High Frequency Trading Servers Market Share, Size, Trends, Industry Analysis Report, By Processor (X-86-based, ARM-based, Non-X86 based), By Form Factor, By Application (Equity Trading, Forex Markets, Commodity Markets), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4186

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

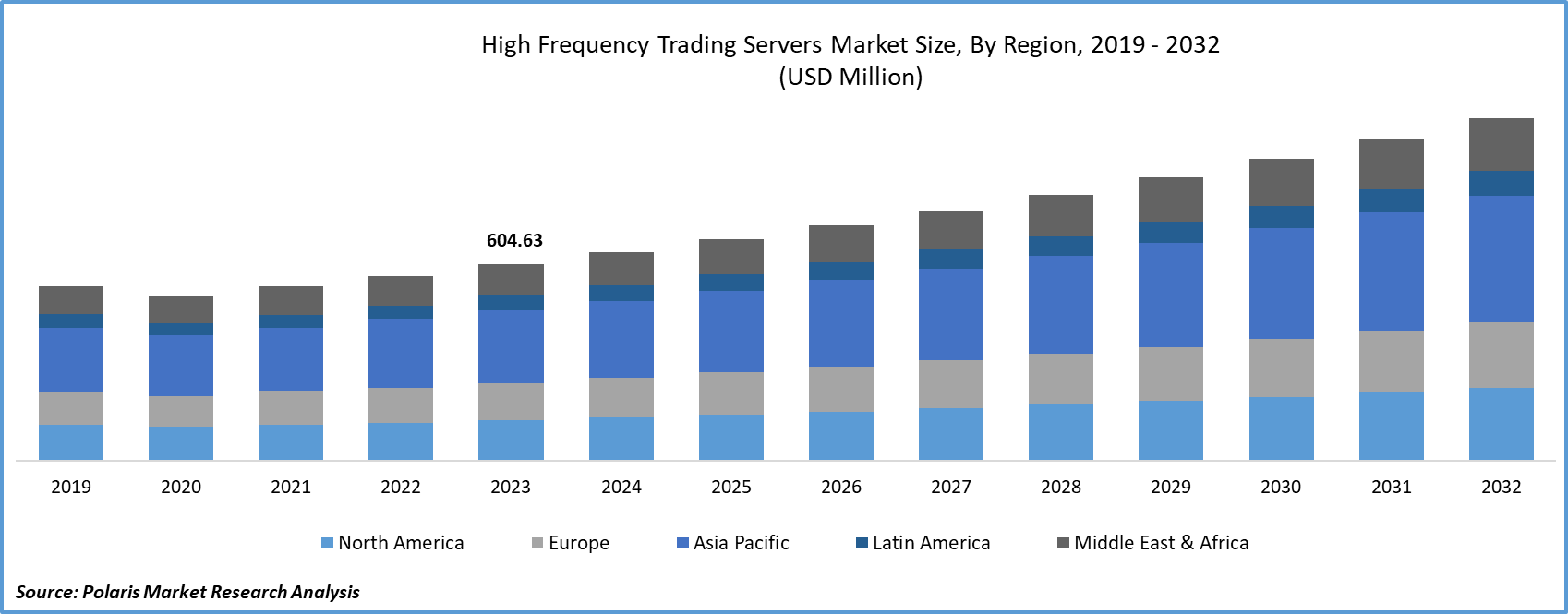

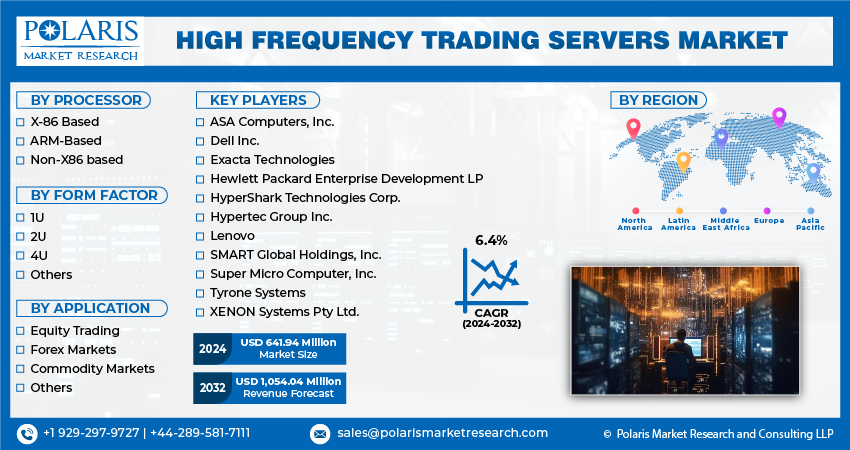

The global high frequency trading servers market was valued at USD 604.63 million in 2023 and is expected to grow at a CAGR of 6.4% during the forecast period.

