Green Ammonia Market Size, Share, Trends, Industry Analysis Report: By Technology (Solid Oxide Electrolysis, Proton Exchange Membrane, and Alkaline Water Electrolysis), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM2647

- Base Year: 2023

- Historical Data: 2019-2022

Green Ammonia Market Overview

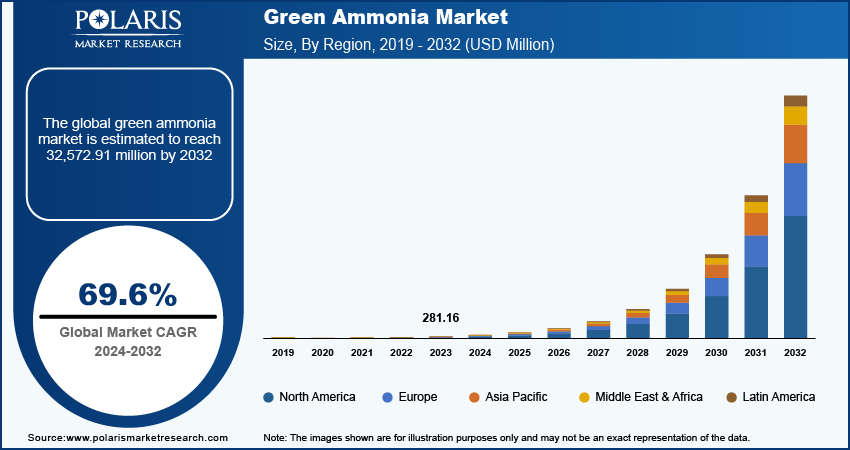

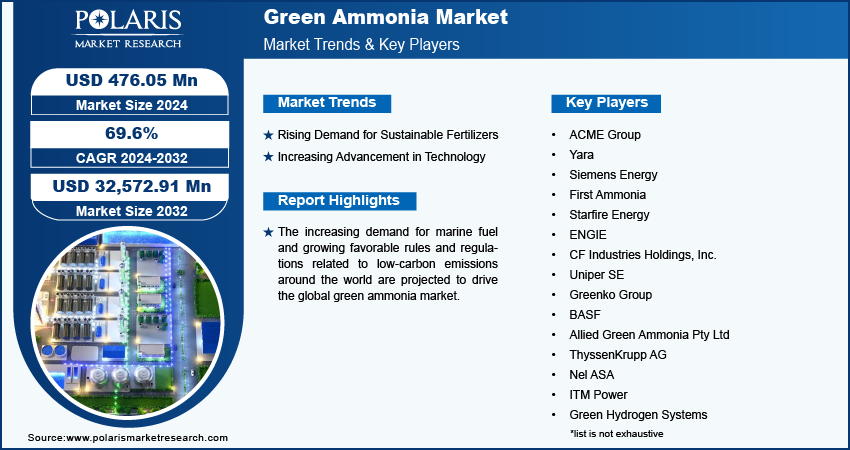

The global green ammonia market size was valued at USD 281.16 million in 2023. The market is projected to grow from USD 476.05 million in 2024 to USD 32,572.91 million by 2032, exhibiting a CAGR of 69.6% during 2024–2032.

Green ammonia, a derivative of ammonia produced using renewable energy sources, is gaining traction as a sustainable alternative to traditional ammonia, which is primarily synthesized through fossil fuel-based processes. Conventional ammonia production, largely reliant on the Haber-Bosch method, emits significant greenhouse gases and contributes approximately 1-2% of global carbon emissions. In contrast, green ammonia is synthesized using hydrogen generated from water electrolysis powered by renewable energy sources such as wind, solar, or hydroelectric power. This process not only eliminates carbon emissions during production but also positions green ammonia as a versatile chemical with applications ranging from fertilizers to clean fuels for transportation and energy storage.

The increasing demand for marine fuel is projected to drive the global green ammonia market. Green ammonia, produced from renewable energy sources (like wind or solar) through the electrolysis of water and subsequent nitrogen fixation, is being widely used as a marine fuel as many shipping companies are looking for cleaner fuel alternatives to meet stringent regulations aimed at reducing greenhouse gas emissions. Therefore, as the demand for marine fuel increases, the adoption of green ammonia also spurs.

