Hematologic Malignancies Therapeutics Market Size, Share, Trends, Industry Analysis Report: By Disease (Leukemia, Lymphoma, and Myeloma), Therapy, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1347

- Base Year: 2024

- Historical Data: 2020-2023

Hematologic Malignancies Therapeutics Market Overview

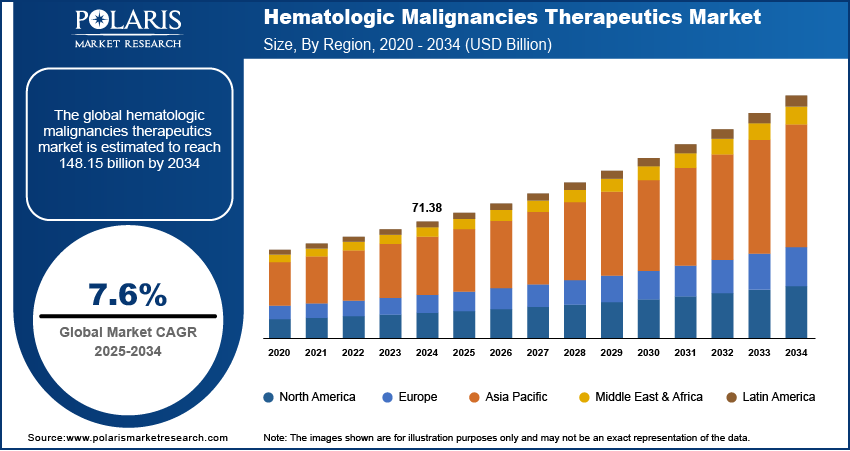

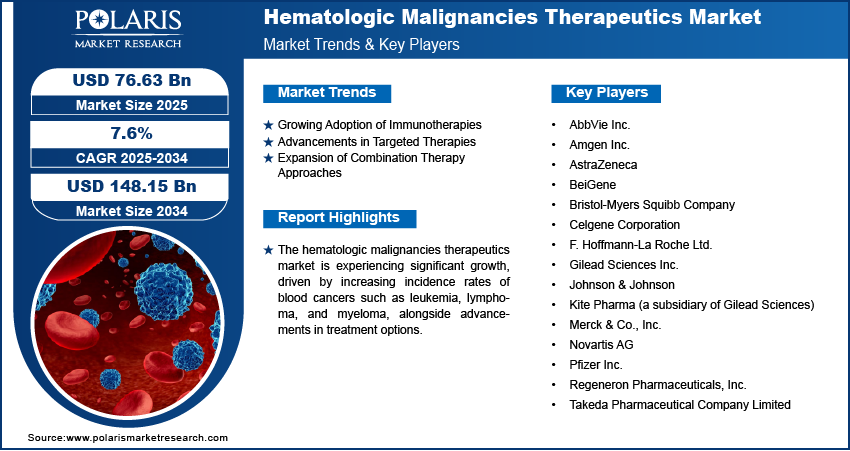

The hematologic malignancies therapeutics market size was valued at USD 71.38 billion in 2024. The market is projected to grow from USD 76.63 billion in 2025 to USD 148.15 billion by 2034, exhibiting a CAGR of 7.6% during the forecast period.

The hematologic malignancies therapeutics market focuses on the development and commercialization of treatments for blood cancers, including leukemia, lymphoma, and multiple myeloma. This market is driven by the increasing prevalence of hematologic cancers, advancements in targeted therapies, and rising demand for personalized medicine. Key trends such as the growing adoption of cancer immunotherapy, CAR-T cell therapy, and the development of next-generation monoclonal antibodies. Additionally, increased investment in research and development, coupled with regulatory approvals for new therapeutics, is expected to support market growth. Challenges such as high treatment costs and limited accessibility in developing regions impact the hematologic malignancies therapeutics market expansion.

