Guillain-Barre Syndrome Diagnostics Market Size, Share, Trends, Industry Analysis Report: By Test (Lumber Puncture, Nerve Conduction, Electromyography, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5538

- Base Year: 2024

- Historical Data: 2020-2023

Guillain-Barre Syndrome Diagnostics Market Overview

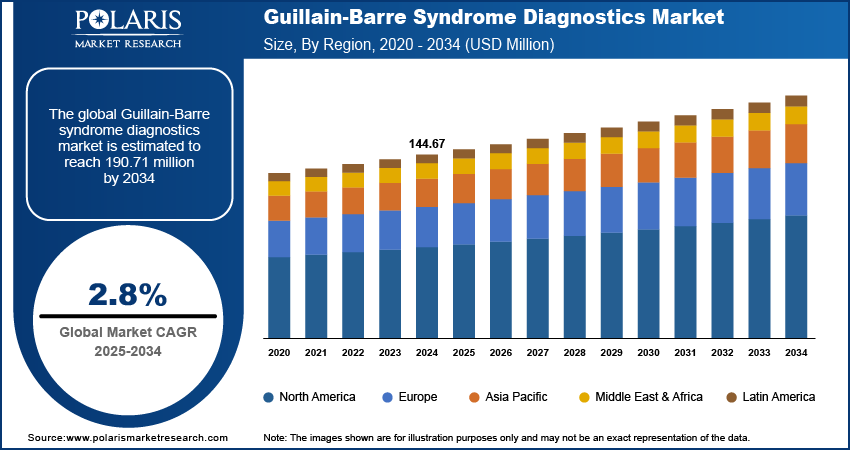

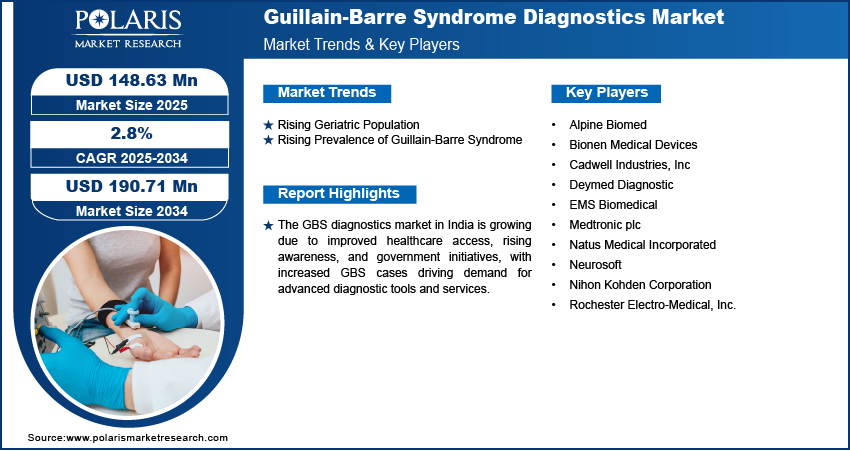

The global Guillain-Barre syndrome (GBS) diagnostics market size was valued at USD 144.67 million in 2024. The market is projected to grow from USD 148.63 million in 2025 to USD 190.71 million by 2034, exhibiting a CAGR of 2.8% during 2025–2034.

Guillain-Barré Syndrome (GBS) is diagnosed through a combination of clinical evaluation, where symptoms such as muscle weakness and sensory changes are assessed, and diagnostic tests such as nerve conduction studies and lumbar puncture. Elevated protein levels in the cerebrospinal fluid (without a significant increase in white blood cells) are often indicative of GBS, alongside abnormal nerve conduction results.

There has been a noticeable increase in awareness about rare diseases, including Guillain-Barré Syndrome, in recent years. Both healthcare professionals and the general public are becoming more knowledgeable about the symptoms, triggers, and risks associated with GBS. This heightened awareness has led to more frequent and proactive testing, ensuring that people who show symptoms receive a diagnosis sooner. The awareness is being driven by educational campaigns, social media discussions, and support networks that focus on rare diseases. This shift is driving the demand for specialized diagnostic services and tools to address the need for early detection of GBS, thereby driving the Gullain-Barre syndrome diagnostics market demand.

