Halal Food Market Size, Share, Trends, Industry Analysis Report: By Product Type (Raw Meat, Processed & Packed Food, Bakery & Confectionery, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 116

- Format: PDF

- Report ID: PM1476

- Base Year: 2024

- Historical Data: 2020-2023

Halal Food Market Overview

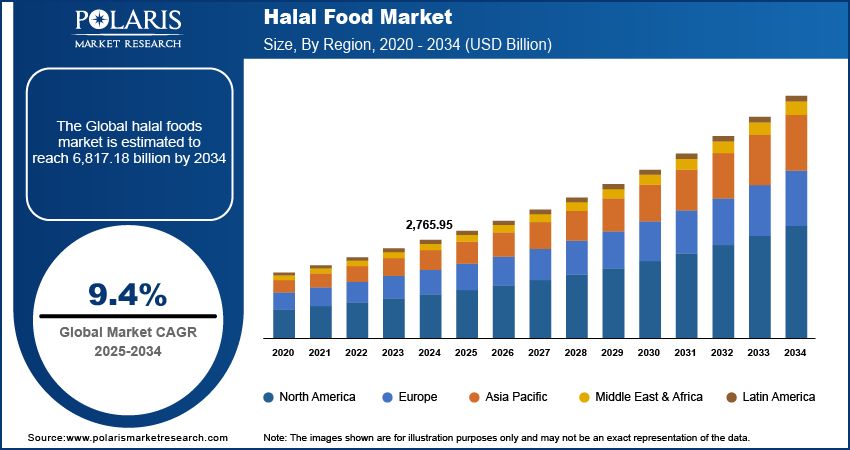

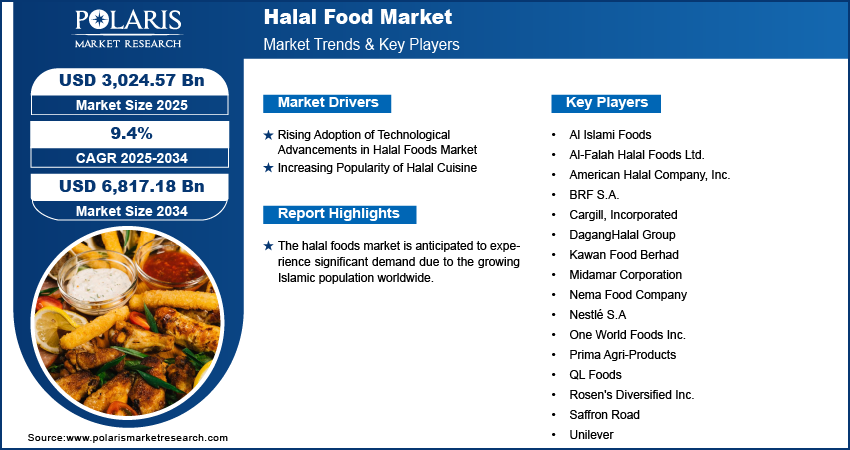

The global halal food market size was valued at USD 2,765.95 billion in 2024. The market is anticipated to grow from USD 3,024.57 billion in 2025 to USD 6,817.18 billion by 2034, exhibiting a CAGR of 9.4% from 2025 to 2034.

“Halal” means “permissible,” which describes the behaviors, actions, and goods that Shariah, the Islamic code of law, accepts. In the halal food market ecosystem, the manufacturing, packaging, storage and distribution of food and beverages is done as per Islamic law. Halal food products are considered healthy, fresh, and organic and can be a good option for individuals seeking natural, clean, and ethically produced food.

The halal food market is anticipated to experience significant demand in the coming years due to the growing Islamic population worldwide. In addition, the rising number of vegans globally is another factor driving market expansion. Further, the improving economic conditions in Islamic nations are expected to create substantial demand for halal food and beverages.

Governments and regulatory agencies, particularly in Muslim-majority nations, have launched several initiatives to support and oversee the halal food sector in collaboration with international counterparts. These initiatives cover laws, licenses, and labeling specifications. The global halal food trade is expanding with the expansion of the travel and tourism sector. As Muslim tourists desire halal cuisine, non-Islamic countries are opening halal eateries, cafes, and other establishments, which would create new opportunities for the halal food market growth during the forecast period.

The lack of a standardized, universally accepted definition of halal, along with varying certification processes across countries, is creating confusion and hindering the halal food market growth. Also, logistical challenges in the supply chain, such as ensuring the segregation of halal and non-halal products, drive up operational costs for businesses. The limited availability of halal-certified products in certain markets further restricts consumer choices, adversely impacting the market expansion.

