Glycols Market Size, Share, Trends, Industry Analysis Report: By Product (Propylene Glycol and Ethylene Glycol), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1539

- Base Year: 2024

- Historical Data: 2020-2023

Glycols Market Overview

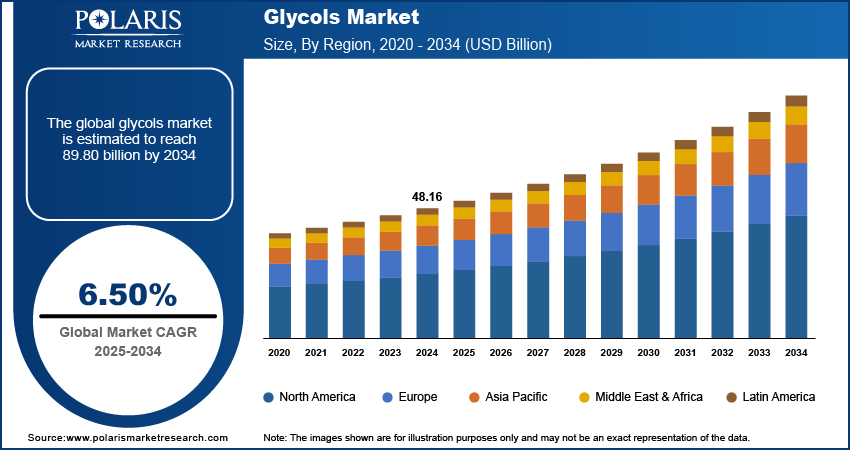

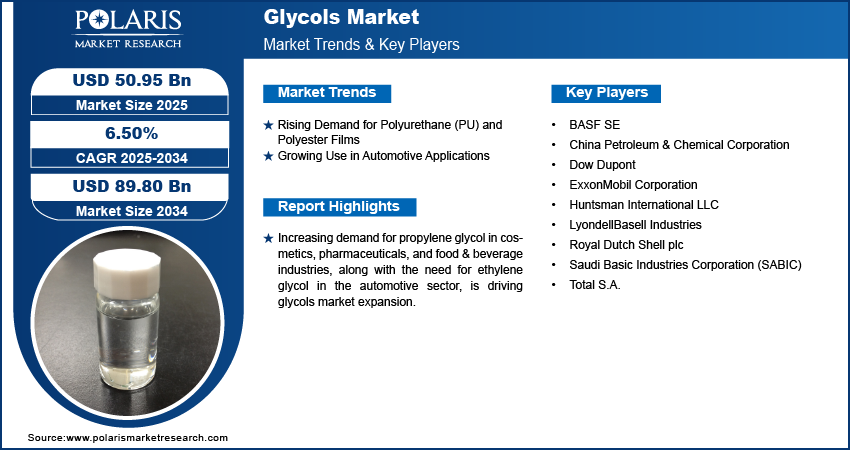

The global glycols market size was valued at USD 48.16 billion in 2024. The market is projected to grow from USD 50.95 billion in 2025 to USD 89.80 billion by 2034, at a CAGR of 6.50% from 2025 to 2034.

Glycols are a class of organic compounds having two hydroxyl groups on nearby carbon atoms. These compounds are colorless, sweet, odorless, low-volatility, low viscosity, and hygroscopic liquid at room temperature. They are also widely used in the production of plastics, resins, and polyester fibers. Glycols also have other industrial applications as coolants, antifreeze, and chemical intermediates.

The booming packaging sector, driven by shifting consumer preferences and the rapid surge in e-commerce, is driving the glycols market growth. Glycols like ethylene glycol and polyethylene glycol play a crucial role in packaging, serving as humectants, solvents, or coatings. In addition, the rising demand for propylene glycol in the cosmetics, pharmaceuticals, and food & beverages sectors is contributing to the glycols market expansion.

