Hemophilia A Treatment Market Size, Share, Trends, Industry Analysis Report: By Treatment Type (On-Demand, Cure, and Prophylaxis), Therapy Type, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1107

- Base Year: 2024

- Historical Data: 2020-2023

Hemophilia A Treatment Market Overview

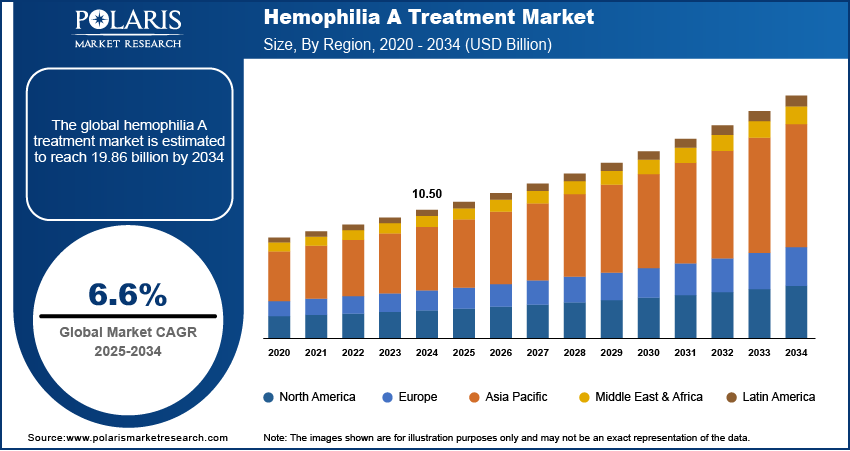

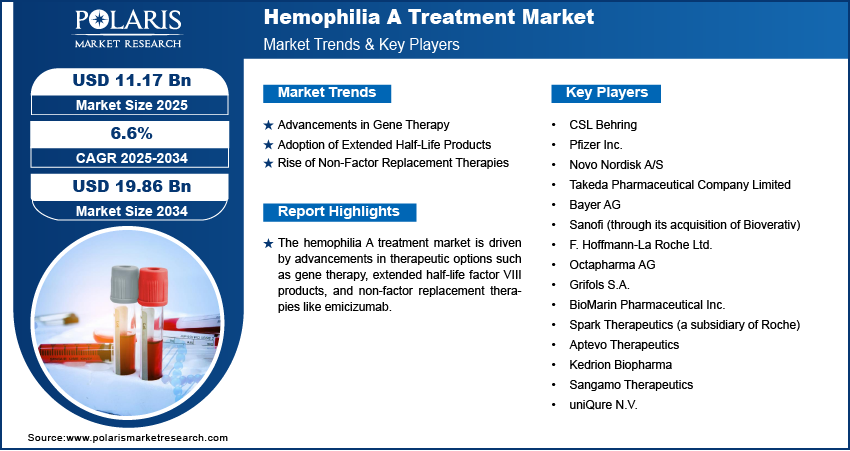

The global hemophilia A treatment market size was valued at USD 10.50 billion in 2024. The market is projected to grow from USD 11.17 billion in 2025 to USD 19.86 billion by 2034, exhibiting a CAGR of 6.6% from 2025 to 2034.

The hemophilia A treatment market focuses on therapies for managing hemophilia A, a genetic bleeding disorder caused by insufficient clotting factor VIII. This market includes recombinant therapies, plasma-derived therapies, gene therapies, and emerging advancements in prophylactic treatments.

Rising awareness about hemophilia, growing adoption of prophylactic treatment regimens, and advancements in gene therapy research are a few of the key factors driving the hemophilia A treatment market growth. A notable trend is the development of extended half-life factor VIII products, offering reduced dosing frequency. Additionally, significant investments in innovative therapies, including non-factor replacement products and gene-editing technologies, are shaping the market landscape.