To Understand More About this Research: Request a Free Sample Report

Halal Food Market Dynamics

Rising Adoption of Technological Advancements in Halal Food Market

In halal food production, the use of advanced techniques in food processing, packaging, and distribution enhances the efficiency of production while maintaining the integrity of the product supply chain. Various emerging food technologies, such as 3D printing and plant-based meat alternatives, have enabled the creation of a diverse range of halal products, catering to the evolving preferences of consumers. Technological advancements play a crucial role in meeting the complex requirements of halal certification and ensuring compliance with Islamic dietary laws. Owing to all these advantages, emerging technological advancements in halal food products are one of the key trends anticipated to drive the growth of the halal food market.

Increasing Popularity of Halal Cuisine

Halal foods have become increasingly popular among Muslim and non-Muslim consumers in recent years, evolving from a religious dietary standard to a symbol of meal hygiene, safety, and reliability. Several governments worldwide have enacted halal labeling and certification laws, resulting in a rise in consumer demand for these foods. In response to this consumer interest, manufacturers have broadened their product line, developing several value-added product items. For instance, in February 2024, Midamar Corporation announced the launch of its premium Halal Beef Jerky. The company claimed that jerky is all-natural and gluten-free, and it will be available in three flavors such as original, hot honey, and Teriyaki. Thus, the increasing popularity of halal cuisine drives the halal food market growth.

Halal Food Market Segment Insights

Halal Food Market Insights by Product Type

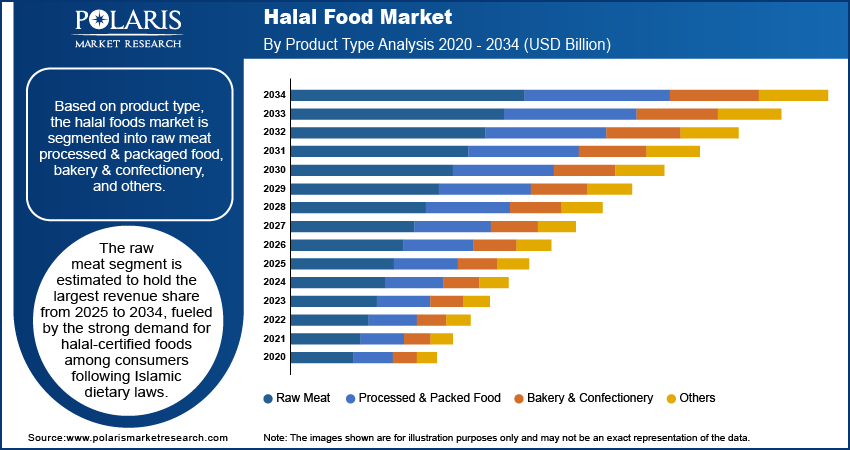

The halal food market, based on product type, is segmented into raw meat, processed & packaged food, bakery & confectionery, and others. The raw meat segment is estimated to hold the largest revenue share from 2025 to 2034, fueled by the strong demand for halal-certified foods among consumers sticking to Islamic dietary laws, which emphasize the consumption of meat prepared by halal principles. The raw meat segment encompasses a variety of meats such as beef, chicken, lamb, and goat, which are an essential part of traditional halal cuisine.

The rising global Muslim population, along with an increasing awareness of halal dietary practices, contributes to the sustained demand for raw halal meat products. In addition, the emphasis on authenticity and traceability in halal food production strengthens the raw meat segment, as consumers often prioritize unprocessed, whole cuts of meat to ensure the halal integrity of their food. Raw meat is important to various cooking traditions, and its popularity extends beyond individual households to restaurants, catering services, and food service establishments that serve halal meals. As a result, the raw meat segment emerges as a cornerstone of the market and is expected to hold a significant global halal food market share.

Halal Food Market Insights by Distribution Channel

The halal food market segmentation, based on distribution channel, includes supermarkets and hypermarkets, convenience stores, online stores, specialty stores, and others. The supermarkets and hypermarkets segment emerged as the dominant segment, with a 74.9% revenue share, in 2024. These retail formats provide a diverse and comprehensive range of halal products under one roof, offering consumers a convenient shopping experience. This particularly appeals to busy consumers who seek efficiency in their grocery shopping.

Supermarkets and hypermarkets often allocate dedicated sections for halal foods, enhancing visibility and accessibility for consumers seeking halal-certified products. The stringent quality control measures and certification requirements associated with halal foods also align well with the standardized and regulated environment of supermarkets and hypermarkets. As a result, consumers often associate these retail outlets with reliability and adherence to food safety standards, which is crucial in the context of meeting the specific dietary requirements of consumers preferring halal foods.

