High Protein Bakery Products Market Size, Share, Trends, Industry Analysis Report: By Product (Bread, Cookies, Muffins, Waffles, Pancakes, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5473

- Base Year: 2024

- Historical Data: 2020-2023

High Protein Bakery Products Market Overview

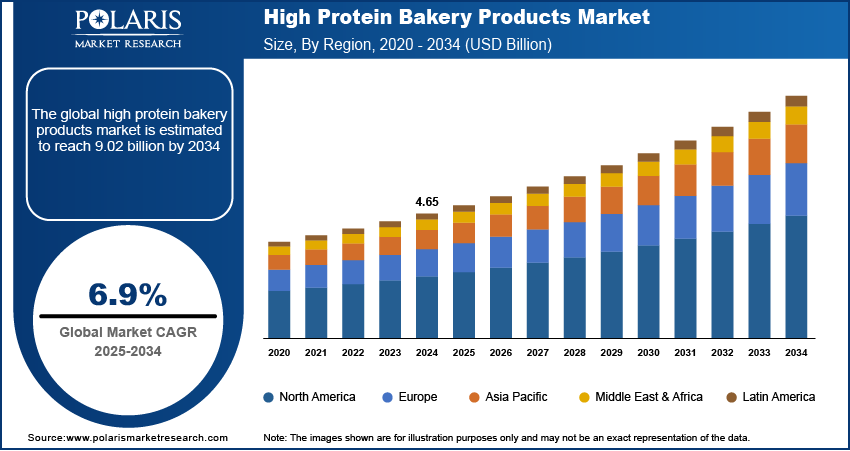

High protein bakery products market size was valued at USD 4.65 billion in 2024. The market is projected to grow from USD 4.96 billion in 2025 to USD 9.02 billion by 2034, exhibiting a CAGR of 6.9 % during 2025-2034.

High protein bakery products are baked goods formulated to contain a more protein than traditional baked products. They are designed to meet the growing demand for protein-rich foods, which are popular for their potential benefits in managing hunger and supporting weight control. High protein bakery products require careful selection of ingredients to ensure both increased protein content and improved nutritional quality. The ingredients of high protein bakery products are derived from plant sources, such as legumes, pseudocereals, and nuts.

The growing obese and diabetic population across the globe is propelling the high protein bakery products market growth. For instance, the World Obesity Federation published a report stating that the number of adults living with obesity will rise from 0.81 billion in 2020 to 1.53 billion in 2035. Also, as per the data published by the International Diabetes Federation, approximately 537 million adults are living with diabetes in the world and is projected to rise to 643 million by 2030 and 783 million by 2045. People with obesity often face challenges related to hunger and cravings, making it difficult to maintain a calorie deficit for weight loss. High-protein bakery products help control appetite by promoting satiety and reducing the urge to snack on unhealthy foods, helping manage calorie deficit and prevent overeating. Diabetic individuals also benefit from high protein bakery products as they have a lower impact on blood sugar levels. Traditional baked goods cause rapid spikes in blood glucose due to their high glycemic index, leading to increased insulin demand. High-protein bakery products slow down digestion and reduce post-meal blood sugar fluctuations, making them a better choice for people managing diabetes. Therefore, as the obese and diabetic population across the globe increases, the high protein bakery products market revenue also spurs.

To Understand More About this Research: Request a Free Sample Report

The high protein bakery products market demand is driven by the growing number of fitness centers globally. Fitness centers often promote the importance of proper nutrition alongside exercise, educating members about the benefits of consuming adequate protein. This awareness drives individuals to look for protein-rich food options, including high protein bakery products that align with their fitness objectives. High protein bakery products, such as protein bars and fortified bread, provide a quick and accessible source of protein, ideal for pre- or post-workout consumption. These products help individuals meet their daily protein requirements without compromising on taste or convenience. Moreover, many fitness centers have on-site cafés or vending machines that offer high-protein bakery products to cater to their members' dietary needs.

