Green Methanol Market Size, Share, Trends, Industry Analysis Report: By Feedstock (Biomass, Carbon Capture & Storage, and Green Hydrogen), Derivatives, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5095

- Base Year: 2023

- Historical Data: 2019-2022

Green Methanol Market Overview

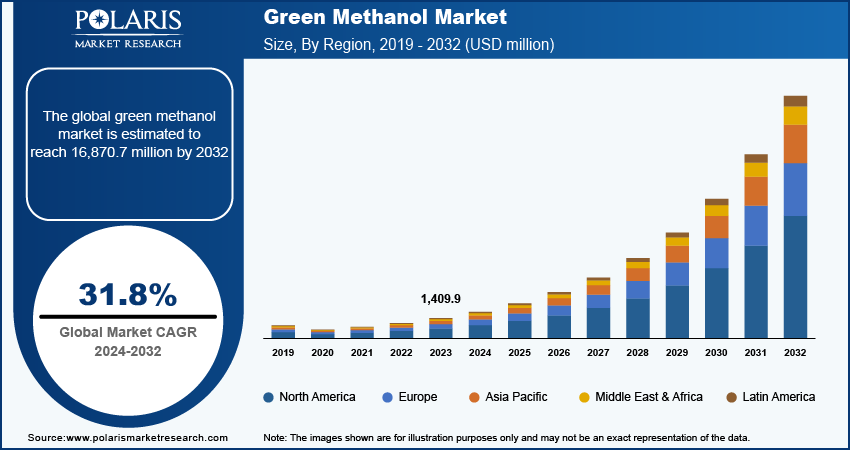

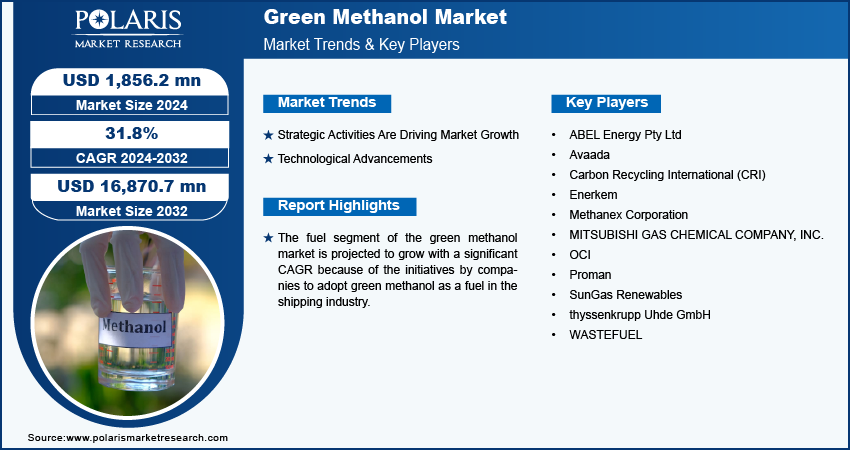

Global green methanol market size was valued at USD 1,409.9 million in 2023. The market is projected to grow from USD 1,856.2 million in 2024 to USD 16,870.7 million by 2032, exhibiting a compound annual growth rate (CAGR) of 31.8% during the forecast period 2024 - 2032.

Green methanol is a sustainable alternative to conventional methanol produced from fossil fuels. It is synthesized through processes that utilize renewable feedstocks or captured carbon dioxide (CO2) combined with renewable hydrogen. Rising investments in the infrastructure development of methanol production plants worldwide fuel the growth of the green methanol market. The demand for sustainable and low-carbon fuels is increasing, and companies and governments are allocating substantial resources to build and upgrade facilities dedicated to green methanol production.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2024, infrastructure investment company White Summit Capital announced a significant investment of USD 267 million in a green methanol and hydrogen plant in Spain. The plant will utilize green hydrogen and captured carbon dioxide from nearby industries to produce e-methanol. Such investments encompass the construction of advanced production units, research and development centers, and enhanced logistics and distribution networks. Thus, investment in infrastructure development boosts production capacity and supports technological advancements, making green methanol more accessible and competitive in the global market, thereby driving its overall growth.