Halal Food Market Outlook by Regional Insights

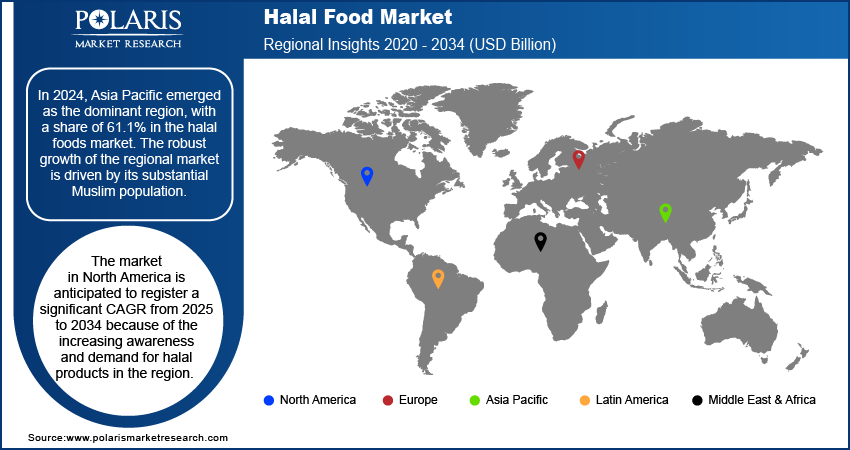

The halal food market report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the global halal food market share by holding 61.1% of the revenue. The robust growth of the regional market is driven by its substantial Muslim population, which forms a significant consumer base adhering to halal dietary practices. Countries such as Indonesia, Malaysia, Pakistan, and Bangladesh, with their large Muslim populations, have played essential roles in shaping the regional market landscape. These nations have seen a surge in demand for a wide range of halal products, ranging from traditional staples such as halal meats and grains to processed foods and convenience items. For example, Indonesia, home to the world's largest Muslim population, has implemented initiatives to promote and regulate the halal industry, further contributing to the market growth. In addition, the rising awareness and growing preferences for halal-certified products among non-Muslim consumers in the region have also contributed to the Asia Pacific halal food market expansion.

The halal food market in North America is anticipated to register a significant CAGR from 2025 to 2034 because of the increasing awareness and demand for halal products among a demographically diverse consumer base that goes beyond the Muslim population. As consumers become more health-conscious and seek ethically sourced and certified food options, the demand for halal foods, known for their stringent quality and safety standards, has risen. Also, the halal food market in North America has benefited from a surge in product innovation, with manufacturers introducing a variety of halal-certified options, including processed foods, snacks, and beverages. Retailers, particularly supermarkets, are increasingly dedicating shelf space to halal products, catering to the evolving preferences of consumers.

Halal Food Market – Key Players and Competitive Insights

The leading halal food market players are emphasizing research and development to improve their offerings and drive market demand. Besides, they are adopting several strategic initiatives, including collaborations, new product launches, and increased investments, to enhance their global footprint. To expand and survive in a more competitive environment, the market players must offer innovative solutions.

In recent years, the halal food market has witnessed several innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few key players in the market are Al Islami Foods; Al-Falah Halal Foods Ltd.; American Halal Company, Inc.; BRF S.A.; Cargill, Incorporated; DagangHalal Group; Kawan Food Berhad; Midamar Corporation; Nema Food Company; Nestlé S.A; One World Foods Inc.; Prima Agri-Products; QL Foods; Rosen's Diversified Inc.; Saffron Road; and Unilever.

List of Key Players in Halal Food Market

- Al Islami Foods

- Al-Falah Halal Foods Ltd.

- American Halal Company, Inc.

- BRF S.A.

- Cargill, Incorporated

- DagangHalal Group

- Kawan Food Berhad

- Midamar Corporation

- Nema Food Company

- Nestlé S.A

- One World Foods Inc.

- Prima Agri-Products

- QL Foods

- Rosen's Diversified Inc.

- Saffron Road

- Unilever

Halal Food Industry Developments

October 2024: The Indian government announced new policy conditions for exporting halal meat. With the new guidelines, only meat produced, packaged, or processed in units certified under the ‘India Conformity Assessment Scheme (I-CAS) - Halal' will be allowed to be exported to 15 nations, including Saudi Arabia, Bangladesh, and the UAE.

June 2024: Saffron Road, owned by American Halal Company, expanded its product line with four new frozen food options. The new offerings include Drunken Noodles, Vegetable Bibimbap, Korean Fire-Roasted Chicken, and Fire-Roasted Adobo Chicken. The company stated that all of these products are certified gluten-free and halal.

Halal Food Market Segmentation

By Product Type Outlook

- Raw Meat

- Processed & Packed Food

- Bakery & Confectionery

- Others

By Distribution Channel Outlook

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

- Specialty Stores

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Halal Food Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,765.95 billion |

|

Market Size Value in 2025 |

USD 3,024.57 billion |

|

Revenue Forecast by 2034 |

USD 6,817.18 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The halal food market size was valued at USD 2,765.95 billion in 2024 and is projected to reach USD 6,817.18 billion by 2034.

The halal food market is anticipated to register a CAGR of 9.4% from 2025 to 2034.

The market growth is primarily driven by the increasing popularity of halal cuisine and technological advancements in halal food products.

Asia Pacific emerged as the dominant region in the halal food market in 2024.

Key segments covered in the halal food market report are product type, distribution channel, and region.