High Protein Bakery Products Market Dynamics

Increasing Gen-Z Population Worldwide

Gen-Z consumers prioritize health, wellness, and fitness more than previous generations, driving a shift toward protein-rich diets. According to data from the World Economic Forum, there are over 2 billion people in the Generation Z age group worldwide, which highlights the significant size of this consumer segment. Gen-Z is highly influenced by social media and digital content, which often promotes healthy eating and fitness trends. Influencers and health experts on platforms such as Instagram, TikTok, and YouTube advocate for protein-rich diets, further popularizing high protein bakery products. This digital influence shapes Gen-Z's purchasing decisions, driving them to adopt high protein bakery products. Hence, as the Gen-Z population increases globally, the demand for high protein bakery products also grows.

Growing Urbanization Across Globe

Urban residents usually has limited time for meal preparation, leading them to seek quick and nutritious food options. High protein bakery products offer a solution by providing essential nutrients in a convenient and portable form, ideal for busy city life. Urbanization also brings increased awareness and access to health and wellness information. For instance, the United Nations published a report stating that the global urban population is expected to reach 68% by 2050, highlighting the rapid growth of urban areas. As urban residents are more likely to be exposed to fitness trends, nutritional advice, and health-conscious communities. This exposure drives them to make informed dietary choices, including the consumption of high protein foods. High protein bakery products align with this trend by offering a healthier alternative to traditional baked goods, which are high in sugar and carbohydrates.

Urban infrastructure supports the distribution and availability of high protein bakery products. These areas have well-established retail networks, including supermarkets, specialty stores, and online platforms, making these products easily accessible, thereby increasing sales. Moreover, urban areas typically have higher disposable incomes, allowing residents to invest in premium food products such as high protein bakery products. Therefore, the high protein bakery products market demand is increasing with the growing urbanization across the globe.

High Protein Bakery Products Market Segment Analysis

High Protein Bakery Products Market Evaluation by Product

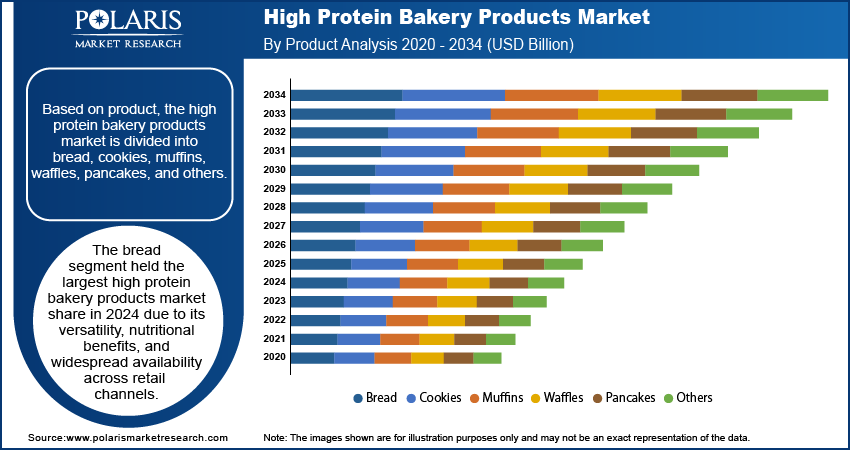

Based on product, the high protein bakery products market is divided into bread, cookies, muffins, waffles, pancakes, and others. The bread segment held the largest high protein bakery products market share in 2024 due to its versatility, nutritional benefits, and widespread availability across retail channels. Many individuals incorporated protein-enriched bread into their daily diets as a staple food item, making it a consistent choice among health-conscious consumers, fitness enthusiasts, and individuals managing specific dietary needs. The rising awareness of protein’s role in muscle maintenance, satiety, and overall well-being contributed to increased demand for protein-rich bread. Consumers looking for better alternatives to traditional bread sought protein-fortified options that aligned with weight management and balanced nutrition goals, contributing to the dominance of the segment.

