Halal Pharmaceuticals Market Size, Share, Trends, Industry Analysis Report: By Drug, Dosage Form (Injectables, Tablets & Capsules, Orals, Topicals, and Others), Therapeutic Area, Certification Type, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 117

- Format: PDF

- Report ID: PM1479

- Base Year: 2024

- Historical Data: 2020-2023

Halal Pharmaceuticals Market Overview

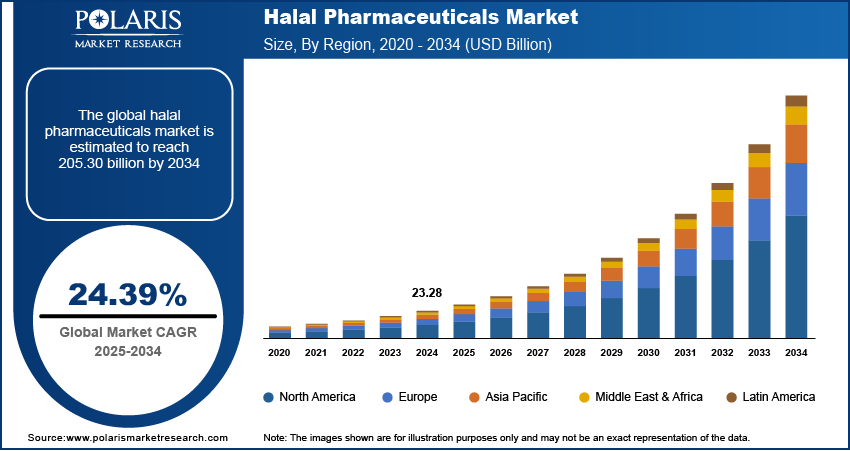

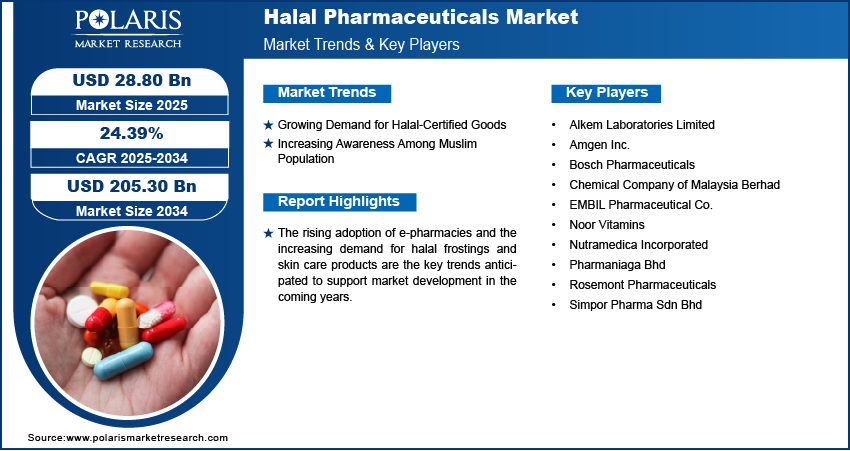

The global halal pharmaceuticals market size was valued at USD 23.28 billion in 2024. The market is projected to grow from USD 28.80 billion in 2025 to USD 205.30 billion by 2034, at a CAGR of 24.39% from 2025 to 2034.

Halal pharmaceuticals are medicines that are produced and packaged according to Islamic law. These pharmaceuticals are expected to meet high standards of quality and purity. They are made from ingredients that are permissible, such as plants, soil, water, and animals slaughtered according to Islamic law. Halal pharmaceuticals are free from prohibited (haram) constituents, including animal, pork, or alcohol-derived substances.

The rising global Muslim population is one of the key factors driving the halal pharmaceuticals market growth. The growing number of absolute vegans globally is also influencing the demand for halal pharmaceuticals. Additionally, the increasing ethical and religious consciousness in healthcare is supporting the use of dietary supplements and medications with halal certification. Other factors contributing to the market expansion include improving economic conditions and growing awareness of environmental and health hazards such as adulteration, non-compliance, and fraudulent use in Islamic countries.

To Understand More About this Research: Request a Free Sample Report

The rise of bespoke medicine, the rising adoption of e-pharmacies, and the increasing demand for halal frostings and skin care products are some of the key halal pharmaceuticals market trends. Halal pharmaceuticals consider sustainable production practices that minimize environmental damage. This presents several opportunities for manufacturers to develop and market innovative and sustainable halal food and medicine products made specifically for Muslim patients.

