Healthcare Data Integration Market Share, Size, Trends, Industry Analysis Report, By Component (Tools, Services), By Deployment (Cloud, On-premise), By End Use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4233

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

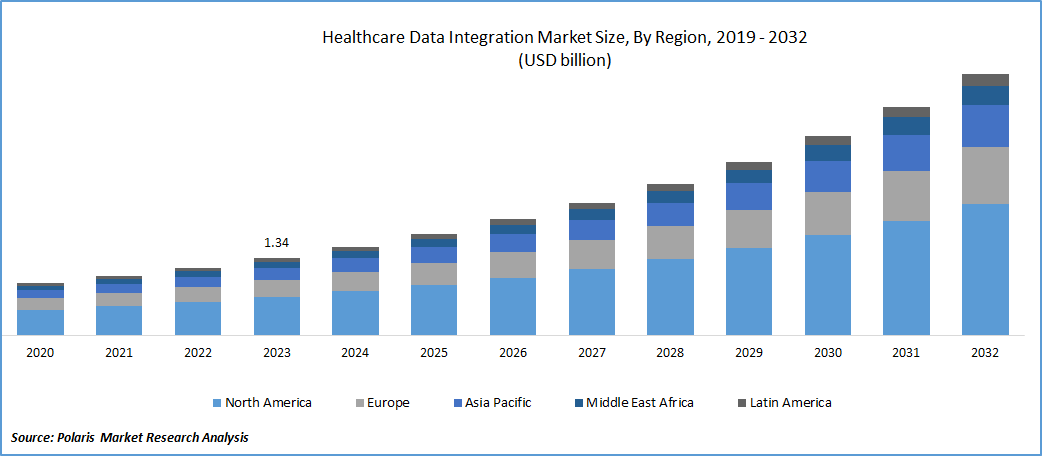

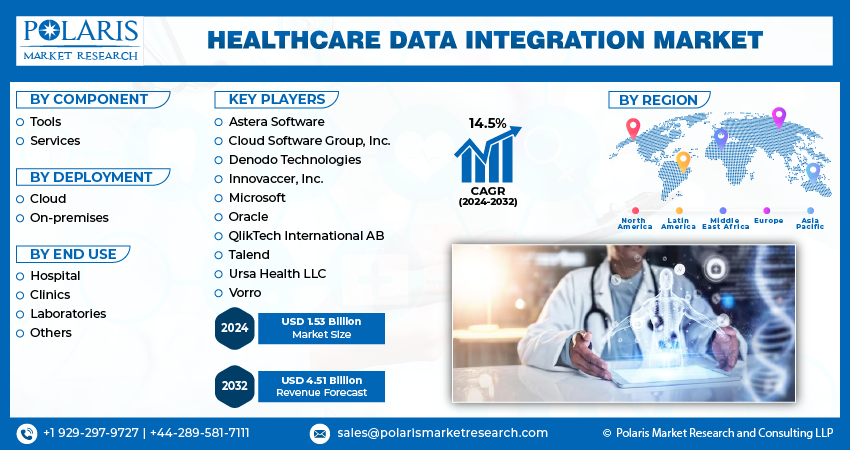

The global healthcare data integration market was valued at USD 1.34 billion in 2023 and is expected to grow at a CAGR of 14.5% during the forecast period.

Growth is fueled by the extensive use of electronic health records (EHRs) and other healthcare IT systems. Furthermore, the need to integrate data from diverse sources to create a holistic patient health profile, combined with the rising demand for value-based healthcare, is propelling the market's growth. These factors are reshaping the industry's focus, emphasizing the enhancement of patient care, simplifying information accessibility, and endorsing value-driven healthcare initiatives.

To Understand More About this Research: Request a Free Sample Report

Additionally, it aids medical research by providing researchers with vast datasets, accelerating the progress of developing new treatments and disease cures. The growing requirement for healthcare data integration market is primarily propelled by the necessity for data-informed decision-making and enhanced patient care. Data integration facilitates clinical decision support by offering immediate access to patient data, thereby refining the precision and speed of medical judgments. Furthermore, it enhances operational efficiency by optimizing resource distribution and managing the supply chain effectively through thorough data analysis.

In patient care, data integration allows for personalized medicine, early detection of diseases, and coordinated care, leading to improved outcomes and reduced costs. Moreover, it enhances patient engagement by providing access to data and supports telehealth services. Healthcare research and development also benefit from data integration, streamlining clinical research and drug discovery processes. Additionally, it aids in quality reporting and ensures compliance with regulatory standards.

Healthcare organizations collaborated by integrating data to identify individuals with significant medical histories, making them susceptible to severe illnesses. Predictive models were created, allowing for a proactive approach to treatment. The healthcare sector also acknowledged the potential of data integration in public health management. Healthcare providers utilized various data sources to gain profound insights into the health requirements of specific populations. This integrated data played a vital role in implementing preventive measures and averting potential crises.

Growth Drivers

Increased spending on healthcare globally is a significant driver for the biophotonics market.

SATUSEHAT serves as a pivotal element in Indonesia's digital health transformation initiative, uniting all healthcare facilities nationwide into a cohesive health data repository. The platform is dedicated to improving healthcare quality, efficiency, and accessibility for every citizen. Data integration in the healthcare sector involves consolidating patient health data from diverse origins such as EHRs, claims data, lab results, and medication history. Employing tools like data warehouses, data lakes, and master data management solutions, this process creates a comprehensive patient profile. This comprehensive view assists healthcare providers in detecting fraud by pinpointing irregularities and patterns in data from multiple sources, thereby bolstering the integrity of healthcare systems.

