Heat Pump Water Heater Market Size, Share, Trends, Industry Analysis Report: By Technology, Capacity, Operation Type (Electric and Hybrid), Application, Tank Capacity, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5407

- Base Year: 2024

- Historical Data: 2020-2023

Heat Pump Water Heater Market Overview

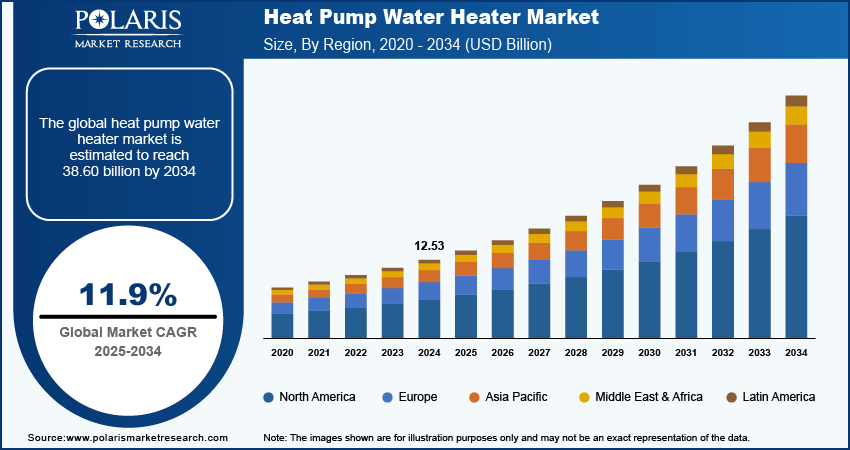

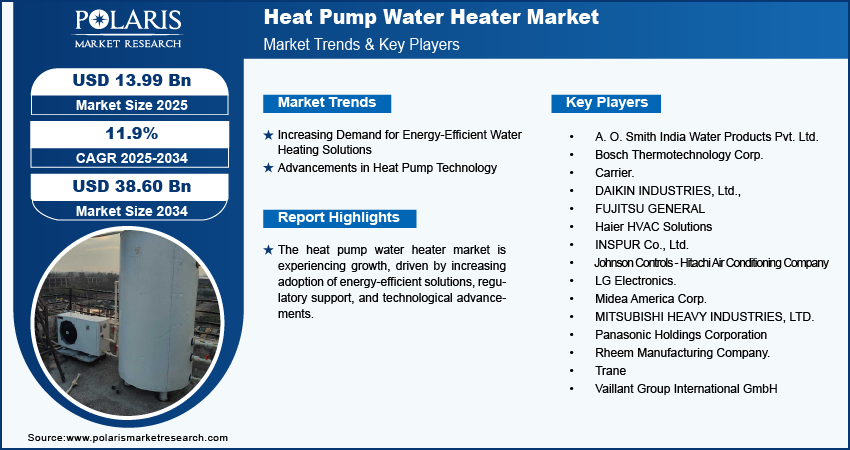

The global heat pump water heater market size was valued at USD 12.53 billion in 2024. It is expected to grow from USD 13.99 billion in 2025 to USD 38.60 billion by 2034, at a CAGR of 11.9% from 2025 to 2034.

A heat pump water heater (HPWH) is an energy-efficient system that extracts heat from the surrounding air and transfers it to water, reducing electricity consumption compared to conventional water heaters.

The market for heat pump water heaters is expanding due to increasing adoption across residential, commercial, and industrial sectors to mitigate carbon dioxide (CO₂) emissions. A September 2021 NEDC report stated that producing hot water and steam for homes, commercial buildings, and low-temperature industrial applications in the US results in 520 million metric tons of carbon emissions annually, equivalent to 113 million cars and 27 percent more than the 410 million metric tons from heating buildings. As global efforts to curb climate change intensify, industries and households are transitioning to sustainable heating solutions. Additionally, HPWHs play a crucial role in reducing dependence on fossil fuels, aligning with decarbonization goals and stringent environmental regulations. The rising awareness of energy conservation and the push for greener alternatives are further accelerating the heat pump water heater market growth.

