Heat Exchangers Market Size, Share, Trends, Industry Analysis Report: By Product (Plate & Frame Heat Exchanger, Shell & Tube Heat Exchanger, Air-Cooled Heat Exchanger, and Others), Material, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1355

- Base Year: 2024

- Historical Data: 2020-2023

Heat Exchangers Market Overview

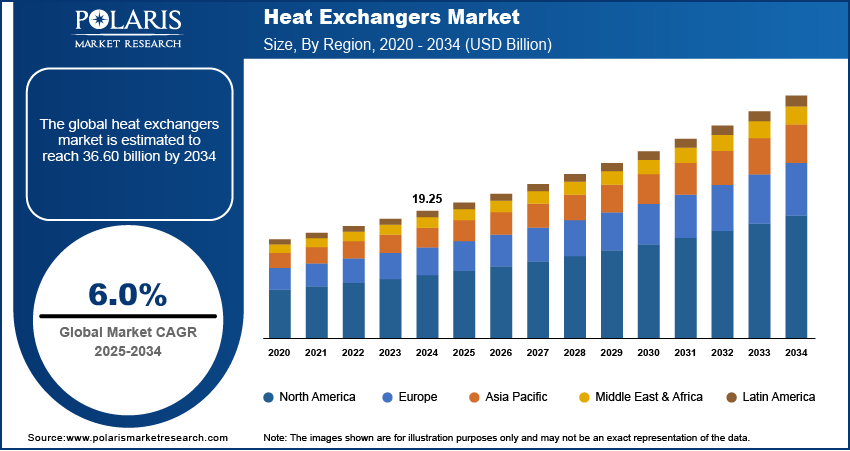

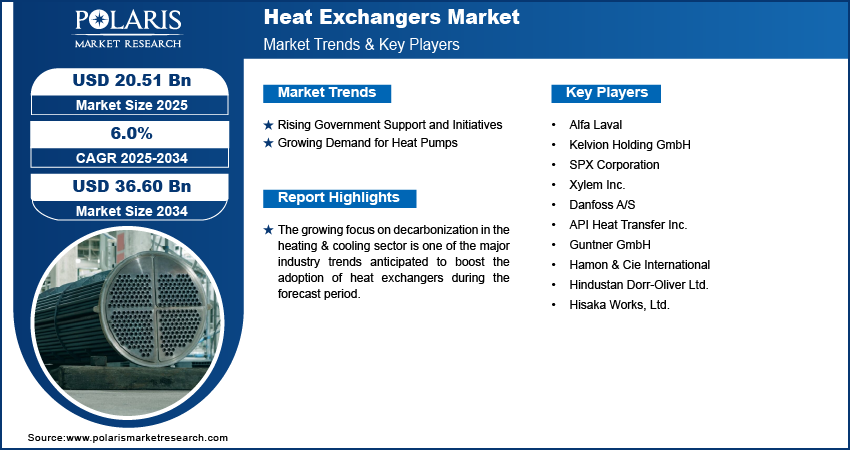

The global heat exchangers market size was valued at USD 19.25 billion in 2024. The market is projected to grow from USD 20.51 billion in 2025 to USD 36.60 billion by 2034. It is projected to exhibit a CAGR of 6.0% from 2025 to 2034.

A heat exchanger is a device that transfers heat between two or more fluids at varied temperatures. The fluids are separated by a wall having high thermal conductivity. The thickness of the wall is designed such that the fluids don’t mix or come in direct contact. Heat exchangers differentiate themselves from fuel, nuclear, or electrical heat transfer equipment. Here, the heat source and receiving medium need to be fluids. Heat exchangers operate using thermodynamic principles, describing the transfer of thermal energy at the macroscopic level.

To Understand More About this Research: Request a Free Sample Report

Heat exchangers are mainly classified based on their flow configuration and construction type. The most basic heat exchanger involves the movement of cold and hot fluids in the same or opposing directions. Based on their functionality, heat exchangers can be classified as recuperative heat exchangers, regenerative heat exchangers, and direct mixing type heat exchangers. These heat exchangers have a wide variety of applications in several sectors, including chemical plants, petrochemical plants, power stations, and petroleum refineries.

The rapid industrialization across the world is one of the key factors driving the heat exchangers market growth. Chemical, HVAC, automotive, food & beverage, and petrochemical are among the top end-use industries driving the global demand for heat exchangers. Further, the increased emphasis on improving energy efficiency and reducing carbon emissions is another factor driving the market forward.