The demand for Ultra-Low Latency (ULL) in trading systems, coupled with advancements in quantum computing, is anticipated to propel market growth in the coming years. Additionally, the increasing requirement for intent-based networking to support high-frequency trading environments is expected to open opportunities for future expansion. These servers, driven by mathematical algorithms, enable lightning-fast trading transactions in mere nanoseconds. Notably, these high-speed executions leverage robust computational analysis, surpassing the capabilities of traditional stock trading servers.

To Understand More About this Research: Request a Free Sample Report

Ensuring secure handling of High-Frequency Trading (HFT), especially at edge nodes that demand swift order execution, is crucial. To stay competitive, managing latency becomes paramount. While many HFT servers are situated within the exchanges for a split-second advantage in price information, more is needed. Communication is still needed among various office locations and different exchanges. In this context, edge computing can be advantageous, reducing latency by processing data locally and transmitting it to the intended location, saving valuable microseconds.

In a HFT environment, the need for ultra-low latency is crucial for managing multiple orders and conducting rapid data analysis and correlation. To achieve this, trading firms strategically position their data centers near stock exchanges. This proximity allows for faster data feeds, facilitating quicker response times for trading applications. The advantage of locating data centers near stock exchanges lies in the ability to access high-bandwidth networks with low-latency connections. This close physical proximity minimizes the time it takes for data to travel between the trading infrastructure and the stock exchange servers. As a result, trading firms can execute trades more swiftly, gaining a competitive edge in the high-speed and highly competitive landscape of HFT.

In the coming years, algorithmic-based equity trading is anticipated to become increasingly popular. Algorithmic trading provides equity traders with the capability to implement and adjust stop-loss strategies. Given the volatility and unpredictability of stock markets, effectively managing large portfolios poses a challenge. Therefore, the integration of stop-loss strategies with HFT systems is expected to assist trading firms in risk management and loss prevention, thereby opening opportunities for servers that support these applications.

Growth Drivers

Rising demand for HFT applications

An HFT server represents a specific category within high-performance computing applications and incorporates features such as Artificial Intelligence (AI) and deep learning. These servers empower traders to anticipate stock market trends and execute trades within milliseconds. The rising demand for HFT applications is particularly notable in large investment banks and firms providing hedge funds. This growing interest and adoption of HFT technologies present significant opportunities for expansion within the industry. High-frequency trading allows for rapid decision-making and execution, providing a competitive advantage in the dynamic and fast-paced landscape of financial markets. As a result, investment entities seek to leverage HFT servers to enhance their trading strategies and gain a competitive edge in the high frequency trading servers market.

Report Segmentation

The market is primarily segmented based on processor, form factor, application, and region.

|

By Processor |

By Form Factor |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Processor Analysis

X-86 segment held the largest share in 2023

X-86 segment held the largest share. Segment’s growth is primarily due to the widespread adoption of the x-86 core processors and reliance on the software code built on the customized architecture. Moreover, x-86 processors demonstrate compatibility with high-computing applications, including data analytics workloads and AI, facilitating rapid computing executions. These characteristics enable financial service providers to execute trading transactions with minimal latency.

The ARM-based processor segment is projected to grow at the fastest rate. This is due to the growing adoption of cloud-based migration tools, facilitating the porting of server applications onto ARM architecture. Moreover, the cost-effectiveness of ARM-based servers compared to the X86 chips contributes to the favorable growth of this segment.

By Application Analysis

Equity trading segment registered the largest market share in 2023

The equity trading segment accounted for the largest share. This significant market share can be attributed to the widespread adoption of HFT platforms, particularly within large-cap equity markets. The prevalence of HFT in these markets underscores its influence and dominance in contributing to the overall revenue within the segment.

The Forex segment will grow rapidly. The prosperous performance of equity trading has had a notable impact on the increased adoption of High-Frequency Trading (HFT) in forex markets, opening opportunities for growth. Traders operating in these markets seek to enhance their profitability by employing low-latency servers within stock exchanges for swift trade execution. HFT servers, equipped with low-latency capabilities, enable forex traders to handle substantial data volumes and facilitate high-speed transactions.

