Glycerol Monostearate Emulsifiers Market Share, Size, Trends, Industry Analysis Report, By End-Use (Personal Care & Cosmetics, Food & Beverages, Pharmaceuticals, Others); By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4597

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

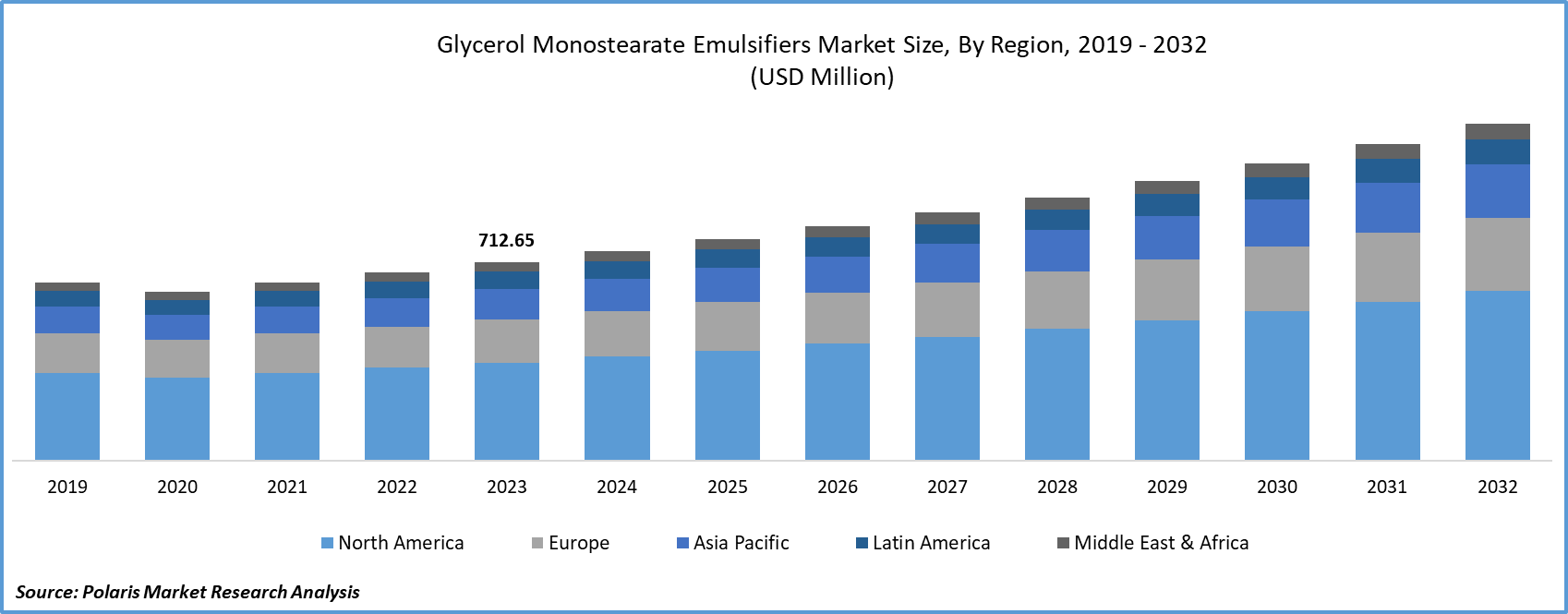

Global glycerol monostearate emulsifiers market size was valued at USD 712.65 million in 2023. The market is anticipated to grow from USD 752.63 million in 2024 to USD 1,209.10 million by 2032, exhibiting a CAGR of 6.1% during the forecast period

Glycerol Monostearate Emulsifiers Market Overview

Glycerol monostearate (GMS) stands out as a highly utilized emulsifier in various industries because of its versatile attributes. Derived from glycerin and stearic acid, GMS showcases both lipophilic and hydrophilic properties, rendering it an efficient emulsifying agent. Its capacity to create stable water-in-oil emulsions can be attributed to its molecular structure, featuring a lipophilic tail and a hydrophilic head that readily dissolves in oily organic compounds. This characteristic enables GMS to adeptly stabilize mixtures of water and oil, effectively preventing phase separation.