To Understand More About this Research: Request a Free Sample Report

Hematologic Malignancies Therapeutics Market Dynamics

Growing Adoption of Immunotherapies

Immunotherapies, particularly CAR-T cell therapies, are revolutionizing the treatment landscape for hematologic malignancies. These therapies leverage the body’s immune system to target and destroy cancer cells, offering a new avenue for patients with relapsed or refractory cancers. For example, CAR-T therapies such as axicabtagene ciloleucel and tisagenlecleucel have shown high remission rates in patients with diffuse large B-cell lymphoma. According to a 2023 study published in Blood Advances, over 60% of patients treated with CAR-T therapy for relapsed lymphomas achieved durable responses. The increasing success of these therapies is driving their adoption globally, supported by ongoing clinical trials to expand their applications.

Advancements in Targeted Therapies

Targeted therapies, including kinase inhibitors and monoclonal antibodies, are a cornerstone of hematologic malignancies treatment. These therapies focus on specific molecular targets associated with cancer cells, minimizing damage to healthy tissues. For instance, Bruton’s tyrosine kinase (BTK) inhibitors, such as ibrutinib and acalabrutinib, have transformed the management of chronic lymphocytic leukemia (CLL) and mantle cell lymphoma. According to a 2021 report in Nature Reviews Clinical Oncology, BTK inhibitors have contributed to five-year survival rates exceeding 80% in CLL patients. The continued development of novel agents targeting mutations and pathways, such as BCL2 and FLT3, is further shaping the hematologic malignancies therapeutics market.

Expansion of Combination Therapy Approaches

Combination therapies are gaining prominence due to their potential to enhance efficacy and reduce resistance in hematologic malignancies. These approaches integrate immunotherapies, targeted therapies, and traditional chemotherapy to achieve synergistic effects. For example, the combination of venetoclax, a BCL2 inhibitor, with azacitidine has become a standard of care for older adults with acute myeloid leukemia (AML). Clinical trials have demonstrated response rates exceeding 70% in certain patient populations, as highlighted by findings in The Lancet Oncology. The shift towards personalized combination regimens is a key trend driven by advancements in genomics and biomarker research

Hematologic Malignancies Therapeutics Market Segment Insights

Hematologic Malignancies Therapeutics Market Assessment by Disease

The hematologic malignancies therapeutics market assessment, based on disease, includes leukemia, lymphoma, and myeloma. Among these, leukemia represents the largest market share due to the high incidence and prevalence rates, coupled with advancements in treatment options such as targeted therapies and immunotherapies. Acute myeloid leukemia (AML) and chronic lymphocytic leukemia (CLL) are particularly significant contributors, driven by the adoption of therapies such as FLT3 inhibitors and monoclonal antibodies. According to the American Cancer Society, approximately 59,610 new cases of leukemia are expected annually in the US, highlighting the substantial demand for effective treatments in this segment.

The lymphoma segment is also anticipated to register the fastest growth during the forecast period, attributed to advancements in CAR-T cell therapies and checkpoint inhibitors that are transforming the standard of care for diseases such as diffuse large B-cell lymphoma and Hodgkin lymphoma. Increasing clinical trial activity and regulatory approvals for new therapies further drive this growth. Additionally, myeloma treatments are witnessing steady advancements, with the introduction of next-generation proteasome inhibitors and immunomodulatory agents improving patient outcomes. This diverse therapeutic landscape underscores the dynamic nature of innovation in hematologic malignancies.

Hematologic Malignancies Therapeutics Market Evaluation by Therapy

The hematologic malignancies therapeutics market evaluation, based on therapy, includes chemotherapy, immunotherapy, targeted therapy, and others. Immunotherapy holds the largest market share, driven by the widespread adoption of treatments such as CAR-T cell therapies, immune checkpoint inhibitors, and monoclonal antibodies. The transformative impact of these therapies, particularly in treating relapsed or refractory blood cancers, has been a key factor in their dominance. For instance, therapies such as pembrolizumab and nivolumab have shown significant clinical efficacy in hematologic malignancies, further cementing immunotherapy's role as a cornerstone of modern treatment. Growing approval rates and increasing integration of immunotherapies in treatment protocols continue to boost their market presence.

