Hardware Security Module Market Size, Share, Trends, Industry Analysis Report: By Deployment Type (On-Premise and Cloud), Type, Application, Vertical, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 176

- Format: PDF

- Report ID: PM2679

- Base Year: 2024

- Historical Data: 2020-2023

Hardware Security Module Market Overview

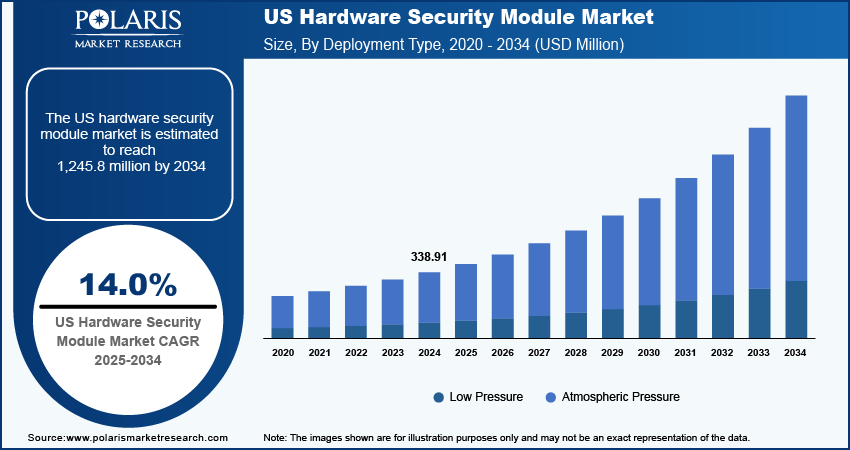

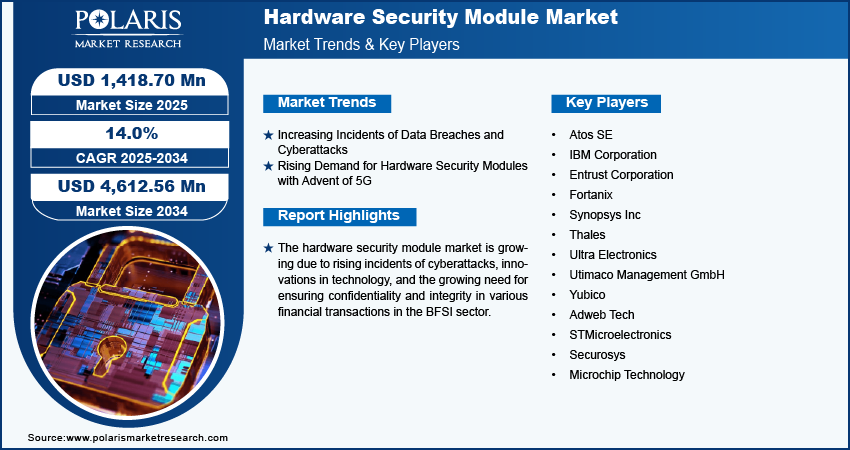

The global hardware security module market size was valued at USD 1,261.06 million in 2024. The market is projected to grow from USD 1,418.70 million in 2025 to USD 4,612.56 million by 2034, exhibiting a CAGR of 14.0% during 2025–2034.

The hardware security module (HSM) market has witnessed significant growth and evolution in recent years, driven by the escalating need for robust data protection solutions due to the rising incidents of cyber threats. HSMs are specialized hardware devices that provide secure key management and cryptographic services, ensuring the confidentiality and integrity of sensitive information. One of the primary driving factors behind the growth of the HSM market is the rising frequency and sophistication of cyberattacks. In 2021, 2,323 US public sector entities faced financially-motivated ransomware attacks, causing disruption, financial loss, and 118 data breaches. With cybercriminals becoming increasingly adept at exploiting vulnerabilities in digital systems, organizations across various sectors, including finance, healthcare, and government, are recognizing the critical importance of safeguarding their data. HSMs offer a dedicated and highly secure environment for key storage and cryptographic operations, making them indispensable in fortifying the overall cybersecurity posture of these entities.

To Understand More About this Research: Request a Free Sample Report

The ever-expanding digital landscape and the proliferation of online transactions fuel the demand for secure and seamless payment solutions. As a result, the financial sector has emerged as a significant contributor to the HSM market. Banks, payment processors, and financial institutions leverage HSMs to secure payment transactions, authenticate users, and protect sensitive financial data. The global shift toward digital currencies and decentralized finance (DeFi) platforms has further augmented the demand for HSMs, underscoring their pivotal role in ensuring the security of digital assets and transactions.

