Headwear Market Size, Share, Trends, Industry Analysis Report: By Product Type (Hats & Caps, Beanies, Headbands, Helmets, and Others), Material Type, Distribution Channel, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3417

- Base Year: 2024

- Historical Data: 2020-2023

Headwear Market Overview

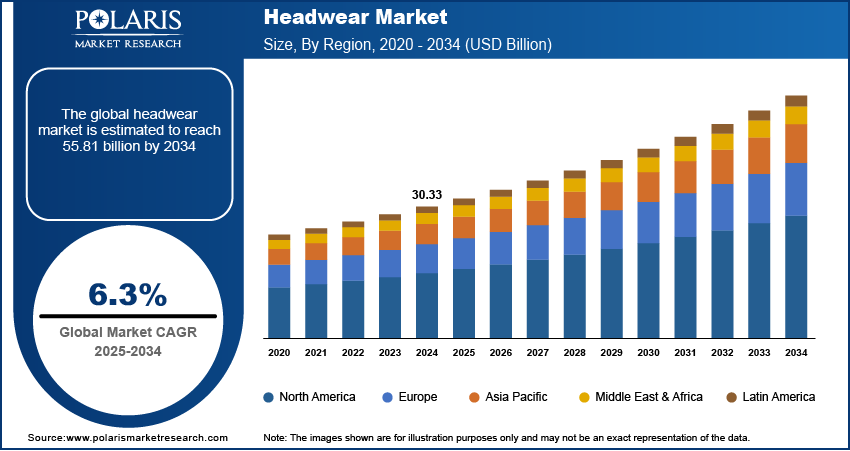

The global headwear market size was valued at USD 30.33 billion in 2024. The market is expected to grow from USD 32.21 billion in 2025 to USD 55.81 billion by 2034, exhibiting a CAGR of 6.3% from 2025 to 2034.

The headwear market involves the production, distribution, and sale of various head coverings, including hats, caps, beanies, headbands, and other accessories. Headwear caters to diverse purposes such as fashion, sports, functionality, cultural expression, and protection from weather conditions, driving consistent demand across global consumer segments.

The increasing consumer preference for stylish and versatile headwear as a fashion accessory is one of the major factors driving the headwear market expansion. In addition, growing participation in sports and fitness activities is fueling the demand for performance-oriented headwear, such as caps and sweatbands, contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

The headwear market thrives on a combination of celebrity endorsements, social media influence, and seasonal demand. High-profile figures and influencers often set fashion trends, making branded caps, beanies, and hats desirable among consumers. Social media platforms like Instagram and TikTok amplify this effect, as viral trends and influencer collaborations drive sales. Additionally, the demand for headwear is cyclical, ensuring year-round sales opportunities. In colder months, winter beanies and wool hats gain popularity, while summer sees a rise in demand for sun hats, caps, and visors. This steady demand allows brands to create seasonal collections and capitalize on changing consumer needs. The fusion of digital marketing and seasonal demand makes the headwear industry highly dynamic and profitable.

Headwear Market Dynamics

Expansion of E-Commerce Platforms

The expansion of e-commerce platforms is significantly contributing to the increased demand for headwear. For instance, the Census Bureau reported that U.S. retail e-commerce sales for Q3 2024 were estimated at USD 300.1 billion, representing a 2.6 percent increase from Q2 2024. E-commerce provides a seamless shopping experience, allowing customers to explore diverse styles, materials, and designs. The availability of customizable headwear options through online channels has also enhanced consumer accessibility, driving higher engagement. Additionally, the convenience of home delivery and exclusive online promotions has strengthened the demand for headwear products, enabling brands to reach broader audiences and capture untapped market opportunities. This digital shift continues to reshape headwear market dynamics, positioning e-commerce as a key growth driver.

