High-Performance Polyamides Market Size, Share, Trends, Industry Analysis Report: By Type (Polyamide 6T, Polyarylamide, Polyamide 12, Polyamide 9T, Polyamide 11, Polyamide 46, and Polyphthalamide), Manufacturing Process, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5498

- Base Year: 2024

- Historical Data: 2020-2023

High-Performance Polyamides Market Overview

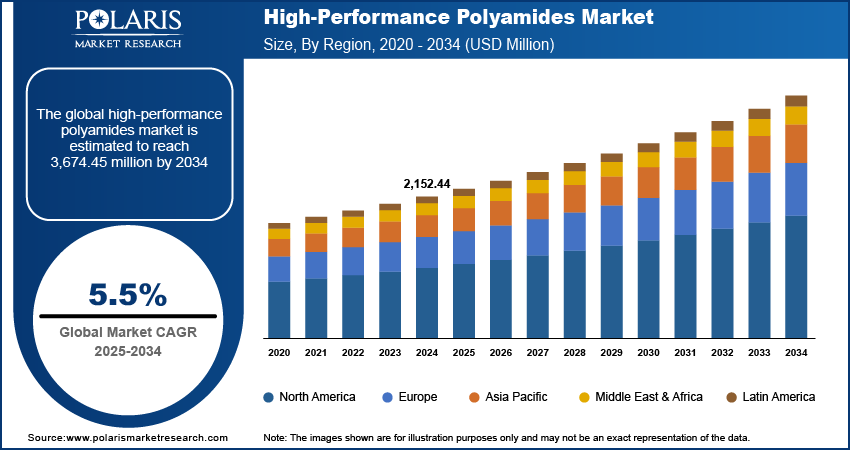

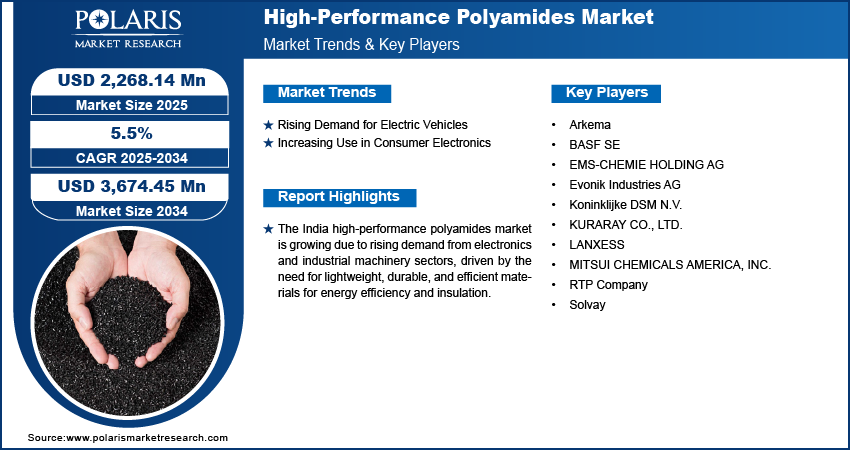

The high-performance polyamides market size was valued at USD 2,152.44 million in 2024. The market is projected to grow from USD 2,268.14 million in 2025 to USD 3,674.45 million by 2034, exhibiting a CAGR of 5.5% during 2025–2034.

High-performance polyamides are advanced synthetic polymers known for their exceptional strength, durability, and heat resistance. They are commonly used in demanding applications such as automotive, aerospace, and industrial sectors due to their superior mechanical and thermal properties.

High-performance polyamides are essential for industries such as automotive and aerospace due to their ability to reduce weight without compromising strength. In the automotive sector, lightweight materials help improve fuel efficiency and reduce CO2 emissions, aligning with environmental regulations. Similarly, aerospace applications require materials that withstand extreme conditions while being light in weight to ensure better fuel efficiency and performance. High-performance polyamides, with their strength, heat resistance, and low weight, are ideal materials for components such as gears, bearings, and electrical connectors in both industries, driving their widespread use and thereby fueling the high-performance polyamides market expansion.