The growing favorable rules and regulations related to low-carbon emissions around the world are propelling the green ammonia market. Regulatory support fosters investment in research and development for green ammonia production and utilization technologies. This leads to advancements that enhance efficiency, safety, and cost-effectiveness, making the fuel more appealing for industries looking to innovate and reduce emissions. Additionally, governments often implement incentives, such as tax breaks or subsidies, to encourage the adoption of low-carbon technologies. These financial incentives make the transition to green ammonia more economically attractive for businesses, accelerating its uptake in various sectors such as marine and agriculture.

Green Ammonia Market Driver Analysis

Rising Demand for Sustainable Fertilizers

The rising demand for sustainable fertilizers worldwide is projected to fuel the global green ammonia market. Increased awareness of the environmental impact of traditional fertilizers drives farmers and agricultural businesses to seek more sustainable alternatives. Green ammonia, which is considered more sustainable than traditional fertilizers, is used as a nitrogen source in fertilizers, aligning with the sustainability goals of farmers. Moreover, governments increasingly implement regulations aimed at reducing chemical runoff and promoting sustainable agricultural practices. These policies encourage the adoption of eco-friendly and organic fertilizers, including those derived from ammonia.

Increasing Advancement in Technology

The increasing advancement in technology is expected to drive the global green ammonia market. Innovations in electrolysis and nitrogen fixation technologies make the production of green ammonia more efficient and cost-effective, making it a more attractive option for industries seeking sustainable fuels. Furthermore, advancements in technology contribute to understanding the potential applications and benefits of green ammonia across different sectors, discovering new uses such as in carbon capture or as a hydrogen carrier, thereby increasing demand.

Green Ammonia Market Segment Insights

Green Ammonia Market Breakdown: Technology Insights

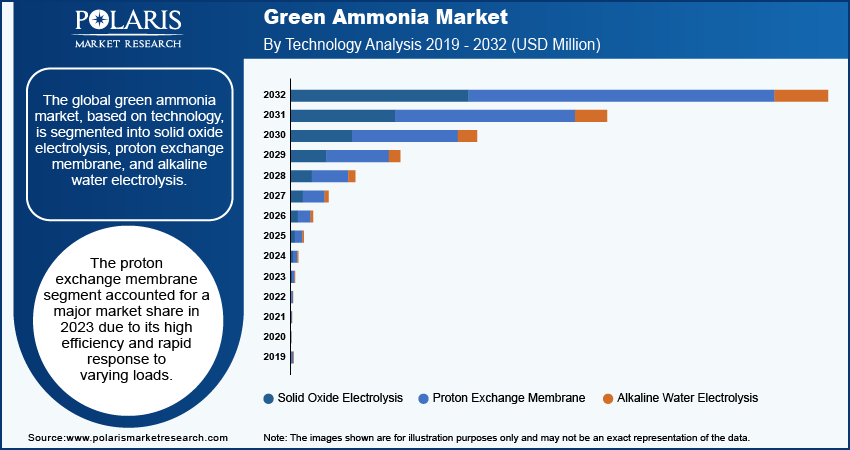

The global green ammonia market, based on technology, is segmented into solid oxide electrolysis, proton exchange membrane, and alkaline water electrolysis. The proton exchange membrane segment accounted for a major market share in 2023 due to its high efficiency and rapid response to varying loads. PEM systems excel in producing hydrogen at lower temperatures and pressures, which makes them suitable for integration with renewable energy sources like wind and solar. Their compact size and ability to operate effectively in smaller-scale applications attract interest from industries looking to adopt sustainable practices without the need for extensive infrastructure. Additionally, PEM technology supports higher purity levels of hydrogen, enhancing the overall quality of the green ammonia, which further solidifies its position in the market.