Policymakers worldwide are implementing subsidies, tax rebates, and strict efficiency standards to encourage the use of low-carbon heating solutions and the adoption of heat pump water heaters. For instance, in August 2022, the US Department of Energy (DOE) stated that the IRA offers significant incentives for home energy improvements, including rebates of up to USD 8,000 for heat pumps and USD 4,000 for retrofits. The programs target low-income households with doubled rebates, while tax credits support efficient appliances and energy audits. These initiatives make HPWHs more cost-effective for consumers, and they also contribute to reducing overall energy consumption at a national level. The integration of efficiency standards and financial incentives is driving manufacturers to innovate and enhance product performance, ensuring broader market acceptance. Consequently, these regulatory measures are playing a pivotal role in driving the heat pump water heater market expansion.

To Understand More About this Research: Request a Free Sample Report

Heat Pump Water Heater Market Dynamics

Increasing Demand for Energy-Efficient Water Heating Solutions

Traditional water heating systems, particularly those reliant on electricity or fossil fuels, contribute to high energy expenditures for residential, commercial, and industrial users. Heat pump water heaters (HPWHs) offer a cost-effective alternative by utilizing ambient heat to warm water, thereby lowering energy consumption. Businesses and homeowners are increasingly opting for HPWHs to achieve long-term savings with rising energy prices and the growing emphasis on sustainability. This shift towards energy-efficient water heating solutions has driven manufacturers to innovate and introduce new products in emerging markets. For instance, in January 2024, Havells India Limited launched India’s first heat pump water heater, designed for residential use. The technology offers up to 75% energy savings, setting new standards in water heating. Additionally, the higher efficiency of HPWHs compared to conventional systems enhances return on investment, making them a preferred choice for cost-conscious consumers. Thus, the rising demand for energy-efficient heating solutions is boosting the heat pump water heater market revenue.

Advancements in Heat Pump Technology

Innovations in compressor design, refrigerants, and control systems have enhanced the efficiency and durability of HPWHs, making them more suitable for diverse climatic conditions. For instance, in November 2024, Daikin launched the EWYE-CZ air-to-water inverter heat pump, utilizing R-454C refrigerant for high energy efficiency and producing hot water up to 70°C, ideal for low-carbon heating needs. These improvements address concerns related to operational performance, such as maintaining efficiency in colder environments and optimizing heat transfer. Enhanced reliability also extends product lifespan, reducing maintenance costs and making HPWHs a more attractive long-term investment. Additionally, smart control features and integration with renewable energy sources are improving the appeal of these systems. Therefore, as technological advancements continue to improve efficiency and adaptability, they are driving broader adoption of HPWHs across residential and commercial applications.