Rising Disposable Income Globally

The rising disposable income levels worldwide have led to increased consumer spending on premium and branded products. For instance, in 2024, data from the Department of Commerce indicates that real disposable incomes have consistently experienced a monthly growth rate of 3% or higher in America. This surge in purchasing power has boosted the demand for high-quality, stylish, and durable headwear options. Consumers are now more inclined to invest in headwear that reflects personal style and social status with greater financial flexibility. This shift has also encouraged manufacturers and brands to innovate and cater to evolving consumer preferences, creating new opportunities within the premium segment of the headwear market.

Headwear Market Segment Insights

Headwear Market Assessment by Product Type Outlook

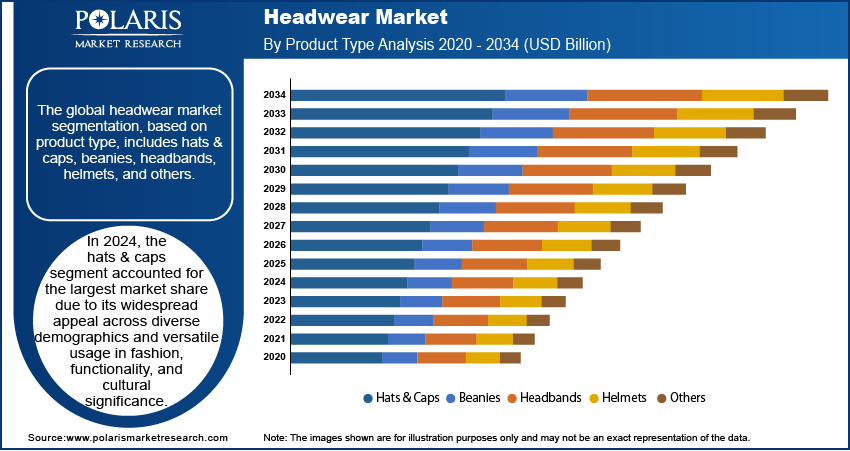

The global headwear market segmentation, based on product type, includes hats & caps, beanies, headbands, helmets, and others. In 2024, the hats & caps segment accounted for the largest market share due to its widespread appeal across diverse demographics and versatile usage in fashion, functionality, and cultural significance. Hats & caps are staples in wardrobes globally, catering to various purposes such as sun protection, style statements, and sporting events. Evolving fashion trends, frequent product launches, and collaborations between brands and influencers further boost the segment's dominance. Additionally, hats & caps are often seen as affordable accessories, contributing to their consistent market demand.

Headwear Market Evaluation by End Use Outlook

The global headwear market segmentation, based on end use, includes men, women, children, sports, entertainment, fashion, military and law enforcement, and others. The sports segment is expected to witness significant growth during the forecast period. This is attributed to the increasing emphasis on fitness, health, and active lifestyles, which has led to higher participation in sports and outdoor activities. The rising awareness regarding protective gear and the demand for performance-enhancing headwear tailored for specific sports such as cycling, cricket, baseball, and skiing also contribute to this growth. Innovations in materials offering lightweight, breathable, and moisture-wicking properties further attract consumers seeking comfort and functionality. Sports headwear’s dual role in safety and brand sponsorship opportunities enhances its visibility, thereby contributing to the segment’s robust growth in the market.

