Hemostasis and Tissue Sealing Agents Market Size, Share, Trends, Industry Analysis Report

: By Product (Topical Hemostat, Adhesive & Tissue Sealant), By Material, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM1610

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

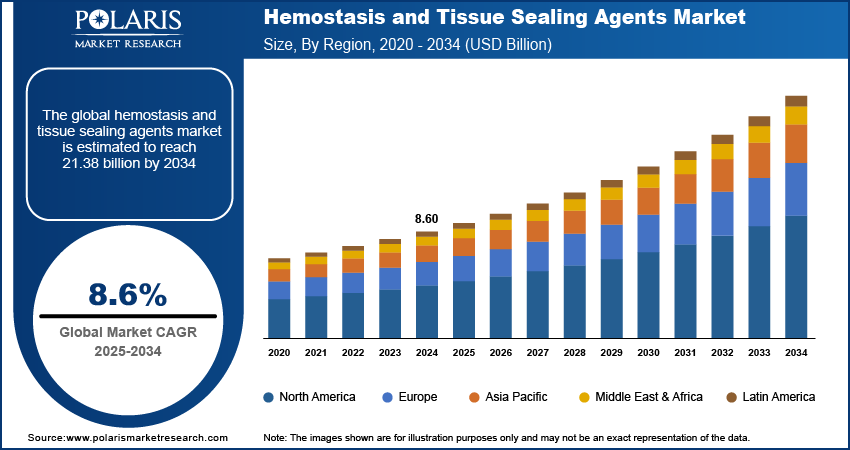

The global hemostasis and tissue sealing agents market size was valued at USD 8.29 billion in 2024, exhibiting a CAGR of 8.6% during 2025–2034. The market growth is driven by increasing surgeries, rising disease rates, advancements in minimally invasive techniques, and growing demand for bio-based and combination products.

Key Insights

- The topical hemostats segment is the largest market contributor globally due to their efficiency in controlling bleeding, simplicity in application, quick action, and extensive use in surgery for various diseases.

- The mineral-based segment is growing rapidly due to increasing demand for inorganic agents, such as zeolite and kaolin.

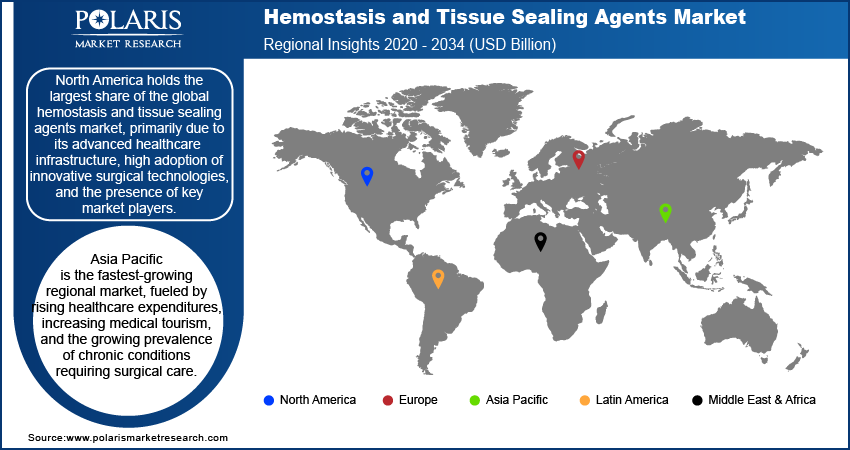

- North America leads the market due to its advanced healthcare infrastructure, high adoption of novel surgical devices, and the dominance of leading companies in the market.

- Asia Pacific is the most rapidly developing market, driven by increased spending on healthcare, rising medical tourism, and a surge in chronic ailments that require surgical intervention.

