High Performance Computing Market Size, Share, & Industry Analysis Report

: By Component (Hardware and Software & Services), By Deployment, By Industrial Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: pdf

- Report ID: PM3042

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

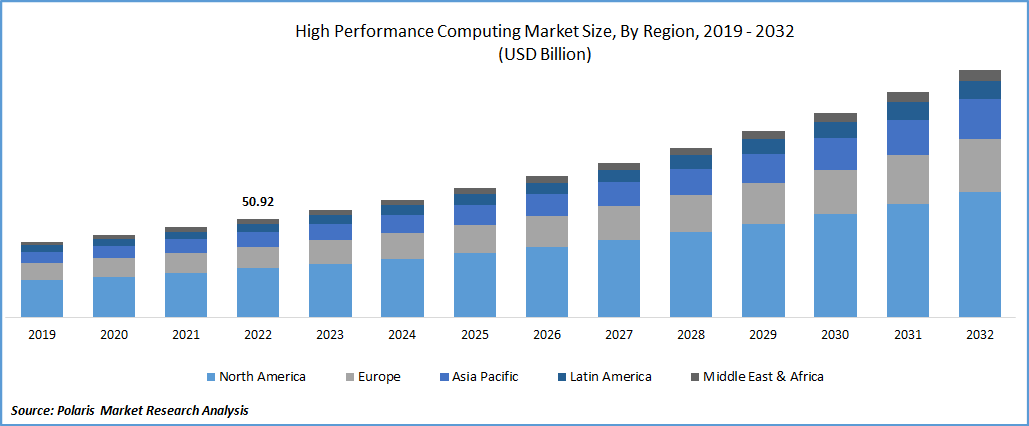

The high performance computing (HPC) market size was valued at USD 55.97 billion in 2024. It is projected to grow from USD 60.03 billion in 2025 to USD 115.09 billion by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

Government initiatives supporting the development of HPC infrastructure and growing demand for efficient data processing and analysis in fields such as scientific research, artificial intelligence (AI), and big data analytics significantly contribute to market growth.

High performance computing (HPC) refers to the aggregation of computing power to deliver significantly higher performance than typical desktop computers or workstations. This is achieved through the use of AI in supercomputers and computer clusters to solve advanced computational problems. HPC systems are composed of numerous computer nodes working in parallel to process large volumes of data at high speeds. The increasing complexity of computational problems across various industries is driving the demand for more powerful HPC hardware, including high performance processors, interconnects, and storage systems. This technology is crucial for organizations seeking competitive advantages through faster and more intricate data analytics.

The HPC market growth is propelled by advancements in parallel processing technologies and the increasing need for complex computational capabilities across diverse sectors. The rapid digitization across various sectors further fuels the HPC market, as organizations require systems capable of handling large datasets and performing intensive tasks at high speeds.

To Understand More About this Research:Request a Free Sample Report

Market Dynamics

Increasing Demand for Big Data Analytics

As the volume of data generated by businesses and consumers continues to grow exponentially, the need for systems capable of processing and analyzing these large datasets becomes critical. As per IBM, by 2025, ∼80% of all data stored globally will be unstructured, including text, audio, video, and sensor data. Extracting meaningful insights from this vast, complex, and unstructured data requires the immense computational power of HPC systems. The ability of these systems to handle massive amounts of data at high speeds enables businesses to gain valuable insights, improve decision-making, and enhance operational efficiency. This capability is essential for industries such as finance, healthcare, and manufacturing, where real-time data processing is crucial. The rising demand for big data analytics across various sectors is thus a key factor driving the demand for HPC systems.

Growing Adoption of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) applications require immense computational power to process and learn from large datasets. HPC systems provide the necessary infrastructure to train complex AI models and perform advanced analytics. As per AWS, the adoption of AI in businesses is rapidly accelerating. As of 2024, 78% of organizations reported using AI, a significant jump from 55% the previous year. The integration of AI with HPC allows businesses to enhance decision-making, improve efficiency, and unlock insights from vast datasets. Industries such as pharmaceuticals, finance, and energy management are harnessing AI-enhanced HPC for applications ranging from drug discovery to predictive analytics and real-time simulations. As AI and ML continue to evolve, the demand for HPC resources will continue to rise in the coming years.

Advancements in Hardware Components

As technology progresses, the performance and efficiency of system components such as processors, memory, and interconnects are constantly improving. These advancements enable HPC systems to process data more rapidly and efficiently, supporting the growing demand for complex computational capabilities across various sectors. The continuous innovation in hardware technology is therefore a key factor driving the growth of the high performance computing market.

