High Performance Composites Market Size, Share, Trends, Industry Analysis Report: By Resin Type (Thermoset Resin and Thermoplastic Resin), Fiber, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 115

- Format: PDF

- Report ID: PM1352

- Base Year: 2024

- Historical Data: 2020-2023

High-Performance Composites Market Overview

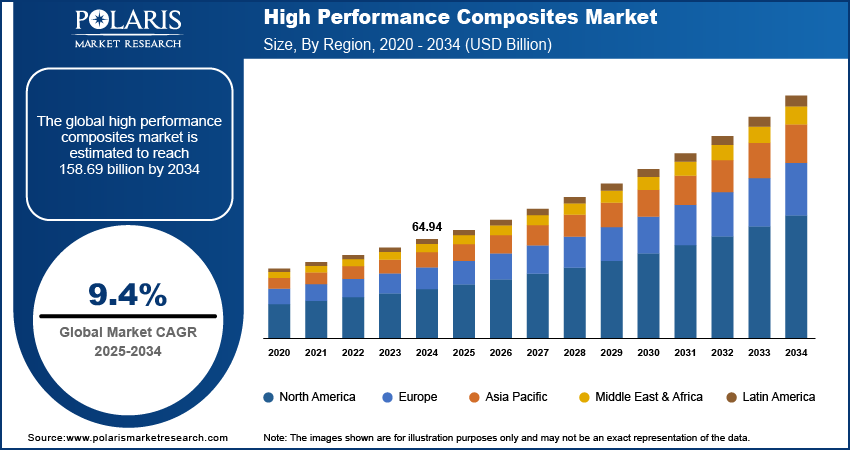

The high performance composites market size was valued at USD 64.94 billion in 2024. The market is projected to grow from USD 70.94 billion in 2025 to USD 158.69 billion by 2034, at a CAGR of 9.4% from 2025 to 2034.

High-performance composites (HPCs) are engineered materials created by fusing two or more distinct materials to produce particular qualities that cannot be obtained from individual components alone. HPCs are advanced materials used in a variety of industries due to their strength, durability, and other performance properties. They are made of matrices and reinforcements and are used in many applications across various industries such as aerospace, automotive, construction, marine, and sports equipment. HPCs have a number of benefits, including a high strength-to-weight ratio, dimensional stability, cost-effective repair, and corrosion resistance.

To Understand More About this Research: Request a Free Sample Report

Consumer preferences and legal requirements drive the growing need for environmentally friendly composite materials. Purchase decisions are influenced by consumers' and businesses' growing environmental consciousness, which raises demand for goods with low environmental impact. The adoption of environmentally friendly composites is fueled by the imposition of strict regulations and government programs encouraging the reduction of carbon emissions and sustainable practices. Additionally, technological advancements in composite manufacturing have made it possible to produce recycled and bio-derived composite materials, increasing their marketability.

The high performance composites market demand is growing at a faster rate due to the expansion of the automotive industry and rising sales of aircraft. Growing awareness of the benefits of high-performance composites over alternatives creates a number of market opportunities. To minimize their environmental impact, the consumer goods, building, automotive, and aviation industries are actively seeking new materials. Additionally, the use of these composites in the production of wind turbines and pressure vessels is another potential factor that is anticipated to propel the high performance composites market development in the coming years.

High-Performance Composites Market Dynamics

Expansion of Building and Construction Industry

The building and construction industry uses high-performance composites extensively, including but not limited to concrete and cultured marble. This is due to their superior properties such as durability, weight reduction, and high tensile strength. Rising urbanization, growing infrastructure development, and increasing residential housing plans are among the factors driving the construction industry's rapid expansion. The use of high performance composites in concrete, cement structures, cement boards, and other applications has increased due to the growing frequency of building and construction activities. The lightweight and affordable nature of these materials boosts the high performance composites market demand.