To Understand More About this Research: Request a Free Sample Report

Continuous improvements in manufacturing techniques, such as improved polymerization processes and the ability to create stronger and more durable materials, have made these polyamides even more suitable for a wider range of applications. Innovations such as better processing capabilities, cost-efficient production, and customization options allow manufacturers to meet the demands of various industries. This technological progress leads to more efficient use of polyamides, boosting their adoption in automotive, electronics, aerospace, and other sectors. These factors boost the high-performance polyamides market demand.

High-Performance Polyamides Market Dynamics

Rising Demand for Electric Vehicles

The demand for electric vehicles (EVs) and e-mobility technologies is rising. According to the International Energy Agency, Sales of electric cars have reached 14 million units per year in 2023, an increase from 4% in 2020. These materials are highly suited for applications in EVs due to their ability to resist heat and provide electrical insulation. In EVs, components such as battery casings, electrical connectors, and wiring systems need materials that handle high temperatures and provide insulation against electrical currents. Polyamides, known for their strength and thermal stability, offer ideal solutions for these needs. Therefore, the rising demand for electric vehicles propels the high-performance polyamides market development.

Increasing Use in Consumer Electronics

High-performance polyamides are increasingly being used in consumer electronics, including smartphones, laptops, and wearables, due to their excellent properties such as heat resistance, electrical insulation, and flexibility. In electronics, components often face high operational temperatures and need materials that are both durable and capable of insulating against electrical currents. Polyamides help meet these needs by offering protection against heat and contributing to lightweight, durable designs. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022, showcasing the growing demand for electronic devices. Therefore, the rising demand for electronic devices is propelling the use of high-performance polyamides in the consumer electronics industry, boosting the high-performance polyamides market growth.

High-Performance Polyamides Market Segment Analysis

High-Performance Polyamides Market Assessment by Type Outlook

The high-performance polyamides market segmentation, based on type, includes polyamide 6T, polyarylamide, polyamide 12, polyamide 9T, polyamide 11, polyamide 46, and polyphthalamide. The polyamide 12 segment is expected to witness significant growth during the forecast period. Polyamide 12 is known for its excellent chemical resistance, low moisture absorption, and high flexibility, due to which it is widely used in various industries, including automotive, electronics, and industrial applications. The material’s ability to withstand extreme temperatures and harsh conditions makes it ideal for components such as fuel lines, electrical connectors, and medical devices. The growing demand for lightweight, durable, and high-performance materials is boosting the popularity of polyamide 12, driving the segmental growth.

High-Performance Polyamides Market Evaluation by End Use Outlook

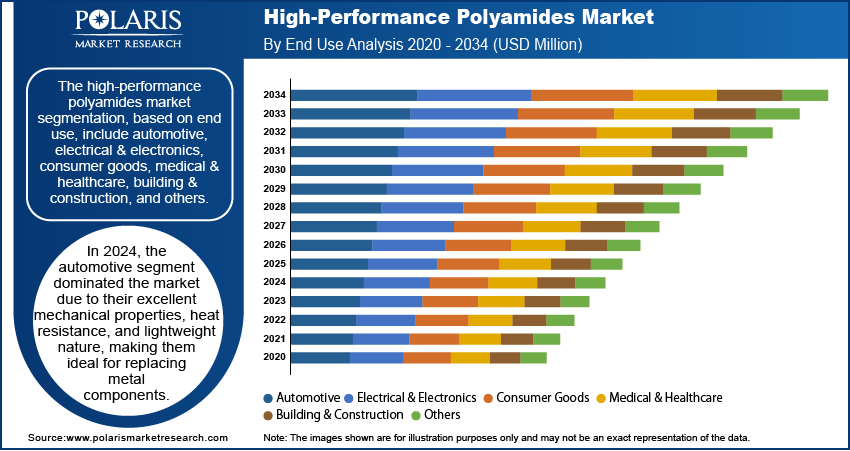

The high-performance polyamides market segmentation, based on end use, includes automotive, electrical & electronics, consumer goods, medical & healthcare, building & construction, and others. The automotive segment dominated the high-performance polyamides market share in 2024 due to excellent mechanical properties, heat resistance, and lightweight nature high-performance polyamides, making them ideal for replacing metal components. These materials are widely used in parts such as engine covers, fuel systems, electrical connectors, and interior components, helping reduce vehicle weight and improve fuel efficiency. The automotive industry's focus on sustainability and performance enhancement is driving the demand for high-performance polyamides in the industry.

