Hematology Analyzers and Reagents Market Size, Share, Trends, Industry Analysis Report: By Product and Services (Hematology Products & Services, Hemostasis Products & Services, and Immunohematology Products & Services), Price Range, Usage Type, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5262

- Base Year: 2024

- Historical Data: 2020-2023

Hematology Analyzers and Reagents Market Overview

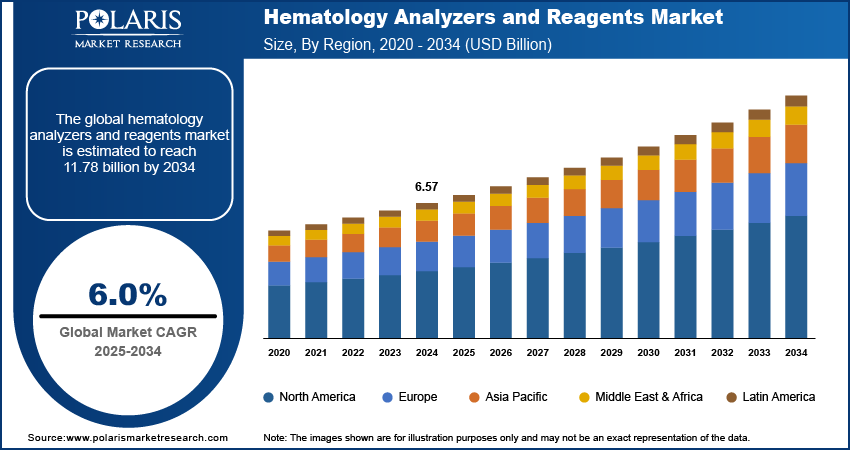

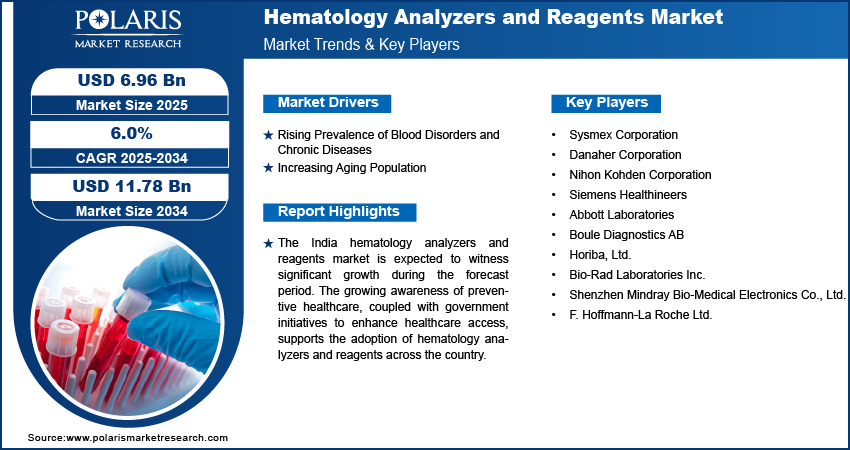

The hematology analyzers and reagents market size was valued at USD 6.57 billion in 2024. The market is projected to grow from USD 6.96 billion in 2025 to USD 11.78 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period.

Hematology analyzers and reagents are essential tools in medical laboratories for examining blood samples, diagnosing various blood disorders, and monitoring overall health. Growing healthcare investments, especially in emerging economies, are boosting the hematology analyzers and reagents market growth. Improved healthcare infrastructure enables hospitals, clinics, and labs to adopt sophisticated hematology analyzers and reagents. Furthermore, innovations in hematology analyzers, such as the integration of artificial intelligence and automation, have enhanced testing accuracy, speed, and usability. Advanced analyzers provide more detailed blood cell analysis and even identify rare cells, which aids in early and precise diagnosis of blood disorders, thereby fueling the hematology analyzers and reagents market expansion.

