market Statistics

2024 Market Size: USD 33.13 billion

2034 Projected Market Size: USD 93.92 billion

CAGR (2025-2034): 11.01%

North America: Largest Market in 2024

AI Impact on High Throughput Screening Market

- AI accelerates compound screening by rapidly analyzing vast datasets. This helps reduce time in early drug discovery stages.

- Machine learning models identify promising molecular interactions with higher precision, lowering false positives and negatives.

- Automated decision-making enhances assay design and optimizes experimental workflows.

- Integration of AI with robotics and cloud platforms supports large-scale, cost-effective screening. This integration drives innovation and enables pharmaceutical companies to bring new therapies to market faster.

To Understand More About this Research: Request a Free Sample Report

The high throughput screening market is experiencing robust growth driven by the increasing prevalence of chronic diseases, and the persistent need for effective treatments have fueled a surge in drug discovery service initiatives worldwide. HTS is a method widely used in drug discovery and research to quickly test millions of chemicals, genes, or pharmacological agents. Its purpose is to identify active compounds, antibodies, or genes that impact specific biomolecular pathways. This process uses automated systems and advanced software to handle and analyze a large volume of samples efficiently. According to the WHO, non-communicable diseases (NCDs) cause 41 million deaths annually, with 17 million premature deaths occurring mainly in low and middle-income countries, where cardiovascular diseases account for 17.9 million deaths, followed by cancers (9.3 million), chronic obstructive pulmonary disease (4.1 million), and diabetes (2 million). This raises the demand for high throughput screening tests.

HTS has emerged as a technology in the healthcare sector, revolutionizing the speed and efficiency of identifying potential drug candidates. Automating the assessment of extensive libraries of chemical compounds against disease targets, HTS accelerates the early stages of drug discovery. This capability is particularly crucial in tackling complex diseases where traditional methods would be too slow or labor-intensive. HTS allows researchers to quickly evaluate thousands to millions of compounds, pinpointing those suitable for further development. This speedy screening process accelerates the discovery of lead compounds and also enhances the likelihood of finding molecules with pharmacological properties. As a result, pharmaceutical companies and research institutions are increasingly investing in HTS technologies to rise their pipelines with new therapeutic candidates. For instance, in February 2022, Bruker's Sierra launched the SPR-32 Pro platform, which enables high-throughput multiplexed assays for precise insights into molecular interactions in drug discovery.

Continuous advancements in robotics, automation, and software have also revolutionized HTS platforms, significantly enhancing their efficiency and capabilities. Automating repetitive tasks such as sample handling, compound screening, and data analysis, modern HTS systems optimize workflows and accelerate the evaluation of extensive compound libraries. Moreover, advancements in software have improved the integration of HTS data with downstream analysis tools, facilitating quicker decision-making in drug discovery and development processes.

Market Dynamics

Rising Demand for Personalized Medicines

The high throughput screening is being driven by the shift towards personalized medicine, representing a transformative approach in healthcare, aiming to tailor medical treatments to individual patients based on their unique genetic makeup, environmental exposures, and lifestyle factors. HTS is pivotal in this paradigm shift by enabling the rapid identification of personalized medicine biomarkers associated with diseases and treatment responses.

Through HTS, researchers screen large numbers of genetic analysis, proteins, and other molecular targets to pinpoint those most relevant to individual patient profiles. This capability enhances understanding of disease mechanisms at a molecular level and also facilitates the development of targeted therapies and personalized medicines through overall process analysis. For instance, in February 2024, SCIEX's Echo MS+ system enhanced high-throughput screening in drug discovery, supporting personalized medicine through precise qualitative and quantitative analysis. Moreover, HTS supports the discovery and validation of biomarkers that serve as indicators for disease diagnosis, prognosis, and treatment response prediction. Healthcare providers make informed decisions about personalized treatment strategies by integrating data from HTS with clinical and demographic information, optimizing patient outcomes and improving overall healthcare efficiency.