Industry Dynamics

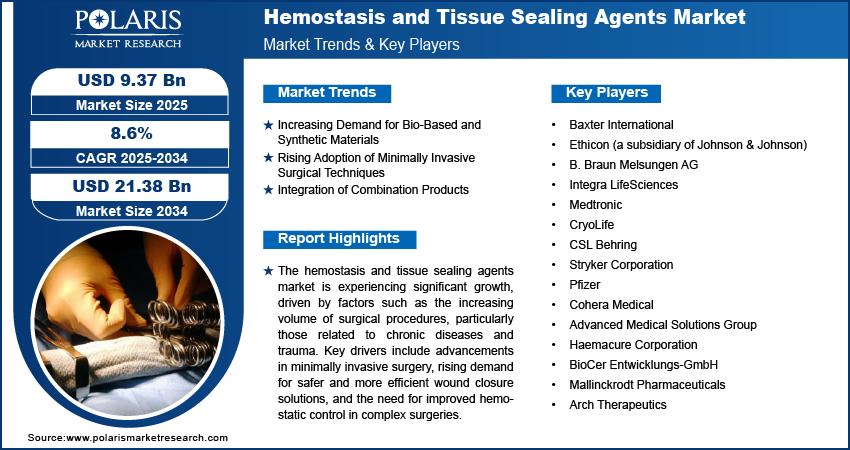

- The growing adoption of bio-based and synthetic materials in hemostasis and tissue sealing agents will be a prominent market trend in the future.

- The growing demand for minimally invasive procedures is fueling the need for hemostasis and tissue-sealing agents.

- The increasing application of combination products with hemostatic and adhesive properties is increasing surgical efficiency, outcomes, and market growth.

- One of the major restraints of the hemostasis and tissue sealing agents market is the premium pricing of advanced products, which may restrict their adoption and availability, especially in low-income economies.

Market Statistics

2024 Market Size: USD 8.29 billion

2034 Projected Market Size: USD 18.80 billion

CAGR (2025-2034): 8.6%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The global hemostasis and tissue sealing agents market refers to the sector encompassing products used to control bleeding and facilitate wound closure during surgical procedures. These agents include hemostats, fibrin sealants, and adhesives. They are designed to improve surgical outcomes and reduce complications. The increasing prevalence of chronic diseases requiring surgery, a growing number of surgical procedures worldwide, and advancements in minimally invasive techniques drive the hemostasis and tissue sealing agents market demand. A few trends shaping the market include a shift toward bio-based and synthetic materials offering enhanced biocompatibility and efficacy and rising demand for combination products that integrate hemostatic and adhesive properties. Regulatory approvals and innovation in product formulations are further fueling market growth.

Market Dynamics

Increasing Demand for Bio-Based and Synthetic Materials

Materials, such as polyethylene glycol (PEG)-based adhesives and fibrin sealants, are gaining traction due to their superior biocompatibility, reduced risk of immune reactions, and enhanced performance in sealing and hemostasis. For instance, bio-based agents, particularly those derived from fibrin or collagen, are preferred in procedures requiring natural integration into tissues. Additionally, synthetic sealants, such as cyanoacrylate-based adhesives, offer faster polymerization and higher tensile strength, making them suitable for advanced surgical applications. Advancements in material science and the need for safer alternatives to traditional agents boost the use of hemostasis and tissue sealing agents made from bio-based and synthetic materials. Thus, the growing adoption of bio-based and synthetic materials in hemostasis and tissue sealing agents is expected to emerge as the key hemostasis and tissue sealing agents market trend in the future.

Rising Adoption of Minimally Invasive Surgical Techniques

Minimally invasive surgeries (MIS) offer various advantages such as reduced blood loss, shorter recovery times, and lower risks of complications, making effective hemostatic agents essential for these procedures. According to the National Library of Medicine, MIS accounted for over 15 million procedures annually in the US alone in recent years. This trend is expected to continue as surgeons increasingly rely on advanced hemostatic technologies that are compatible with laparoscopic and robotic-assisted surgeries. The need for products that can be precisely applied in confined surgical fields has led to the development of innovative delivery systems and formulations tailored for MIS. Thus, the growing preference for minimally invasive procedures is significantly influencing the demand for hemostasis and tissue-sealing agents.

Integration of Combination Products

Combination products that merge hemostatic and adhesive properties offer multifunctional benefits during surgical interventions. These products combine the hemostatic properties of materials such as thrombin and fibrin with adhesive capabilities, enhancing both bleeding control and wound closure. This integration reduces procedural complexity and enhances efficiency in the operating room. Recent innovations have introduced dual-purpose sealants capable of managing high-pressure bleeding and creating a watertight seal in challenging procedures, such as cardiovascular surgeries. Surgeons are increasingly adopting these products to improve patient outcomes and streamline surgical workflows, contributing to their rising prominence in the market. Thus, the rising integration of combination products is one of the key hemostasis and tissue sealing agents market trends.

