Health Information Exchange Market Share, Size, Trends, Industry Analysis Report, By Type (Private, Public); By Solution; By Implementation Model; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4037

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

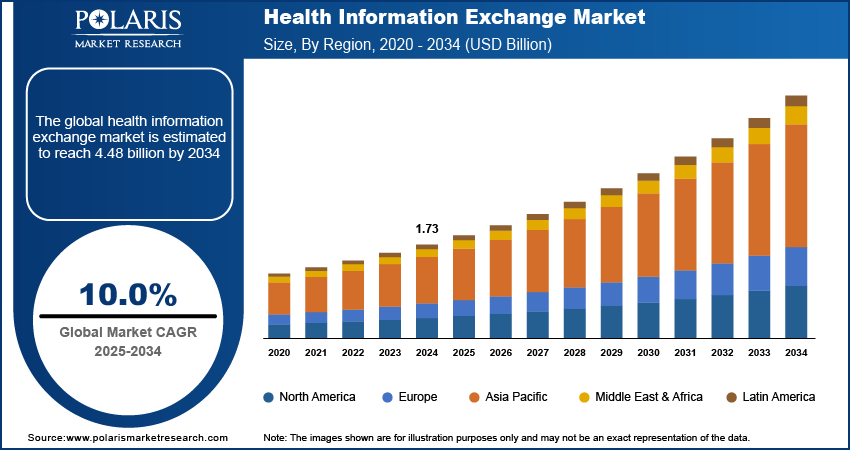

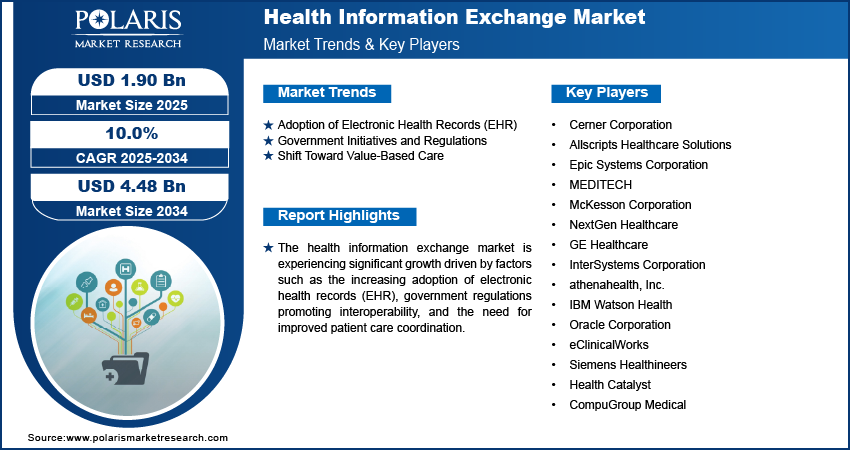

The global health information exchange market size and share was valued at USD 1477.78 million in 2023 and is expected to grow at a CAGR of 12.50% during the forecast period.

Health Information Exchange involves the electronic sharing of healthcare data among medical facilities, as well as health information organizations—entities overseeing and regulating this data exchange alongside government agencies, adhering to established national standards.

Electronic health information exchange permits doctors, nurses, pharmacists, and alternate healthcare donors and patients to suitably obtain and firmly apportion a patient's important medical information electronically, enhancing the quality, speed, security, and price of patient care. When the medical detail is divided between donors, it takes place by fax, mail, or most possibly by patients themselves, who often convey their records from appointment to appointment.

If a practice has effectively included faxing patient details into its business procedure course, it may ask why it should transform to electronic health information exchange. The health information exchange market sales are soaring as several advantages with information exchange exist irrespective of the manner in which it is relayed. However, the worth of electronically exchanging is the evenness of the data. Once standardized, the data conveyed can smoothly mingle into the recipient's electronic health record.

The research study offers an in-depth analysis of the competitive landscape in the industry. It examines the top players in the health information exchange market on the basis of multiple factors, including market position, sales, new developments and products/services offered. Also, it details the key strategies like mergers, partnerships and collaborations that have been taken by health information exchange industry key players to improve their position in the market.

To Understand More About this Research: Request a Free Sample Report

The primary goal of HIE is to facilitate secure and proper access to a patient's health records, ultimately enhancing the efficiency, quality, safety, and expediency of healthcare delivery. Although HIE commonly pertains to the exchange of information between multiple healthcare entities or providers, it can also denote an organization tasked with facilitating this exchange.