The research and development in fuel cell technology are significantly driving the green methanol market. The companies are emphasizing on development of fuel cell systems to enhance the efficiency and viability of methanol as a clean energy source. For instance, in June 2024, Blue World Technologies, a Danish company specializing in fuel cell systems, conducted testing on a 200 kW high-temperature PEM fuel cell module designed to operate using green methanol. Such developments in fuel cell technology are making green methanol a more attractive option for various applications, including transportation, stationary power generation, and portable energy systems, thereby driving the green methanol market growth.

Green Methanol Market Drivers and Trends

Strategic Activities Are Driving Market Growth

The key market players are engaging in strategic activities, including collaborations, joint ventures, and partnerships, to leverage expertise and resources for the development of green methanol production plants. For instance, in February 2024, Mabanaft and Vast, a renewable energy company, collaborated to construct the SM1 green methanol plant in Port Augusta, southern Australia. The facility is expected to utilize concentrated solar thermal power (CSP) to produce 7,500 tons/year of green methanol and will feature a 10MW electrolyzer. Such partnerships combine the technological expertise to generate zero-emission heat and electricity for green methanol production. Thus, these types of joint ventures are fostering innovation and accelerating the development of advanced production technologies, leading to the expansion of the green methanol market.

Technological Advancements

The advancements in technology aimed at improving the efficiency and feasibility of green methanol production are driving growth in the green methanol market by boosting competitiveness. For instance, in October 2023, KBR introduced PureM, an innovative green methanol technology, to complement its existing clean ammonia and hydrogen technologies. PureM offers an environment-friendly approach to the production of fuels and high-value chemicals. Such technological progress is boosting the efficiency and scalability of production and reducing costs, making green methanol a more attractive option for various applications. Consequently, the enhancement in the competitiveness of green methanol and expansions in its potential applications are paving the way for the growth of the green methanol market.

Green Methanol Market Segment Insights

Green Methanol Market Analysis by Feedstock Insights

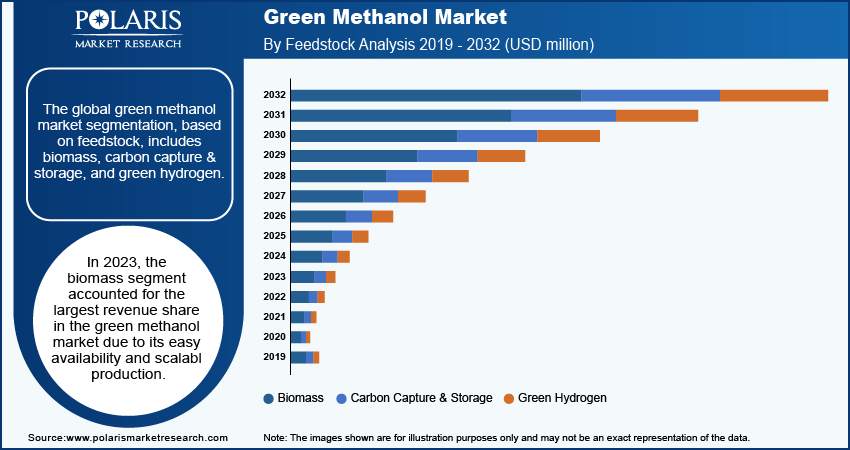

The global green methanol market segmentation, based on feedstock, includes biomass, carbon capture & storage, and green hydrogen. In 2023, the biomass segment accounted for the largest revenue share in the green methanol market due to its easy availability and scalable production. Biomass, obtained from organic materials such as forestry waste, agricultural residues, and dedicated energy crops, provides a renewable and carbon-neutral feedstock for producing green methanol. Furthermore, the segment benefits from well-established conversion technologies, such as gasification and fermentation, which efficiently transform biomass into methanol while capturing and utilizing the carbon dioxide released in the process. Thus, the broad availability of biomass and the strong presence of infrastructure and technologies to convert biomass into methanol is contributing to the dominance of the biomass segment in the green methanol market.

