HDPE Pipes Market Size, Share, Trends, Industry Analysis Report

: By Diameter (<500 MM, 500–1000 MM, 1000–2000 MM, 2000–3000 MM, and > 3000 MM), Grade, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5460

- Base Year: 2024

- Historical Data: 2020-2023

HDPE Pipes Market Overview

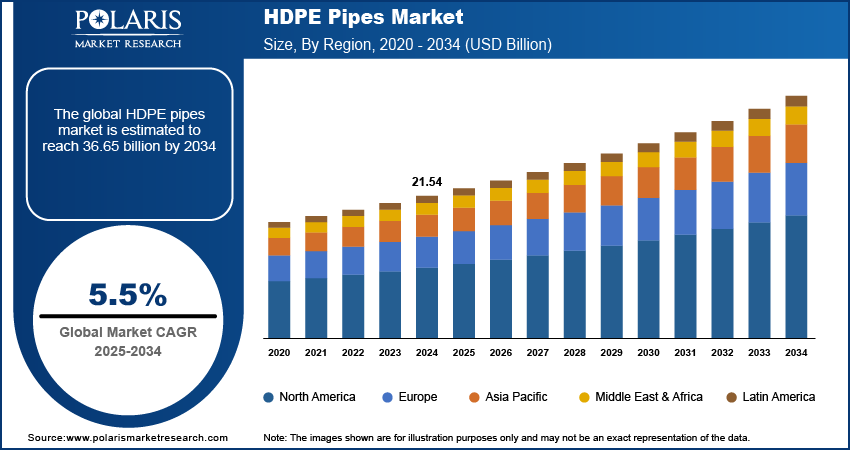

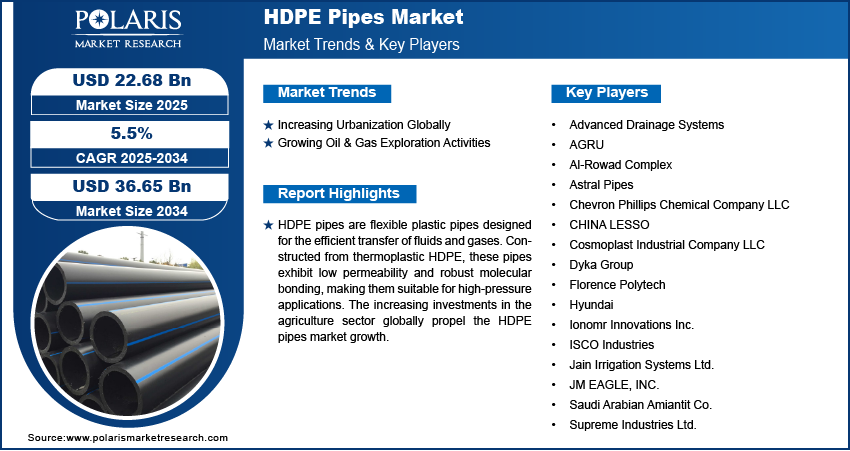

The global HDPE pipes market size was valued at USD 21.54 billion in 2024. The market is projected to grow from USD 22.68 billion in 2025 to USD 36.65 billion by 2034, exhibiting a CAGR of 5.5 % during 2025–2034.

HDPE pipes are flexible plastic pipes designed for the efficient transfer of fluids and gases. Constructed from thermoplastic HDPE, these pipes exhibit low permeability and robust molecular bonding, making them suitable for high-pressure applications. The mechanical properties of HDPE pipes include high tensile strength and flexibility. These pipes withstand extreme temperatures and environmental conditions without cracking or breaking. HDPE pipes are used across various sectors, including municipal water supply, gas distribution, sewage systems, irrigation, and industrial processes.

The increasing investments in the agriculture sector globally propel the HDPE pipes market growth. According to the data published by the Food and Agriculture Organization, global agriculture investments increased from USD 476 billion in 2012 to USD 597 billion in 2022. Increased funding encourages the adoption of advanced irrigation techniques such as drip and sprinkler systems. These systems rely heavily on HDPE pipes due to their durability, corrosion resistance, and flexibility. The rise in agriculture investment further leads to an increase in irrigation projects, which directly spurs the need for HDPE pipes, making them an essential component in agricultural expansion. Moreover, investments in arid and semi-arid regions for agriculture expansion necessitate robust water transport infrastructure, further increasing the demand for HDPE pipes.