Targeted therapy is also registering the fastest growth rate within the market, attributed to the precision and efficacy these treatments offer by addressing specific molecular targets in cancer cells. Bruton’s tyrosine kinase (BTK) inhibitors, FLT3 inhibitors, and BCL2 inhibitors exemplify this segment's rapid innovation. For example, the FDA-approved ibrutinib has significantly improved outcomes for patients with chronic lymphocytic leukemia (CLL). Additionally, advancements in biomarker identification and companion diagnostics are enhancing the development of targeted therapies, accelerating their uptake in clinical settings. This growing emphasis on precision medicine continues to drive investment and innovation in the targeted therapy segment.

Hematologic Malignancies Therapeutics Market Outlook by End Use

The hematologic malignancies therapeutics market outlook, based on end use, includes hospital pharmacies, retail pharmacies, and others. Hospital pharmacies hold the largest market share, driven by their role as primary distributors of advanced therapeutics for hematologic cancers. The complex nature of treatments such as CAR-T cell therapies, which require specialized handling and administration, makes hospital pharmacies critical for ensuring patient access. Additionally, the rising prevalence of hematologic malignancies and the growing number of hospital admissions for cancer treatment contribute to the dominance of this segment. The integration of multidisciplinary care within hospitals further supports the widespread use of hospital pharmacies for treatment distribution.

Retail pharmacies are also experiencing the fastest growth rate, supported by the increasing availability of oral oncolytics and targeted therapies that can be administered at home. Medications such as kinase inhibitors and immunomodulators have simplified treatment regimens for certain hematologic malignancies, driving demand through retail channels. The convenience of these therapies, combined with growing patient preference for outpatient care, enhances the segment's growth potential. Expanding initiatives to improve the accessibility of cancer treatments in remote areas also contribute to the rising significance of retail pharmacies in the distribution network.

Hematologic Malignancies Therapeutics Market Regional Insights

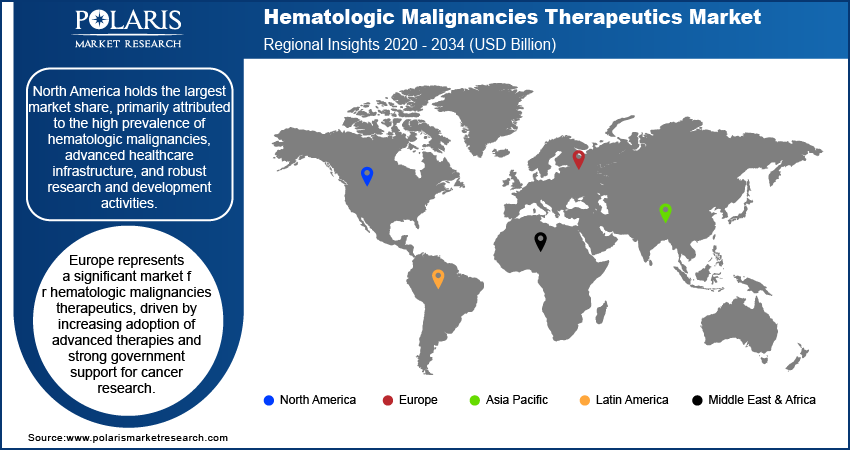

The hematologic malignancies therapeutics market exhibits a significant regional presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest hematologic malignancies therapeutics market share, primarily attributed to the high prevalence of hematologic malignancies, advanced healthcare infrastructure, and robust research and development activities. The region benefits from substantial government and private sector investment in innovative therapies, along with early regulatory approvals for new treatments such as CAR-T cell therapies and targeted therapies. Additionally, the presence of leading biopharmaceutical companies and a strong focus on precision medicine further bolster the dominance of North America in the market. High patient awareness and access to advanced therapies also contribute to its leading position.