Green Methanol Market Analysis by Application Insights

The global green methanol market segmentation, based on application, includes chemical feedstock, fuel, and others. The fuel segment of the green methanol market is projected to grow with a significant CAGR because of the initiatives by companies to adopt green methanol as a fuel in the shipping industry. The organizations are utilizing green methanol as a viable alternative to conventional marine fuels due to its lower carbon emissions and compatibility with existing engine technologies. For instance, in May 2024, Sanlorenzo introduced the 50Steel/171, Almax, a superyacht equipped with a green methanol fuel cell system and developed in partnership with Siemens Energy. These types of efforts are boosting the adoption of green methanol to support renewable fuel initiatives, thereby contributing to the significant growth of the fuel segment in the global market.

Green Methanol Market Analysis by Regional Insights

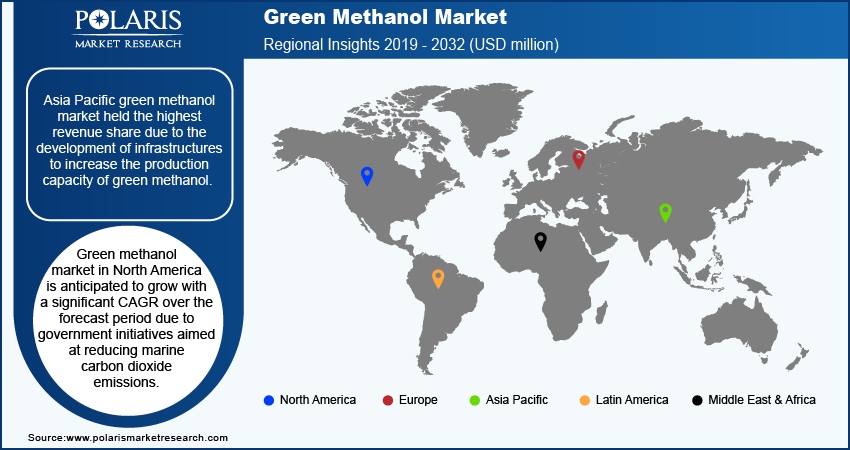

By region, the study provides the green methanol market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific green methanol market held the highest revenue share due to the development of infrastructures to increase the production capacity of green methanol. The chemical firms are collaborating with shipping companies in the region to build production facilities. For instance, in December 2023, A.P. Moller-Maersk, a Danish shipping group, partnered with Japan's Mitsubishi Gas Chemical to establish a green methanol supply base at the port of Yokohama in Japan. These types of strategic collaborations and the ongoing developments of infrastructure in Asia Pacific have contributed to the dominant revenue share of the region in the global green methanol market.

The China green methanol market is expected to grow significantly due to the growing emphasis of the country on transition to cleaner energy sources to meet climate targets and reduce carbon footprint. The Chinese government is actively promoting green methanol through supportive projects, initiatives, and incentives aimed at boosting the production and use of sustainable fuels. For instance, in 2021, the Ministry of Industry and Information Technology (MIIT) issued the 14th Five-Year Plan for Industrial Green Development, which incorporates the promotion of alternative fuel vehicles, such as methanol-based vehicles. Thus, the efforts, along with the focus on the development of renewable methanol to reduce carbon footprint, are expected to drive the green methanol market in the country.

Green methanol market in North America is anticipated to grow with a significant CAGR over the forecast period due to government initiatives aimed at reducing marine carbon dioxide emissions. In response to emphasizing on minimizing emissions from the shipping industry, North American governments are actively supporting the adoption of green methanol as an alternative to conventional marine fuels. The initiatives, such as the Zero-Emission Shipping Mission and the US Maritime Decarbonization Action Plan, include implementing policies that promote the use of low-carbon fuels and research and development for green fuel technologies. These initiatives are fostering partnerships between regulatory bodies and industry stakeholders, thereby accelerating the market growth of green methanol in North America.