Heat Pump Water Heater Market Segment Insights

Heat Pump Water Heater Market Assessment by Operation Type Outlook

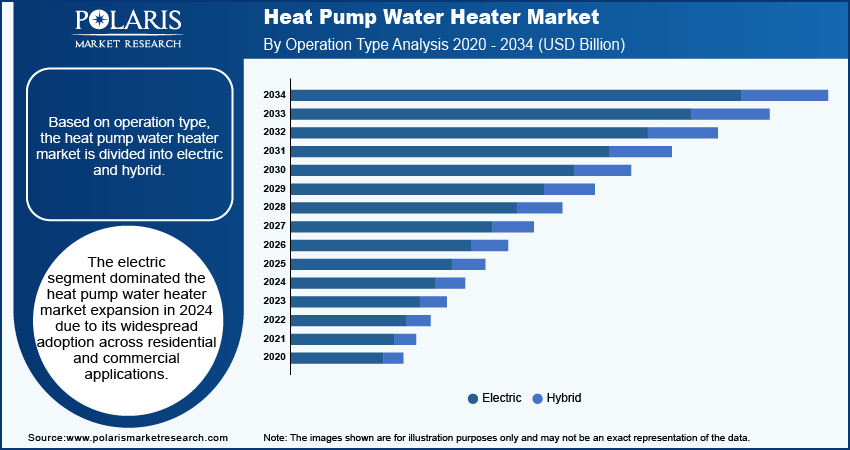

The global heat pump water heater market assessment, based on operation type, includes electric and hybrid. The electric segment dominated the heat pump water heater market expansion in 2024 due to its widespread adoption across residential and commercial applications. Electric heat pump water heaters are preferred for their ease of installation, lower upfront costs compared to hybrid variants, and minimal reliance on fossil fuels. Additionally, improvements in compressor efficiency and refrigerant technology have enhanced the performance of electric HPWHs, making them a viable alternative to conventional electric resistance water heaters. The growing emphasis on decarbonization and energy efficiency has further driven the demand for electric HPWHs as they align with sustainability initiatives. Moreover, government incentives and regulatory mandates promoting energy-efficient appliances have accelerated their adoption, solidifying the segment's market leadership.

Heat Pump Water Heater Market Evaluation by Tank Capacity Outlook

The global heat pump water heater market evaluation, based on tank capacity, includes upto 150 L, 150 to 300 L, 300 to 500 L, and above 500 L. The 300 to 500 L segment is expected to witness the fastest heat pump water heater market growth during the forecast period, driven by rising demand from commercial establishments and multi-family residential buildings. This capacity range offers an optimal balance between storage volume and operational efficiency, making it suitable for applications requiring a continuous supply of hot water. Hotels, hospitals, and large households increasingly prefer 300 to 500 L HPWHs due to their ability to meet higher water heating demands without increasing energy consumption. Additionally, advancements in system design, such as improved heat exchangers and smart control integration, have enhanced the efficiency of this segment. Thus, as the need for energy-efficient water heating solutions continues to grow, the demand for 300 to 500 L HPWHs is expected to rise significantly.

Heat Pump Water Heater Market Regional Analysis

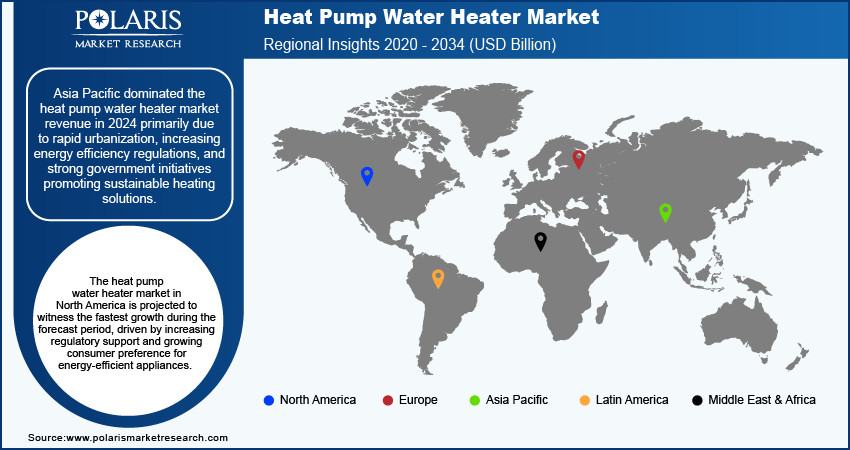

By region, the report provides the heat pump water heater market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the heat pump water heater market revenue in 2024 primarily due to rapid urbanization, increasing energy efficiency regulations, and strong government initiatives promoting sustainable heating solutions. Countries such as China, Japan, and South Korea have been at the forefront of adopting HPWHs, supported by favorable policies and strict environmental targets. Additionally, the region's expanding residential and commercial infrastructure has driven demand for cost-effective and energy-efficient water heating systems. For instance, in September 2024, PHNIX launched the airExpert inverter R290 all-in-one heat pump water heater, using eco-friendly R290 refrigerant (GWP of 3) to reduce carbon footprints and energy costs. It promotes greener heating and accelerates heat pump adoption in homes with a COP of 3.0. The presence of key manufacturers and advancements in local production capabilities have further contributed to the regional market dominance by ensuring product availability and affordability. Asia Pacific remains the leading market for heat pump water heaters, with rising consumer awareness and a shift toward low-carbon technologies.

