Helicopter Simulator Market Share, Size, Trends, Industry Analysis Report

By Hardware (Full flight, fixed base); By Application (Military, Commercial), By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 113

- Format: PDF

- Report ID: PM2054

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

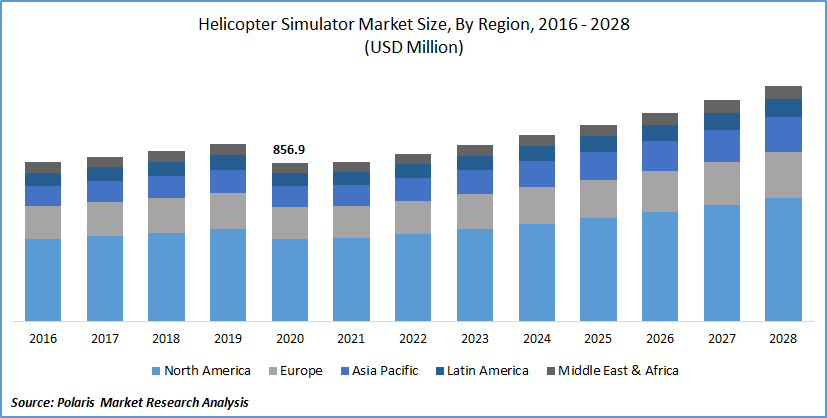

The global helicopter simulator market was valued at USD 856.9 million in 2020 and is expected to grow at a CAGR of 5.7% during the forecast period. The key factors responsible for the market growth include a shortage of skilled pilots, a rise in pilot training institutes, growing concerns towards passenger safety, and innovations in flight simulators. In contrast, the development of simulators for unmanned aerial systems and technological advancement in helicopter simulation technology create a lucrative opportunity for helicopter simulator market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, in 2021, +VIDEO Alsim, a flight simulator maker, has released the Airliner, their advanced jet simulator built to meet ICAO's Competency-Based Training (CBT) regulations. It's a single-generic, cutting-edge training gadget that can replicate various aircraft, including the B737MAX, A320, E190-E2, and SSJ100. It is a multi-purpose hybrid simulator for advanced MCC, APS, JOC, and UPRT training for medium to large approved training organizations.

The helicopter simulator provides the illusion of obstacles and objects that a pilot near the flying zone can face. It comprises environmental parameters such as clouds, mountains, and others in a visual system to make the pilot experience a real-life obstacle while driving helicopters. Also, the motion system of the helicopter simulator is designed to train pilots on controlling complexes and vibrations that occur through helicopters. Due to such inherent properties, the helicopter simulator is expected to procure commendable market demand in the upcoming period.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The significant rise in air traffic and tourism activities worldwide is leveraging the market demand for skilled pilots from the aviation industry worldwide. By 2025, the projected shortfall of airline pilots in the United States is estimated to reach over 4,505, up from 3,170 in 2016. Similarly, in India, according to corrective and preventive action plant research, the country had over 7,963 pilots in 2019. It will need 17,000 more in the next ten years, with 9,000 first officers being promoted to commanders. Therefore, market demand for helicopter simulators has gained traction in the commercial and military sector to train pilots effectively and efficiently on flying helicopters.

Furthermore, because of the increased use of high-level safety measures, the airline industry's expanding technology adoption is improving aircraft efficiency to a large extent. Well-trained pilots also fuel the market for simulator systems. Because aircraft models, sizes, and technology vary on a regular basis, pilots must be trained in tactical interaction and know-how to handle aircraft equipment in detail. The flight deck and cabin crews undergo simulator training in augmented reality (AR) and virtual reality (VR). Therefore, these benefits are expected to drive the growth of the helicopter simulator market over the forecast years.

Report Segmentation

The market is primarily segmented on the basis of product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product Type

Full flight simulator accounts for the leading share in the global market in 2020. These simulators are gaining potential market demand from aspiring pilots to increase operational efficiency and higher training capabilities. It is integrated with night vision devices and motion sensors in order to make the pilot learn about expected situations he might face during flying helicopters. The Association of such advanced technologies is primitively leveraging the market demand for full flight simulator technology from commercial and military training institutes, thereby driving the helicopter simulator segment's growth.

Insight by Application

Based on the application segment, military helicopter accounts for the leading revenue contributor in the global market for helicopter simulator in 2020. Military helicopter simulators prepare pilots for tasks such as logistics and troop, cargo, and ammo delivery. Additionally, pilots receive training in a comprehensive mission simulator on warfare conditions, which is extremely important and costly to provide on an actual helicopter. As a result of these considerations, military simulations have become increasingly popular.

Geographic Overview

North America held the largest share in the global market in 2020. The presence of significant market players in the region is one of the major factors contributing to the region's growth. Growing helicopter registration and market demand for the skilled pilot is propelling the region's growth. For instance, as per Statista, the total registration of helicopters in Canada was 2,830 in 2017, growing to 2,879 by 2020.

Moreover, the growing importance of simulation training for pilot and passenger safety is leveraging the market demand for helicopter simulators. For example, according to the US Helicopter Safety Team (USHST), in 2017, there were 121 helicopter accidents in the United States, with 20 of them being deadly, resulting in 34 deaths. In 2017, the rate of helicopter accidents in the United States was 3.55 per 100,000 flight hours, with a fatal accident rate of 0.59 per 100,000 flight hours. Thereby driving the region's growth. APAC is projected to register a lucrative growth rate over the study period. This is primarily due to the rise in passenger volume traveling by air, which has raised the market demand for commercial pilots. This is expected to result in the adoption of flight simulators in the near future, propelling the region's growth.

As per the Indian Brand Equity Foundation, around 2024, India will overtake the United Kingdom as the world's third-largest aviation market. Air passenger traffic reached 316.5 million from April 2018 to February 2019. From USD 234.0 billion in 2017, travel and tourism contributed USD 247.3 billion to India's GDP in 2018. By 2028, it is expected that the contribution will have increased to USD 492.2 billion. Moreover, in 2019, Indian airlines employed 2,301 pilots, many of whom had previously worked for Jet Airways. Airlines employed 1,696 and 1,221 pilots through examinations in 2018 and 2017, respectively.

Furthermore, due to an increase in air travelers in Arab countries in recent years, the Middle East and Africa market is expected to rise rapidly. In addition, rising tourism investment and the existence of well-known airlines in the region are projected to propel the Middle East industry forward. In addition, due to increased passenger traffic and domestic airline operations, the rest of the world's market will experience moderate development.

Competitive Insight

Some of the major players operating the global market include Airbus SE, Avion Group, Boeing, C.A.E. Inc., Collins Aerospace, DXC Technology Company, Elbit Systems, Ltd, ELITE Simulation Solutions, FlightSafety International, FRASCA International Inc., Indra Sistemas, L3 Harris Technologies, Inc., Precision Flight Controls, Raytheon Technologies Corporation, Rheinmetall, SIMCOM Aviation Training, Textron, Thales Group, and TRU Simulation + Training.

Helicopter Simulator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 856.9 million |

|

Revenue forecast in 2028 |

USD 1,275.8 million |

|

CAGR |

5.7% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 – 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Airbus SE, Avion Group, Boeing, C.A.E. Inc., Collins Aerospace, DXC Technology Company, Elbit Systems, Ltd, ELITE Simulation Solutions, FlightSafety International, FRASCA International Inc., Indra Sistemas, L3 Harris Technologies, Inc., Precision Flight Controls, Raytheon Technologies Corporation, Rheinmetall, SIMCOM Aviation Training, Textron, Thales Group, and TRU Simulation + Training. |