To Understand More About this Research: Request a Free Sample Report

Hemophilia A Treatment Market Dynamics

Advancements in Gene Therapy

Gene therapy focuses on correcting the underlying genetic defect by delivering a functional copy of the F8 gene, which codes for clotting factor VIII. Recent clinical trials have demonstrated the potential for sustained expression of factor VIII, reducing or eliminating the need for regular infusions. For example, a 2023 study published in The New England Journal of Medicine reported that patients receiving gene therapy achieved factor VIII activity levels sufficient to significantly reduce bleeding episodes. This advancement is further supported by the increasing number of regulatory approvals and the expanding pipeline of innovative gene therapies, highlighting the shift toward long-term, curative approaches. Thus, advancements in gene therapy are driving the hemophilia A market expansion.

Adoption of Extended Half-Life Products

Extended half-life (EHL) factor VIII products are gaining traction as they improve patient compliance by reducing infusion frequency. Products like Eloctate and Adynovate have demonstrated clinical efficacy in maintaining factor VIII levels for longer durations compared to traditional therapies. According to data from the World Federation of Hemophilia (WFH), EHL therapies have improved the quality of life for patients by allowing for fewer injections while achieving better prophylactic outcomes. This trend addresses the challenges of adherence, particularly in younger populations, and is expected to drive further innovation in treatment protocols in the hemophilia A market.

Rise of Non-Factor Replacement Therapies

Non-factor replacement therapies, such as emicizumab, represent a significant shift in the treatment paradigm for hemophilia A. Unlike traditional factor-based treatments, these therapies work independently of factor VIII to restore clotting function. Emicizumab, approved by the FDA in 2017, has been widely adopted due to its subcutaneous administration and proven efficacy in reducing annualized bleeding rates. A 2022 study published in Blood Advances highlighted that patients on emicizumab experienced up to a 90% reduction in bleeding events compared to those on conventional factor replacement therapy. This trend underscores the growing preference for therapies offering convenience and improved outcomes, particularly for patients with inhibitors.

Hemophilia A Treatment Market Segment Insights

Hemophilia A Treatment Market Assessment – Treatment Type-Based Insights

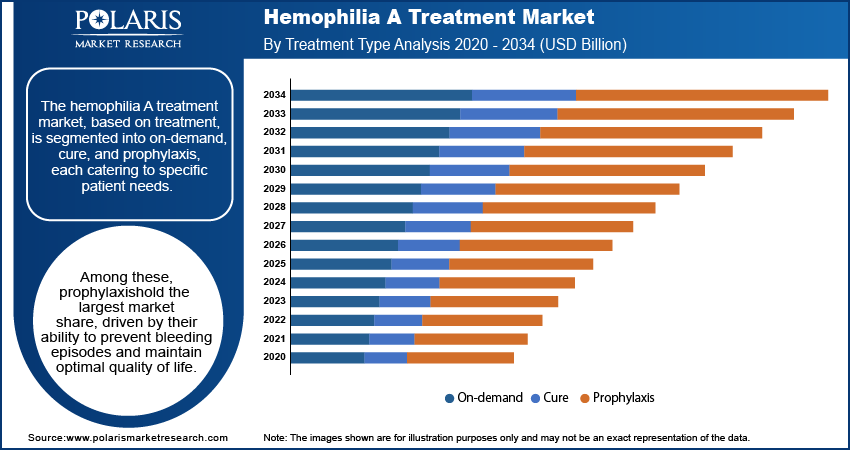

The hemophilia A treatment market, based on treatment type, is segmented into on-demand, cure, and prophylaxis, each catering to specific patient needs. Among these, prophylaxis hold the largest market share, driven by their ability to prevent bleeding episodes and maintain optimal quality of life. These treatments, primarily utilizing factor VIII replacement products or non-factor replacement therapies such as emicizumab, are being increasingly adopted due to their proven efficacy in reducing annualized bleeding rates. Growing awareness among healthcare providers and patients regarding the long-term benefits of prophylaxis further supports the dominance of this segment.

The cure segment, particularly with advancements in gene therapy, is registering the fastest growth in the market. These therapies offer the potential for sustained or permanent resolution of hemophilia A by addressing its genetic root cause. Clinical trials demonstrating the feasibility of achieving near-normal factor VIII activity levels have accelerated interest and investment in this segment. The ongoing approval of gene therapy products and increasing patient preference for one-time treatments over regular infusions are expected to fuel its rapid expansion. These developments are reshaping treatment paradigms and enhancing patient outcomes.