The North America heat pump water heater market is projected to witness the fastest growth during the forecast period, driven by increasing regulatory support and growing consumer preference for energy-efficient appliances. The US and Canada have introduced strict energy efficiency standards and financial incentives to encourage the adoption of HPWHs, accelerating heat pump water heater market penetration. Additionally, rising electricity costs and heightened awareness of carbon emissions have prompted homeowners and businesses to transition toward sustainable water heating solutions. Technological advancements, such as improved cold-climate performance and smart connectivity features, have made HPWHs more appealing to North American consumers. Therefore, as the region continues to prioritize decarbonization and sustainability, the demand for HPWHs is expected to experience substantial growth.

Heat Pump Water Heater Market – Key Players and Competitive Insights

The competitive landscape features a mix of global leaders and regional players aiming to capture heat pump water heater market share through innovation, strategic partnerships, and geographic expansion. Key global players such as Rheem Manufacturing Company, A. O. Smith Corporation, Daikin Industries, Ltd., and Mitsubishi Electric Corporation leverage strong R&D capabilities and extensive distribution networks to deliver energy-efficient, advanced heat pump water heating systems. Heat pump water heater market trends highlight a growing demand for energy-efficient and eco-friendly solutions, driven by increasing awareness of sustainability and the need to reduce carbon footprints. Innovations such as smart heat pump water heaters with IoT integration and hybrid systems combining heat pumps with solar thermal technology are gaining traction, reflecting advancements in energy efficiency and user convenience. According to the heat pump water heater market analysis, the market is projected to experience substantial growth, fueled by rising energy costs, government incentives for energy-efficient appliances, and stringent environmental regulations.

Regional players are capitalizing on localized needs by offering cost-effective and tailored solutions, especially in emerging markets. This growth is supported by rapid urbanization, rising disposable incomes, and increasing awareness of energy-efficient technologies. Heat pump water heater market competitive strategies include mergers and acquisitions, partnerships with utility companies, and collaborations with government bodies to promote energy-efficient solutions. Additionally, companies are focusing on product differentiation by introducing advanced features such as Wi-Fi connectivity, energy usage monitoring, and compatibility with renewable energy sources. These developments highlight the importance of technological innovation, market adaptability, and regional investments in driving the expansion of the heat pump water heater industry. A few key major players are A. O. Smith India Water Products Pvt. Ltd.; Bosch Thermotechnology Corp.; Carrier; DAIKIN INDUSTRIES, Ltd.; FUJITSU GENERAL; Haier HVAC Solutions; INSPUR Co., Ltd.; Johnson Controls - Hitachi Air Conditioning Company; LG Electronics; Midea America Corp.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Panasonic Holdings Corporation; Rheem Manufacturing Company; Trane; and Vaillant Group International GmbH.

A. O. Smith India Water Products Pvt. Ltd. is a subsidiary of A. O. Smith Corporation, a water technology company with a 140-year history of providing high-quality, innovative products. A. O. Smith entered the Indian market in 2008. In 2010, the company inaugurated a manufacturing plant in Bengaluru, India, which was expanded in 2014 to include water purification products. A. O. Smith is known for its focus on customer satisfaction, integrity, and innovation. The company has introduced many innovative features to appeal to Indian consumers, such as blue diamond glass lining, glass-coated heating elements, energy-efficient insulation, and multiple color options. In the water purifier market, A. O. Smith was the first to offer instant mineralized hot water purifiers. Their home water filteration product utilize a patented side stream RO membrane and silver charged membrane technology (SCMT) for double protection against microbial contamination. A. O. Smith offers various water heater solutions for commercial needs, such as heat pump water heaters, fuel-based water heaters, and natural gas-fired water heaters. The company's heat pump water heaters are designed for energy efficiency.