Increasing Use of High Performance Composites in Wind Turbine Blades

High performance composites are made from high-performance fibers, including carbon fiber, glass fiber, aramid fiber, quartz fiber, ceramic fiber, boron fiber, ultrahigh-molecular-weight polyethylene (UHWPE) fiber, and new fibers such as poly (p-phenylene benzothiazole) (PBO) fibers. These materials are commonly used in the production of wind turbines owing to their lightweight, high tensile strength, and high thermal conductivity. Therefore, the increasing use of high-performance composites in wind turbine blades propels the high performance composites market growth.

High Performance Composites Market Segment Insights

High Performance Composites Market Outlook by Resin Type

Based on resin type, the high performance composites market is bifurcated into thermoplastic resin and thermoset resin. The thermoset resins segment dominated the high performance composites market share in 2024. Thermoset resins, such as polyester and epoxy, have great qualities, including high strength, durability, and chemical and heat resistance. Such qualities make them appropriate for a range of uses in the construction, automotive, and aerospace sectors. The demand for thermoset resins is rising due to improvements in manufacturing techniques and the growing need for lightweight, high-performance materials.

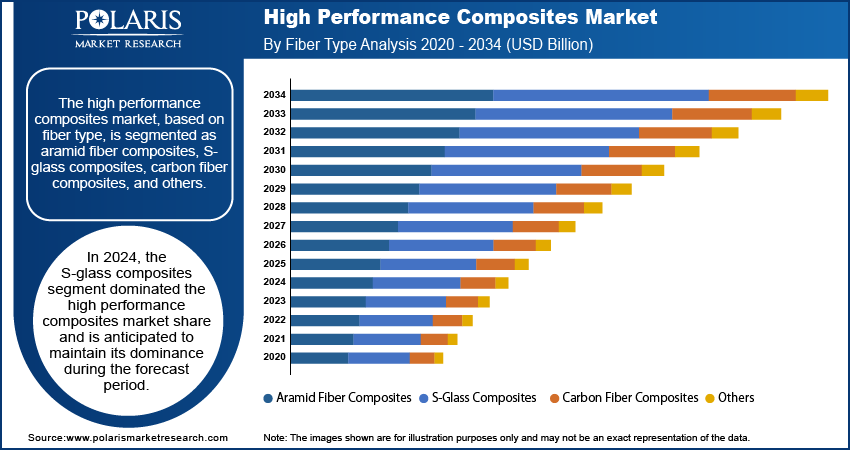

High Performance Composites Market Assessment by Fiber Type

By fiber type, the high-performance composites market is segmented into carbon fiber composites, S-glass composites, and aramid fiber composites. The S-glass composites segment is expected to register the highest CAGR during the forecast period. S-glass high performance composites are being utilized more frequently in military aircraft for firewalls, floor panels, and fuselage skins owing to their force-resistant nature, which has helped the market expand. They are also more fatigue resistant, robust, and lightweight. In the manufacturing of helicopter blades, S-glass composites are utilized. Additionally, due to their increased strength, flexibility, and dimensional stability, these composites are increasingly being used as robotic arms on space shuttles.