Europe represents a significant market for hematologic malignancies therapeutics, driven by increasing adoption of advanced therapies and strong government support for cancer research. Countries such as Germany, the UK, and France are key contributors due to their well-established healthcare systems and high focus on clinical trials for new treatments. The European Medicines Agency’s streamlined regulatory framework facilitates faster approval of innovative therapies, further supporting market growth. Additionally, rising awareness about personalized medicine and access to high-quality cancer care are key factors boosting the hematologic malignancies therapeutics market in Europe.

Asia Pacific is witnessing rapid hematologic malignancies therapeutics market growth, primarily due to increasing cancer incidence, improving healthcare infrastructure, and rising investment in research and development. Countries such as China, Japan, and India are at the forefront of this growth, driven by expanding patient populations and government initiatives to enhance cancer care. The availability of cost-effective biosimilars and the growing focus on medical tourism further contribute to the market's expansion in this region. Emerging collaborations between global and regional pharmaceutical companies also play a crucial role in driving innovation and accessibility in Asia Pacific.

Hematologic Malignancies Therapeutics Market – Key Market Players and Competitive Insights

Key players active in the hematologic malignancies therapeutics market include major pharmaceutical and biotechnology companies driving innovation and providing therapies for leukemia, lymphoma, and myeloma. Some prominent companies include AbbVie Inc.; Amgen Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Gilead Sciences Inc.; Johnson & Johnson; Novartis AG; Pfizer Inc.; Merck & Co., Inc.; Takeda Pharmaceutical Company Limited; AstraZeneca; BeiGene, Kite Pharma (a subsidiary of Gilead Sciences); Celgene Corporation (acquired by Bristol-Myers Squibb); and Regeneron Pharmaceuticals, Inc. These companies focus on developing advanced immunotherapies, targeted therapies, and supportive care products for hematologic malignancies.

The market is characterized by a high degree of competition, with companies prioritizing research and development efforts to launch innovative therapies. Collaboration and licensing agreements are common strategies, enabling firms to expand their product pipelines and market reach. For instance, partnerships between pharmaceutical companies and academic institutions have facilitated the advancement of CAR-T cell therapies and next-generation monoclonal antibodies. Additionally, some companies are investing in companion diagnostics to improve the efficacy and precision of targeted therapies, thereby enhancing their competitive position in the market.

Insights reveal that established players maintain a strong presence by leveraging robust distribution networks and established brand recognition. At the same time, emerging biopharmaceutical firms contribute to the competitive landscape by focusing on niche treatment areas and novel therapeutic approaches. Companies with a diversified portfolio encompassing both approved treatments and a strong pipeline of candidates tend to have a competitive edge. The growing demand for personalized medicine and targeted treatment options is expected to intensify competition further, encouraging continuous innovation and strategic alliances within the market.

AbbVie Inc. is a hematologic malignancies therapeutics market key player, with a strong focus on developing targeted therapies. The company’s flagship product, venetoclax, a BCL-2 inhibitor, is widely used in the treatment of chronic lymphocytic leukemia (CLL) and acute myeloid leukemia (AML). AbbVie’s collaborations with other pharmaceutical firms have enhanced its research capabilities in oncology.

Gilead Sciences Inc. has a significant market presence, particularly through its subsidiary, Kite Pharma, which specializes in CAR-T cell therapies. Kite Pharma’s Yescarta and Tecartus have been pivotal in treating relapsed or refractory lymphomas.

Key Companies in Hematologic Malignancies Therapeutics Market

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- BeiGene

- Bristol-Myers Squibb Company

- Celgene Corporation (acquired by Bristol-Myers Squibb)

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences Inc.

- Johnson & Johnson

- Kite Pharma (a subsidiary of Gilead Sciences)

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

Hematologic Malignancies Therapeutics Market Developments

- November 2024: Kite Pharma expanded its global manufacturing capacity for CAR-T cell therapies to meet rising demand, signaling Gilead's commitment to advancing innovative treatment solutions for hematologic malignancies.

- October 2024: AbbVie announced positive clinical trial results for venetoclax in combination therapies for AML, further advancing its role in personalized cancer treatments.