Increasing Advancements in Assay Development

Technological advancements in assay development have revolutionized high throughput screening (HTS), making it a cornerstone in pharmaceuticals, biotechnology, and academic research. Miniaturization of assays allows researchers to perform screenings with reduced sample and reagent volumes, significantly lowering costs and increasing throughput. This innovation has streamlined the process of testing large compound libraries against disease targets, accelerating drug discovery timelines. Furthermore, multiplexing technologies enable simultaneous measurement of multiple molecular targets within a single assay, providing comprehensive insights into complex biological processes. This capability is crucial for understanding disease mechanisms and identifying potential therapeutic candidates with higher specificity and efficiency.

High-content screening (HCS) represents another leap forward, combining HTS with advanced imaging and automated analysis techniques. HCS allows researchers to assess cellular morphology, protein localization, and other complex phenotypic characteristics across large-scale assays. These technological advancements collectively expand the scope and capability of HTS, empowering researchers to tackle diverse biomedical challenges and accelerate the development of novel therapies tailored to specific diseases and patient profiles, driving the market revenue.

Segment Insights

Assessment by Type

The global high throughput screening market segmentation, based on type, includes consumables, instruments, services, and software. The consumables segment held the largest share in 2024, primarily due to the widespread use of HTS reagents and assay kits essential throughout the screening process. These consumables require frequent replacement, driving recurring revenue for manufacturers.

The growing demand for HTS consumables supports the overall growth opportunities. Some of the factors contributing to this demand include the expansion of pharmaceutical research and development activities and higher government funding for life sciences research and drug discovery and research. For instance, in July 2022, The Council of Scientific and Industrial Research (CSIR) in India made a significant investment of USD 6.73 million in research and development (R&D) activities focused on drug discovery and development.

Evaluation by Platform Features

The global high throughput screening market segmentation, based on application, includes drug discovery, biochemical screening, life sciences research, and others. The drug discovery segment dominated the market in 2024, driven by heightened research efforts in drug discovery and development within the pharmaceutical and biotechnology sectors. HTS’s integration with genomics, proteomics, and computational biology enhances its ability to identify and validate drug candidates more effectively. Additionally, increased support and partnerships from government agencies and research institutions aimed at accelerating drug discovery processes further bolstered growth in this application segment.

Regional Insights

By region, the report provides the high throughput screening market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the high throughput screening market revenue share in 2024, driven by a significant increase in research and development and investments by pharmaceutical and biotechnology companies for drug and biomarker development to address the growing prevalence of chronic diseases such as cancer and cardiovascular conditions. According to the International Agency for Research on Cancer, in 2022, there were 20 million new cancer cases and 9.7 million cancer-related deaths worldwide, with projections for 2040 reaching 29.9 million new cases and 15.3 million deaths. Such rising cancer patients in North America drives the growth opportunities. Additionally, the region's increased healthcare expenditure supports the adoption of advanced screening technologies, further propelling the growth.

The Asia Pacific high throughput screening industry is projected to witness the fastest growth during the forecast period, driven by a diverse patient population that embraces a wide range of therapeutics and digital therapeutics, thereby increasing the demand for unique drug development. Also, the market is driven by rapid growth in the pharmaceutical and biotech industries, increasing investments, cost advantages, supportive government initiatives, and rising disease burden. According to Government of India initiatives projections, in January 2024, India's Pharma-MedTech sector endeavors to enhance its global stature through robust R&D and innovation, aiming to grow the pharmaceutical industry from USD 50 billion to USD 120-130 billion and the medical technology sector from USD 11 billion to USD 50 billion by 2030. Additionally, advancements in HTS technologies are improving drug discovery efficiency, making the region a pivotal hub for pharmaceutical innovation.