High Performance Composites Market Regional Insights

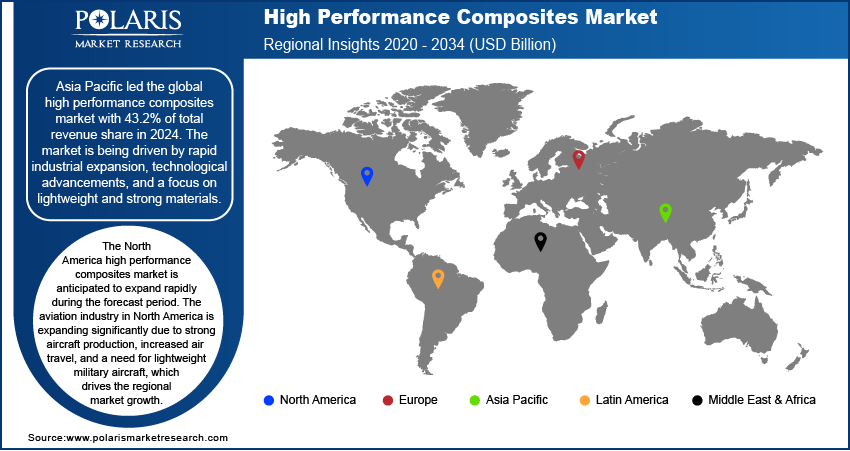

By region, the report offers high performance composites market insights into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. With the largest revenue share of 43.2% in 2024, Asia Pacific led the global high-performance composites market. Rapid industrial expansion, advancements in technology, and an emphasis on robust and lightweight materials are driving the regional market. Growing demand in sectors such as construction, automotive, and aerospace is fueling the Asia Pacific high performance composites market expansion. To capitalize on the expanding market opportunities in the area, key stakeholders are focusing on developing strategic alliances and innovations. The high strength-to-weight ratios, corrosion resistance, and design flexibility of composites, along with their suitability for automotive interiors, designs, and components, are responsible for this growth.

The North America high performance composites market is projected to register the highest CAGR during the forecast period. North America's aviation industry is expanding significantly due to a combination of strong aircraft production, increased air travel, and a need for lightweight military aircraft. Aerospace manufacturing and air traffic are increasing, which will expand the need for high-performance composites in North America to meet specifications for strength, lightweight, shape constancy, and erosion protection coatings in aircraft production. The composites are becoming more popular since they are essential for meeting the performance standards needed in contemporary aircraft design.

High Performance Composites Market – Key Players and Competitive Insights

With major market developments such as new product launches, increased investments, mergers and acquisitions, contractual agreements, and cooperation with other organizations, market participants are implementing a variety of strategic initiatives to expand their global footprint. The high-performance composites market will continue to expand as a result of major players investing heavily in R&D to expand their product lines.

Arkema SA; Albany International Corporation; BASF SE, Teijin Ltd.; Owens Corning Corporation; Hexcel Corporation; Solvay S.A.; TPI Composites, Inc.; Koninklijke Ten Cate BV; and Toray Industries Inc. are a few of the top players in the industry.

Key Companies in High Performance Composites Market

- Arkema SA

- DuPont

- Albany International Corporation

- BASF SE

- SGL Carbon

- Teijin Ltd.

- Owens Corning Corporation

- Hexcel Corporation

- SABIC

- Solvay S.A.

- TPI Composites, Inc.

- Koninklijke Ten Cate BV

High Performance Composites Industry Developments

In March 2024, together with Hexcel, Arkema finished their first aircraft construction by utilizing high-performance thermoplastic composites. This program was a component of the HAICoPAS project, which enhanced the manufacture of composite tapes using carbon fibers from Hexcel and Kepstan PEKK resin from Arkema.

In September 2024, Toray Advanced Composites announced the launch of the Toray Cetex TC1130 PESU thermoplastic composite material. The aerospace industry will greatly benefit from this high-performance thermoplastic composite material, which was created especially to meet the increasing demand for lightweight and environmentally friendly materials in aircraft interior applications.

High performance Composites Market Segmentation

By Resin Type Outlook

- Thermoset Resins

- Thermoplastic Resin

By Fiber Outlook

- Aramid Fiber Composites

- S-Glass Composites

- Carbon Fiber Composites

- Others

By Application Outlook

- Construction

- Medical

- Wind Turbine

- Pressure Vessel

- Automotive

- Aerospace & Defense

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Performance Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 64.94 billion |

|

Market Size Value in 2025 |

USD 70.94 billion |

|

Revenue Forecast by 2034 |

USD 158.69 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The high performance composites market size is anticipated to reach USD 158.69 billion by 2034 from USD 70.94 billion in 2025.

The market is expected to register a CAGR of 9.4% during the forecast period.

In 2024, Asia Pacific held the largest revenue share of 43.2 % and dominated the global high performance composites market revenue.

Hexcel Corporation; Arkema SA; Albany International Corporation; BASF SE, Teijin Ltd.; Owens Corning Corporation; Solvay S.A.; TPI Composites, Inc.; Koninklijke Ten Cate BV; and Toray Industries Inc. are among the key players influencing the high performance composites market.

The S-glass composites segment held the largest revenue share of the market in 2024.

In 2024, the thermoset resin segment held a larger revenue share of the high performance composites market.