The solid oxide electrolysis segment is expected to grow at a robust pace in the coming years, owing to its potential for high efficiency and scalability. This technology operates at elevated temperatures, allowing for improved thermodynamic efficiency and reduced energy consumption when producing hydrogen. Industries are increasingly drawn to SOE for its capability to leverage waste heat as the demand for large-scale ammonia production rises. Furthermore, advancements in materials and designs continue to drive down costs and improve performance, making SOE an attractive option for large manufacturers aiming to transition to green ammonia.

Green Ammonia Market Breakdown: End Use Insights

The global green ammonia market, based on end use, is categorized into power generation, transportation, fertilizer, refrigeration, and others. The transportation segment held the largest market share in 2023 due to the urgent need for sustainable fuel alternatives in the shipping and logistics industries. Companies face increasing pressure to comply with stringent emissions regulations, such as those set by the International Maritime Organization. The use of ammonia as a low-emission fuel offers an effective solution, allowing vessels to reduce their carbon footprint significantly. Additionally, advancements in engine technology and fuel cell systems make it feasible for ships to use ammonia without extensive retrofitting, further encouraging adoption.

The fertilizer segment is estimated to grow at a rapid pace during the forecast period, owing to the rising demand for sustainable agricultural practices. The need for eco-efficient fertilizers rises as consumers increasingly prioritize food produced with environmentally friendly inputs. Ammonia serves as a crucial nitrogen source in fertilizer production, and its use helps reduce the carbon emissions associated with traditional fertilizer manufacturing. Furthermore, governments are promoting sustainable agriculture through incentives and regulations that encourage the adoption of low-carbon inputs. This favorable environment supports the growth of the green ammonia market in the fertilizer sector.

Green Ammonia Market Regional Insights

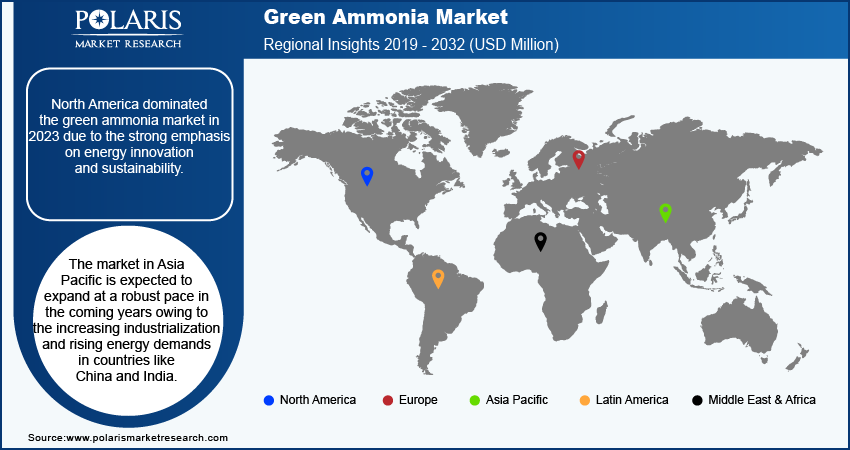

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the green ammonia market in 2023 due to the strong emphasis on energy innovation and sustainability. The US, in particular, led this initiative by investing heavily in renewable energy projects and technologies that utilize ammonia as a cleaner fuel alternative. The US government has introduced supportive policies and incentives to accelerate the transition to low-carbon solutions, fostering a favorable environment for research and development. Additionally, a growing awareness of the need to reduce greenhouse gas emissions in various sectors, including agriculture and transportation, has driven significant interest in adopting green ammonia-based products.

The market in Asia Pacific is expected to expand at a robust pace in the coming years owing to the increasing industrialization and rising energy demands in countries like China and India. These nations are actively seeking sustainable solutions to combat severe air pollution and meet their growing energy needs. Government initiatives focused on promoting clean technologies and sustainable agricultural practices propel the demand for green ammonia in fertilizers and as an energy source. Moreover, substantial investments in renewable energy infrastructure enhance the feasibility and attractiveness of green ammonia production in this region.

Green Ammonia Market – Key Players and Competitive Insights

New entrants have a promising opportunity to establish themselves and capture a significant market share in the coming years. Additionally, key players in the market are pursuing strategies such as mergers and acquisitions to reinforce their market position and broaden their geographical presence. Market participants are also undertaking several strategic activities to expand their footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, and collaborations.

