Heat Shrink Tubing and Sleeves Market Share, Size, Trends, Industry Analysis Report, By Product (Polyolefin, Per Fluoroalkoxy Alkane (PFA), Poly Tetra Fluoro Ethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyether Ether Ketone (PEEK), Others); By Sales Channel; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3850

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

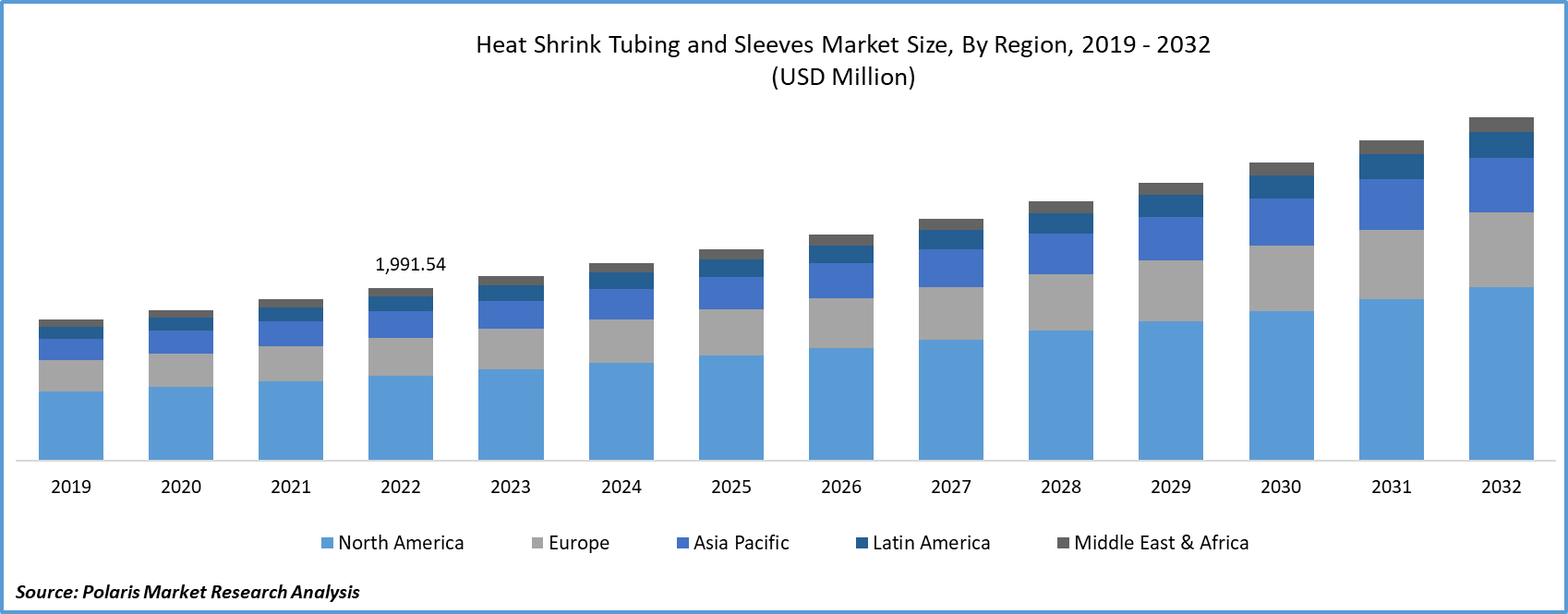

The global heat shrink tubing and sleeves market was valued at USD 1,991.54 million in 2022 and is expected to grow at a CAGR of 7.2% during the forecast period.

The heat shrink tubing and sleeves market plays a pivotal role in a wide range of industries, offering versatile solutions for electrical insulation, cable protection, and mechanical reinforcement. This market has experienced significant growth and innovation in recent years, driven by the increasing demand for reliable and durable solutions in sectors such as electronics, automotive, aerospace, telecommunications, and construction. As businesses and industries continue to seek efficient and cost-effective methods for bundling and protecting cables, wires, and components, the market remains dynamic and competitive.

To Understand More About this Research: Request a Free Sample Report

Materials used to form heat shrink tubing are specially designed and have been strengthened using radiation cross-linking, a technique with product design that enables repeatable, dependable, and shrink-to-fit installations that are compatible with numerous manufacturing processes. The automotive, telecommunications, power distribution, aerospace, defence, industrial, and commercial applications of these devices are used all over the world. The materials used to create the tube items have been specially developed, and radiation cross-linking is a method that has improved them.

The COVID-19 pandemic has disrupted various industries, including automotive, aerospace, construction, and electronics, which are major consumers of heat shrink tubing and sleeves. The economic slowdown, lockdown measures, and supply chain disruptions have led to a decrease in production and demand for these industries, consequently impacting the demand for heat shrink products. Many infrastructure projects, construction activities, and manufacturing projects were delayed or put on hold due to the pandemic. This has resulted in reduced demand for heat shrink tubing and sleeves.

Industry Dynamics

Growth Drivers

Technological Advancement

Technological development in heat shrink tubing is driving force behind the growth of the heat shrink tubing and sleeves market. Technology has enabled the use of advanced manufacturing techniques for heat shrink tubing, such as extrusion processes and laser-etching. These have led to innovations in shrink technology, including faster and more efficient shrinking capabilities. For example, at MD&M West, Junkosha introduced its most recent heat shrink technology. The first ultra-small peelable heat shrink tubing (PHST) & high-shrink ratio PHST were introduced by materials expert at the MD&M West. As a result, these advancements have expanded the application possibilities and enhanced the overall performance and reliability of heat shrink tubing, driving the growth.