The anticipated increase in the use of the product as an emulsifier in the pharmaceutical industries, personal care and cosmetics, and food and beverages is expected to drive glycerol monostearate emulsifiers market size in the forecast period.

According to the China Ministry of Agricultural and Rural Affairs (MARA), the dairy industry in China has experienced consistent growth, with production increasing from 40.3 million metric tons (Mmt) in 2022 to 42.3 Mmt in 2023. Despite this growth, there is still room to match local consumption levels, which reached 70.18 Mmt in 2023.

To Understand More About this Research: Request a Free Sample Report

Glycerol monostearate with a purity below 90% may include impurities or lower concentrations of the desired compound. These variants are widely employed in extensive industrial operations where their emulsifying and stabilizing properties are essential, and the precise purity level is not a critical factor. Glycerol monostearate with a purity exceeding 90% is utilized in various applications within the food industry, contributing to enhanced texture, consistency, and shelf life of food products. In the baked goods sector, GMS plays a role in producing items like pastries, bread, and cakes.

Glycerol Monostearate Emulsifiers Market Dynamics

Market Drivers

Rising advancements in the creation of plant-based alternatives with clean labels bolstering the growth of the Glycerol Monostearate Emulsifiers market.

In response to the increasing demand for organic components in food products, there is a notable glycerol monostearate emulsifiers market trend towards developing clean-label and plant-based alternatives. This shift aligns with the broader consumer preference for natural and sustainable ingredients. The innovation in glycerol monostearate emulsifiers aims to cater to a diverse range of sectors, with a particular focus on enhancing functionality and meeting the evolving expectations of health-conscious consumers.

The glycerol monostearate emulsifiers market key players and manufacturers are actively exploring ways to modify glycerol monostearate emulsifiers to address specific needs, such as improving emulsion stability or creating customized textures in food products. Beyond the food industry, GMS's mixing and stabilizing qualities are finding applications in non-food sectors, including pharmaceuticals and personal care items. These developments underscore ongoing efforts to expand the uses of glycerol monostearate across various industries, reflecting a commitment to innovation and versatility in response to glycerol monostearate emulsifiers market demands and driving the glycerol monostearate emulsifiers market’s growth.

Market Restraints

Environmental Sustainability Issues and their impact are likely to hamper the growth of the market.

The production of Glycerol Monostearate (GMS), especially when derived from animal-based sources, has sparked concerns regarding its environmental impact. Issues such as greenhouse gas emissions and high water consumption in the manufacturing process have become focal points of scrutiny. This has prompted both consumers and regulatory bodies to advocate for sustainable alternatives that boast lower environmental footprints.

Amidst these sustainability concerns, there is a growing demand for the development and adoption of eco-friendly practices in the production of GMS. Manufacturers are increasingly pressured to explore and implement more sustainable sourcing methods, production processes, and ingredient choices to address these environmental challenges. This shift reflects a broader recognition within the industry of the imperative to align with environmentally conscious practices and meet the rising expectations for sustainable solutions.

Report Segmentation

The market is primarily segmented based on end-use and region

|

By End-Use |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

Glycerol Monostearate Emulsifiers Market Segmental Analysis

By End-Use Analysis

- In 2023, the food and beverages sector dominated the market, holding the largest share of revenue. This substantial share can be attributed to the widespread utilization of GM's emulsifiers, primarily due to their capacity to effectively blend ingredients that would otherwise separate, such as oil and water. This is particularly evident in products like margarine, ice cream, and salad dressings, where glycerol monostearate emulsifiers play a crucial role. Its stabilizing characteristics contribute significantly to the texture and consistency of items like yogurt, ensuring a smooth and cohesive feel by preventing undesirable separation.