Market Segment Insights

Market Assessment – By Component

The high performance computing market, by component, is segmented into hardware and software & services. The hardware segment holds the largest share, due to the substantial investments required for the physical infrastructure that forms the backbone of HPC systems. These systems involve high performance processors, advanced memory solutions, sophisticated interconnect technologies, and specialized storage systems. The initial setup and ongoing upgrades of these physical components represent a significant portion of the overall expenditure in deploying HPC capabilities. As organizations across various sectors increasingly adopt HPC to address complex computational challenges, the demand for robust and high-capacity hardware continues to be a primary driver of rising revenue and share within the component segmentation.

The software & services segment is anticipated to exhibit the highest growth rate during the forecast period. This growth is fueled by the increasing need for specialized software solutions to optimize the performance and utilization of HPC infrastructure. This includes operating systems designed for parallel processing, middleware for efficient resource management, application development tools, and sophisticated data analytics platforms. Furthermore, the demand for professional services such as consulting, integration, and maintenance is also on the rise as organizations seek expertise to effectively deploy and manage their HPC environments. The growing complexity of HPC applications and the need for tailored solutions are expected to drive significant expansion in the software & services segment in the coming years.

Market Evaluation– By Deployment

The market, by deployment, is segmented into on-premise and cloud. The on-premise segment accounts for a larger share, fueled by the established presence of traditional HPC infrastructure within organizations that require high levels of customization, control, and data security. Industries such as government, defense, and some segments of scientific research have historically favored on-premise deployments to manage sensitive data and maintain dedicated high-performance computing resources tailored to their specific needs. The substantial upfront investments in hardware and the long-standing operational practices contribute to the current dominance of the on-premise deployment segment.

The cloud deployment model is expected to witness the highest growth rate during the forecast period. This rapid expansion is driven by the increasing advantages offered by cloud-based HPC solutions, including scalability, flexibility, and cost-effectiveness. Cloud platforms provide organizations with on-demand access to high-performance computing resources without the need for significant upfront capital expenditure and the associated maintenance overhead. The ability to scale computing resources up or down based on requirements makes cloud computing particularly attractive for applications with fluctuating demands, such as simulations, data analytics, and artificial intelligence workloads. The growing acceptance of cloud technologies and the increasing availability of specialized HPC cloud instances are fueling the high growth trajectory of the cloud deployment segment.

Market Assessment – By Industrial Vertical

The market, by industrial vertical, is segmented into healthcare & life science, energy & utilities, manufacturing, aerospace & defense, education & research, media & entertainment, BFSI, and others. Currently, the education & research segment holds the largest share. This significant share is primarily attributed to the extensive utilization of HPC systems in academic institutions and research organizations worldwide. These entities rely on high-performance computing for a wide range of applications, including scientific simulations, data analysis, and complex modeling across various disciplines. The continuous pursuit of knowledge and the need for advanced computational power in these sectors have established education & research as the dominating segment.

The healthcare & life science segment is anticipated to experience the highest growth rate during the forecast period. This rapid growth is driven by the increasing adoption of HPC in areas such as drug discovery services and development, genomic sequencing, medical imaging equipment analysis, and personalized medicine. The ability of HPC to process vast amounts of biological and medical data at high speeds is crucial for accelerating research, improving diagnostic capabilities, and developing new therapies. The growing emphasis on precision medicine and the increasing complexity of healthcare data are expected to fuel significant expansion in the healthcare & life science segment in the coming years.

Regional Footprint

The high performance computing market demonstrates significant regional presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each of these regions exhibits unique dynamics, influenced by factors such as government initiatives, research and development activities, the presence of key industry players, and the adoption rate across various end-user verticals. While North America and Europe have historically been significant contributors, Asia Pacific is emerging as a region with substantial growth potential, driven by increasing investments in technology and a growing number of high-performance computing applications across diverse sectors.

North America holds the largest share, owing to the presence of leading technology providers, substantial investments in research and development, and the widespread adoption of HPC solutions across various industries, including government, aerospace & defense, and healthcare & life science. The region's robust technological infrastructure and early adoption of advanced computing technologies have solidified its position as the leader. Furthermore, the strong presence of major research institutions and universities actively utilizing HPC for scientific advancements contributes significantly to the North America high performance computing market growth.

The Asia Pacific high performance computing market is projected to exhibit the highest growth rate during the forecast period. This rapid growth is fueled by increasing government support for technological advancements, a growing number of data centers, and the rising adoption of HPC across various sectors such as manufacturing, BFSI, and education & research. Countries in this region are making significant investments in developing their digital infrastructure and promoting the use of advanced computing technologies to drive economic growth and innovation. The increasing computational requirements from a rapidly expanding digital economy and a growing focus on artificial intelligence and big data analytics are key factors propelling the demand for high performance computing solutions across the region.

Key Players and Competitive Insights

A few major players actively operating in the industry include International Business Machines Corporation (IBM); Hewlett Packard Enterprise Company (HPE); Dell Technologies Inc.; Atos SE; Fujitsu Limited; Lenovo Group Limited; Advanced Micro Devices, Inc. (AMD); NVIDIA Corporation; Intel Corporation; and Oracle Corporation. These companies offer a range of HPC solutions, including hardware components such as high-performance servers, processors, and networking equipment, as well as software and services tailored for demanding computational workloads.