To Understand More About this Research: Request a Free Sample Report

The HDPE pipes market demand is driven by the rising industrialization and growing environmental regulations. Industries are investing in modern facilities with advanced plumbing and drainage systems that require high-quality pipes. HDPE pipes offer a cost-effective and long-lasting solution, making them a preferred choice for industrial water management and underground piping networks. Additionally, governments enforce strict guidelines for industrial waste management and water conservation, requiring industries to upgrade their piping systems. HDPE pipes provide leak-proof and chemically resistant solutions, ensuring compliance with environmental standards.

HDPE Pipes Market Dynamics

Increasing Urbanization Globally

Various regions across the world are witnessing rising urbanization. The Our World in Data published a report in 2024, stating that more than half of the world's population now live in urban areas. Municipalities and developers are constructing new residential and commercial buildings as cities are expanding. These residential and commercial buildings require reliable plumbing and drainage solutions. HDPE pipes offer durability, flexibility, and corrosion resistance, making them ideal and essential in these buildings for water distribution networks. Governments and private developers are further investing heavily in infrastructure development to meet the rising demand for clean water and efficient sewage systems, leading to an increase in HDPE pipe consumption.

Surging urbanization leads to the rise of smart city developments, which focus on advanced infrastructure systems that rely on durable and adaptable piping solutions. HDPE pipes support high-pressure water supply networks, fiber optic cable protection, and gas distribution in smart cities, which increases their adoption. Therefore, increasing urbanization increases the demand for HDPE pipes.

Growing Oil & Gas Exploration Activities

Increasing oil and gas exploration activities require durable and corrosion-resistant pipelines to transport water, construction chemicals, and slurry in drilling operations. HDPE pipes provide a lightweight, flexible, and cost-effective solution, making them essential for fluid handling system in oil and gas exploration activities. Furthermore, rising offshore and onshore drilling projects fuel HDPE pipe consumption. Many oil and gas companies operate in harsh environments where traditional metal pipes corrode quickly. HDPE pipes withstand extreme temperatures, chemical exposure, and high-pressure conditions, making them ideal for transporting extracted resources and drilling fluids. Exploration projects in remote areas also rely on HDPE pipes for water supply and wastewater disposal, ensuring smooth and efficient operations in challenging terrains. Hence, the growing oil and gas exploration activities across the world boost the HDPE pipes market development.

HDPE Pipes Market Segmental Insights

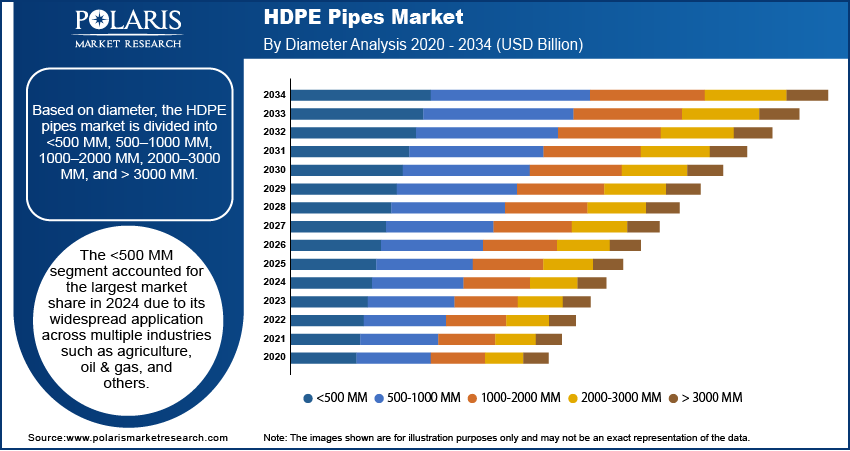

HDPE Pipes Market Evaluation by Diameter

Based on diameter, the HDPE pipes market is divided into <500 MM, 500–1000 MM, 1000–2000 MM, 2000–3000 MM, and > 3000 MM. The <500 MM segment accounted for major HDPE pipes market share in 2024 due to its widespread application across multiple industries such as agriculture and oil & gas. Municipal water supply systems, agricultural irrigation networks, and small-scale industrial piping projects primarily drove the demand for HDPE pipes with <500 MM diameter. Many urban and rural infrastructure projects favored these pipes for potable water distribution and drainage solutions owing to their ease of installation, lightweight properties, and cost-effectiveness. Additionally, the increasing adoption of drip and sprinkler irrigation in agriculture significantly contributed to segment growth. Farmers and agribusinesses preferred smaller-diameter pipes for efficient water management, reducing wastage, and improving crop yields. The construction industry's expansion further boosted demand for pipes with a diameter of <500 MM, as these pipes served as essential components in plumbing, underground utilities, and stormwater management systems. Government initiatives aimed at improving sanitation and water accessibility in developing nations also played a crucial role in maintaining the segment's dominance.