Market Segment Insights

Market Outlook – Product-Based Insights

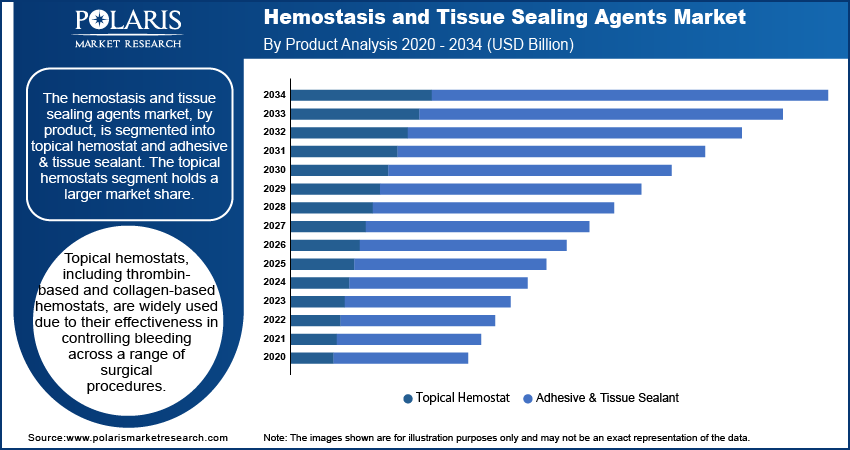

The hemostasis and tissue sealing agents market, by product, is segmented into topical hemostat and adhesive & tissue sealant. The topical hemostats segment holds a larger share of the global hemostasis and tissue sealing agents market revenue. These products, including thrombin-based and collagen-based hemostats, are widely used due to their effectiveness in controlling bleeding across a range of surgical procedures. Their ease of application, rapid action, and ability to provide localized hemostasis make them an essential tool in operating rooms. The increasing number of surgical interventions for chronic conditions such as cardiovascular diseases and cancer further drives the demand for topical hemostats. Moreover, their extensive availability and adoption across hospitals and ambulatory surgical centers contribute to their dominant market presence.

The adhesive and tissue sealant segment is registering a higher growth rate, fueled by advancements in surgical techniques and increasing demand for products that improve wound closure and reduce complications. Innovations in adhesive formulations, such as the development of bioresorbable and synthetic options, are addressing key challenges in surgical care, including post-operative leakage and infection prevention. These sealants are particularly gaining traction in cardiovascular, neurological, and gastrointestinal surgeries, where precision and reliable sealing are critical. The expanding application scope of these agents in minimally invasive and robotic-assisted surgeries is further propelling their market growth.

Market Assessment – Material-Based Insights

The hemostasis and tissue sealing agents market, by material, is segmented into chitosan-based and mineral-based. The chitosan-based segment dominates the global hemostasis and tissue sealing agents market share. Chitosan, a biopolymer derived from chitin, is highly valued for its biocompatibility, biodegradability, and intrinsic antimicrobial properties, making it a preferred material in surgical applications. These agents are particularly effective in promoting rapid hemostasis and reducing the risk of post-operative infections, especially in vascular and trauma surgeries. The widespread use of chitosan-based products is further driven by ongoing advancements in formulation technologies, ensuring enhanced efficacy and ease of application in various surgical settings.

The mineral-based segment is experiencing a higher growth rate within the market, attributed to the increasing demand for inorganic agents such as kaolin and zeolite. These materials are highly effective in accelerating coagulation cascades and controlling severe bleeding, particularly in emergency care and battlefield medicine. The segment's growth is further supported by the rising adoption of mineral-based hemostats in minimally invasive and laparoscopic procedures, where precise and immediate bleeding control is critical. Innovations in product delivery systems and the growing focus on developing cost-effective mineral-based solutions are also contributing to their accelerated market expansion.

Market Evaluation – Application-Based Insights

Based on application, the hemostasis and tissue sealing agents market is segmented into trauma, general surgery, minimally invasive surgery, gynecology, and others. The general surgery segment holds the largest market share. This dominance is attributed to the high number of surgical procedures performed for conditions such as appendectomies, hernia repairs, and gastrointestinal surgeries, where effective bleeding control and wound closure are critical. The increasing prevalence of chronic diseases requiring surgical intervention and the adoption of advanced surgical techniques further drive the demand for these agents in general surgery. Additionally, hospitals and surgical centers increasingly rely on hemostatic products and sealants to improve procedural outcomes and reduce complications, ensuring sustained growth in this segment.