High-Performance Polyamides Market Regional Analysis

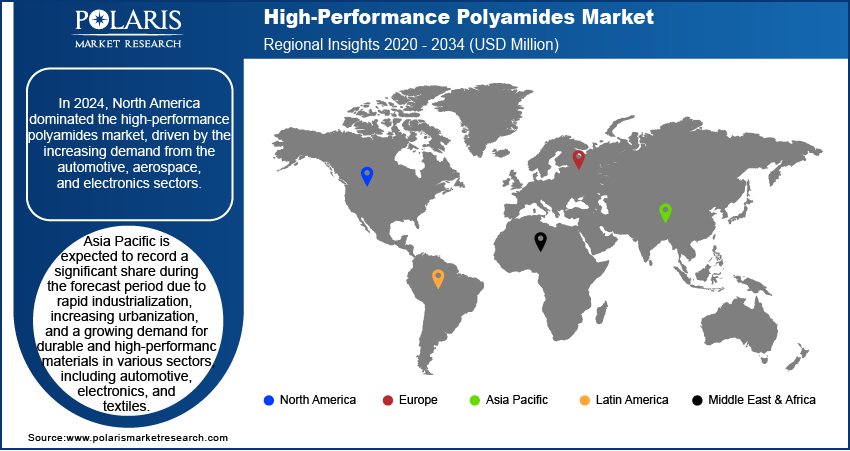

By region, the study provides the high-performance polyamides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the high-performance polyamides market revenue share, driven by the increasing demand from the automotive, aerospace, and electronics sectors. The region’s automotive industry, in particular, is focused on reducing vehicle weight and improving fuel efficiency, leading to a higher adoption of polyamides in various components. Additionally, the growing emphasis on sustainability and eco-friendly materials is pushing manufacturers to use high-performance polyamides in production. North America is also home to key players and has strong research and development activities, which help boost innovation in polyamide-based applications, further driving the market growth.

According to the high-performance polyamides market statistics, Asia Pacific is expected to record a significant market share during the forecast period due to rapid industrialization, increasing urbanization, and a growing demand for durable and high-performance materials in various sectors, including automotive, electronics, and textiles. The automotive and electronics industries are major industries in the region, and a significant shift toward lightweight and energy-efficient components is driving the demand for high-performance polyamides across Asia Pacific.

The high-performance polyamides market in India is experiencing substantial growth due to the growing demand from industries such as electronics and industrial machinery. The country’s electronics sector, in particular, is focusing on lightweight materials to improve energy efficiency and meet industry standards, which is driving the adoption of polyamides. The need for durable, cost-effective, and efficient materials is increasing as India is witnessing rapid urbanization and industrialization, driving the high-performance polyamides market expansion in India.

High-Performance Polyamides Market Players & Competitive Analysis Report

The high-performance polyamides market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the high-performance polyamides market trends by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. Major players in the high-performance polyamides market, includes, Arkema; BASF SE; EMS-CHEMIE HOLDING AG; Evonik Industries AG; Koninklijke DSM N.V.; KURARAY CO., LTD.; LANXESS; MITSUI CHEMICALS AMERICA, INC.; RTP Company; and Solvay.

BASF SE is a global chemical corporation with seven distinct business segments, which include chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products. BASF offers Ultramid Structure LFX, which is a high-performance, long glass fiber reinforced polyamide (PA) by BASF, ideal for metal replacement in demanding applications due to its superior strength, isotropic properties, and improved surface quality.