Halal Pharmaceuticals Market Dynamics

Growing Demand for Halal-Certified Goods

The demand for halal-certified goods is rapidly growing due to the increasing global Muslim population, which drives a consistent need for products that comply with Islamic dietary laws. This has led to a significant market expansion across food, cosmetics, and other consumer goods. This is fueled by the rising awareness of food safety and ethical consumption practices among consumers, both Muslim and Non-Muslim alike. this also includes a growing middle class within Muslim communities with increased purchasing power for premium halal products. Southeast Asia, the Middle East, and portions of Europe are all experiencing this change. The demand for vitamins, herbal remedies, and dietary supplements with halal certification has also increased in these regions. The demand is further fueled by consumers looking for halal supplement alternatives in places like Indonesia and Malaysia.

Increasing Awareness Among Muslim Population

According to the Population Reference Bureau, there are currently 1.9 billion Muslims worldwide, and that number is expected to rise to 2.2 billion in the coming ten years. The Muslim population is more likely to seek pharmaceuticals and other products that comply with Islamic dietary regulations and have halal certification. The rising awareness of health and wellness among Muslim communities is driving pharmaceutical companies to innovate and invest in halal certifications. Additionally, healthcare providers are increasingly providing Halal medications to accommodate the unique needs of their Muslim patients. Thus, the increasing awareness about halal products among the Muslim population is boosting the halal pharmaceuticals market revenue.

Halal Pharmaceuticals Market Segment Insights

Halal Pharmaceuticals Market Evaluation by Drug Insights

The halal pharmaceuticals market, based on drugs, is segmented into over-the-counter (OTC) drugs, cosmetics, prescription drugs, nutraceuticals, and medical devices. The prescription drugs segment held the largest market share in 2024, driven by the increasing incidence of chronic diseases and growing demand for halal-certified medications. Prescription medications include a range of vaccines and treatments aimed at managing and treating both chronic and acute illnesses. These conditions encompass various cancers, heart diseases, diabetes, as well as rare diseases.

The market for over-the-counter (OTC) medications is also anticipated to expand significantly as a result of rising demand for self-medication and increased awareness of halal products. Due to the rising demand for halal-certified supplements and the growing popularity of natural and herbal products, the nutraceuticals segment is anticipated to grow at the fastest rate.

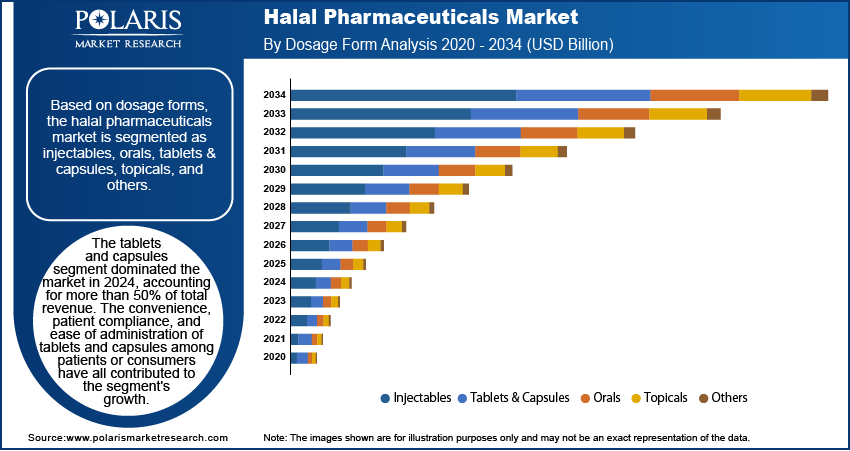

Halal Pharmaceuticals Market Assessment by Dosage Form Insights

Based on dosage forms, the market is segmented as injectables, orals, tablets & capsules, topicals, and others. With more than 50% of the market's total revenue, the tablets & capsules segment has the largest market share in 2024. The growth of the tablets & capsules segment is owed to the convenience, patient compliance, and ease of administration of tablets and capsules among patients or consumers. Due to the growing prevalence of chronic and lifestyle diseases and the growing demand for injectable medications for chronic illnesses, the injectables segment is anticipated to grow at the fastest rate during the forecast period.