The minimally invasive surgery segment is witnessing the highest growth rate, driven by the rising adoption of laparoscopic and robotic-assisted procedures across various specialties. These techniques require precise hemostatic solutions and tissue sealants compatible with confined surgical fields and specialized instruments. The demand is further fueled by the growing preference for minimally invasive surgeries due to their advantages, such as reduced recovery time, lower infection rates, and minimal scarring. Advancements in product delivery systems designed for minimally invasive applications, along with growing healthcare infrastructure and surgeon expertise, are key factors accelerating the expansion of this segment.

Market Outlook – End User-Based Insights

The hemostasis and tissue sealing agents market, by end user, is segmented into hospitals, ambulatory surgical centers, and research institutes. The hospitals segment holds the largest market share. Hospitals are the primary providers of advanced surgical care, performing a high volume of complex and emergency procedures where hemostatic agents and sealants are essential to control bleeding and ensure effective wound closure. The availability of skilled professionals, advanced surgical facilities, and a wide range of hemostatic products drives the dominance of this segment. Additionally, the increasing prevalence of chronic diseases and trauma cases further solidifies the significant role of hospitals as the primary end users of these products.

Regional Insights

By region, the study provides hemostasis and tissue sealing agents market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the market, primarily due to its advanced healthcare infrastructure, high adoption of innovative surgical technologies, and the presence of key market players. The region's dominance is further supported by a high volume of surgical procedures, particularly for chronic diseases and trauma, and substantial investments in research and development to improve hemostatic and sealing solutions. Favorable reimbursement policies and stringent regulatory standards also contribute to market growth in North America. Additionally, the well-established network of hospitals and ambulatory surgical centers ensures widespread availability and utilization of these products, solidifying the region's leading position.

Europe represents a significant market for hemostasis and tissue sealing agents, driven by its advanced healthcare systems and increasing adoption of minimally invasive surgical procedures. The region benefits from a high prevalence of chronic diseases and an aging population, both of which contribute to a greater need for surgical interventions. Countries such as Germany, France, and the UK are key contributors, with robust healthcare funding and ongoing advancements in surgical technologies. Furthermore, favorable regulatory frameworks and collaborations between healthcare providers and manufacturers foster innovation and market growth in the region.

Asia Pacific is the fastest-growing regional market, fueled by rising healthcare expenditures, increasing medical tourism, and the growing prevalence of chronic conditions requiring surgical care. Countries such as China, India, and Japan are leading this growth, supported by expanding healthcare infrastructure and a rising focus on improving surgical outcomes. The region also benefits from a growing awareness of advanced surgical products and an increasing number of skilled surgeons trained in using hemostatic and sealing agents. Government initiatives to enhance healthcare access and affordability further drive market expansion in Asia Pacific.

Key Players and Competitive Insights

Baxter International, Ethicon (a subsidiary of Johnson & Johnson), B. Braun Melsungen AG, Integra LifeSciences, Medtronic, CryoLife, CSL Behring, Stryker Corporation, Pfizer, Cohera Medical, Advanced Medical Solutions Group, Haemacure Corporation, BioCer Entwicklungs-GmbH, Mallinckrodt Pharmaceuticals, and Arch Therapeutics are a few key players actively operating in the hemostasis and tissue sealing agents market. These companies are involved in the development, production, and distribution of a wide range of hemostatic agents and tissue sealants, catering to diverse surgical needs and specialties. Players, such as Ethicon and Baxter, have established extensive product portfolios, while others focus on niche innovations and specific applications.

The competitive landscape in the hemostasis and tissue sealing agents market is characterized by ongoing innovation, with companies investing heavily in research and development to improve product efficacy and safety. For instance, bio-based products and synthetic sealants with enhanced biocompatibility are gaining attention, allowing players to cater to the growing demand for minimally invasive surgical solutions. Strategic initiatives such as product launches, mergers and acquisitions, and collaborations are common as companies aim to expand their market presence and address emerging needs. The focus on regulatory compliance and securing approvals from authorities such as the FDA and EMA remains a critical aspect of competition in this space.

Market players are also leveraging regional opportunities to strengthen their positions. For example, several companies are expanding their operations in fast-growing regions such as Asia Pacific to benefit from the rising number of surgeries and improving healthcare infrastructure. Similarly, collaborations with hospitals and surgical centers are enabling manufacturers to better understand end user requirements and tailor their offerings accordingly. The balance between established players with broad portfolios and emerging firms with innovative solutions drives the dynamic and competitive nature of this market.