In addition to the financial sector, stringent regulatory requirements have acted as a catalyst for the adoption of HSMs. Various data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the US, mandate the implementation of robust security measures to protect sensitive information. Compliance with these regulations necessitates the deployment of HSMs, which provide the cryptographic mechanisms and secure key storage essential for regulatory adherence.

Hardware Security Module Market Drivers and Trends

Increasing Incidents of Data Breaches and Cyberattacks

In recent years, the digital landscape has been witnessing the rising incidents of data breaches and cyberattacks, causing significant concerns for individuals, businesses, and governments across the world. These incidents compromise sensitive information and erode trust in online systems. In response to this growing threat, HSMs have emerged as a crucial line of defense, providing a robust solution to protect sensitive data and cryptographic keys.

According to IBM, the global average cost of a data breach was USD 4.45 million in 2023, a 15% increase over three years. Hackers and malicious entities have become increasingly adept at exploiting vulnerabilities in software-based security systems. HSMs, being physical devices that store and manage cryptographic keys, offer a hardware-based approach, making it significantly harder for attackers to gain unauthorized access. As organizations recognize the limitations of purely software-based solutions, they are turning to HSMs to enhance their security infrastructure. Thus, the rising number of cyberattacks and data breaches boosts the hardware security module market growth.

Rising Demand for Hardware Security Modules with Advent of 5G

The advent of 5G technology has ushered in a new era of connectivity, enabling faster data transmission, lower latency, and increased network reliability. This advancement has transformed the way we communicate and significantly impacted various industries, including healthcare, finance, transportation, and manufacturing. As private 5G networks become more widespread, the demand for robust security measures has escalated, leading to a substantial increase in the adoption of HSMs. These HSMs play a crucial role in ensuring the confidentiality, integrity, and authenticity of data in 5G networks. For instance, the Ericsson Authentication Security Module provides advanced security features to enhance users’ privacy protection during the 5G era. It achieves this by seamlessly integrating a HSM into Ericsson’s dual-mode 5G Core solution.

Another driving factor behind the increased demand for HSMs in the 5G landscape is the rising concern regarding cybersecurity threats. With the proliferation of connected devices and the massive amounts of sensitive data transmitted over 5G networks, the risk of cyberattacks has grown exponentially. HSMs provide a dedicated and tamper-resistant hardware platform for secure key storage and cryptographic operations, making it extremely challenging for malicious actors to compromise sensitive information. The robust encryption capabilities offered by HSMs are essential in safeguarding critical data, ensuring that communication between devices and networks remains confidential and secure.

Hardware Security Module Market Segment Insights

Hardware Security Module Market Breakdown By Deployment Type

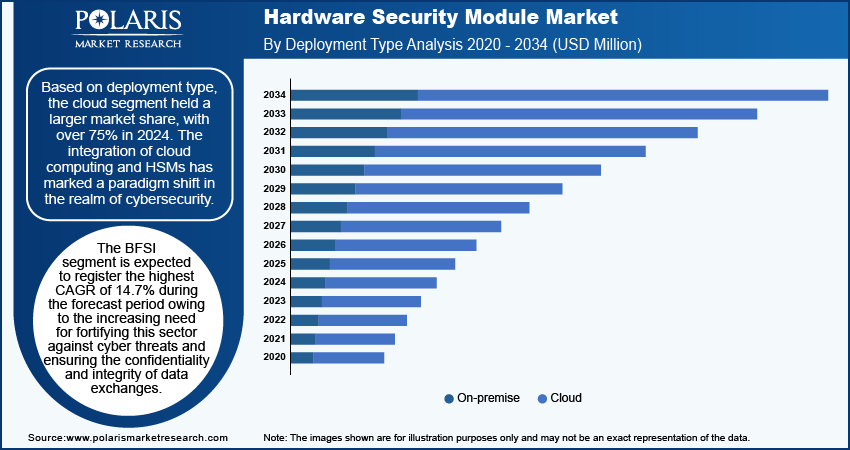

Based on deployment type, the hardware security module market is segmented into on-premise and cloud. The cloud segment held a larger market share, with over 75% in 2024. The integration of cloud computing and HSMs has marked a paradigm shift in the realm of cybersecurity. This innovative amalgamation represents a crucial advancement in ensuring the confidentiality, integrity, and availability of sensitive data and cryptographic keys in cloud environments. These cloud services seamlessly interact with specialized HSMs, enhancing the security posture of digital assets stored and processed in the cloud. Cloud-based HSMs serve as dedicated hardware devices designed to manage and safeguard encryption keys, ensuring that cryptographic operations are executed securely and efficiently. By leveraging the cloud, organizations gain unparalleled scalability, flexibility, and accessibility to computing resources, while HSMs reinforce these advantages with their tamper-resistant hardware, protecting critical cryptographic keys from unauthorized access and misuse.