Increased global automotive production and the rising number of air passengers are driving demand for glycols as antifreeze, coolant, and de-icing fluids. The glycol market development is going on due to its extensive use in various end-use industries, including automotive (antifreeze, coolant), aviation (de-icing fluids), construction (HVAC systems, insulation), and packaging (PET resins). Increasing demand from industries such as textiles, packaging, expanding polyester fiber production, and the demand for sustainable solutions are creating several glycol market opportunities.

To Understand More About this Research: Request a Free Sample Report

Glycols Market Dynamics

Rising Demand for Polyurethane (PU) and Polyester Films

Polyethylene terephthalate (PET), polyester films, and polyurethane (PU) adhesives are being increasingly used across various sectors. Ethylene glycol is a vital component in the production of these films. PU and polyester films find widespread applications in the food & beverage industry for packaging juices, soft drinks, water, alcoholic beverages, and edible oils. They are also used in the automotive and transportation industries to improve performance and create lightweight designs. In addition, PU films can be laminated with other materials like foams, textiles, or glass to create composite materials. Thus, the rising demand for PU and polyester films is driving the glycols market development.

Growing Use in Automotive Applications

Ethylene glycol is an essential component of engine coolants and antifreeze solutions, which help keep internal combustion engines running at their ideal temperature, avoid freezing in cold locations, and prevent overheating in hot conditions. These coolants and antifreeze agents are in high demand due to the growing automotive industry globally. The need for high-performance coolants and heat transfer fluids is further fueled by the rising popularity of electric vehicles (EVs), which need efficient thermal management for their batteries and electric drivetrains. In addition, there is a sizable aftermarket for engine coolants and antifreeze solutions beyond the initial fill-up of new automobiles. Consumers regularly change these solutions to ensure smooth and efficient operations of their vehicles. As a result, the growing use of glycols in automotive applications is propelling the glycols market expansion.

Glycols Market Segment Insights

Glycols Market Assessment by Product Insights

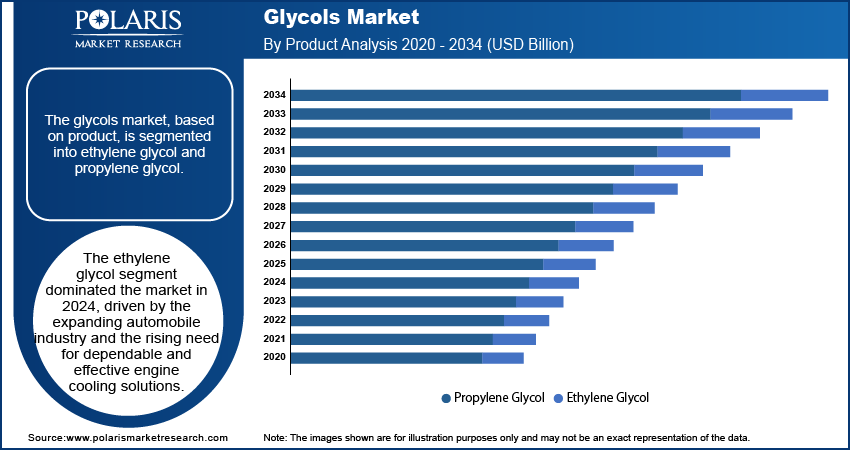

The glycols market, based on product, is segmented into propylene glycol and ethylene glycol. The ethylene glycol segment dominated the market in 2024. This is attributed to the expanding automobile industry and the rising need for dependable and effective engine cooling solutions. The various desirable properties of ethylene glycol, including a low freezing point and a high boiling point, make it a vital component in coolants and antifreeze solutions to maintain engine temperature and avoid freezing or overheating. In addition, ethylene glycol also functions as a reagent in the production of alkyd resins, polyesters, synthetic resins, and waxes. Moreover, the chemical finds usage as an ingredient in hydraulic fluids and paint solvents. These widespread applications of ethylene glycol contribute to the segment’s leading position in the market.