The growing focus on decarbonization in the heating & cooling sector is one of the major industry trends anticipated to boost the adoption of heat exchangers. The rising demand for cost-effective, sustainable, and low-energy consumption heat exchangers is likely to provide lucrative heat exchangers market opportunities during the forecast period.

Heat Exchangers Market Dynamics

Rising Government Support and Initiatives

Government support and initiatives across different regions and countries have played a significant role in driving the adoption of energy-efficient heat exchangers in various end-use industries. New efficiency standards set by agencies such as the Office of Energy Efficiency and Renewable Energy (DOE), the Paris Agreement, and National Energy Commissions have introduced mandates regarding smart construction and manufacturing practices. These norms and initiatives aim to promote sustainability in the industrial, commercial, and residential sectors by using energy-efficient heat exchangers and other systems. Thus, the implementation of favorable government initiatives and support drives the heat exchangers market expansion.

Growing Demand for Heat Pumps

Heat exchangers are a vital component of heat pumps. They facilitate the transfer of thermal energy between fluids to heat or cool air. Heat exchangers also play a crucial role in determining the size, refrigerant charge, stability, performance, and longevity of heat pump systems. Heat pumps are commonly used for heating, ventilation, and air conditioning across residential, commercial, and industrial sectors. The growing demand for heat pumps, especially in Europe, is driving the need for heat exchangers and having a favorable impact on the heat exchangers market development.

Heat Exchangers Market Segment Insights

Heat Exchangers Market Outlook Based on Product

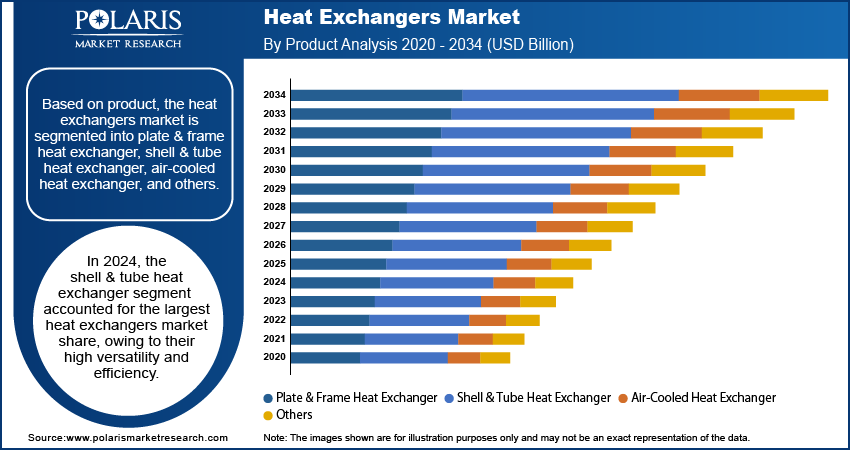

The heat exchangers market, based on product, is segmented into plate & frame heat exchanger, shell & tube heat exchanger, air-cooled heat exchanger, and others. In 2024, the shell & tube heat exchanger segment accounted for the largest heat exchangers market share of 37.1%. A shell & tube heat exchanger consists of multiple tubes mounted inside a cylindrical shell. It passes heat between two fluids by passing them through separate channels separated by a solid barrier. These heat exchangers are known for their ease of use, cost-effectiveness, and efficiency. They are commonly used in oil refineries and other large chemical processes where a wide temperature and pressure range is required. Thus, the versatility and efficiency of shell & tube heat exchangers contribute to their dominant position in the market.

Heat Exchangers Market Assessment Based on End Use

The heat exchangers market, based on end use, is segmented into oil & gas, chemical & petrochemical, HVAC & refrigeration, food & beverage, power generation, pulp & paper, and others. The chemical & petrochemical segment dominated the market with a revenue share of 24.5% in 2024. Heat exchangers are commonly used in the chemical processing industry to control temperature and facilitate energy transfer between fluids. They facilitate energy optimization by enabling the recovery of waste heat from exhaust gases and other process streams. Also, the design flexibility and high corrosion resistance of heat exchangers offer them the ability to handle fluids with varying solid levels. The booming petrochemical industry, driven by the increased demand for plastics, packaging, and medical equipment, fuels the high adoption of heat exchangers.