Hardware Security Module Market Breakdown By Vertical Insights

Based on vertical, the hardware security module market is segmented into consumer goods & retail; banking, financial services, and insurance; aerospace & defense; public sector/government; energy & power; industrial manufacturing; medical & life sciences; transportation; IT & telecommunications; and others. The banking, financial services, and insurance segment is expected to register the highest CAGR of 14.7% during the forecast period. In the banking, financial services, and insurance (BFSI) industry, the integration of advanced technologies has become paramount, ensuring security, efficiency, and trust in the digital age. One such crucial component shaping the landscape of security in this sector is the hardware security module (HSM). An HSM is a dedicated hardware device that safeguards sensitive data, cryptographic keys, and digital identities. Its primary role is to ensure confidentiality and integrity in various financial transactions, ranging from online banking to payment processing. In essence, an HSM acts as the digital fortress, fortifying the BFSI sector against cyber threats and ensuring the confidentiality and integrity of data exchanges.

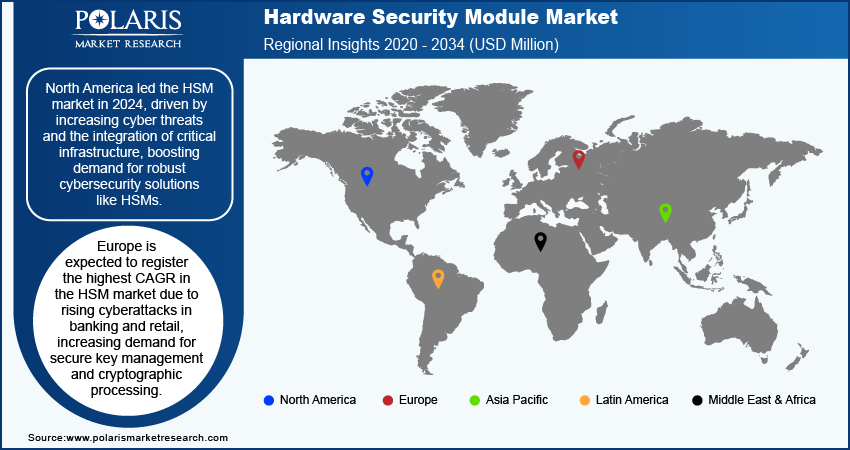

Hardware Security Module Breakdown By Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America accounted for the largest market share in 2024. In North America, the hardware security module (HSM) market has experienced significant growth owing to the escalating cyber threats and the increasing integration of critical infrastructure across national boundaries. Companies operating across the region have been proactive in their efforts to enhance cybersecurity measures. They are strengthening their defenses and increasing cooperation with each other and governments to address the region's vulnerability to cyberattacks. Companies are recognizing the importance of protecting endpoint devices, given the proliferation of IT businesses in the region. As a result, the adoption of HSMs has become a strategic choice for safeguarding sensitive data and cryptographic keys.

The hardware security module market in Europe is expected to register the highest CAGR during the forecast period. The rising number of cyberattacks in the banking and retail industries significantly impacts the growth of the hardware security module (HSM) market in Europe. As these industries increasingly become targets of sophisticated cyber threats, they are recognizing the need for robust security measures to protect sensitive financial and customer data. HSMs, which provide secure key management and cryptographic processing, are a crucial component in safeguarding digital assets.

The banking sector in Europe has witnessed a surge in cyberattacks, with hackers targeting financial institutions that utilize the SWIFT network for money transfers. Malware such as Odinaff, Danabot, Backswap, and Camubot have been employed to breach their security systems. This has highlighted the vulnerability of traditional financial systems and underscored the importance of implementing HSMs to enhance data protection. Banks are increasingly investing in HSMs to secure transactions and sensitive customer information, thereby driving the growth of the HSM market in Europe.