Moreover, the confectionery industry extensively relies on glycerol monostearate emulsifiers, employing it in the production of chocolate, toffee, and caramel. In chocolate manufacturing, GMS proves invaluable in preventing the separation of cocoa butter and cocoa, ensuring a final product with a glossy and smooth appearance. Additionally, in the production of caramel and toffee, GMS plays a key role in controlling crystallization, leading to a desired texture and mouthfeel. The multifunctional properties of GMS establish it as an indispensable ingredient in the confectionery sector.

- The personal care and cosmetics segment stands out as another significant consumer of glycerol monostearate emulsifiers, which is attributed to the glycerol monostearate emulsifiers market growth. Functioning as a stabilizing agent, GMS proves invaluable in preventing product separation, rendering it a valuable component in eye creams, makeup, hand creams, sunscreens, and moisturizers. GMS's multifunctional attributes have positioned it as a widely embraced ingredient in the personal care and cosmetics industry, playing a pivotal role in enhancing the stability, texture, and overall performance of a diverse array of products. Additionally, the increasing emphasis on organic and natural products has influenced GMS's application in end-user segments like emulsifiers for skincare products.

Glycerol Monostearate Emulsifiers Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

This is attributed to the presence of some of the world's largest agricultural product manufacturers, including Thailand, India, China, Vietnam, and others. Coupled with the significant population in these countries, they have established extensive food production and processing industries. The consistent expansion of the middle-class demographic in these regions has led to shifts in food consumption habits, prompting an increased preference for processed food and beverages. Consequently, this surge in demand within the food and beverages industry has further heightened the need for GMS.

China has emerged as a significant player in the food processing market in recent decades, maintaining substantial growth. Additionally, The dairy industry's production capacity in China is anticipated to experience remarkable growth, making it a key driver for the glycerol monostearate emulsifiers market revenue growth in the country.

The forecast period is expected to see a notable CAGR in North America. The growth of the cosmetics and personal care industry in North America is a key driver for the GMS market as an emulsifier. For instance, in February 2023, Unilever announced the construction of a manufacturing facility in Nuevo Leon, Mexico, with a planned investment of USD 400 million to boost its manufacturing capacity for beauty and personal care products. This strategic development is anticipated to elevate the usage of GMS as an emulsifier in the manufacturing of cosmetics and personal care items.

Competitive Landscape

The Glycerol Monostearate Emulsifiers market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ACM chemicals

- Alfa Chemistry

- Alpha Chemicals Private Limited

- BASF SE

- Croda International Plc

- Estelle Chemicals Pvt. Ltd.

- Evonik Industries AG

- Kao Corporation

- LobaChemie Pvt. Ltd.

- Oleon NV

- Spectrum Chemical

- Wilmar International Ltd

Recent Developments

- In December 2023, Croda International Plc has recently launched a new production facility named Pastillator 4 (PSO4) situated in Jurong Island, Singapore. This facility is strategically positioned to address the increasing demand for esters and pastille format alkoxylates. The company is making a substantial investment of USD 16.4 million to augment the site's overall capacity to 15,000 metric tons, reflecting its commitment to meeting the rising market requirements.

- In January 2023, Oleon N.V. disclosed its intention to double the capacity of its isostearic acid and dimer acid production facility located in Ertvelde, Belgium, by the year 2024. Upon completion of the expansion, the production unit is projected to reach a total capacity of 14,125 tons.

Report Coverage

The Glycerol Monostearate Emulsifiers market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive end-use and futuristic growth opportunities.

Glycerol Monostearate Emulsifiers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 752.63 million |

|

Revenue Forecast in 2032 |

USD 1,209.10 million |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Glycerol Monostearate Emulsifiers market size is expected to reach USD 1,209.10 Million by 2032.

Key players in the market are ACM Chemicals, Alfa Chemistry, Alpha Chemicals Private Limited, BASF SE, Croda International Plc

Asia Pacific contribute notably towards the global Glycerol Monostearate Emulsifiers Market

Global glycerol monostearate emulsifiers market exhibiting a CAGR of 6.1% during the forecast period

The Glycerol Monostearate Emulsifiers Market report covering key segments are end-use and region