Key Players & Competitive Analysis Report

The high throughput screening (HTS) landscape is experiencing robust evolution, primarily driven by technological advancement in automation, miniaturization, and artificial intelligence integration. Industry analysis identifies Thermo Fisher Scientific, Danaher Corporation, and Agilent Technologies as dominant players who have established leadership through comprehensive product portfolios spanning reagents, equipment, and software solutions. These leaders are strategically focusing on partner & customer ecosystem development to maintain competitive positioning. The sector is witnessing substantial disruptions and trends in assay methodologies, with phenotypic screening gaining momentum alongside traditional target-based approaches. Small and medium-sized businesses are carving specialized niches through innovative assay development services and AI-driven data analysis platforms. Strategic alliances between instrument manufacturers and consumable suppliers are reshaping value propositions, particularly in pharmaceutical discovery applications. A latent demand and opportunities are emerging in precision medicine applications, where high-content analysis capabilities enable more sophisticated drug development pathways. Future development strategies increasingly emphasize integrated workflows, reduced sample volumes, and enhanced data analytics capabilities. Digitalization across the drug discovery continuum is expanding the total addressable market, while regulatory dynamics around clinical validation present key strategic challenges for emerging technologies. A few key major players are Agilent Technologies, Inc., Aurora Biomed Inc., Axxam S.p.A., Biomat Srl, Bio-Rad Laboratories, Inc., BMG Labtech GmbH, Brand GmbH+Co KG, Charles River Laboratories, Corning Incorporated, Creative Biolabs, Crown Bioscience, Danaher Corporation, DIANA Biotechnologies, A.S., Eppendorf SE, Eurofins Scientific, Gilson Incorporated, Greiner AG, Hamilton Company, HighRes Biosolutions, Lonza, Merck KGaA, Mettler-Toledo International Inc., Porvair Plc, Revvity, Inc., Sartorius AG, Sygnature Discovery Limited, Tecan Group Ltd., Thermo Fisher Scientific Inc., Waters Corporation.

Agilent Technologies, Inc. specializes in life sciences, diagnostics, and applied markets; headquartered in Santa Clara, California, and serves customers in over 110 countries with a workforce of approximately 18,000 employees. Established in 1999 as a spin-off from Hewlett-Packard, Agilent has built a strong reputation for providing advanced instruments, software, consumables, and services that support research, diagnostics, and quality assurance across diverse industries, such as pharmaceuticals, biotechnology, and environmental sciences. In the field of HTS, Agilent is recognized as an innovator, offering highly customizable and flexible solutions designed to optimize complex screening workflows in drug discovery, genomics, and functional biology. Their HTS platforms, such as the BioCel System, integrate automation, liquid handling, and environmental controls to accommodate a wide range of assay formats and protocols, ensuring high precision and throughput for compound screening and analysis. Agilent’s systems support seamless sample preparation, data acquisition, and analysis, enabling researchers to efficiently process large libraries of compounds or genetic materials with minimal manual intervention. Strategic investments in R&D and technology partnerships have allowed Agilent to continuously enhance its HTS product portfolio, such as the integration of advanced software and detection instruments, thereby maintaining its status as a trusted partner for laboratories seeking to accelerate scientific discovery and innovation in high-throughput environments.

Thermo Fisher Scientific Inc., headquartered in Waltham, Massachusetts, specializes in serving science, with a workforce of around 125,000 employees worldwide. Formed in 2006 through the merger of Thermo Electron and Fisher Scientific, the company provides an extensive portfolio of analytical instruments, laboratory equipment, specialty diagnostics, and life sciences solutions, supporting customers across pharmaceuticals, biotechnology, clinical diagnostics, and research institutions. In the field of HTS, Thermo Fisher offers integrated automation platforms, advanced detection systems, and comprehensive assay solutions designed to accelerate drug discovery and biological research. Their HTS technologies enable researchers to rapidly screen large libraries of compounds or genetic materials, streamlining the identification of potential drug candidates and biomarkers. Thermo Fisher’s solutions combine precision robotics, liquid handling, and high-content imaging with powerful data analysis software, ensuring scalability and reproducibility across a wide range of assay formats. The company’s continuous investment in innovation, combined with its industry-leading brands such as Thermo Scientific, Applied Biosystems, and Invitrogen, positions Thermo Fisher as a trusted partner for laboratories seeking to enhance productivity, reduce time-to-results, and drive scientific breakthroughs in high-throughput environments.