Hematologic Malignancies Therapeutics Market Segmentation

By Disease Outlook (Revenue, USD Billion, 2020 - 2034)

- Leukemia

- Lymphoma

- Myeloma

By Therapy Outlook (Revenue, USD Billion, 2020 - 2034)

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Others

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hematologic Malignancies Therapeutics Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 71.38 billion |

|

Market Size Value in 2025 |

USD 76.63 billion |

|

Revenue Forecast in 2034 |

USD 148.15 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The hematologic malignancies therapeutics market has been segmented into detailed segments of disease, therapy, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: The growth and marketing strategies in the hematologic malignancies therapeutics market focus on expanding product portfolios, enhancing patient access, and advancing innovative treatments. Companies are increasingly investing in research and development to introduce next-generation therapies, such as CAR-T cell therapies and targeted treatments. Strategic partnerships and collaborations with research institutions and other pharmaceutical firms are common to accelerate the development and commercialization of new therapies. Additionally, expanding distribution networks, improving patient education, and offering support services help increase market penetration. These efforts are complemented by targeted marketing campaigns aimed at healthcare professionals and patients, emphasizing the benefits of advanced treatments in managing blood cancers.

FAQ's

? The hematologic malignancies therapeutics market size was valued at USD 71.38 billion in 2024 and is projected to grow to USD 148.15 billion by 2034.

? The market is projected to register a CAGR of 7.6% during the forecast period, 2024-2034.

? North America had the largest share of the market.

? Some prominent companies include AbbVie Inc.; Amgen Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Gilead Sciences Inc.; Johnson & Johnson; Novartis AG; Pfizer Inc.; Merck & Co., Inc.; Takeda Pharmaceutical Company Limited; AstraZeneca; BeiGene; Kite Pharma (a subsidiary of Gilead Sciences); Celgene Corporation (acquired by Bristol-Myers Squibb); and Regeneron Pharmaceuticals, Inc.

? The leukemia segment accounted for the largest share of the market.

? The chemotherapy segment accounted for the largest share of the market.

? Hematologic malignancies therapeutics refer to the medical treatments used to manage blood cancers, which include leukemia, lymphoma, and myeloma. These cancers affect the blood, bone marrow, lymphatic system, or spleen and require specialized therapeutic approaches. Treatments in this field involve chemotherapy, immunotherapy (such as CAR-T cell therapies and monoclonal antibodies), targeted therapies that target specific cancer-related molecules, and supportive care to manage symptoms and side effects. The goal of hematologic malignancies therapeutics is to control the progression of the disease, achieve remission, and improve patient outcomes by using a combination of these advanced treatment options.

? A few key trends in the hematologic malignancies therapeutics market are described below: Increasing Adoption of Immunotherapies: The use of CAR-T cell therapies and immune checkpoint inhibitors is growing, providing promising results for relapsed or refractory blood cancers. Advancements in Targeted Therapies: Precision medicine is expanding, with therapies targeting specific genetic mutations and molecular pathways, improving treatment efficacy and reducing side effects. Rise of Combination Therapies: Combining immunotherapies, targeted therapies, and traditional treatments like chemotherapy is becoming more common, aiming to enhance efficacy and reduce resistance. Regulatory Approvals for Novel Therapies: Accelerated approvals for new treatments, especially in advanced stages of hematologic malignancies, are boosting market growth.

? A new company entering the Hematologic Malignancies Therapeutics market could focus on developing next-generation immunotherapies and targeted treatments, particularly those addressing unmet needs in rare or refractory blood cancers. Investing in personalized medicine through genetic profiling and companion diagnostics could also offer a competitive edge by tailoring therapies to individual patient needs. Additionally, exploring combination therapy approaches that integrate existing treatments with novel agents could enhance efficacy and patient outcomes. Collaborations with academic institutions and healthcare providers for early-stage clinical trials and fast-track regulatory approvals would also be beneficial. Focusing on expanding access through cost-effective options or biosimilars can further differentiate the company in a growing market.

? Companies manufacturing, distributing, or purchasing Hematologic Malignancies Therapeutics and related products, and other consulting firms must buy the report.