Furthermore, augmenting strategies by various market leaders are significantly contributing to the development in the market. Partnerships and collaborations lead to the development of advanced manufacturing technologies, improved materials, and innovative product designs. For example, in June 2021, Italian modular green hydrogen production plants were being developed in collaboration with the Swiss utility Axpo and ABB. In that regard, the two businesses recently inked a memorandum of understanding with the goal of creating a workable business plan for producing affordable, environmentally friendly hydrogen. By leveraging these advancements, companies can produce heat shrink tubing and sleeves that offer better durability, higher heat resistance, enhanced electrical insulation, and other desirable properties. This drives the market with considerable revenue worldwide.

Report Segmentation

The market is primarily segmented based on material type, sales channel, application, and region.

|

By Material Type |

By Sales Channel |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type Analysis

Polyolefin segment held the largest market share in 2022

In 2022, polyolefin segment held the largest market share which are versatile and can be used in various industries and applications. They offer excellent electrical insulation, mechanical protection, and chemical resistance properties, making them suitable for applications in electrical, automotive, aerospace, telecommunications, and other industries. The broad range of applications contributes to the dominance of the polyolefin segment. Moreover, polyolefin heat shrink products are often cost-effective compared to other materials. They provide a good balance between performance and affordability, making them a preferred choice for many applications. These are known for their easy installation and shrinkability.

By Sales Channel Analysis

Original Equipment Manufacturer (OEM) segment held fastest market share in 2022

Original Equipment Manufacturer (OEM) segment held fastest market share in 2022 which allow heat shrink tubing and sleeves manufacturers to directly supply their products to original equipment manufacturers. This enables manufacturers to establish strong relationships with OEMs, understand their specific requirements, and tailor their products accordingly. OEMs often prefer direct sourcing from manufacturers to ensure product quality, customization options, and reliable supply.

Moreover, this sales channel is typically integrated into the supply chain of the original equipment manufacturers. This integration enables manufacturers to align their production and delivery processes with the manufacturing schedules and requirements of the OEMs. This often involves high-volume sales and long-term contracts. Original equipment manufacturers require a continuous supply of heat shrink tubing and sleeves for their production processes. By securing long-term contracts with OEMs, manufacturers can ensure stable sales volume and revenue, contributing to the dominance of the OEM sales channel in the market.

Regional Insights

North America is accounting the largest market share during forecast year

North America is accounting the largest market share during forecast year. Electric vehicles, safety standards, aftermarket demand, technological advancements, and manufacturing processes, are the key driver for the heat shrink tubing and sleeves market. Primarily, the rising popularity of electric vehicles further contributes to the demand for heat shrink tubing and sleeves. For instance, in 2021, almost 630,000 electric vehicles were sold in the United States, doubling their market share to 4.5%. EVs require complex electrical systems and connections, including high-voltage wiring and battery components. Heat shrink tubing and sleeves play a crucial role in insulating and protecting these sensitive electrical components, ensuring their safe and reliable operation.

Asia Pacific is fastest growing region during the forecast years. The automotive industry is playing a significant role in driving the market in this region. Asia Pacific is a major hub for automotive manufacturing, with countries like China, Japan, South Korea, and India being major contributors. For instance, according to information from the Ministry of Industry and Information Technology, approximately 26 million vehicles, including 21.48 million passenger cars, were sold in 2021, an increase of 7.1% from the previous year. The region has witnessed significant growth in automotive production, driven by factors such as rising disposable incomes, increasing urbanization, and favorable government policies. As the automotive industry expands in the region, the demand for heat shrink tubing and sleeves for various applications also increases.

Key Market Players & Competitive Insights

Key players offer a critical understanding of the strategies, strengths, and market positions of within the industry. These insights are vital for stakeholders, including businesses, investors, and analysts, to assess competitive dynamics, anticipate industry trends, and make informed decisions.

The global players include:

- 3M

- ABB

- Alpha Wire

- Changyuan ElectronicsCygia

- Dasheng Group

- Dunbar Products

- GREMCO GmbH

- HellermannTyton

- Hilltop

- Huizhou Guanghai Electronic Insulation Materials

- Molex

- Panduit

- PEXCO

- Prysmain Group

- Qualtek Electronics Corp.

- SHAWCOR

- Shenzhen Woer Heat - Shrinkable Material

- Sumitomo Electric Industries

- TE Connectivity

- Techflex

- Thermosleeve USA

- Zeus Industrial Products, Inc.

Recent Developments

- In September 2022, a recyclable, light-blocking shrink sleeve called GreenLabelTM BlockOut has just been released by Brook + Whittle. With a patented light-blocking coating, this patent-pending solution enables brands switch from glass and difficult-to-recycle plastics to transparent PET packaging. Even better, this shrinks sleeve maximises recycling without contaminating the recycling stream by working with the present recycling system.

Heat Shrink Tubing and Sleeves Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,129.88 million |

|

Revenue forecast in 2032 |

USD 3,967.35 million |

|

CAGR |

7.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Material Type, By Sales Channel, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in heat shrink tubing and sleeves market are 3M, ABB, Alpha Wire, Changyuan ElectronicsCygia, Dasheng Group.

The global heat shrink tubing and sleeves market is expected to grow at a CAGR of 7.2% during the forecast period.

The heat shrink tubing and sleeves market report covering key segments are material type, sales channel, application, and region.

key driving factors in industrial heat shrink tubing and sleeves market are Automotive Sector Expansion.

The global heat shrink tubing and sleeves market size is expected to reach USD 3,967.35 Million by 2032