Halal Pharmaceuticals Market Regional Analysis

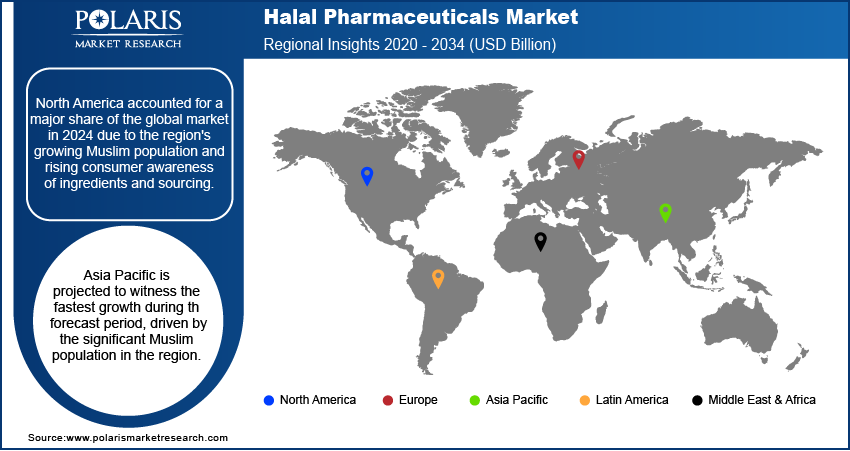

By region, the report offers the halal pharmaceuticals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America accounted for a larger share of the global market in 2024, driven by the region's growing Muslim population and rising consumer awareness of ingredients and sourcing. The presence of a well-established regulatory framework for halal certification fosters consumer trust and transparency in the region. In addition, the presence of several market participants focused on R&D to cater to diverse consumer needs and address growing health concerns fuels the region’s larger market share.

The Asia Pacific halal pharmaceuticals market is projected to witness the fastest growth during the forecast period due to the significant Muslim population in the region. The market has already demonstrated enormous growth potential in nations like Malaysia and Indonesia. Government programs promoting halal certification in the food and pharmaceutical industries also contribute to the regional market growth.

Halal Pharmaceuticals Market – Key Players and Competitive Insights

The leading market players are emphasizing research and development to improve their offerings and drive market demand. Besides, they are adopting several strategic initiatives, including collaborations, new product launches, and increased investments, to enhance their global footprint. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the halal pharmaceuticals market has witnessed several innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. The key players in the market include Amgen Inc., Alkem Laboratories Limited, EMBIL Pharmaceutical Co.,Simpor Pharma Sdn Bhd, Chemical Company of Malaysia Berhad, Pharmaniaga Bhd, Nutramedica Incorporated, Rosemont Pharmaceuticals, Bosch Pharmaceuticals, and Noor Vitamins.

List of Halal Pharmaceuticals Market Key Players

- Alkem Laboratories Limited

- Amgen Inc.

- Bosch Pharmaceuticals

- Chemical Company of Malaysia Berhad

- EMBIL Pharmaceutical Co.

- Noor Vitamins

- Nutramedica Incorporated

- Pharmaniaga Bhd

- Rosemont Pharmaceuticals

- Simpor Pharma Sdn Bhd

Halal Pharmaceuticals Industry Developments

In October 2023, the National Committee of Sharia Economy and Finance (KNEKS) unveiled the Indonesian Halal Industry Master Plan (MPIHI) 2023–2029 during the 2023 Indonesia Sharia Economic Festival (ISEF) that focuses on increasing productivity and strengthening halal brand and awareness.

In June 2023, The Public Investment Fund (PIF), a well-known international investment organization in Saudi Arabia, announced its newest project, Lifera. Lifera is a commercial-scale contract development and manufacturing organization (CDMO) that seeks to support the growth of the bio/pharmaceutical industry in Saudi Arabia. Lifera supports the production of a wide range of halal pharmaceutical products.

Halal Pharmaceuticals Market Segmentation

By Drug Outlook

- Over-The-Counter (OTC) Drugs

- Cosmetics

- Prescription Drugs

- Nutraceuticals

- Medical Devices

By Dosage Form Outlook

- Injectables

- Tablets & Capsules

- Orals

- Topicals

- Others

By Therapeutic Area Outlook

- Diabetes

- Cardiovascular Diseases

- Gastrointestinal Disorders

- Anti-Infectives

- Respiratory Diseases

- Neurological Disorders

- Oncology

- Others

By Certification Type Outlook

- Halal International Standard

- Gulf Standard

- Malaysia Standard

- Others

By End Users Outlook

- Pharmacies

- Hospitals & Clinics

- Online Pharmacies

- Retailers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Halal Pharmaceuticals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.28 billion |

|

Market Size Value in 2025 |

USD 28.80 billion |

|

Revenue Forecast by 2034 |

USD 205.30 billion |

|

CAGR |

24.39% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The halal pharmaceuticals market was valued at USD 23.28 billion in 2024 and is projected to grow to USD 205.30 billion in 2034.

The market is projected to register a CAGR of 24.39% during 2025–2034.

North America held the largest market share in 2024.

Rosemont Pharmaceuticals, Chemical Company of Malaysia Berhad, Noor Vitamins, EMBIL Pharmaceutical Co., Ltd, Bosch Pharmaceuticals, Nutramedica Incorporated, Pharmaniaga Bhd, and Simpor Pharma Sdn Bhd are a few of the key market players.

The prescription drugs segment dominated the market revenue share in 2024.

The tablets & capsules segment dominated the halal pharmaceuticals market in 2024.