Hemophilia A Treatment Market Evaluation – Therapy Type-Based Insights

The hemophilia A treatment market, by therapy type, is segmented into factor replacement therapy, desmopressin & fibrin sealants, and gene therapy & monoclonal antibodies. The factor replacement therapy segment holds the largest market share, attributed to its established use as the primary treatment for hemophilia A. Both recombinant and plasma-derived factor VIII products are widely prescribed for their efficacy in managing bleeding episodes and for prophylaxis. The increasing adoption of extended half-life factor VIII products has further strengthened the segment's position, providing patients with improved convenience and reduced infusion frequency.

Gene therapy & monoclonal antibodies represent the fastest-growing segment due to their innovative and long-term therapeutic potential. Gene therapy, by addressing the genetic root cause of hemophilia A, offers a curative approach that has gained significant traction among patients and providers. Similarly, monoclonal antibodies such as emicizumab have demonstrated effectiveness in both inhibitor and non-inhibitor patients, with subcutaneous administration providing a notable advantage. Robust clinical data and ongoing approvals in this segment are driving its rapid growth, supported by investments in R&D and the introduction of novel therapies to the market.

Hemophilia A Treatment Market Outlook – Distribution Channel-Based Insights

The hemophilia A treatment market, segmented by distribution channel, includes hospital pharmacies and specialty pharmacies. Hospital pharmacies hold the largest market share due to their critical role in managing acute and emergency care for hemophilia patients. These pharmacies are integral to delivering factor replacement therapies and other treatments immediately during bleeding episodes or surgical procedures. Additionally, the presence of specialized healthcare professionals within hospitals ensures appropriate dosing and administration, further solidifying this segment’s prominence in the market.

Specialty pharmacies are registering the fastest growth in the market, driven by the increasing adoption of advanced therapies such as gene therapy and monoclonal antibodies. These pharmacies are uniquely equipped to manage high-cost and complex treatments, providing patients with the necessary support for long-term care and adherence. Their ability to offer personalized patient education, streamlined insurance processing, and home delivery services makes them an attractive option for managing chronic conditions like hemophilia A. The growth of specialty pharmacies is further fueled by partnerships with pharmaceutical companies and advancements in telepharmacy services, enhancing accessibility and patient convenience.

Hemophilia A Treatment Market Regional Analysis

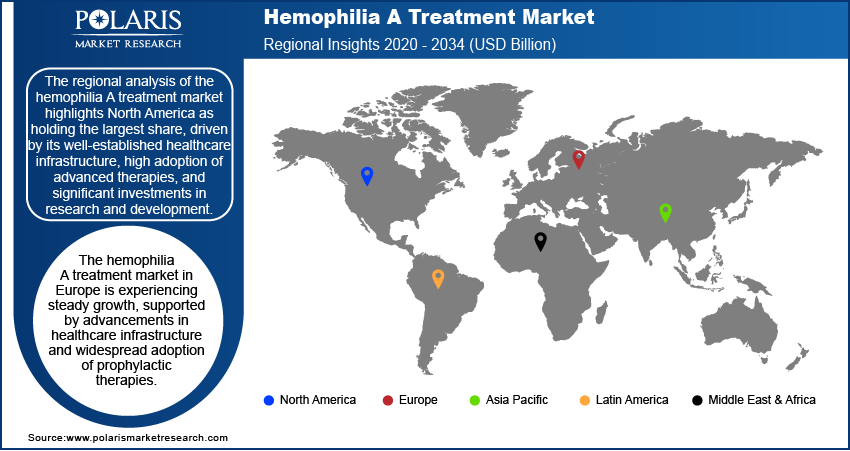

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regional analysis of the hemophilia A treatment market highlights North America as holding the largest share, driven by its well-established healthcare infrastructure, high adoption of advanced therapies, and significant investments in research and development. The region benefits from favorable reimbursement policies and the presence of major biopharmaceutical companies actively involved in developing innovative treatments such as gene therapy and monoclonal antibodies. Additionally, increasing awareness campaigns by organizations like the National Hemophilia Foundation and robust clinical trial activity contribute to the market growth in this region. While Europe and Asia Pacific are also emerging as key markets due to advancements in healthcare systems and rising patient awareness, North America’s leadership is anchored by its comprehensive healthcare support and access to advanced treatments.