List of Key Companies

- Agilent Technologies, Inc.

- Aurora Biomed Inc.

- Axxam S.p.A.

- Biomat Srl

- Bio-Rad Laboratories, Inc.

- BMG Labtech GmbH

- Brand GmbH+Co KG

- Charles River Laboratories

- Corning Incorporated

- Creative Biolabs

- Crown Bioscience

- Danaher Corporation

- DIANA Biotechnologies, A.S.

- Eppendorf SE

- Eurofins Scientific

- Gilson Incorporated

- Greiner AG

- Hamilton Company

- HighRes Biosolutions

- Lonza

- Merck KGaA

- Mettler-Toledo International Inc.

- Porvair Plc

- Revvity, Inc.

- Sartorius AG

- Sygnature Discovery Limited

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

- Waters Corporation

High Throughput Screening Industry Development

September 2025: Axxam announced a strategic collaboration with B’SYS. According to Axxam, the collaboration aims to provide access to tested ion channel cell lines for identifying potential drug candidates using high-throughput electrophysiology.

April 2025: CytoTronics launched its Neural application for Pixel systems, enabling high-throughput drug screening for neurological diseases. The platform combines electrical imaging and electrophysiology in multiplexed assays, supporting 2D/3D cultures and scaling to 384-well plates for large-scale HTS workflows.

March 2025: HORIBA launched the PoliSpectra Rapid Raman Plate Reader (RPR) for high-throughput screening, enabling non-destructive, real-time analysis of 96 wells in one minute. The automated system integrates with liquid handlers and offers live process monitoring via patented rapid Raman technology.

May 2024: Twist Bioscience launched Twist Multiplexed Gene Fragments (MGFs), enabling high-throughput screening applications with pools of directly synthesized DNA fragments up to 500 base pairs in length.

December 2023: Piramal Pharma expanded its drug discovery capabilities with a new high-throughput screening facility in Ahmedabad, India, enhancing in-vitro biology services for comprehensive client support across research and development.

November 2022: Metrion Biosciences expanded with its new high throughput screening (HTS) capability and enlarged facilities in Cambridge, UK, enhancing ion channel drug discovery services for global clients.

High Throughput Screening Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Consumables

- Reagents & Assay Kits

- Laboratory Consumables

- Instruments

- Liquid Handling Systems

- Detection Systems

- Imaging Systems

- Others

- Services

- Software

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Cell-based Assays

- 2D Cell Culture

- 3D Cell Culture

- Scaffold-based Technology

- Scaffold-free Technology

- Reporter-based Assays

- Perfusion Cell Culture

- Lab-on-a-Chip Technology (LOC)

- Label-free Technology

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug Discovery

- Biochemical Screening

- Life Sciences Research

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Throughput Screening Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 33.13 billion |

|

Market Size Value in 2025 |

USD 36.69 billion |

|

Revenue Forecast in 2034 |

USD 93.92 billion |

|

CAGR |

11.01% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 33.13 billion in 2024 and is projected to grow to USD 93.92 billion by 2034.

The global market is projected to register a CAGR of 11.01% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Agilent Technologies, Inc., Aurora Biomed Inc., Axxam S.p.A., Biomat Srl, Bio-Rad Laboratories, Inc., BMG Labtech GmbH, Brand GmbH+Co KG, Charles River Laboratories, Corning Incorporated, Creative Biolabs, Crown Bioscience, Danaher Corporation, DIANA Biotechnologies, A.S., Eppendorf SE, Eurofins Scientific, Gilson Incorporated, Greiner AG, Hamilton Company, HighRes Biosolutions, Lonza, Merck KGaA, Mettler-Toledo International Inc., Porvair Plc, Revvity, Inc., Sartorius AG, Sygnature Discovery Limited, Tecan Group Ltd., Thermo Fisher Scientific Inc., Waters Corporation.

The consumables segment held the largest share of the market in 2024.

The drug discovery segment dominated the market in 2024.