Baxter International offers a broad range of surgical products, including hemostats and tissue sealants designed to address bleeding and wound closure in various surgical procedures. The company has a strong global presence, supported by continuous investments in research and innovation.

Ethicon, a subsidiary of Johnson & Johnson, is another prominent participant in the market, known for its wide portfolio of surgical products, including hemostatic agents and sealants. The company focuses on integrating technology and precision to address surgical challenges, with a particular emphasis on minimally invasive and complex procedures.

List Of Key Companies

- Baxter International

- Ethicon (a Subsidiary of Johnson & Johnson)

- B. Braun Melsungen AG

- Integra LifeSciences

- Medtronic

- CryoLife

- CSL Behring

- Stryker Corporation

- Pfizer

- Cohera Medical

- Advanced Medical Solutions Group

- Haemacure Corporation

- BioCer Entwicklungs-GmbH

- Mallinckrodt Pharmaceuticals

- Arch Therapeutics

Hemostasis and Tissue Sealing Agents Industry Developments

- In June 2023, Baxter announced the launch of its next-generation fibrin sealant aimed at improving hemostasis during minimally invasive surgeries, showcasing its focus on enhancing surgical outcomes through advanced solutions.

- In March 2023, Ethicon revealed its collaboration with a major hospital network to pilot a new bio-resorbable hemostatic agent, aiming to reduce surgical complications and improve patient recovery. This initiative highlights its commitment to advancing product development through strategic partnerships.

Hemostasis and Tissue Sealing Agents Market Segmentation

By Product Outlook

- Topical Hemostat

- Adhesive & Tissue Sealant

By Material Outlook

- Chitosan-Based

- Mineral-Based

By Application Outlook

- Trauma

- General Surgery

- Minimally Invasive Surgery

- Gynecology

- Others

By End User Outlook

- Hospitals

- Ambulatory Surgical Centers

- Research Institutes

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hemostasis and Tissue Sealing Agents Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.29 billion |

|

Market Size Value in 2025 |

USD 8.94 billion |

|

Revenue Forecast by 2034 |

USD 18.80 billion |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.29 billion in 2024 and is projected to grow to USD 18.80 billion by 2034.

The global market is projected to register a CAGR of 8.6% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players actively operating in the hemostasis and tissue sealing agents market are Baxter International, Ethicon (a subsidiary of Johnson & Johnson), B. Braun Melsungen AG, Integra LifeSciences, Medtronic, CryoLife, CSL Behring, Stryker Corporation, Pfizer, Cohera Medical, Advanced Medical Solutions Group, Haemacure Corporation, BioCer Entwicklungs-GmbH, Mallinckrodt Pharmaceuticals, and Arch Therapeutics

The topical hemostat segment accounted for a larger share of the global market in 2024.

The chitosan-based segment accounted for a larger share of the global market in 2024.

Hemostasis and tissue sealing agents are medical products used to control bleeding and promote wound closure during surgical procedures. Hemostasis agents help stop or control bleeding by facilitating clot formation or accelerating the body’s natural clotting process. These agents include hemostatic dressings, powders, gels, and sponges, which are typically used in surgeries to manage both minor and severe bleeding. Tissue-sealing agents are substances that help seal tissues or organs during surgery to prevent leaks, promote healing, and reduce the risk of infection

A few key trends in the hemostasis and tissue sealing agents market are described below: Shift Toward Bio-Based and Synthetic Materials: Increasing demand for materials with better biocompatibility and biodegradability, such as chitosan-based and fibrin-based agents. Rising Adoption of Minimally Invasive Surgeries: Growing use of laparoscopic and robotic-assisted surgeries, driving the need for hemostatic and sealing solutions compatible with these techniques. Integration of Combination Products: Development of products that combine hemostatic and adhesive properties for more efficient wound management. Focus on Product Innovation: Ongoing research to improve the efficacy, safety, and ease of use of hemostatic agents and tissue sealants.

For a new company entering the hemostasis and tissue sealing agents market, focusing on innovation in product development can provide a competitive edge. This includes creating bio-based, synthetic, or bio-resorbable materials that offer enhanced biocompatibility and reduced risks of complications. Additionally, investing in advanced delivery systems tailored for minimally invasive surgeries, where precision is key, can differentiate the company. Building strong partnerships with healthcare providers to understand evolving surgical needs and developing cost-effective, high-quality solutions for emerging markets will also be crucial.

Companies manufacturing, distributing, or purchasing hemostasis and tissue sealing agents and related products and other consulting firms must buy the report.