Health Information Exchange (HIE) empowers individuals by furnishing them with an electronic rendition of their medical records that they can readily share with their healthcare providers. Research has shown that the use of HIE can amplify communication between patients and providers, ultimately resulting in heightened patient satisfaction.

For instance, in January 2023, CSRI collaborated with eHealth Exchange to Advance TEFCA. This partnership involves the participation of five prominent health data exchanges in the United States, working alongside the envisioned Qualified Health Information Network to enhance the interoperability framework.

The healthcare information exchange market is chiefly stimulated by the digitization of healthcare systems, complemented by a growing acceptance of HIE systems due to heightened connectivity among healthcare providers. Additionally, the escalating government backing for establishing an advanced data exchange infrastructure, coupled with mounting investments from both public and private entities, is propelling the expansion of the healthcare information exchange market. Nevertheless, challenges such as privacy and security apprehensions, substantial initial infrastructure investments, and a slower return on investment are impeding the market's progress.

Growth Drivers

Increased Focus on Digital Transformation is Projected to Spur Product Demand

Health Information Exchange (HIE) is assuming a pivotal role in healthcare systems, enhancing interoperability, particularly in light of ever-evolving technology and the expanding array of options for exchanging health data. As providers recognize the advantages of HIE in patient care, its utilization is on the rise globally.

Moreover, it safeguards patient safety by minimizing medical and medication errors. This is achieved through secure data storage in a centralized database and the use of digital channels for information exchange. Health Information Exchange (HIE) stores data digitally, eliminating the necessity for paperwork or manual handling. This significantly diminishes the risk of information loss, as all data is securely stored in digital format.

Having access to a robust health information exchange can pave the way for prospects, including the development of care management platforms, cross-facility utilization, and the implementation of advanced clinical and financial analytics. Additionally, HIE systems are instrumental in aiding governments globally, ensuring timely access to public health data. This, in turn, assists governments in effective planning and prioritization of programs aimed at enhancing public health.

Report Segmentation

The market is primarily segmented based on type, solution, implementation model, application, and region.

|

By Type |

By Solution |

By Implementation Model |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

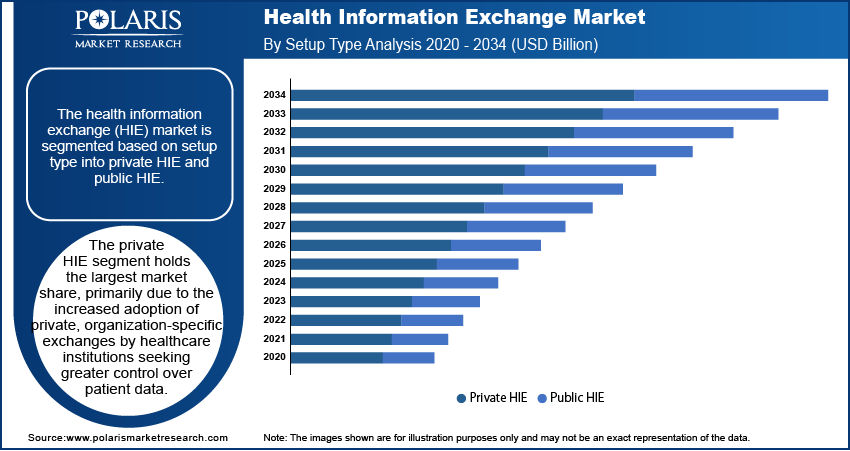

Private Segment is Expected to Witness the Highest Growth During the Forecast Period

The private segment is projected to grow at a CAGR during the projected period, mainly due to the increasing demand for secure and customized health data-sharing solutions within closed networks. This is particularly relevant for organizations like private hospitals, clinics, and specialized healthcare providers who prioritize data security and personalized information exchange among their network of stakeholders. Additionally, the growing emphasis on patient privacy and compliance with regulatory standards further propels the adoption of private health information exchange solutions. This segment caters to entities seeking tailored HIE solutions that align with their specific operational needs and compliance requirements.

However, the public health information exchange segment is the need for seamless and standardized data sharing across diverse healthcare entities within a region or community. Public health information exchange plays a crucial role in promoting coordinated care, especially in situations involving emergencies, outbreaks, or population health management. Additionally, government initiatives and policies aimed at improving healthcare accessibility and outcomes often mandate the implementation of public health information exchange solutions. This segment addresses the broader healthcare ecosystem, focusing on the exchange of information between various public and private healthcare organizations, government agencies, and community resources to enhance overall public health.