The demand for portable and user-friendly hematology analyzers has upsurged due to the rising preference for point-of-care testing in outpatient settings, remote areas, and emergencies. This trend is driving product innovation and expanding the market for compact, efficient analyzers. Moreover, the COVID-19 pandemic increased the need for comprehensive blood analysis, including complete blood count (CBC) tests, which are often used to detect signs of infections or immune response. This spike in testing has accelerated hematology analyzer usage across healthcare facilities globally, which is further contributing to the hematology analyzers and reagents market development.

To Understand More About this Research: Request a Free Sample Report

Hematology Analyzers and Reagents Market Driver Analysis

Rising Prevalence of Blood Disorders and Chronic Diseases

Increasing cases of anemia, leukemia, and infections are fueling the demand for precise hematology testing. For instance, according to the World Health Organization, in 2023, globally, about 40% of children aged 6 to 59 months, 37% of pregnant women, and 30% of women aged 15 to 49 years were affected by anemia. Additionally, chronic conditions such as diabetes and cardiovascular disease require consistent blood monitoring, making hematology analyzers essential in diagnostic laboratories and healthcare facilities. This demand reflects a growing need for advanced hematology solutions that enable routine blood assessments, support early diagnosis, and enhance patient management in chronic disease care. Therefore, the rising prevalence of blood disorders and chronic diseases is a key driver in the hematology analyzers and reagents market expansion.

Increasing Aging Population

Older adults are more susceptible to conditions that necessitate regular blood analysis, including cancers, infections, and immune disorders, all of which require ongoing diagnostic support. According to the United Nations, the global population aged 65 and above is projected to grow from 761 million in 2021 to 1.6 billion by 2050. This demographic shift emphasizes the need for advanced hematology solutions that efficiently handle increased testing volumes and provide the detailed, reliable results necessary for managing age-related health complexities. Therefore, the expanding elderly population globally boosts the hematology analyzers and reagents market growth.

Hematology Analyzers and Reagents Market Segment Analysis

Hematology Analyzers and Reagents Market Assessment by Product and Services

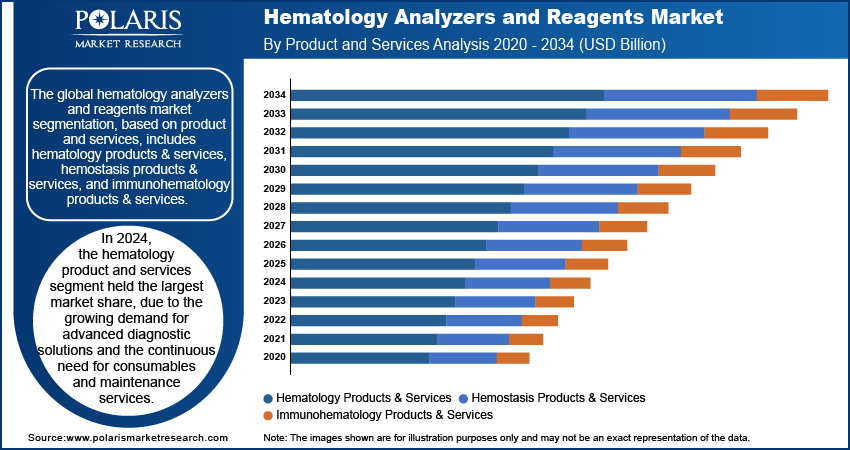

The global hematology analyzers and reagents market segmentation, based on product and services, includes hematology products & services, hemostasis products & services, and immunohematology products & services. In 2024, the hematology product and services segment held the largest share of the market due to the growing demand for advanced diagnostic solutions and the continuous need for consumables and maintenance services. Hospitals, diagnostic laboratories, and research centers are increasingly relying on high-precision hematology analyzers to enhance diagnostic accuracy and speed, addressing the rising incidence of chronic diseases and blood disorders.

