Health Sensors Market Share, Size, Trends, Industry Analysis Report, By Product; By Application; By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa); Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 112

- Format: PDF

- Report ID: PM2572

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

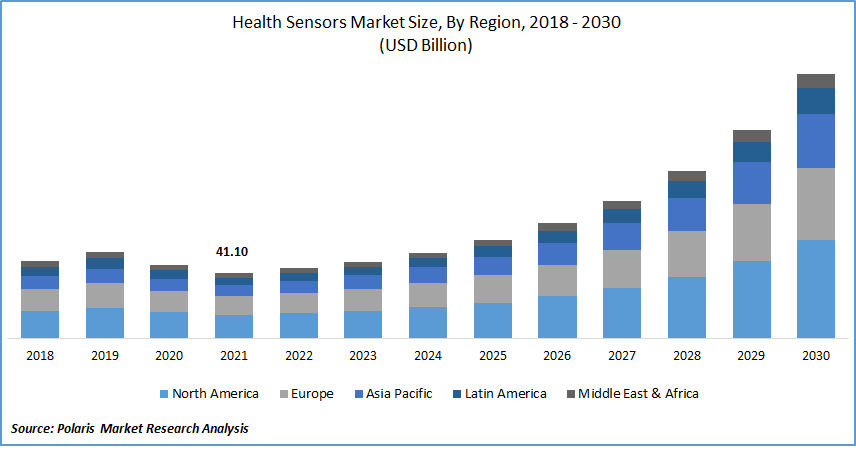

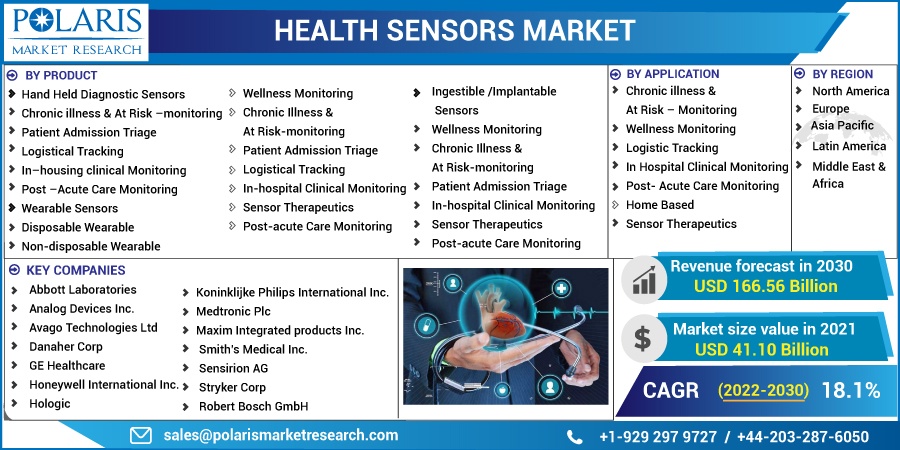

The global health sensors market was valued at USD 41.10 billion in 2021 and is expected to grow at a CAGR of 18.1% during the forecast period. Sensors are used in electronic medical devices to convert various stimuli into electrical signals for processing. Vital signs and other health factors can be monitored remotely and at the bedside with sensors. Additionally, they can increase the intelligence of medical devices like life-supporting implants.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Health parameters and vital signs can be measured whenever patients or their caregivers need them by means of wearable, implantable, and edible sensors. These products enable telemedicine and preventive treatment, as well as help to bring healthcare to patients' homes. It is expected that the market for health sensors will expand as chronic diseases become more widespread.

These connected medical applications use of sensor technology helps lower costs, achieve better results, and monitor patient conditions using data-driven information, all of which contribute to improving patient experiences with value-based care.

These sensor technologies can also physically monitor a patient's interior organs during medical procedures in addition to monitoring medical tools and equipment. As a result, in order for these instruments to function in a medical application in the current healthcare environment, they must fulfill a number of conditions.

The need for health sensors is expected to rise as chronic diseases are becoming common throughout the world. A number of companies are collaborating to develop a line of wearable gadgets for measuring body temperature. Frontline medical workers can immediately test persons with a high fever, one of the most prevalent signs of COVID-19, due to the wearable devices, which provide real-time data.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Technological improvements are linked to the rise in demand for round-the-clock monitoring, tracking of medical data, and the prevalence of chronic diseases. The demand for health sensors is expected to rise as chronic diseases become more prevalent worldwide.

Additionally, several companies are introducing health sensor devices that sense heart and pulse rate, blood oxygen, and many more. Due to the introduction of mobile apps that made it easier for people to keep track of their daily calorie intake and distance traveled, among other things, an increase in people's interest in recording & tracking information about their habits is predicted to support industry growth.