Headwear Market Regional Analysis

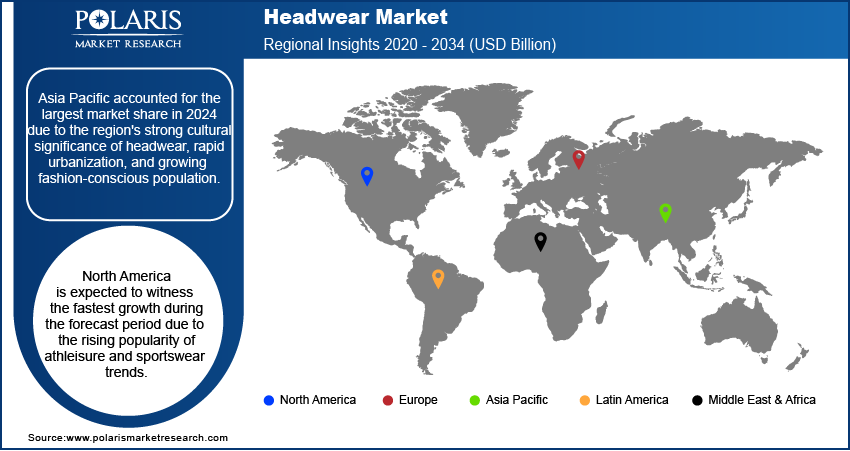

By region, the study provides the headwear market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's strong cultural significance of headwear, rapid urbanization, and growing fashion-conscious population. Increasing disposable income levels, coupled with the rising popularity of global fashion trends, have driven the demand for premium and branded headwear products. Additionally, the expanding e-commerce sector in countries such as China, India, and Japan has enhanced accessibility to a wide range of headwear options, boosting market growth. For instance, the India Brand Equity Foundation reports that the Indian e-commerce sector is expanding rapidly. The market was valued at USD 25.75 billion in FY20 and is projected to grow to USD 325 billion by 2030, highlighting its significant growth potential. The region’s vibrant sports industry and the increasing adoption of headwear as a style statement further contribute to the regional market dominance.

The North America headwear market is expected to witness the fastest growth during the forecast period due to the rising popularity of athleisure and sportswear trends, coupled with a growing emphasis on personal style and self-expression. The increasing participation in outdoor, sports, and fitness activities has fueled demand for functional and stylish headwear, such as caps, hats, and headbands, designed for both performance and style. For instance, in 2023, the US registered 242 million individuals aged six and older participating in at least one sport or fitness activity, marking a 2.2% rise from 2022. Nearly 80% of Americans engage in physical activities, subsequently boosting the demand for sports-specific headwear products. Additionally, the region's thriving e-commerce platforms and the adoption of advanced marketing strategies by key players have improved consumer access to a diverse range of headwear products. Innovations in headwear design, sustainability-focused products, and celebrity endorsements further drive the regional market expansion.

Headwear Market – Key Players and Competitive Insights

The competitive landscape of the headwear market is highly dynamic, driven by both established global brands and emerging regional players that are continuously evolving to meet consumer demands. Leading companies prioritize innovation in design, quality, and functionality to stay competitive, often incorporating advanced technologies and premium materials to create stylish yet practical headwear options. Sustainability is becoming a key differentiator, with a growing number of brands focusing on eco-friendly and recyclable materials to appeal to environmentally conscious consumers. Effective branding strategies, including the use of celebrity endorsements, collaborations with fashion designers, and targeted advertising campaigns, help firms build strong customer loyalty and enhance market visibility.

The rise of online shopping platforms has created new opportunities for competition, allowing even smaller and niche players to reach global markets. E-commerce also facilitates direct consumer engagement, making it easier for brands to gather valuable consumer insights and tailor their products accordingly. Additionally, the popularity of customized and personalized headwear has intensified the competitive environment as companies strive to offer unique, one-of-a-kind designs that resonate with specific consumer groups.

Frequent product launches and the expansion of product lines continue to be key strategies for growth, as brands work to diversify their offerings for different segments, such as sports, fashion, military, and lifestyle. Furthermore, collaborations between headwear brands and prominent sports teams or fashion icons continue to influence consumer behavior, driving both product innovation and demand. The competitive dynamics in the headwear market are also shaped by factors such as pricing strategies, distribution channels, and the ability to adapt to ever-changing fashion trends.

Adidas AG, is a German corporation that designs, manufactures, and markets athletic and sports lifestyle products. The company was founded in 1949 and is headquartered in Bavaria, Germany. Its extensive product portfolio encompasses footwear, apparel, and accessories, including fitness equipment, bags, sunglasses, and balls. The company distributes and markets its products through own-branded stores, retail stores, sporting goods chains, wholesale outlets, buying groups, department stores, e-retailers, franchise stores, lifestyle retail chains, e-commerce platforms, and mobile shopping apps. Adidas has a global presence with business operations spanning the Americas, Europe, Asia Pacific, Africa, and the Middle East. North America and Greater China are key markets, accounting for approximately 40% of the company's annual retail sales. The company produces millions of units of sportswear and shoes annually. Adidas AG is also engaged in the design and manufacturing of athletic and lifestyle products, including a diverse range of headwear items. Adidas AG offers stylish caps, beanies, and visors, blending performance, fashion, and branding, appealing to athletes, streetwear enthusiasts, and trendsetters.