Haier HVAC Solutions has been serving customers in Europe for over 30 years, providing advanced climate control with a focus on energy efficiency and sustainability. They offer a variety of HVAC systems, such as VRF units, chillers, and ducted units, suitable for residential, light commercial, and large commercial applications. Their technology enables precise climate control, improved energy efficiency, and user-friendly operation, such as remote monitoring and automated adjustments. Haier's flexible installation options cater to diverse needs, from individual homes to large buildings. Its Heat Pump Water Heater is an energy-efficient solution that lowers energy consumption, costs, and CO₂ emissions compared to traditional boilers. The company’s Air to Water Heat Pump range utilizes renewable energy from the outside air for heating and hot water. Haier also offers a new high-temperature heating range, including the Super Aqua A2W Monobloc and more. Haier is expanding its trustworthy brand presence in Europe with premium products and strong post-sale support, with a production capacity of over 27 million units annually across 16 factories, including eight abroad.

List of Key Companies in Heat Pump Water Heater Market

- A. O. Smith India Water Products Pvt. Ltd.

- Bosch Thermotechnology Corp.

- Carrier.

- DAIKIN INDUSTRIES, Ltd.

- FUJITSU GENERAL

- Haier HVAC Solutions

- INSPUR Co., Ltd.

- Johnson Controls - Hitachi Air Conditioning Company

- LG Electronics.

- Midea America Corp.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Panasonic Holdings Corporation

- Rheem Manufacturing Company.

- Trane

- Vaillant Group International GmbH

Heat Pump Water Heater Industry Developments

July 2024: A.O. Smith launched the Voltex MAX hybrid heat pump water heater, offering 40% higher First Hour Ratings and advanced modes for increased hot water and energy efficiency.

October 2024: Nyle Water Heating Systems introduced the Pyroclast Commercial Integrated Heat Pump Water Heater, featuring advanced Phase Change Material (PCM) technology. This system offers 375 gallons of thermal storage with minimal installation time and pathogen risk.

Heat Pump Water Heater Market Segmentation

By Technology Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Air to Water

- Water Source

- Geothermal

By Capacity Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Upto 20 kW

- 21 to 50 kW

- 51 to 100 kW

- Above 100 kW

By Operation Type Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Electric

- Hybrid

By Application Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Residential

- Industrial

- Commercial

By Tank Capacity Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- Upto 150 L

- 150 to 300 L

- 300 to 500 L

- Above 500 L

By Regional Outlook (Volume, Thousand Units; Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heat Pump Water Heater Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.53 billion |

|

Market Size Value in 2025 |

USD 13.99 billion |

|

Revenue Forecast by 2034 |

USD 38.60 billion |

|

CAGR |

11.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Thousand Units; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global heat pump water heater market size was valued at USD 12.53 billion in 2024 and is projected to grow to USD 38.60 billion by 2034.

• The global market is projected to register a CAGR of 11.9% during the forecast period.

• Asia Pacific dominated the heat pump water heater market revenue in 2024.

• Some of the key players in the market are A. O. Smith India Water Products Pvt. Ltd.; Bosch Thermotechnology Corp.; Carrier; DAIKIN INDUSTRIES, Ltd.; FUJITSU GENERAL; Haier HVAC Solutions; INSPUR Co., Ltd.; Johnson Controls - Hitachi Air Conditioning Company; LG Electronics; Midea America Corp.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Panasonic Holdings Corporation; Rheem Manufacturing Company; Trane; and Vaillant Group International GmbH.

• The electric segment dominated the heat pump water heater market expansion in 2024.