By Form Factor Analysis

2U segment held the significant market revenue share in 2023

The 2U segment held the largest share due to the ability to expand its IT infrastructure at a reduced cost. Additionally, the 2U form factor presents increased flexibility within a single chassis, facilitating high-speed transactions across multiple computer systems. Moreover, 2U servers deliver substantial computing power with a compact footprint, effectively handling high-performance workloads such as those found in high-frequency trading computing applications.

1U segment will grow at a substantial pace. This is attributed to its capacity to deliver high-density computing, low latency, cost-effectiveness, and scalability. The compact size enables enhanced computing power within a confined space, and when co-located in data centers, it contributes to latency reduction. Furthermore, 1U servers present cost savings in terms of power consumption and efficient utilization of rack space.

Regional Insights

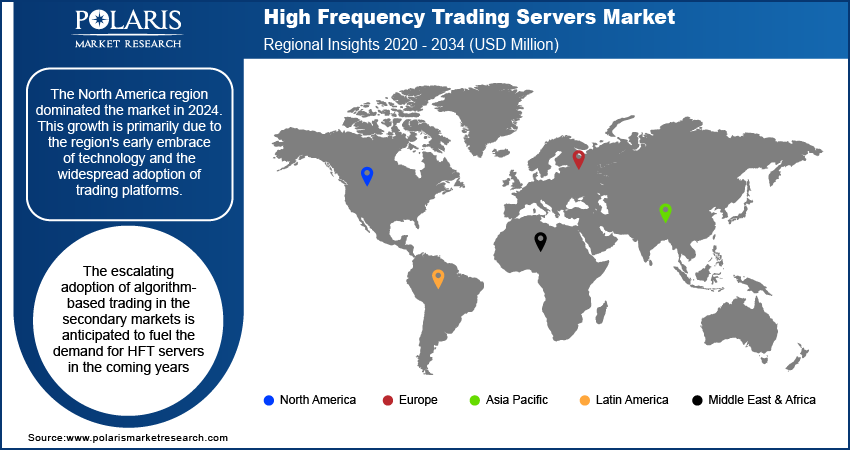

North America region held the largest share of the global market in 2023

The North America region dominated the market. This growth is primarily due to the region's early embrace of technology and the widespread adoption of trading platforms. Additionally, the presence of key vendors offering technical support to financial firms for seamless deployment of after-sales services has played a pivotal role in fostering regional market growth. The escalating adoption of algorithm-based trading in the secondary markets is anticipated to fuel the demand for HFT servers in the coming years.

The Asia Pacific region is projected to grow at a rapid pace. The Chinese government's initiatives aimed at fostering automated trading in financial markets have been instrumental in propelling market growth, with indications suggesting a continuation of this trend in the coming years. Developed economies in the region, including Japan and Australia, are expected to undergo incremental growth, primarily due to their early adoption of HFT systems.

Key Market Players & Competitive Insights

To maintain competitiveness, participants in the market are strategically combining organic and inorganic growth approaches. Key industry players are actively engaged in forming partnerships, expanding their business operations, introducing new products, and securing contracts, all aimed at enhancing their market share.

Some of the major players operating in the global market include:

- ASA Computers, Inc.

- Dell Inc.

- Exacta Technologies

- Hewlett Packard Enterprise Development LP

- HyperShark Technologies Corp.

- Hypertec Group Inc.

- Lenovo

- SMART Global Holdings, Inc.

- Super Micro Computer, Inc.

- Tyrone Systems

- XENON Systems Pty Ltd.

Recent Developments

- In April 2023, Orthogone Technologies and Napatech entered a strategic partnership to create an advanced SmartNIC platform designed for HFT applications. This joint effort targets financial technology firms in need of HFT applications that can handle significant transaction data volumes with high throughput and extremely low latency.

- In May 2021, Toshiba Corporation and Dharma Capital signed a JV to evaluate the effectiveness of HFT strategies for the Japanese listed stocks. The project utilizes Toshiba's Simulated Bifurcation Machine, a quasi-quantum computer, to investigate optimal solutions.

High Frequency Trading Servers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 641.94 million |

|

Revenue forecast in 2032 |

USD 1,054.04 million |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Processor, By Form Factor, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global high frequency trading servers market size is expected to reach USD 1,054.04 Million by 2032

Key players in the market are ASA Computers, Dell, Exacta Technologies, HyperShark Technologies

North America contribute notably towards the global high frequency trading servers market

The global high frequency trading servers market is expected to grow at a CAGR of 6.4% during the forecast period.

The high frequency trading servers market report covering key segments are processor, form factor, application, and region.