The competitive landscape is characterized by intense rivalry among established technology giants and specialized vendors. Competition is driven by continuous innovation in hardware performance, energy efficiency, and software capabilities, as well as the ability to provide comprehensive solutions that cater to the diverse needs of various industry verticals. Key competitive factors include product differentiation, strategic partnerships, and the ability to offer scalable and cost-effective HPC solutions, including cloud-based offerings. Companies are focused on enhancing their product portfolios to address the growing demands for big data analytics, artificial intelligence, and scientific research, leading to a dynamic and evolving environment.

International Business Machines Corporation (IBM), headquartered in Armonk, New York, US, offers a broad spectrum of HPC solutions, including powerful server systems such as the IBM Power Systems, high-performance storage solutions, and specialized software for workload management and data analytics. Their offerings cater to a wide range of applications in scientific research, financial modeling, and weather forecasting, making them a significant contributor to the HPC.

Hewlett Packard Enterprise Company (HPE), located in Spring, Texas, US, provides a comprehensive portfolio of HPC products and services, including high-performance computing clusters, supercomputers, and related software and storage solutions. Their products are utilized across various industries, such as energy, life sciences, and manufacturing, enabling complex simulations and data-intensive computations. HPE's focus on delivering scalable and efficient HPC infrastructure positions them as a relevant player in addressing the evolving market demands.

List of Key Companies in High Performance Computing Market

- Advanced Micro Devices, Inc. (AMD)

- Atos SE

- Dell Technologies Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company (HPE)

- Intel Corporation

- International Business Machines Corporation (IBM)

- Lenovo Group Limited

- NVIDIA Corporation

- Oracle Corporation

High Performance Computing Industry Developments

- March 2025: Axelera AI, a provider of AI hardware acceleration technology, announced the launch of its Titania chiplet in March 2025. This chiplet is designed for high-performance and energy-efficient AI inference and incorporates an innovative Digital In-Memory Computing (D-IMC) architecture.

- May 2025: HCLTech announced a collaboration with Microsoft to establish a center of excellence (CoE) focused on high performance computing. As part of this initiative, HCLTech revealed its plans to train 3,000 professionals over three years, leveraging Microsoft's Azure cloud HPC technologies.

High Performance Computing Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Servers

- Systems

- Networking Devices

- Storage Devices

- Software & Services

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-premise

- Cloud

By Industrial Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Healthcare & Life Science

- Energy & Utilities

- Manufacturing

- Aerospace & Defense

- Education & Research

- Media & Entertainment

- BFSI

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Performance Computing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 55.97 billion |

|

Market Size Value in 2025 |

USD 60.03 billion |

|

Revenue Forecast by 2034 |

USD 115.09 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The high performance computing (HPC) market has been broadly segmented on the basis of component, deployment, and industrial vertical. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

The high performance computing market growth strategy hinges on continuous technological innovation, particularly in processor performance, energy efficiency, and interconnectivity. Industry penetration is being enhanced through strategic collaborations between hardware providers, software developers, and cloud service platforms to deliver integrated and accessible HPC solutions. Addressing diverse industry-specific needs with tailored offerings and highlighting the benefits of HPC in areas such as big data analytics and AI is crucial for development. Furthermore, expanding outreach to emerging economies with increasing computational demands and focusing on user-friendly interfaces and cloud-based accessibility will be key marketing strategies to drive further growth and adoption.

FAQ's

The market size was valued at USD 55.97 billion in 2024 and is projected to grow to USD 115.09 billion by 2034.

The market is projected to register a CAGR of 7.5% during the forecast period.

Following are a few of the market trends: ? Increasing Adoption of Hybrid and Multi-Cloud HPC: Organizations are increasingly leveraging a combination of on-premise and cloud-based HPC resources to optimize cost and flexibility. Multi-cloud strategies, utilizing services from multiple cloud providers, are also gaining traction. ? Growing Integration of AI and ML Workloads: The demand for HPC systems capable of handling complex AI and ML tasks, including model training and inference, is significantly rising.

North America held the largest share of the market in 2024.

A few major players include International Business Machines Corporation (IBM); Hewlett Packard Enterprise Company (HPE); Dell Technologies Inc.; Atos SE; Fujitsu Limited; Lenovo Group Limited; Advanced Micro Devices, Inc. (AMD); NVIDIA Corporation; Intel Corporation; and Oracle Corporation.

The education & research segment accounted for the largest share of the market in 2024.

High Performance Computing (HPC) refers to the practice of aggregating significant computing resources to achieve performance levels far exceeding those of typical desktop computers or even standard servers. Instead of relying on a single powerful machine, HPC systems harness the power of many interconnected computers, known as nodes, working in parallel to tackle complex computational tasks.