Report Segmentation

The market is primarily segmented based on component, deployment, end use, and region.

|

By Component |

By Deployment |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

Tools segment held the largest share

Tools segment dominated the market. This dominance can be credited to the widespread uptake of data integration tools in healthcare institutions. These tools play a pivotal role in improving data accuracy, understanding patient demographics in depth, enabling well-informed decision-making, enhancing overall efficiency, and reducing operational expenses. With the escalating volumes of healthcare data from various sources, data integration tools have become indispensable for healthcare organizations aiming to streamline their operations and deliver superior-quality care.

Service segment will grow at significant pace. These include the growing complexity of healthcare data integration initiatives and the rising need for specialized expertise to efficiently implement and oversee data integration solutions. Additionally, the increasing adoption of cloud-based data integration services is bolstering the growth of this segment.

By Deployment Analysis

On-premises segment accounted for the largest market share in 2022

On-premises segment accounted for the largest market share. This growth is attributed to the benefits that on-premises data integration solutions offer to healthcare organizations. These advantages include heightened control and security, essential for complying with strict data security and privacy regulations in the healthcare sector. It is also known for their exceptional performance and reliability, especially for healthcare organizations dealing with real-time processing of large data volumes.

Cloud segment will exhibit robust growth rate. This expansion can be primarily credited to the healthcare sector's growing embrace of cloud computing, buoyed by its advantages such as scalability, flexibility, and cost-efficiency. Given the deluge of data originating from sources like Electronic Health Records (EHRs), patient portals, and wearable devices, healthcare organizations require robust data integration for a comprehensive patient health overview and informed decision-making. Cloud-based data integration solutions, with their ease of deployment, scalability, and cost-effectiveness, are witnessing increased demand, further fueling their market growth.

By End Use Analysis

Hospital segment accounted for the largest market share in 2022

Hospital segment accounted for the largest market share. Hospitals stand as the primary consumers of healthcare data, necessitating the amalgamation of data from diverse sources, ranging from EHRs to billing systems and patient portals. The integration of healthcare data within hospitals offers multifaceted benefits. It enriches patient care by empowering clinicians with comprehensive medical histories, enabling well-informed decision-making. Additionally, it drives cost efficiency by optimizing administrative processes, automating tasks like billing and insurance claims processing.

Laboratories segment will exhibit robust growth rate. This surge is propelled by the escalating volume and intricacy of laboratory data, fueled by advancements in testing technology and the increasing prevalence of chronic diseases. Efficient management of this complex data necessitates robust data integration solutions. Moreover, there is a rising demand for enhanced laboratory efficiency and productivity, with data integration playing a pivotal role in automating tasks, streamlining workflows, and improving staff communication. These advancements lead to significant gains in efficiency and productivity.

Regional Insights

North America region accounted for the largest share of global market in 2022

North America dominated the global market. This dominance is propelled by the region's proactive embrace of digital health technologies such as Clinical Decision Support Systems (CDSSs), & telemedicine. These technologies generate substantial volumes of data, underscoring the crucial need for effective integration solutions. Regulatory mandates and financial incentives provided by the governments have encouraged healthcare providers to adopt IT solutions, spurring the uptake of healthcare data integration.

APAC will grow at the substantial pace. The region's large and growing population, coupled with an increasing incidence of chronic diseases, is driving the demand for healthcare data integration solutions. These solutions are geared towards improving patient care and reducing costs. Additionally, major players in the region are strategically diversifying their product offerings, investing significantly, and establishing key partnerships.

Key Market Players & Competitive Insights

Key industry players are proactively strengthening their product portfolios and global market footprint by forming strategic partnerships and launching new products. These endeavors encompass a mix of organic and inorganic growth strategies, including product improvements, the introduction of innovative offerings, entering into agreements and collaborations, expanding their business reach, and engaging in mergers and acquisitions.

Some of the major players operating in the global market include:

- Astera Software

- Cloud Software Group, Inc.

- Denodo Technologies

- Innovaccer, Inc.

- Microsoft

- Oracle

- QlikTech International AB

- Talend

- Ursa Health LLC

- Vorro

Recent Developments

-

In June 2023, CipherHealth has collaborated with the SADA, to improve patient care by integrating social determinants of health (SDOH) data. This partnership aims to simplify the accessibility and usability of SDOH data for healthcare providers, fostering a more fair and efficient healthcare system.

- In October 2023, Productive Edge, collaborated with the Redox, to tackle critical issues in healthcare, such as fragmented health data, real-time analytics, and compliance.

- In August 2022, Indonesia launched SATUSEHAT, a healthcare data integration platform, which translates to "ONEHEALTHY" in Indonesian.

Healthcare Data Integration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.53 billion |

|

Revenue forecast in 2032 |

USD 4.51 billion |

|

CAGR |

14.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deployment, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the market dynamics of the 2024 Healthcare Data Integration Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Healthcare Data Integration Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Radiation Dose Management Market Size, Share 2024 Research Report

Automotive Brake System Market Size, Share 2024 Research Report

Inhalation Anesthesia Market Size, Share 2024 Research Report

FAQ's

The global healthcare data integration market size is expected to reach USD 4.51 billion by 2032

Astera Software, Cloud Software, Denodo Technologies, Innovaccer, Microsoft are the top market players in the market

North America region contribute notably towards the global Healthcare Data Integration Market

The global healthcare data integration market is expected to grow at a CAGR of 14.5% during the forecast period.

Component, deployment, end use, and region are the key segments in the Healthcare Data Integration Market