Puma SE is engaged in designing, developing, and marketing athletic and casual footwear, apparel, and accessories. The company was founded in 1948 and is headquartered in Bavaria, Germany. Puma's product portfolio includes a wide range of items for women, men, and children under the Puma and Cobra Golf brands and stichd. The company also licenses independent firms to produce and market fragrances, eyewear, watches, and various accessories. Puma distributes its products through a combination of company-owned retail stores, licensed outlets, e-commerce platforms, and wholesale channels. It is also engaged in headwear production, providing a variety of caps and hats that cater to both sports enthusiasts and fashion-conscious consumers. The brand’s headwear often features the iconic Puma logo and is designed to complement its athletic apparel lines while appealing to lifestyle markets.

List of Key Companies in Headwear Market

- Adidas AG

- Calvin Klein

- Gianni Versace S.R.L.

- Guccio Gucci S.P.A.

- New Era Cap

- Lacoste

- Superdry Plc

- Nike, Inc.

- Ralph Lauren Media LLC

- Puma SE

- Pipolaki

- Under Armour Inc.

- Boardriders

- New Balance Inc.

- The Gap Inc

- Topgolf Callaway Brands Corp

Headwear Industry Developments

In June 2024, The Virginia Tech Helmet Lab expanded its focus to develop a comprehensive rating system for protective helmets in various applications. This initiative aims to enhance safety performance by evaluating helmets with advanced materials and testing methodologies for impact protection in both sporting and non-sporting contexts.

In May 2022, Cap America acquired Wear-A-Knit, a Minnesota-based custom knitwear company. This acquisition is expected to increase Cap America's production capacity and expand its custom knitwear product offerings, further strengthening its position as a leading supplier of high-quality headwear and accessories in the market.

In May 2022, Atlantis Headwear partnered with Caps Direct to introduce sustainable headwear to the market. The partnership aims to appeal to conscious consumers and drive positive change while contributing to the market growth with a range of styles and designs, from classic caps to modern headwear options.

Headwear Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Hats & Caps

- Beanies

- Headbands

- Helmets

- Others

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Cotton

- Wool

- Polyester

- Leather

- Nylon

- Acrylic

- Natural Fibers

- Synthetic Blends

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline Stores

- Online Stores

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Men

- Women

- Children

- Sports

- Entertainment

- Fashion

- Military and Law Enforcement

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Headwear Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30.33 billion |

|

Market Size Value in 2025 |

USD 32.21 billion |

|

Revenue Forecast in 2034 |

USD 55.81 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global headwear market size was valued at USD 30.33 billion in 2024 and is projected to grow to USD 55.81 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

Asia Pacific accounted for the largest global market share in 2024 due to the region's strong cultural significance of headwear, rapid urbanization, and growing fashion-conscious population.

Some of the key players in the market are Adidas Ag; Calvin Klein; Gianni Versace S.R.L.; Guccio Gucci S.P.A.; New Era Cap; Lacoste; Superdry Plc; Nike, Inc.; Ralph Lauren Media Llc; Puma Se; Pipolaki; Under Armour Inc; Boardriders; New Balance Inc; The Gap Inc; and Topgolf Callaway Brands Corp.

The hats & caps segment accounted for the largest market share in 2024 due to its widespread appeal across diverse demographics and versatile usage in fashion, functionality, and cultural significance.

The sports segment is expected to witness significant growth during the forecast period due to the increasing emphasis on fitness, health, and active lifestyles, which has led to higher participation in sports and outdoor activities.