To Understand More About this Research: Request a Free Sample Report

Healthcare infrastructure improvements worldwide, particularly in developing regions, have increased the adoption of advanced diagnostics, including for GBS. Better access to hospitals, laboratories, and diagnostic tools has enabled faster and more accurate testing for GBS, especially in areas where resources were previously limited. Improved healthcare facilities, both in terms of quality and availability, ensure that more patients undergo timely testing. The overall demand for diagnostic services has grown due to these improvements, thereby fueling the Guillain-Barre syndrome diagnostic market growth.

Guillain-Barre Syndrome Diagnostics Market Dynamics

Rising Geriatric Population

The percentage of the population more than 50 years old is rising. According to the World Bank Group, in 2023, 10% of the world's population was 65 years and above. Aging leads to a weakened immune system, making individuals more susceptible to infections, which increase the risk of developing Guillain-Barré syndrome, especially after viral or bacterial illnesses. Older adults are also more likely to experience severe complications from GBS, making early diagnosis crucial for better treatment outcomes. The growing number of elderly individuals globally has created a higher demand for diagnostic services that detect GBS early, ensuring timely interventions and improving patient care, thereby boosting the Guillain-Barre syndrome diagnostics market development.

Rising Prevalence of Guillain-Barre Syndrome

The number of Guillain-Barré syndrome (GBS) cases is rising globally. GBS, an autoimmune disorder often triggered by infections, has become more prevalent globally, particularly after viral infections such as the flu. According to the World Health Organization, in 2023, the National Center for Epidemiology, Prevention, and Disease Control (CDC) of Peru called for an epidemiological alert due to a sudden rise in GBS cases in Peru, where the cases suddenly peaked at 130 from a usual number of 20 cases per year. These increasing numbers of affected individuals have created a high demand for quick and accurate diagnostic tools that identify the condition early. Early diagnosis helps initiate appropriate treatment, which reduces complications and improves outcomes. Additionally, healthcare providers are responding by investing in advanced diagnostic equipment and services to meet the expanding need for effective GBS detection and management, thereby propelling the GBS diagnostics market opportunities.

Guillain-Barre Syndrome (GBS) Diagnostics Market Segment Analysis

GBS Diagnostics Market Assessment by Test Outlook

The Guillain-Barre syndrome diagnostics market segmentation, based on test, includes lumbar puncture, nerve conduction, electromyography, and other. The lumbar puncture segment is expected to witness fastest growth during the forecast period. Lumbar puncture, also known as a spinal tap, is a critical test that helps diagnose GBS by analyzing the cerebrospinal fluid for elevated protein levels. This test is vital for confirming the diagnosis, especially when symptoms are unclear. Its ability to provide definitive results, along with advancements in medical technology that make the procedure safer and more efficient, has driven its increasing demand, thereby driving the segmental growth.

GBS Diagnostics Market Evaluation by End Use Outlook

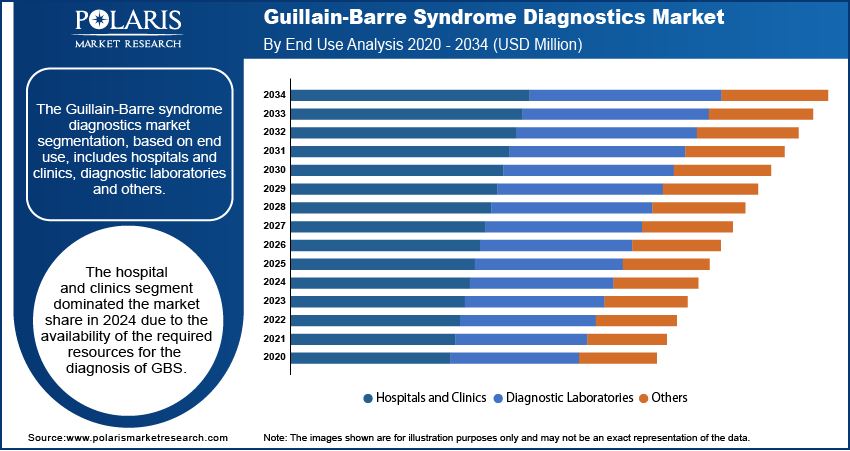

The Guillain-Barre syndrome diagnostics market segmentation, based on end use, includes hospitals and clinics, diagnostic laboratories, and others. The hospitals and clinics segment dominated the GBS diagnostics market share in 2024. Hospitals and clinics are the primary settings where GBS diagnosis occurs, as they have the necessary diagnostic equipment and skilled healthcare professionals to perform tests such as lumbar punctures and nerve conduction studies. These facilities are equipped to handle complex cases and offer immediate treatment, which is crucial for managing GBS effectively. Additionally, a growing number of patients seeking medical care for GBS symptoms has raised the demand for diagnostic services in hospitals and clinics, driving their dominance in the Guillain-Barre syndrome diagnostics market.