Green Methanol Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the green methanol market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The market is experiencing significant investments in technology and infrastructure by key players. Companies in the market are introducing advanced production technologies and strategic partnerships. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the green methanol market include ABEL Energy Pty Ltd; Avaada; Carbon Recycling International (CRI); Enerkem; Methanex Corporation; MITSUBISHI GAS CHEMICAL COMPANY, INC.; OCI; Proman; SunGas Renewables; thyssenkrupp Uhde GmbH; and WASTEFUEL.

WasteFuel is a climate technology product manufacturing company that specializes in producing renewable fuels. The company uses scalable technologies to convert agricultural and municipal waste into low-carbon fuels, such as green methanol. WasteFuel has formed strategic partnerships with global companies to ensure that each biorefinery project considers operational, environmental, and commercial aspects. In September 2021, Maersk invested in WasteFuel to advance the development of green bio-methanol production in the America and Asia. The investment is aimed at establishing biorefineries using technologies to create sustainable fuels from unrecoverable waste.

OCI is a multinational chemical manufacturing company that specializes in producing methanol, nitrogen, and hydrogen-based products. The company has a significant presence across four continents and caters to various energy-intensive industries worldwide, such as transportation, agriculture, and construction. OCI utilizes biomethane to manufacture green methanol at its US plant, which contributes to decarbonization. The company offers an extensive range of products, including methanol, nitrogen fertilizers, biofuels, melamine, diesel exhaust fluid, and other nitrogen-based products. OCI's production capacity spans several segments, such as Methanol Europe, Methanol US, and Nitrogen Europe. In September 2023, OCI Global announced the increase in production capacity to around 400,000 metric tons per year to meet the rising demand for green methanol from diverse high-emission industries such as shipping, road transport, and industrial sectors.

List of Key Companies in Green Methanol Market

- ABEL Energy Pty Ltd

- Avaada

- Carbon Recycling International (CRI)

- Enerkem

- Methanex Corporation

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- OCI

- Proman

- SunGas Renewables

- thyssenkrupp Uhde GmbH

- WASTEFUEL

Green Methanol Industry Developments

June 2023: OCI Global and A.P. Moller-Maersk formed a new partnership to propel the green methanol-powered container ship. As part of the deal, OCI has agreed to supply ISCC-certified green bioethanol, which will be used to fuel Maersk's dual-fueled container ship.

July 2023: SunGas Renewables, a manufacturer of gasification systems, announced its plan to build a green methanol production plant in Central Louisiana, U.S. The development is aligned with the company's strategy to supply methanol for A.P. Moller–Maersk's upcoming fleet of methanol-fueled container vessels.

May 2024: Shenergy Group, the natural gas supplier in Shanghai, constructed infrastructure to convert large quantities of kitchen food waste into green methanol. This green methanol serves as an eco-friendly fuel alternative for the carbon-intensive shipping industry.

Green Methanol Market Segmentation

By Feedstock Outlook

- Biomass

- Carbon Capture & Storage

- Green Hydrogen

By Derivatives Outlook

- Acetic Acid

- Biodiesel

- Dimethyl Ether

- Formaldehyde

- Gasoline

- Methanol-To-Olefins & Methanol-To-Propylene

- Methyl Methacrylate

- Methyl Tertiary Butyl Ether

- Others

By Application Outlook

- Chemical Feedstock

- Fuel

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Green Methanol Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,409.9 million |

|

Market Size Value in 2024 |

USD 1,856.2 million |

|

Revenue Forecast in 2032 |

USD 16,870.7 million |

|

CAGR |

31.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global green methanol market size was valued at USD 1,409.9 million in 2023 and is projected to grow to USD 16,870.7 million by 2032.

The global market is expected to grow at a CAGR of 31.8% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market

The key players in the market ABEL Energy Pty Ltd; Avaada; Carbon Recycling International (CRI); Enerkem; Methanex Corporation; MITSUBISHI GAS CHEMICAL COMPANY, INC.; OCI; Proman; SunGas Renewables; thyssenkrupp Uhde GmbH; and WASTEFUEL.

The biomass segment held the highest share of the green methanol market in 2023.

The fuel category had the highest CAGR in the global market.