The miniaturization of physiological sensors increased expansion toward better functionality in smart devices, and rising demand for continuous monitoring in healthcare services are the primary drivers of the wearable health sensors market's lucrative growth.

Wearable sensors are important in medical analytics as it allows for the analysis and diagnosis of disease using the data obtained from the device. In addition, technology and widespread medical application use are boosting the market for ingestible sensors.

The COVID-19 outbreak has also increased product demand across the globe. In the modern era of artificial intelligence, innovative and advanced technology can help the world combat disease (AI). The ability of the products to collect data such as blood pressure, ECG, body temperature, blood oxygen saturation levels, heart rate, and others helps in the prevention of coronavirus outbreaks. Therefore, it is anticipated that wearable technology will rapidly advance in order to assist patients who have been exposed to the novel coronavirus (COVID-19).

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The Wearable Sensors Market Segment Accounted For the Largest Share in 2021

It is expected that over the upcoming period, demand for wearable sensors will rise due to their numerous benefits. Rising R&D spending and business partnerships are expected to fuel market growth.

The miniaturization of physiological sensors, increased expansion toward better functioning of smart devices, improvement in battery sizes, and rising demand for continuous monitoring in healthcare services are the primary drivers of the wearable health sensors market's lucrative growth. Devices can monitor patients physiological and mobility activity due to wearable sensors. These sensors may be directly attached to the body or concealed within clothing, footwear, wristbands, and headbands.

Chronic Illness & At-Risk Monitoring Market Segment Accounted For the Largest Share in 2021

The chronic illness & at-risk monitoring led the global market in 2021 and accounted for the largest share. This is due to the demand for point-of-care diagnostics and the increasing prevalence of chronic diseases. Chronic conditions like diabetes must be monitored to assess whether a patient's condition is improving or deteriorating. As a result, a range of technologies are available to monitor patient health issues and track activities.

North America Dominated the Industry Globally

In 2021, North America dominated the market and held the highest market share. This is due to factors like its well-established medical infrastructure, high healthcare spending, the presence of dominating firms, and the rapid adoption of advanced technologies.

The rapid adoption of patient monitoring and homecare devices for routine, ongoing, and long-term patient monitoring, are anticipated to fuel the region's growth of these segments over the period. Medical cost habits are expected to help boost the region's market growth.

The prevalence of accidents, sports injuries, and lifestyle-related medical issues are additional factors that are anticipated to boost expansion. Growing demand for excellent emergency care and increased acceptance of mobile surgery centers are expected to boost the market. In Addition, the rising prevalence of cardiac problems has increased the demand for health sensor equipment in Asia Pacific countries. Asia Pacific region is expected to witness fastest rate of market growth over the projected period.

Competitive Insight

Top players in the global health sensor market include Abbott Laboratories, Analog Devices Inc., Avago Technologies Ltd, Danaher Corp, GE Healthcare, Honeywell International Inc. Hologic, Koninklijke Philips, International Inc., Medtronic Plc, Maxim Integrated Product Inc., Smith’s Medical Inc., Sensirion AG, Stryker Corp, Robert Bosch GmbH, Roche, TDK Corporation, TE Connectivity Ltd, Texas Instruments Incorporated, and Varian Medical System.

Recent Developments

Feb 2020: AMS, a provider of high-performance sensor solutions, announced the release of the thinnest dedicated blood oxygen saturation (SpO2) sensor available on the market. This sensor enables the remote monitoring of this vital sign in small consumer goods like earbuds, smartwatches, and wristbands, as well as in medical devices like oximeters and patches. The new AS7038RB's strong performance also indicates that it is used for remote diagnostic equipment, including disposable patches used in hospital emergency rooms to measure electrocardiograms (ECG) and SpO2.

Mar 2021: The development a millimeter-scale transceiver that enhances ingestible sensors was revealed by researchers at Imec (Belgium), a center for Nano electronics and digital technology. A wireless transmitter and receiver that can both fit into a millimeter-scale capsule have been created by scientists. This ingestible sensor may be included into a range of advanced technologies now being utilized to track medical conditions within the human body.

May 2021: Stryker acquired OrthoSensor Inc. in May 2021. This was anticipated to aid the business in gaining market share in joint replacement and musculoskeletal treatment.

Health Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 41.10 Billion |

|

Revenue forecast in 2030 |

USD 166.56 Billion |

|

CAGR |

18.1 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By product , By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Abbott Laboratories, Analog Devices Inc., Avago Technologies Ltd, Danaher Corp, GE Healthcare, Honeywell International Inc. Hologic, Koninklijke Philips, International Inc., Medtronic Plc, Maxim Integrated products Inc., Smith’s Medical Inc., Sensirion AG, Stryker Corp, Robert Bosch GmbH, Roche, TDK Corporation, TE Connectivity Ltd, Texas Instruments Incorporated, Varian Medical System |