Hematology Analyzers and Reagents Market Outlook by Usage

The global hematology analyzers and reagents market segmentation, based on usage type, includes standalone and POCT. The standalone segment is expected to witness a higher CAGR during the forecast period due to the rising demand for independent, high-capacity hematology analyzers in large hospitals and diagnostic laboratories. These standalone analyzers offer advanced features for comprehensive blood analysis and can handle high sample volumes efficiently, making them ideal for settings with substantial testing needs. Additionally, capability of standalone analyzers and reagents for in-depth, automated diagnostics reduces the need for manual intervention, enhancing operational efficiency and accuracy.

Hematology Analyzers and Reagents Market Breakdown, by Regional Outlook

By region, the study provides hematology analyzers and reagents market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share. The US and Canada have high rates of chronic conditions, such as cardiovascular diseases, diabetes, and cancers, which require routine blood testing for effective management. This high prevalence increases the need for hematology testing solutions, fueling the market for hematology analyzers and reagents in North America. For instance, according to the Centers for Disease Control and Prevention, in 2022, heart disease claimed the lives of approximately 0.7 million people, accounting for 1 in every 5 deaths in the US.

The US accounted for larger hematology analyzers and reagents market share in 2024 due to the highly developed healthcare system with extensive access to advanced diagnostic technology. The country’s well-equipped hospitals, clinics, and diagnostic labs frequently invest in advanced hematology analyzers, ensuring high testing efficiency and accuracy. This infrastructure advantage significantly drives demand for hematology products and services.

The Asia Pacific hematology analyzers and reagents market is expected to witness significant growth during the forecast period due to increasing healthcare expenditure and advancements in medical infrastructure across the region. Rapid urbanization and rising awareness of preventive healthcare are driving demand for regular diagnostic testing, particularly for chronic diseases and blood disorders. Additionally, the expanding elderly population and a growing incidence of conditions such as anemia, diabetes, and cardiovascular diseases are fueling the need for advanced hematology solutions. Supportive government initiatives aimed at improving healthcare access and expanding diagnostic services further contribute to the market’s robust growth outlook in Asia Pacific.

The India hematology analyzers and reagents market is expected to witness significant growth during the forecast period. The growing awareness of preventive healthcare, coupled with government initiatives to enhance healthcare access, further supports the adoption of hematology analyzers and reagents across the country.

Hematology Analyzers and Reagents Market – Key Players and Competitive Analysis Report

The competitive landscape of the hematology analyzers and reagents market is characterized by the presence of several key players, ranging from global giants to regional specialists. Major companies such as Abbott Laboratories, Siemens Healthineers, Beckman Coulter, and Roche Diagnostics dominate the market, offering a wide range of advanced hematology analyzers, reagents, and associated services. Major players are focusing on product innovation, technological advancements, and strategic partnerships to enhance their market positions. Additionally, several emerging players are contributing to the competition by introducing cost-effective solutions tailored to meet the needs of smaller healthcare facilities and diagnostic centers, particularly in emerging markets. Intense competition in the market is also driven by the increasing demand for automation, artificial intelligence integration, and point-of-care solutions, prompting companies to invest heavily in R&D. Furthermore, collaborations with healthcare providers, mergers and acquisitions, and regional expansions are common strategies employed to capture a larger market share and meet the growing global demand for hematology testing. A few key major players are Sysmex Corporation; Danaher Corporation; Nihon Kohden Corporation; Siemens Healthineers; Abbott Laboratories; Boule Diagnostics AB; Horiba, Ltd.; Bio-Rad Laboratories Inc.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; and F. Hoffmann-La Roche Ltd.

Abbott Laboratories is a global healthcare company that discovers, develops, manufactures, and sells a wide range of healthcare products worldwide. The company operates in four segments—established pharmaceutical products, diagnostic products, nutritional products, and medical devices. Abbott’s pharmaceutical products segment offers generic pharmaceuticals for various medical conditions such as hypertension, pancreatic exocrine insufficiency, and pain management. The diagnostic products segment provides laboratory and transfusion medicine systems, point-of-care testing, molecular diagnostics, and informatics solutions for clinical laboratories. In August 2023, Abbott received FDA clearance for its Alinity h-series hematology system, allowing US laboratories to conduct comprehensive blood count analyses (CBCs) as part of the Alinity diagnostic product line.