Heat Exchangers Market Outlook by Regional Analysis

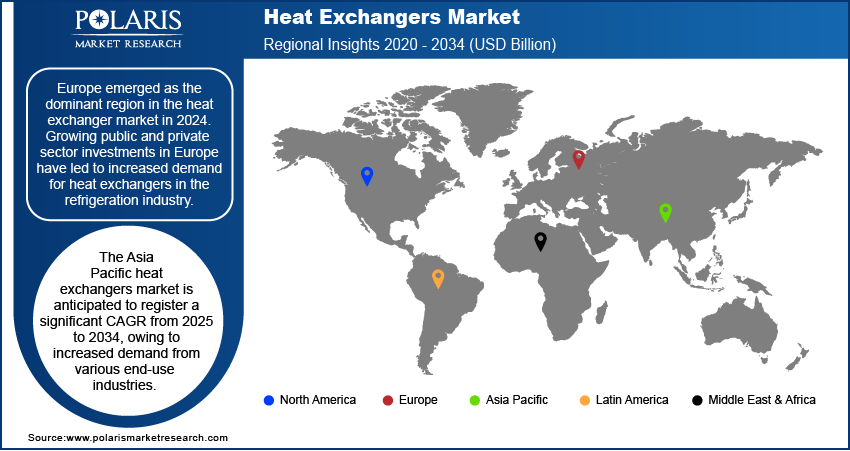

The market report offers heat exchangers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the market with a 32.9% revenue share in 2024. Growing public and private sector investments in Europe have led to increased demand for heat exchangers in the refrigeration industry. Further, increased demand from various end-use sectors for heat exchangers with high durability and cost-efficiency drives the regional market size.

The Asia Pacific heat exchangers market is anticipated to register a significant CAGR of 5.9% from 2025 to 2034. Manufacturing, chemical, oil & gas, and petrochemical industries are among the major contributors to product demand in the region. Rising construction projects in industrial and commercial establishments are also expected to drive the heat exchangers market expansion in Asia Pacific.

Heat Exchangers Market – Key Players and Competitive Insights

The leading players are introducing innovative products in the heat exchangers market to cater to the growing demand from consumers. Further, they are entering new markets in developing regions to expand their customer base, strengthen their market presence, and increase their market share. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the heat exchangers market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. The research report offers market assessments of all the major players, including Alfa Laval, Kelvion Holding GmbH, SPX Corporation, Xylem Inc., Danfoss A/S, API Heat Transfer Inc., Guntner GmbH, Hamon & Cie International, Hindustan Dorr-Oliver Ltd., and Hisaka Works, Ltd.

List of Key Companies in Heat Exchangers Market

- Alfa Laval

- Kelvion Holding GmbH

- SPX Corporation

- Xylem Inc.

- Danfoss A/S

- API Heat Transfer Inc.

- Guntner GmbH

- Hamon & Cie International

- Hindustan Dorr-Oliver Ltd.

- Hisaka Works, Ltd.

Heat Exchangers Industry Developments

December 2023: Alfa Laval announced its partnership with Outokumpu to reduce carbon emissions associated with Alfa Laval’s heat exchangers. The company stated that it will use Circle Green stainless steel in the production of its heat exchangers to cut carbon emissions.

September 2023: Kelvion Holding GmbH announced an investment of USD 4.3 million in the expansion of its manufacturing capacities in Sarsdtet. According to Kelvion, the company aims to cater to increased demand for heat exchangers across various end-use industries.

Heat Exchanger Market Segmentation

By Product Outlook

- Plate & Frame Heat Exchanger

- Brazed Plate & Frame Heat Exchanger

- Gasketed Plate & Frame Heat Exchanger

- Welded Plate & Frame Heat Exchanger

- Others

- Shell & Tube Heat Exchanger

- Air-Cooled Heat Exchanger

- Others

By Material Outlook

- Metals

- Alloys

- Others

By End Use Outlook

- Oil & Gas

- Chemical & Petrochemical

- HVAC & Refrigeration

- Food & Beverage

- Power Generation

- Pulp & Paper

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heat Exchangers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.25 billion |

|

Market Size Value in 2025 |

USD 20.51 billion |

|

Revenue Forecast by 2034 |

USD 36.60 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 19.25 billion in 2024 and is projected to grow to USD 36.60 billion by 2034.

The market is projected to register a CAGR of 6.0% from 2025 to 2034.

Europe accounted for the largest heat exchangers region-wise market size in 2024.

Alfa Laval, Kelvion Holding GmbH, SPX Corporation, Xylem Inc., Danfoss A/S, API Heat Transfer Inc., Guntner GmbH, Hamon & Cie International, Hindustan Dorr-Oliver Ltd., and Hisaka Works, Ltd. are a few key players in the market.

The shell & tube heat exchanger segment accounted for the largest heat exchangers market share in 2024.

The chemical & petrochemical segment dominated the market for heat exchangers in 2024.