ACME Group; Yara; Siemens Energy; First Ammonia; Starfire Energy; ENGIE; CF Industries Holdings, Inc.; Uniper SE; Greenko Group; BASF; Allied Green Ammonia; McPhy Energy; Enapter; Topsoe; FulePositive Corporation; Hygenco; LONGi; Hiringa Energy; Iberdrola, S.A.; and CEEC Global are among the major players in the green ammonia market.

BASF, founded in 1865 as Badische Anilin- und Soda-Fabrik, is one of the largest chemical producers in the world, headquartered in Ludwigshafen, Germany. The company is making significant strides in the field of sustainable ammonia production, particularly through its initiatives in green and biomass-balanced ammonia. BASF is innovating its ammonia production processes to align with environmental goals, with increasing global emphasis on sustainability and reducing carbon footprints. In May 2024, BASF announced to offer the first biomass-balanced products for its ammonia and urea portfolio.

ThyssenKrupp AG, founded in 1999 by the merger of Thyssen and Krupp, is a prominent German multinational conglomerate developing sustainable solutions in the chemical industry. ThyssenKrupp's innovative technology enables the production of green ammonia without fossil fuels, thereby eliminating CO2 emissions during the manufacturing process.

Key Companies in the Green Ammonia Market

- ACME Group

- Yara

- Siemens Energy

- First Ammonia

- Starfire Energy

- ENGIE

- CF Industries Holdings, Inc.

- Uniper SE

- Greenko Group

- BASF

- Allied Green Ammonia Pty Ltd

- ThyssenKrupp AG

- Nel ASA

- ITM Power

- Green Hydrogen Systems

- McPhy Energy S.A.

- Enapter S.r.l.

- Topsoe

- FulePositive Corporation

- Hygenco

- LONGi

- Hiringa Energy Ltd

- Iberdrola, S.A.

- CEEC Global Ltd

Green Ammonia Industry Developments

October 2023: DAI Infrastruktur partnered with Siemens Energy to advance its green ammonia project in East Port Said, Egypt. The project, named “Ra,” is planned to have an annual production capacity of 2 million tons of green ammonia, with operations expected to begin by 2028.

August 2022: Uniper SE signed a Memorandum of Understanding (MoU) with EverWind Fuels to acquire green ammonia from EverWind’s first production facility in Nova Scotia. Both companies plan to negotiate a binding offtake agreement for 500,000 tonnes of green ammonia annually.

August 2022: The Avaada Group announced to establish green ammonia production facility in Kota, Rajasthan. The project is designed to provide sustainable solutions to meet India's growing energy needs.

May 2022: LSB Industries signed an agreement with ThyssenKrupp Uhde USA & Bloom Energy to produce around 30,000 tonnes of green ammonia annually at its facility in Pryor, Oklahoma.

Green Ammonia Market Segmentation

By Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2024 - 2032)

- Solid Oxide Electrolysis

- Proton Exchange Membrane

- Alkaline Water Electrolysis

By End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2024 - 2032)

- Power Generation

- Transportation

- Fertilizer

- Refrigeration

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2024 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Green Ammonia Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 281.16 Million |

|

Market Size Value in 2024 |

USD 476.05 Million |

|

Revenue Forecast by 2032 |

USD 32,572.91 Million |

|

CAGR |

69.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Volume, Kilotons, Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global green ammonia market size was valued at USD 281.16 million in 2023 and is projected to grow to USD 32,572.91 million by 2032.

The global market is projected to register a CAGR of 69.6% during 2023–2032.

Europe accounted for the largest share of the global market in 2023.

ACME Group; Yara; Siemens Energy; First Ammonia; Starfire Energy; ENGIE; CF Industries Holdings, Inc.; Uniper SE; Greenko Group; BASF; Allied Green Ammonia; McPhy Energy; Enapter; Topsoe; FulePositive Corporation; Hygenco; LONGi; Hiringa Energy; Iberdrola, S.A.; and CEEC Global are among the key players in the market.

The proton exchange membrane segment led the green ammonia market in 2023.

The transportation segment held the largest market share in 2023.