The Europe hemophilia A treatment market is experiencing steady growth, supported by advancements in healthcare infrastructure and widespread adoption of prophylactic therapies. Countries such as Germany, the UK, and France are leading the region due to their high awareness levels, strong reimbursement frameworks, and access to innovative treatments. Additionally, initiatives by organizations such as the European Haemophilia Consortium are enhancing patient education and driving the adoption of new therapies, including gene therapy and non-factor replacement treatments.

Asia Pacific represents a rapidly growing market for hemophilia A treatment, driven by increasing healthcare investments and a rising prevalence of hemophilia in densely populated countries like China and India. Expanding healthcare access and growing awareness of hemophilia management are encouraging the adoption of advanced treatments. Governments and non-profit organizations are playing a crucial role by supporting diagnostic initiatives and subsidizing therapies, particularly in emerging economies. The regional market growth is further supported by clinical trials and local manufacturing efforts to make innovative therapies more accessible and affordable.

Hemophilia A Treatment Market – Key Players and Competitive Insights

Key players actively operating in the hemophilia A treatment market include CSL Behring, Pfizer Inc., Novo Nordisk A/S, Takeda Pharmaceutical Company Limited, Bayer AG, Sanofi (through its acquisition of Bioverativ), F. Hoffmann-La Roche Ltd., Octapharma AG, Grifols S.A., BioMarin Pharmaceutical Inc., Spark Therapeutics (a subsidiary of Roche), Aptevo Therapeutics, Kedrion Biopharma, Sangamo Therapeutics, and uniQure N.V. These companies focus on developing and delivering advanced therapies, including recombinant factor VIII, extended half-life products, gene therapies, and monoclonal antibodies.

The competitive landscape of the hemophilia A treatment market is characterized by continuous innovation and strategic collaborations. Companies such as BioMarin Pharmaceutical Inc. and uniQure N.V. are investing in gene therapy development, aiming to provide long-term solutions for hemophilia A patients. Established firms like CSL Behring, Novo Nordisk, and Takeda are focusing on improving existing therapies, such as extended half-life factor VIII products, to enhance patient convenience and adherence. Meanwhile, Roche and its subsidiary Spark Therapeutics are advancing monoclonal antibody treatments and gene therapy pipelines, highlighting a shift toward new, less invasive approaches.

Insights into the market reveal intense competition to address unmet needs, particularly for patients with inhibitors or those requiring prophylactic care. Companies are also engaging in partnerships to enhance R&D efforts and expand their geographical reach. For example, collaborations between biotech firms and academic institutions are accelerating the development of advanced treatments. Additionally, increasing focus on affordability and accessibility in emerging markets is shaping competitive strategies, with players investing in localized manufacturing and tailored solutions to address region-specific challenges.

CSL Behring is a prominent company in the hemophilia A treatment market, known for its comprehensive portfolio of plasma-derived and recombinant therapies. The company offers treatments like Afstyla, a single-chain recombinant factor VIII therapy designed for prophylaxis and on-demand use.

Roche has made significant contributions to the market through its product emicizumab (Hemlibra), a monoclonal antibody therapy for hemophilia A patients with and without inhibitors. This subcutaneous treatment has gained wide acceptance due to its ability to reduce bleeding episodes significantly.

List of Key Companies in Hemophilia A Treatment Market

- CSL Behring

- Pfizer Inc.

- Novo Nordisk A/S

- Takeda Pharmaceutical Company Limited

- Bayer AG

- Sanofi (through its acquisition of Bioverativ)

- F. Hoffmann-La Roche Ltd.

- Octapharma AG

- Grifols S.A.

- BioMarin Pharmaceutical Inc.

- Spark Therapeutics (a subsidiary of Roche)

- Aptevo Therapeutics

- Kedrion Biopharma

- Sangamo Therapeutics

- uniQure N.V.

Hemophilia A Treatment Industry Developments

- In November 2024, Roche reported positive results from a Phase III clinical trial evaluating Hemlibra in pediatric patients, reinforcing its commitment to expanding therapeutic options for younger populations.