Guillain-Barre Syndrome Diagnostics Market Regional Analysis

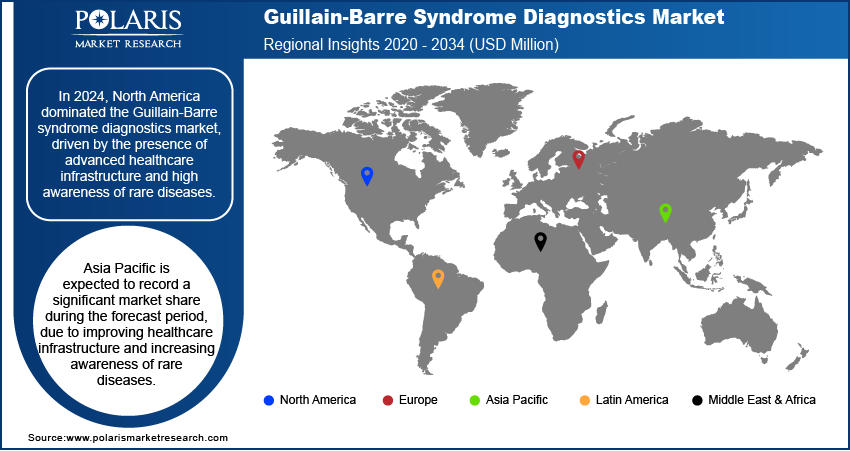

By region, the study provides the Guillain-Barre syndrome diagnostics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the Guillain-Barre syndrome diagnostics market revenue, driven by advanced healthcare infrastructure and high awareness of rare diseases. The US and Canada have well-established healthcare systems with access to advance diagnostic tools, ensuring quick and accurate detection of GBS. Additionally, a high number of GBS cases, particularly following viral infections such as the flu, has led to increased demand for diagnostic services. Additionally, the region’s significant investments in medical research and healthcare innovation are fueling the growth of the diagnostics services, thereby driving the Guillain-Barre syndrome diagnostics market expansion in North America.

Asia Pacific is expected to record a significant share during the forecast period due to improving healthcare infrastructure and increasing awareness of rare diseases. Countries such as Japan, China, and South Korea have advanced medical facilities, contributing to accurate and timely diagnosis of GBS. Moreover, evolving healthcare systems and access to modern diagnostic tools are driving the demand for GBS diagnostics tools. Additionally, growing public health campaigns and better access to healthcare in emerging markets such as India and Southeast Asia are also fostering the Asia Pacific GBS diagnostics market expansion.

The India Guillain-Barre syndrome diagnostics market is experiencing substantial growth fueled by improvements in healthcare access and rising awareness about autoimmune diseases. India has seen an increase in GBS cases due to a large and aging population, driving demand for accurate diagnostic tools. Additionally, the country’s healthcare sector is rapidly evolving, with more hospitals and clinics adopting advanced diagnostic technologies, enabling better GBS detection. Government initiatives aimed at improving healthcare infrastructure and providing more affordable diagnostic services are further contributing to the expansion of autoimmune diseases diagnostics services, thereby boosting the GBS diagnostics market growth in India.

Guillain-Barre Syndrome Diagnostics Market – Key Players & Competitive Analysis Report

The Guillain-Barre syndrome diagnostics market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the GBS diagnostics industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the Guillain-Barre syndrome diagnostics market include Alpine Biomed; Bionen Medical Devices; Cadwell Industries, Inc; Deymed Diagnostic; EMS Biomedical; Medtronic plc; Natus Medical Incorporated; Neurosoft; Nihon Kohden Corporation; and Rochester Electro-Medical, Inc.