HDPE Pipes Market Outlook by Application

In terms of application, the HDPE pipes market is segregated into irrigation systems, drainage & sewage, chemical processing, electrofusion fittings, and others. The irrigation systems segment is expected to grow at a robust pace in the coming years, owing to the increasing investments in agricultural infrastructure and water conservation initiatives. Governments and private stakeholders are promoting efficient irrigation techniques, such as drip and sprinkler systems, to enhance crop yields while minimizing water wastage. Many regions experiencing irregular rainfall and water scarcity have adopted modern irrigation solutions to ensure food security, boosting demand for HDPE pipes. Large commercial farms, as well as small-scale agricultural enterprises, are investing in HDPE pipes to optimize water distribution across fields.

HDPE Pipes Market Regional Analysis

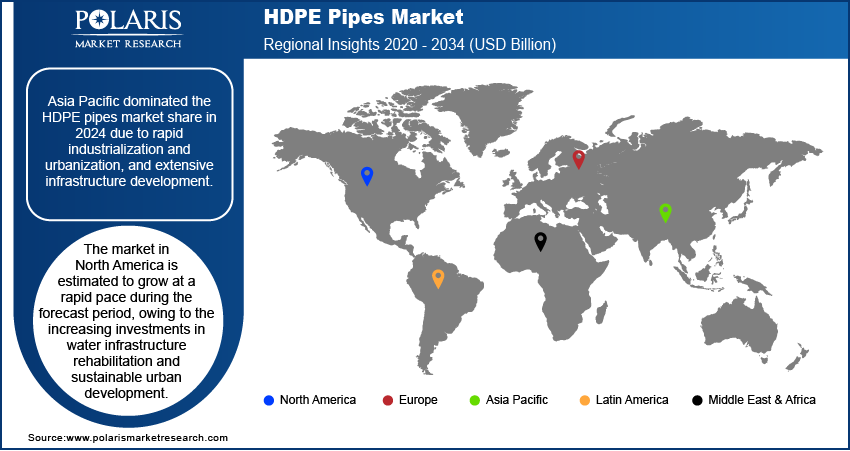

By region, the report provides HDPE pipes market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024 due to rapid industrialization and urbanization, and extensive infrastructure development. Countries in the region invested heavily in modernizing water supply networks, sewage systems, and agricultural irrigation, driving demand for durable and cost-effective piping solutions such as HDPE pipes. China led the Asia Pacific HDPE pipes market revenue share, fueled by its large-scale construction projects, government-backed water conservation initiatives, and expanding industrial base. The country’s Belt and Road Initiative also played a crucial role in increasing demand, as cross-border infrastructure projects required extensive piping networks. Additionally, India and Southeast Asian nations contributed to market growth through rural electrification programs, smart city developments, and rising investments in irrigation systems. The expansion of chemical processing industries, coupled with stringent environmental regulations on wastewater management, further contributed to Asia Pacific dominance.

The North America HDPE pipes market is estimated to grow at a rapid pace during the forecast period, owing to the increasing investments in water infrastructure rehabilitation and sustainable urban development. The US is estimated to lead this regional market due to ongoing efforts to replace aging pipelines, upgrade drainage systems, and enhance wastewater treatment facilities. Many cities across the country have initiated large-scale water infrastructure projects to address contamination issues and improve supply efficiency. Additionally, the expansion of the oil & gas industry, particularly in shale gas extraction and offshore drilling operations, has boosted the HDPE pipes market expansion in North America. Canada is also expected to contribute significantly to the global market share, with its focus on upgrading municipal water management systems and expanding industrial operations in the mining and energy industries.