High Protein Bakery Products Market Assessment by Distribution Channel

In terms of distribution channel, the high protein bakery products market is segregated into hypermarkets & supermarkets, convenience stores, and online stores. The online stores segment is expected to grow in the coming years owing to the rapid expansion of e-commerce, changing consumer purchasing habits, and the convenience of digital shopping. Many consumers prefer online grocery stores for their wider product variety, ease of ordering, and direct access to niche brands that may be available in local supermarkets. Subscription-based models, personalized recommendations, and targeted marketing strategies have also contributed to the rise of online sales. The growth of health-focused direct-to-consumer brands has further fueled online purchases as shoppers seek exclusive, specialty high-protein baked goods delivered to their doorstep. Additionally, busy lifestyles have led more people to opt for the convenience of ordering protein-rich baked products through e-commerce platforms rather than making frequent trips to physical stores, which is estimated to propel the segment growth in the coming years.

High Protein Bakery Products Market Regional Analysis

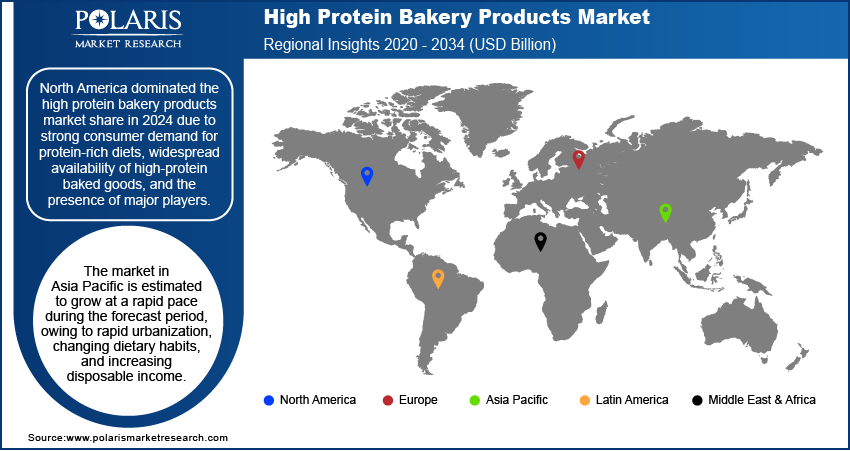

By region, the report provides the high protein bakery products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024 due to strong consumer demand for protein-rich diets, widespread availability of high-protein baked goods, and the presence of major players. The region’s well-established food and beverage industry, coupled with increasing health consciousness among consumers, contributed to the dominance of protein-enhanced bakery products. The US led the market within North America, accounting for the highest sales due to a large population of fitness enthusiasts, growing interest in functional foods, and high purchasing power. Supermarkets, health food stores, and e-commerce platforms in the US offered a wide range of high protein bakery products, further strengthening the market’s presence. The influence of diet trends such as high-protein, keto, and low-carb eating patterns also contributed to the increased consumption of protein-enriched bread, cookies, and snacks in the region.

The High protein bakery products market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to rapid urbanization, changing dietary habits, and increasing disposable income. Consumers in countries such as China, India, and Japan have shown a growing preference for protein-rich foods due to rising health awareness and a shift toward Western-style diets. The expanding middle class in these countries has fueled demand for convenient and nutritious bakery products, leading to a surge in the adoption of protein-food options. E-commerce platforms in the region have also played a crucial role in making high protein bakery products more accessible to a wider audience. Fitness culture and sports nutrition awareness are growing rapidly in the region, further driving the need for protein-enhanced food products, including high protein bakery products.

High Protein Bakery Products Key Market Players & Competitive Analysis Report

The competitive landscape of the high protein bakery products market is marked by the presence of global food manufacturers, specialized nutrition brands, and emerging startups focusing on product innovation, clean-label formulations, and functional ingredients. Companies are investing in high-protein alternatives using plant-based, whey, and collagen protein sources to cater to evolving consumer preferences. Strategic partnerships with retailers and e-commerce expansion are driving market penetration, while regulatory compliance and clean-label claims influence competitive positioning. Advancements in protein fortification, gluten-free options, and sustainable ingredient sourcing further intensify competition, pushing brands to differentiate through taste, texture, and nutritional superiority in an evolving market.