Evonik Industries AG specializes in the production of high-performance specialty chemicals across global regions, including Asia Pacific, Europe, the Middle East, Africa, Central and South America, and North America. The company's operations are segmented into five key areas: Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, and Technology & Infrastructure. The specialty additives component focuses on providing fumed silicas, advanced additives for polyurethane, matting agents, and specialty resins tailored for coatings, paints, and printing inks. The company also supplies isophorone and epoxy curing agents utilized in adhesives, coatings, and composites. Evonik, in the nutrition & care segment, delivers critical products such as D-/L-methionine and lysine for the animal nutrition market, along with a variety of amino acids and peptides. Additionally, the company produces pharmaceutical active ingredients, as well as biocompatible and bioresorbable materials suitable for orthopedic and medical applications. It offers comprehensive system solutions for the cosmetics and detergent industries. The smart materials segment is dedicated to the production of inorganic compounds, including fumed and precipitated silicas and silanes, as well as peroxides used in the paper and textile sectors. This segment also offers specialty catalysts for various synthetic processes and advanced polymer products, such as polyimide 12, polymer foams, specialty polybutadiene, and polyester, alongside alkoxides and membranes. The performance materials segment provides C4 derivatives comprising butadiene, MTBE, butene-1, isopropanol, and DINP primarily for applications in the automotive industry. Additionally, it produces superabsorbent polymers employed in hygiene products, notably diapers. The technology & infrastructure segment contains a range of services, including integrated plant support and maintenance, energy management, process safety and engineering, and logistics solutions. This segment is also involved in strategic site development and offers digital solutions aimed at enhancing the efficiency of chemical production processes. Evonik's High-Performance Polymers' business offers customized VESTAMID, VESTAKEEP, VESTENAMER, and ROHACELL materials. These polymers enhance product performance in automotive, medical, and industrial applications and include membranes and fibers.

List of Key Companies in High-Performance Polyamides Market

- Arkema

- BASF SE

- EMS-CHEMIE HOLDING AG

- Evonik Industries AG

- Koninklijke DSM N.V.

- KURARAY CO., LTD.

- LANXESS

- MITSUI CHEMICALS AMERICA, INC.

- RTP Company

- Solvay

High-Performance Polyamides Industry Developments

In March 2024, Toray Advanced Composites announced the launch of Toray Cetex TC915 PA+. The product, offering enhanced strength and temperature stability, was introduced for high-performance industrial and automotive applications.

In September 2024, DOMO Chemicals unveiled new sustainable polyamide solutions at Fakuma 2024, showcasing innovations such as recycled polyamides and lightweight materials, emphasizing their commitment to sustainability and eco-friendly advancements.

High-Performance Polyamides Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Polyamide 6T

- Polyarylamide

- Polyamide 12

- Polyamide 9T

- Polyamide 11

- Polyamide 46

- Polyphthalamide

By Manufacturing Process Outlook (Revenue – USD Million, 2020–2034)

- Injection Molding

- Blow Molding

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Automotive

- Electrical & Electronics

- Consumer Goods

- Medical & Healthcare

- Building & Construction

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High-Performance Polyamides Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,152.44 million |

|

Market Size Value in 2025 |

USD 2,268.14 million |

|

Revenue Forecast by 2034 |

USD 3,674.45 million |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2,152.44 million in 2024 and is projected to grow to USD 3,674.45 million by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Arkema; BASF SE; EMS-CHEMIE HOLDING AG; Evonik Industries AG; Koninklijke DSM N.V.; KURARAY CO., LTD.; LANXESS; MITSUI CHEMICALS AMERICA, INC.; RTP Company; and Solvay.

The automotive segment dominated the market share in 2024 due to their excellent mechanical properties, heat resistance, and lightweight nature, making them ideal for replacing metal components.

The polyamides 12 segment is expected to witness significant growth during the forecast period due to its excellent chemical resistance, low moisture absorption, and high flexibility.