- In October 2024, CSL Behring announced a strategic collaboration with Enable Injections, LLC to enhance its gene therapy pipeline, aiming to provide innovative solutions for hemophilia A patients.

Hemophilia A Treatment Market Segmentation

By Treatment Type Outlook

- On-Demand

- Cure

- Prophylaxis

By Therapy Type Outlook

- Factor Replacement Therapy

- Desmopressin & Fibrin Sealants

- Gene Therapy & Monoclonal Antibodies

By Distribution Channel Outlook

- Hospital Pharmacies

- Specialty Pharmacies

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hemophilia A Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.50 billion |

|

Market Size Value in 2025 |

USD 11.17 billion |

|

Revenue Forecast by 2034 |

USD 19.86 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The hemophilia A treatment market has been segmented into detailed segments of treatment type, therapy type, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the hemophilia A treatment market focus on expanding access to innovative therapies, increasing patient awareness, and enhancing treatment adherence. Companies are leveraging partnerships with healthcare providers and organizations to promote education and early diagnosis. Additionally, firms are investing in the development of gene therapies, extended half-life products, and monoclonal antibodies to address unmet medical needs. Targeting emerging markets with localized production and affordable treatment options is also a key strategy. Digital health platforms and telemedicine are being integrated to improve patient support and optimize treatment regimens

FAQ's

? The hemophilia A treatment market size was valued at USD 10.50 billion in 2024 and is projected to grow to USD 19.86 billion by 2034.

? The market is projected to register a CAGR of 6.6% from 2025 to 2034.

? North America had the largest share of the market in 2024.

? A few of the players actively operating in the hemophilia A treatment market include CSL Behring, Pfizer Inc., Novo Nordisk A/S, Takeda Pharmaceutical Company Limited, Bayer AG, Sanofi (through its acquisition of Bioverativ), F. Hoffmann-La Roche Ltd., Octapharma AG, Grifols S.A., BioMarin Pharmaceutical Inc., Spark Therapeutics (a subsidiary of Roche), Aptevo Therapeutics, Kedrion Biopharma, Sangamo Therapeutics, and uniQure N.V.

? The prophylactic segment accounted for the largest share of the market in 2024.

? The factor replacement therapy segment accounted for the largest share of the market in 2024.

? Hemophilia A treatment refers to the medical interventions used to manage and treat hemophilia A. In this genetic disorder, the blood lacks sufficient clotting factor VIII, leading to difficulty in blood clotting and an increased risk of excessive bleeding. The primary treatment for Hemophilia A involves replacing the missing clotting factor through factor replacement therapy, which can be either recombinant or plasma-derived. Other treatment options include desmopressin (for mild cases), non-factor replacement therapies like emicizumab, and gene therapies, which aim to address the underlying genetic cause of the disorder. These treatments help manage bleeding episodes, prevent joint damage, and improve the quality of life for patients.

? A few key trends in the hemophilia A treatment market are described below: Advancements in Gene Therapy: Ongoing development of gene therapies aiming for long-term or permanent solutions by addressing the genetic root cause of Hemophilia A. Growth of Extended Half-Life Products: Increased adoption of extended half-life factor VIII products to reduce the frequency of infusions and improve patient convenience. Rise of Non-Factor Replacement Therapies: Expanded use of therapies like emicizumab, which offer alternative treatment options that do not require factor VIII replacement. Focus on Personalized Medicine: Increasing emphasis on personalized treatment plans based on genetic profiling and individual patient needs.

? A new company entering the hemophilia A treatment market could focus on developing innovative therapies, such as gene therapy or non-factor replacement treatments, which are gaining traction for their potential to offer long-term or permanent solutions. Additionally, investing in personalized medicine, tailored to the genetic profiles and specific needs of patients, could differentiate the company. Offering subcutaneous formulations or developing extended half-life products could enhance patient convenience and adherence. Partnering with healthcare providers and organizations to improve patient access, especially in emerging markets, and integrating digital health solutions for better disease management would also position the company for success.

? Companies involved in treatment therapy products of hemophilia A and services, and other consulting firms must buy the report.