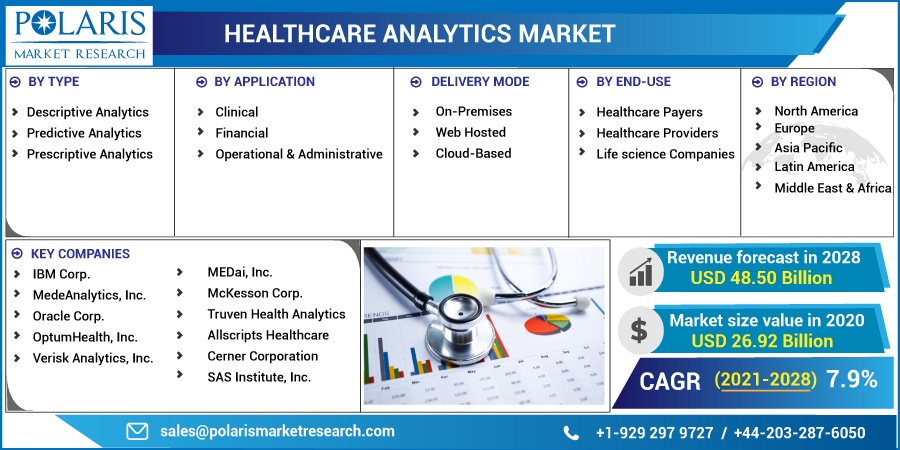

Healthcare Analytics Market Share, Size, Trends, Industry Analysis Report, By Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics), By Application (Clinical, Financial, Operational & Administrative), By End-Use; By Delivery Mode; By Regions; Segment Forecast, 2021 - 2028

- Published Date:Feb-2021

- Pages: 108

- Format: PDF

- Report ID: PM1795

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

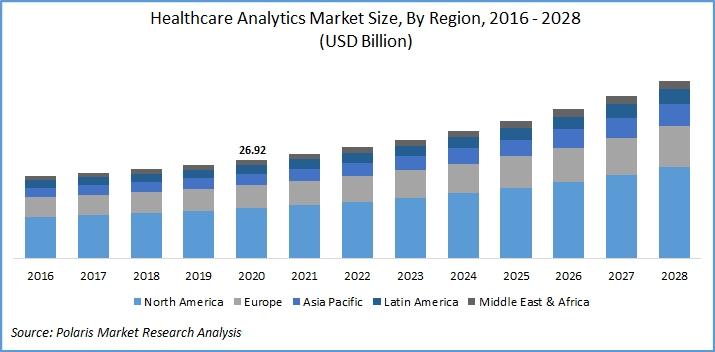

The global healthcare analytics market was valued at USD 26.92 billion in 2020 and is expected to grow at a CAGR of 7.9% during the forecast period. The rising need to reduce healthcare costs, growing prevalence of ever-growing chronic diseases, adoption of analytical services among healthcare stakeholders, and recent advancements in big data and artificial learning are largely responsible for the market growth. COVID-19 pandemic also boosted the adoption of such services, which enables organizations in navigating operational complexities through varied analytic solutions, supporting optimum outcomes.

The healthcare analytics market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Moreover, rising investment in start-ups, strong government policy support, and increasing partnerships and collaborations in the marketplace have propelled the market growth. For instance, in January 2019, the U.S.-based company has partnered with eQHealth Solutions to strengthen the capabilities of the latter’s analytics domain. The acquired firm was known for its ability to extract valuable insights from both structured and unstructured data from the physician notes, prescription diaries, and coordinator’s health risk assessments.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The shift in focus from volume to value-based care and the ongoing pandemic has boosted the adoption of healthcare analytics among healthcare establishments. As per the analysis of Oliver Wyman, in March 2020, the COVID-19 pandemic has encouraged the adoption of analytical solutions for the population at greater risk. The rise in implementation of such solutions has further contributed to manage the potential risks, to deliver meaningful insights, by improving data and analytical services to boost the market growth.

Know more about this report: request for sample pages

Moreover, companies are intensively focusing on value-based care. As per a report published by IBM, “2019 Payer Analytics Market Trends Report”, payers are adopting analytical services to support the transition from fee for service to value-based care. Furthermore, the availability of pay for reporting, risk, and revenue sharing programs, and pay for performance programs with the providers has led to the rise in investments by the payer groups to understand healthcare needs and risks.

Healthcare Analytics Market Report Scope

The market is primarily segmented on the basis of type, application, delivery mode, end-use, and region:

|

By Type |

By Application |

Delivery Mode |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based upon the type, the global healthcare analytics market is categorized into descriptive, predictive, and prescriptive analytics. Of all, the descriptive segment held the largest share in the global market, in 2020. These types employ data visualization techniques to answer underlying patterns for evidence-based clinical decisions. Moreover, the benefits of being offered such a service, such as understanding population cohorts, irregularities in the insurance claim to support organizations in have propelled its adoption among many organizations.

However, the predictive segment is projected to register a lucrative growth rate over the study period. Its increasing adoption is attributed to its benefits over other offerings, such as outbreak prediction, operational efficiency, supply chain analytics, population health and risk assessments, and enhanced patient outcomes. Moreover, it also enables healthcare organizations in eliminating waste, abuse, and fraud. Thereby, such rapid adoption is likely to benefit the adoption of such services.

Insight by Application

The financial market segment held the largest share in the global healthcare analytics market, in 2020. The rising financial burden on healthcare facilities to reduce significant costs is driving the adoption of analytics in financial applications. Key financial applications include claim settlement, fraud analysis, and risk adjustment. For instance, Optum’s performance analytical services offer analytical insights to improve healthcare services, reduce variation, and care continuum to manage financial liabilities.

However, the clinical market segment is projected to register the fastest growth over the study period. Rising adoption of electronic health records, technological advancements, and rising implementation of clinical analytics for cost savings, medication errors, and cost savings. Moreover, its ability to generate real-time insights and cost containment measures also propelled the segment’s growth.

Insight by End-Use

In 2020, the healthcare payers market segment held the largest share over the study period. Segment’s high share is due to its ability in tackling challenges in new health plans, reducing organization costs, and increasing customer base to improve efficiency and maximizing revenue. The healthcare providers market segment is expected to register a lucrative market growth over the projected period. The rising adoption of analytical tools in the hospitals for performance management, operational excellence, population health management, and financial management is making the segment’s growth prospects bright.

Geographic Overview

Geographically, the North American market accounts for one of the largest revenue holders in 2020 of the global market. Regional factors responsible for the growth include increased focus towards value-based care, awareness of healthcare facilities of using analytics, and federal mandate to reduce rising healthcare costs. Moreover, the presence of data analytics firms providing analytics suites also favoring market growth. However, Asia Pacific is expected to register a lucrative growth rate over the study period. Growing IT infrastructure, rising public and private funding in support of adopting advanced analytics solutions, and increased adoption among emerging countries. Moreover, such rapid adoption led to streamlining hospital workflows.

Competitive Insights

Some of the major players operating in the global market include IBM Corp., MedeAnalytics, Inc., Oracle Corp., OptumHealth, Inc., Verisk Analytics, Inc., MEDai, Inc., McKesson Corp., Truven Health Analytics, Allscripts Healthcare, Cerner Corporation, and SAS Institute, Inc. Companies in the market are introducing innovative services to stay competitive. For instance, in December 2020, Amazon web services introduced Amazon HealthLake, a new HIPAA service, which enables healthcare facilities to store, index, tag, and standardize healthcare data through machine learning over cloud platforms.

Want to check out the healthcare analytics market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.