Medtronic plc is one of the world's major providers of medical equipment, solutions, and products. Medtronic was formed in 1949 and currently provides products and solutions to medical institutions, physicians, professionals, and patients in over 150 countries across the world. The cardiovascular portfolio, neuroscience portfolio, medical-surgical portfolio, and diabetes operating unit are the company's four operating segments that principally develop, produce, sell, and market device-based healthcare medicines and solutions. The structural heart & aortic, cardiac rhythm & heart failure, and coronary & peripheral vascular divisions comprise the cardiovascular division. Electrophysiologists, cardiac failure experts, implanting cardiologists, cardiothoracic, cardiovascular, and arterial surgeons, as well as interventional cardiologists and radiologists, are among the key healthcare professionals who use their cardiovascular solutions. The surgical technologies and respiratory, gastrointestinal, and renal divisions comprise the medical-surgical segment. This segment offers are primarily employed by medical networks, physician clinics, outpatient care facilities, as well as other alternative site medical practitioners. The cranial & spinal technologies, specialty treatments, and neuromodulation businesses comprise the neuroscience division. Spinal surgeons, neurologists, neurosurgeons, pain management experts, anesthesiologists, urologists, urogynecologists, orthopedic surgeons, interventional radiologists, as well as nose, ear, and throat specialists are among the key medical professionals who employ these segment goods. The diabetes operating unit creates, produces, and promotes goods and solutions for Type 1 as well as Type 2 diabetes treatment.

Natus Medical Incorporated is a company that specializes in medical devices used to diagnose and treat disorders related to the brain, neural pathways, and sensory nervous systems. Founded in 1987, it provides a range of products and services that are used by healthcare providers worldwide. Natus operates globally, with a presence in over 100 countries through both direct sales and distribution channels. The company's product portfolio is organized into several segments. The brain segment includes neurodiagnostic and neurocritical care solutions, such as electroencephalography (EEG) for monitoring epilepsy and polysomnography (PSG) for assessing sleep disorders. The neural pathways segment focuses on diagnosing nerve and muscle disorders using techniques like electromyography (EMG) and nerve conduction studies (NCS). The sensory nervous system segment deals with hearing and balance disorders, offering solutions for newborn hearing screening and diagnosing vestibular disorders. Additionally, Natus offers products for jaundice management, newborn video streaming, data management for newborn care, and neurosurgical applications. Natus Medical operates in several regions, including North America, where it has direct sales operations in the US and Canada. In Europe, it maintains a direct presence in countries such as the UK, Germany, France, Italy, and the Netherlands. The company also conducts direct sales in the Asia Pacific region, specifically in China, Australia, and New Zealand. Beyond these areas, Natus distributes its products through partnerships in Latin America and other regions.

List of Key Companies in Guillain-Barre Syndrome Diagnostics Market

- Alpine Biomed

- Bionen Medical Devices

- Cadwell Industries, Inc

- Deymed Diagnostic

- EMS Biomedical

- Medtronic plc

- Natus Medical Incorporated

- Neurosoft

- Nihon Kohden Corporation

- Rochester Electro-Medical, Inc.

Guillain-Barre Syndrome Diagnostics Industry Development

In March 2023, Hansa Biopharma announced that enrollment in its Phase 2 study of imlifidase for Guillain-Barré Syndrome (GBS) was completed.

Guillain-Barre Syndrome Diagnostics Market Segmentation

By Test Outlook (Revenue – USD Million, 2020–2034)

- Lumbar Puncture

- Nerve Conduction

- Electromyography

- Other

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Guillain-Barre Syndrome Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 144.67 million |

|

Market Size Value in 2025 |

USD 148.63 million |

|

Revenue Forecast in 2034 |

USD 190.71 million |

|

CAGR |

2.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Guillain-Barre syndrome diagnostics market size was valued at USD 144.67 million in 2024 and is projected to grow to USD 190.71 million by 2034.

The global market is projected to register a CAGR of 2.8% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Alpine Biomed; Bionen Medical Devices; Cadwell Industries, Inc; Deymed Diagnostic; EMS Biomedical; Medtronic plc; Natus Medical Incorporated; Neurosoft; Nihon Kohden Corporation; and Rochester Electro-Medical, Inc.

The hospital and clinics segment dominated the market in 2024 due to the availability of the required resources for the diagnosis of GBS.

The lumber puncture segment is expected to witness the fastest growth during the forecast period as it is a critical test that helps diagnose GBS by analyzing the cerebrospinal fluid for elevated protein levels.