Hardware Security Module Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the hardware security module market growth in the coming years. Market participants are also undertaking a variety of strategic activities, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations, to expand their global footprint. To expand and survive in a more competitive and rising market climate, the market players must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global hardware security module industry to benefit clients and propel business growth. Major players in the hardware security module market are Atos SE, IBM Corporation, Entrust Corporation, Fortanix, Synopsys Inc, Thales, Ultra Electronics, Utimaco Management GmbH, Yubico, Adweb Tech, STMicroelectronics, Securosys, Society for Worldwide Interbank Financial Telecommunication, and Microchip Technology.

Atos SE is delivering digital transformation solutions and services worldwide. The company offers an extensive range of advanced computing solutions, including advanced analytics, artificial intelligence, automation solutions, and cloud services. Atos also enhances customer experiences through digital solutions, such as customer journey analytics and digital customer experience services. In June 2023, Eviden, a subsidiary of Atos and a frontrunner in digital, cloud, big data, and security, introduced AIsaac Cyber Mesh, a cybersecurity detection and response system. This innovative solution is fortified by Amazon Web Services (AWS) Security Data Lake and driven by generative AI technologies. AIsaac Cyber Mesh delivers a comprehensive end-to-end detection, response, and recovery capability, underpinned by a cybersecurity mesh-enabled architecture, integrating generative AI and predictive analytics.

Fortanix is a computing pioneer and a data-centric multi-cloud security firm. In the modern landscape, data disperses across various cloud environments, SaaS platforms, applications, storage systems, and data centers. In June 2022, Fortanix launched Secure Web 3.0 Infrastructure solutions integrated within Fortanix Data Security Manager, enhancing blockchain security with Confidential Computing, safeguarding user wallets, ensuring compliance, and defining a new standard for decentralized applications in the Web 3.0 era.

List of Key Companies in Hardware Security Module Market

- Atos SE

- IBM Corporation

- Entrust Corporation

- Fortanix

- Synopsys Inc

- Thales

- Ultra Electronics

- Utimaco Management GmbH

- Yubico

- Adweb Tech

- STMicroelectronics

- Securosys

- Society for Worldwide Interbank Financial Telecommunication

- Microchip Technology

Hardware Security Module Industry Developments

October 2023: Securosys launched a cloud-attentive Primus HSM for HashiCorp Vault. Users can leverage the complete range of (HSM) capabilities seamlessly through Securosys' plugin, which is fully compatible with Vault Enterprise and Community Editions. This comprehensive integration equips users with the ability to securely administer their keys stored within the HSM and conduct cryptographic operations on the HSM. Furthermore, this solution encompasses advanced HSM functionalities, including hardware-enforced multi-authorization workflows to meet compliance requirements and signature services.

August 2023: Thales introduced the cloud-based payment HSM service, facilitating the swift uptake of cloud payment infrastructure.

April 2023: Securosys, a cybersecurity company, partnered with Achelos GmbH, a German consulting firm, to integrate Securosys High-Security Module products into Achelos' portfolio. The collaboration enables both companies to offer a comprehensive range of services to their B2B clients in the DACH region.

Hardware Security Module Market Segmentation

By Deployment Type Outlook

- On-Premise

- Cloud

By Type Outlook

- LAN Based/ Network Attached

- PCI-Based/ Embedded Plugins

- USB-Based/ Portable

- Smart Cards

By Application Outlook

- Payment Processing

- Code & Document Signing

- Authentication

- Application-Level Encryption

- Database Encryption

- PKI & Credential Management

- Security Sockets Layer (SSL) & Transport Security Layer (TSL)

By Vertical Outlook

- Consumer Goods & Retail

- Banking, Financial Services, and Insurance

- Aerospace & Defense

- Public Sector/Government

- Energy & Power

- Industrial Manufacturing

- Medical & Life Sciences

- Transportation

- IT & Telecommunications

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- Indonesia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hardware Security Module Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,261.06 million |

|

Market Size Value in 2025 |

USD 1,418.70 million |

|

Revenue Forecast by 2034 |

USD 4,612.56 million |

|

CAGR |

14.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hardware security module market size was valued at USD 1,261.06 million in 2024 and is projected to reach USD 4,612.56 million by 2034.

The global market is projected to register a CAGR of 14.0% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Atos SE, IBM Corporation, Entrust Corporation, Fortanix, Synopsys Inc, Thales, Ultra Electronics, Utimaco Management GmbH, Yubico, Adweb Tech, STMicroelectronics, Securosys, Society for Worldwide Interbank Financial Telecommunication, and Microchip Technology.

The cloud segment dominated the market in 2024.

The BFSI segment accounted for the largest market share in 2024.