By Solution Analysis

Portal-Centric Segment Accounted For the Largest Market Share in 2022

The portal-centric segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This is a result of the increasing need for user-friendly and easily accessible platforms for healthcare information management. These portals provide a convenient and centralized means for individuals, patients, and healthcare providers to access, oversee, and exchange health-related data. The emphasis on patient engagement and empowerment further fuels the adoption of portal-centric solutions. Additionally, advancements in technology and the increasing preference for digital communication in healthcare contribute to the prominence of this segment. The portal-centric approach aligns with the evolving healthcare landscape, focusing on enhancing user experience and ensuring seamless information exchange.

By Implementation Model Analysis

Hybrid Model Segment Held a Significant Market Revenue Share in 2022

The hybrid segment held a significant market share in revenue share in 2022. This model, combining aspects of both centralized and decentralized approaches, presents advantages such as extensive data storage capacity and reduced costs, leading to an upsurge in usage rates. Additionally, the adoption of the hybrid model is expected to enhance operational efficiency and the delivery of patient care, further driving the demand for this segment over the forecast period.

By Application Analysis

Web Portal Development Segment Accounted for the Largest Market Share in 2022

The web portal development segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This surge can be linked to the heightened accessibility of patient health information via patient portals. The internal interfacing sector is poised for rapid expansion in the forecast period, driven by its proficiency in gathering comprehensive patient data.

Regional Insights

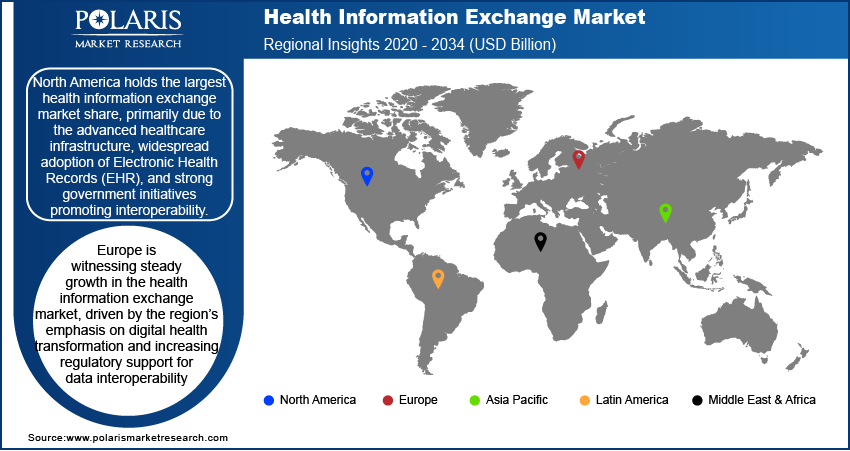

North America Region Dominated the Global Market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to a strong emphasis on healthcare interoperability and data exchange. In this region, there have been collaborative endeavors to establish standardized processes for effortlessly exchanging patient information across diverse healthcare environments and systems. Moreover, government policies like the Health Information Technology for Economic and Clinical Health (HITECH) Act and the Affordable Care Act (ACA) have been instrumental in advancing the adoption of Health Information Exchange (HIE). The substantial presence of a well-developed healthcare IT infrastructure and a considerable number of healthcare providers further bolster the momentum of HIE in North America. Furthermore, the desire to improve patient outcomes, enhance care coordination, and reduce healthcare costs continues to fuel the adoption and expansion of HIE initiatives in the region.

The Asia-Pacific region is expected to witness the highest growth during the forecast period. This is attributed to the expanding patient population, driving the need for enhanced information systems for efficient data management. Additionally, the escalating healthcare expenditure in emerging economies like China and India is anticipated to contribute significantly to this growth.

Key Market Players & Competitive Insights

The health information exchange market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Allscripts Healthcare Solutions

- Cerner Corporation

- Change Healthcare

- Epic Systems Corporation

- GE Healthcare

- Health Catalyst

- IBM Corporation

- InterSystems Corporation

- McKesson Corporation

- Medicity (A Cerner Company)

- NextGen Healthcare

- Optum (A UnitedHealth Group Company)

- Orion Health

- Philips Healthcare

- Siemens Healthineers

Recent Developments

- In October 2023, Sync.MD announced a partnership with Clemson Rural Health, aiming to enhance the secure exchange of health records. Through this collaboration, Sync.MD will furnish a secure digital platform, enabling seamless transmission of health records between Clemson Rural Health clinics and patients in South Carolina’s rural areas.

Health Information Exchange Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1659.11 million |

|

Revenue Forecast in 2032 |

USD 4,255.38 million |

|

CAGR |

12.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Solution, By Implementation Model, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Uncover the dynamics of the Health Information Exchange Market in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.