HDPE Pipes Market – Key Players & Competitive Analysis Report

Prominent market players are investing heavily in research and development to expand their offerings, which will propel the HDPE pipes market growth during the forecast period. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The HDPE pipes market is fragmented, with the presence of numerous global and regional market players. A few major players in the market include Advanced Drainage Systems; AGRU; Al-Rowad Complex; Astral Pipes; Chevron Phillips Chemical Company LLC; CHINA LESSO; Cosmoplast Industrial Company LLC; Dyka Group; Florence Polytech; Ionomr Innovations Inc.; ISCO Industries; Jain Irrigation Systems Ltd.; JM EAGLE, INC.; Saudi Arabian Amiantit Co.; and Supreme Industries Ltd.

Astral Pipes, established in 1996 in Gujarat, India, offers a diverse product range in India's building material sector and is known for introducing new piping technologies to the Indian market. Astral provides a variety of HDPE pipe solutions for different applications. These include TeleRex Pipes and D-Rex Pipes. These pipes are designed for underground cable ducting, providing protection and ease of installation. These pipes are utilized across various sectors such as government, railway, telecommunications, and power distribution. They are available in coil form for diameters up to 63 mm OD and in straight bars for applications requiring straight pipe sections.

Supreme Industries Ltd, established in 1942 by the Modi family, stands as a major company in India's plastics industry. The Taparia family took over the company's management in August 1966. Supreme handles over 640,000 tonnes of polymers annually, making it the largest plastic processor in the country. The company has a widespread presence with 25 production plants across various states, including Punjab, West Bengal, Maharashtra, Gujarat, and Tamil Nadu. It also exports its products to over 20 countries worldwide. Supreme offers a wide array of cost-effective piping solutions, which find usage in the water & waste management and infrastructure sectors. The company provides around 6,729 different types of pipes and fittings, which are manufactured as per various national and international standards.

List of Key Companies in HDPE Pipes Market

- Advanced Drainage Systems

- AGRU

- Al-Rowad Complex

- Astral Pipes

- Chevron Phillips Chemical Company LLC

- CHINA LESSO

- Cosmoplast Industrial Company LLC

- Dyka Group

- Florence Polytech

- Ionomr Innovations Inc.

- ISCO Industries

- Jain Irrigation Systems Ltd.

- JM EAGLE, INC.

- Saudi Arabian Amiantit Co.

- Supreme Industries Ltd.

HDPE Pipes Industry Developments

August 2021: Varuna Neeravari started a new HDPE pipes and fittings unit in Dobaspet 4th Phase Industrial Area, Bangalore Rural, India. The project involves the manufacturing of pipes and fittings.

April 2021: Malaxmi Polymers received consent from the Telangana state pollution control authorities to establish a new HDPE pipes manufacturing project in Maheswaram (Telangana), India. The project involves manufacturing HDPE pipes with a capacity of 78 TPM.

January 2021: Presvels received consent from the Madhya Pradesh state pollution control authorities to establish a new HDPE pipes manufacturing project in Mandideep, Raisen, Madhya Pradesh. The project involves manufacturing HDPE pipes with a capacity of 3000 M.T/Year.

HDPE Pipes Market Segmentation

By Diameter Outlook (Revenue, USD Billion, 2020–2034)

- <500 MM

- 500–1000 MM

- 1000–2000 MM

- 2000–3000 MM

- > 3000 MM

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- PE 80

- PE 100

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Irrigation Systems

- Drainage & Sewage

- Chemical Processing

- Electrofusion Fittings

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Municipal Corporation

- Farmers

- Oil & Gas Explorer

- Builders

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

HDPE Pipes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.54 Billion |

|

Revenue Forecast in 2025 |

USD 22.68 Billion |

|

Revenue Forecast by 2034 |

USD 36.65 Billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global HDPE pipes market size was valued at USD 21.54 billion in 2024 and is projected to grow to USD 36.65 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are Advanced Drainage Systems; AGRU; Al-Rowad Complex; Astral Pipes; Chevron Phillips Chemical Company LLC; CHINA LESSO; Cosmoplast Industrial Company LLC; Dyka Group; Florence Polytech; Ionomr Innovations Inc.; ISCO Industries; Jain Irrigation Systems Ltd.; JM EAGLE, INC.; Saudi Arabian Amiantit Co.; and Supreme Industries Ltd.

The <500 MM segment dominated the market in 2024.