The high protein bakery products market is fragmented, with the presence of numerous global and regional market players. Major players in the market include ARYZTA AG; BetterBrand; EQUII; GoodMills; Grupo Bimbo S.A.B. de C.V.; Kellanova; Kodiak Cakes, LLC.; Modern Bakery LLC; Mondelēz International; Naturell India Pvt. Ltd.; Quest Nutrition & WorldPantry.com LLC; Simple Mills; and The Protein Bakery.

Equii is a major company in the high protein bakery products market, known for its innovative approach to enhancing the nutritional value of staple foods such as bread and pasta. Equii's mission is to create products that are not only nutritious but also sustainable and delicious, addressing the growing demand for healthier, more environmentally friendly food options. The company has successfully expanded its portfolio of high-protein bread products, initially offering loaves with 10 grams of protein per slice. It has also introduced new SKUs with slightly less protein (8 grams per slice) but with added fiber, addressing consumer requests for more balanced nutritional profiles.

GoodMills Group is a major supplier of high-quality flour and milling products, serving industrial, bakery, and retail clients across Europe. The company offers a wide range of flours, including traditional, specialty, and functional flours made from grains like wheat, rye, spelled, corn, and durum for high-protein bread. In the context of high protein bakery products, GoodMills Innovation plays a crucial role by providing solutions that align with current market trends. GoodMills' consumer brands, such as Sofia Mel, Raftul Bunicii, Rosenmehl, and Fini's Feinstes, are known for their high-quality flour products. These brands are widely distributed across modern and traditional trade channels, ensuring easy access for consumers.

Key Companies in High Protein Bakery Products Market

- ARYZTA AG

- BetterBrand

- EQUII

- GoodMills

- Grupo Bimbo S.A.B. de C.V.

- Kellanova

- Kodiak Cakes, LLC.

- Modern Bakery LLC

- Mondelēz International

- Naturell India Pvt. Ltd.

- Quest Nutrition & WorldPantry.com LLC

- Simple Mills

- The Protein Bakery

High Protein Bakery Products Market Developments

January 2025: GoodMills Innovation, the innovation and R&D unit of the GoodMills Group, announced the launch of GoWell Tasty Protein, a new plant-based protein blend for use in baked goods. GoWell Tasty Protein blend enables the simple production of protein-rich baked goods without compromising on taste or sensory quality.

December 2023: EQUII introduced its new EQUII Complete Protein and Added Fiber breads, which are available in both Premium Classic Wheat + Fiber and Premium Multi-Grain + Fiber. These new breads offer 4 grams of dietary fiber per slice as well as 8 grams of complete protein.

September 2023: EQUII, the innovative high complete protein and low-carb bread company, announced the launch of its Plain and Multigrain Bread at Expo East 2023 in Philadelphia. These two new products offer high protein offerings for balanced nutrition.

June 2023: BetterBrand, a food tech company, announced the launch of a low-carb, high-protein bun in three varieties: pretzel, sesame, and brioche.

High Protein Bakery Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020-2034)

- Bread

- Cookies

- Muffins

- Waffles

- Pancakes

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020-2034)

- Hypermarkets & Supermarkets

- Convenience Stores

- Online Stores

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Protein Bakery Products Market Report Scope

|

Report Attributes |

Details |

|

High Protein Bakery Products Market Value in 2024 |

USD 4.65 Billion |

|

High Protein Bakery Products Forecast in 2025 |

USD 4.96 Billion |

|

Revenue Forecast in 2034 |

USD 9.02 Billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global high protein bakery products market size was valued at USD 4.65 billion in 2024 and is projected to grow to USD 9.02 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are ARYZTA AG; BetterBrand; EQUII; GoodMills; Grupo Bimbo S.A.B. de C.V.; Kellanova; Kodiak Cakes, LLC.; Modern Bakery LLC; Mondel?z International; Naturell India Pvt. Ltd.; Quest Nutrition & WorldPantry.com LLC; Simple Mills; and The Protein Bakery.

The bread segment dominated the high protein bakery products market in 2024 due to its versatility, nutritional benefits, and widespread availability across retail channels

The online stores segment is expected to grow at the fastest pace in the coming years due to the rapid expansion of e-commerce, changing consumer purchasing habits, and the convenience of digital shopping.