Glycols Market Evaluation by Application Insights

The glycols market segmentation, based on application, is made into HVAC, airlines, pipeline maintenance, food & beverage, automotive, textiles, medical, polyester fibers & resins, and others. The automotive segment dominated the market in 2024. This dominance is primarily due to glycols, especially ethylene glycol and propylene glycol, are crucial components of engine cooling systems, serving as antifreeze and coolant to prevent freezing and overheating, thereby ensuring reliable and efficient vehicle performance. While the automotive sector is the largest, glycols also find applications in other sectors like HVAC (heating, ventilation, and air conditioning) systems, where they are used as antifreeze agents and heat transfer fluids.

Glycols Market Regional Analysis

By region, the report provides the glycols market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominated the global market in 2024 due to the high demand for glycols from the growing automotive and industrial sectors in the region. These sectors have led to high demand for glycols as antifreeze solutions and engine coolants. In addition, stringent quality standards, a well-established chemical manufacturing infrastructure, and the presence of several key glycol manufacturers contribute to the region’s leading market position.

The Asia Pacific glycols market is projected to witness the fastest growth during the forecast period, driven by rising construction activities, a growing automotive sector, and increased emphasis on sophisticated industrial processes. The growth of the textile and automotive industries in the region is a major driver of glycol demand. Glycols are used in the production of polyester fibers for textiles and as coolants and antifreeze agents in automobiles.

Glycols Market – Key Players and Competitive Insights

The leading market players are introducing new, innovative products to cater to the evolving consumer needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their market presence. To expand and survive in a highly competitive market, market participants must offer innovative solutions.

In recent years, the market for glycols has witnessed several innovation breakthroughs, with the top market participants providing solutions that help meet sustainability goals. The glycols market report offers a market assessment of all the leading players, including ExxonMobil Corporation, Saudi Basic Industries Corporation (SABIC), Dow Dupont, Royal Dutch Shell plc, LyondellBasell Industries, Total S.A., and China Petroleum & Chemical Corporation.

List of Glycols Market Key Players

- BASF SE

- China Petroleum & Chemical Corporation

- Dow Dupont

- ExxonMobil Corporation

- Huntsman International LLC

- LyondellBasell Industries

- Royal Dutch Shell plc

- Saudi Basic Industries Corporation (SABIC)

- Total S.A.

Glycols Industry Developments

In June 2024, Technip Energies announced a technology transfer agreement with Shell Catalysts & Technologies. According to Technip Energies, the agreement aims to accelerate the commercialization of its Bio-2-Glycols technology for the synthesis of bio-based monoethylene glycol from glucose.

In May 2024, Dow announced the expansion of its integrated manufacturing facility in Rayong, Thailand, to increase propylene glycol (PG) production. The company stated that the expansion will increase the facility's PG output by 80,000 tons a year, taking the total production to 250,000 tons per year.

Glycols Market Segmentation

By Product Outlook

- Propylene Glycol

- Ethylene Glycol

By Application Outlook

- HVAC

- Airlines

- Pipeline Maintenance

- Automotive

- Textiles

- Medical

- Polyester Fibers & Resins

- Others

By End-Use Industry Outlook

- Packaging

- Cosmetics

- Textiles

- Automotive & Transportation

- Food & Beverage

- Pharmaceuticals

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Glycols Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 48.16 billion |

|

Market Size Value in 2025 |

USD 50.95 billion |

|

Revenue Forecast by 2034 |

USD 89.80 billion |

|

CAGR |

6.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The glycols market was valued at USD 48.16 billion in 2024 and is projected to grow to USD 89.80 billion in 2034

The market is anticipated to register a CAGR of 6.50% between 2025–2034.

North America held the largest share of the global market in 2024.

ExxonMobil Corporation, BASF SE, Huntsman International LLC, Manali Petrochemicals Limited, Saudi Basic Industries Corporation (SABIC), Dow Dupont, Royal Dutch Shell plc, LyondellBasell Industries, Total S.A., and China Petroleum & Chemical Corporation are a few of the key market players.

The ethylene glycol segment dominated the market in 2024.

The automotive segment held the largest market share in 2024.