Danaher Corporation is an American global conglomerate founded in 1984. Headquartered in Washington, D.C., Danaher specializes in designing, manufacturing, and marketing a diverse range of medical, industrial, and commercial products and services. The company operates through three main segments—life sciences, diagnostics, and environmental & applied solutions—leveraging the Danaher Business System (DBS) to drive operational efficiency and continuous improvement across its operations. Danaher Corporation, with a strategy focused on strategic acquisitions, has evolved from its initial industrial roots into a leading innovator in science and technology.

Key Companies in Hematology Analyzers and Reagents Market

- Sysmex Corporation

- Danaher Corporation

- Nihon Kohden Corporation

- Siemens Healthineers

- Abbott Laboratories

- Boule Diagnostics AB

- Horiba, Ltd.

- Bio-Rad Laboratories Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- F. Hoffmann-La Roche Ltd.

Hematology Analyzers and Reagents Industry Developments

In May 2024, HORIBA announced that its high-throughput hematology analyzer, Yumizen H2500, received FDA 510(k) clearance and is now commercially available in the US.

In May 2023, Bio-Rad Laboratories, Inc. launched the IH-500 NEXT System, a fully automated platform designed for the efficient generation of ID-Cards. This innovative system enhances laboratory workflow by integrating advanced automation features, improving accuracy and throughput in ID testing processes.

Hematology Analyzers and Reagents Market Segmentation

By Product and Services Outlook (Revenue, USD Billion; 2020–2034)

- Hematology Products & Services

- Instruments

- 5-Part and 6-Part Fully Automated Hematology Analyzers

- 3-Part Fully Automated Hematology Analyzers

- Point-of-Care Testing Hematology Analyzers

- Semi-Automated Hematology Analyzers

- Reagents and Consumables

- Hematology Reagents

- Slide Stainers/Makers

- Controls and Calibrators

- Consumables

- Services

- Instruments

- Hemostasis Products & Services

- Instruments

- Reagents & Consumables

- Services

- Immunohematology Products & Services

- Instruments

- Reagents & Consumables

- Services

By Price Range Outlook (Revenue, USD Billion; 2020–2034)

- High Range Hematology Analyzers

- Mid-Range Hematology Analyzers

- Low- Range Hematology Analyzers

By Usage Type Outlook (Revenue, USD Billion; 2020–2034)

- Standalone

- POCT

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Anemia

- Blood Cancer

- Hemorrhagic Conditions

- Infectious Diseases

- Immune System Disorders

- Other Applications

By End User Outlook (Revenue, USD Billion; 2020–2034)

- Hospital Laboratories

- Commercial Service Providers

- Government Reference Laboratories

- Research & Academic Institutes

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hematology Analyzers and Reagents Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.57 billion |

|

Market Size Value in 2025 |

USD 6.96 billion |

|

Revenue Forecast by 2034 |

USD 11.78 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hematology analyzers and reagents market value reached USD 6.57 billion in 2024 and is projected to grow to USD 11.78 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

In 2024, North America dominated the market due to the high rates of chronic conditions, such as cardiovascular diseases, diabetes, and cancers, which require routine blood testing for effective management.

A few key players in the market are Sysmex Corporation; Danaher Corporation; Nihon Kohden Corporation; Siemens Healthineers; Abbott Laboratories; Boule Diagnostics AB; Horiba, Ltd.; Bio-Rad Laboratories Inc.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; and F. Hoffmann-La Roche Ltd.

In 2024, the hematology products & services segment held the largest share of the market, due to the growing demand for advanced diagnostic solutions and the continuous need for consumables and maintenance services.

The standalone segment is expected to witness a higher CAGR during the forecast period due to the rising demand for independent, high-capacity hematology analyzers in large hospitals and diagnostic laboratories.