Gluten-free Products Market Share, Size, Trends, Industry Analysis Report

By Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Specialty Stores, E-commerce Platform, Others); By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 117

- Format: PDF

- Report ID: PM2450

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

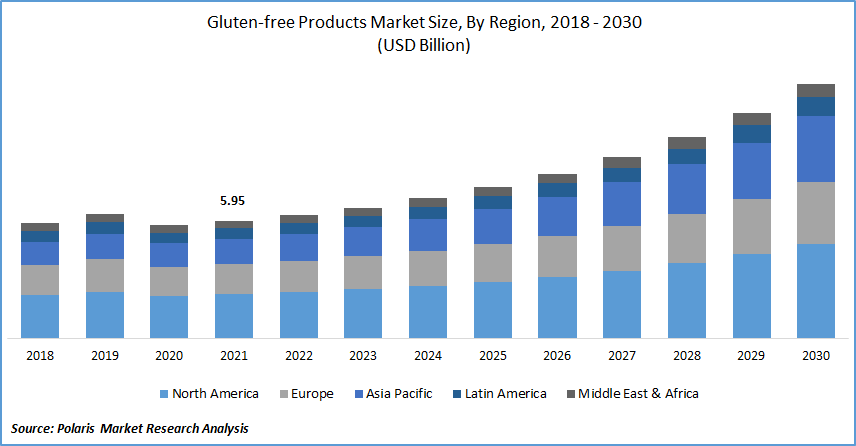

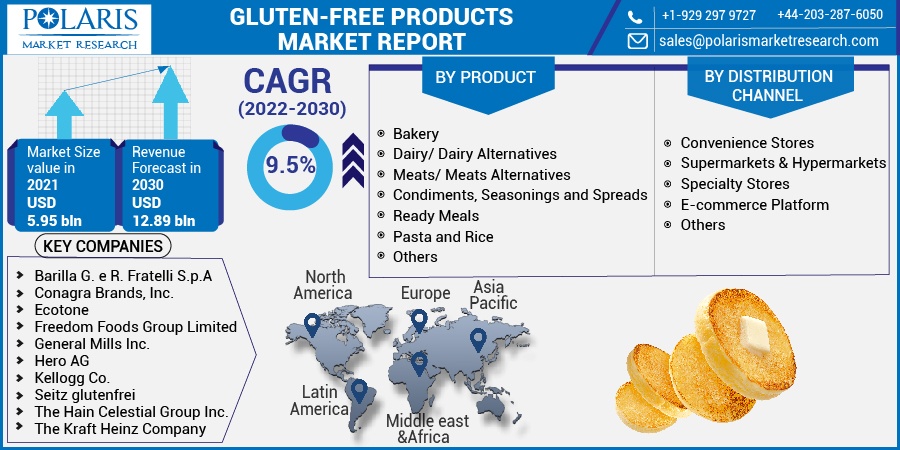

The global gluten-free products market was valued at USD 5.95 billion in 2021 and is expected to grow at a CAGR of 9.5% during the forecast period. The rise in prevalence of celiac disease and associated disorders coupled with lifestyle disorders and consumer shift towards a healthy and balanced diet enabled the industry forward.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Celiac disease can affect women and men of all ages. As per the recent meta-analysis, it is found that the incidence is rising at a significant rate. This is most likely due to improved diagnostic procedures and other environmental factors. Celiac disease affects 1 in every 133 Americans or about 1% of the population. Recent screening studies suggest that the rate in the United States could be higher than 1%. It is reported that 5–22% of celiac disease patients have a first-degree relative who also has the same disease. Celiac disease has no pharmaceutical treatments or cures. The one and only available treatment option for this disease is a gluten-free diet.

The outbreak of COVID-19 has impacted the production and global supply chain activities of gluten-free products. Producers of gluten-free food are unable to source raw materials and create goods to meet demand owing to restricted supply chain activities.

Moreover, most of the factories were closed as a lockdown was imposed by the government of several countries. All these factors have affected the growth of the target industry negatively. In the post-pandemic period, it is anticipated that the demand for gluten-free products market will come across the globe due to the increasing adoption of immunity-boosting food.

Industry Dynamics

Growth Drivers

The increasing incidence of celiac disease and Irritable Bowel Syndrome (IBS) is anticipated to boost the demand for gluten-free products market all over the world as they help to cure these diseases. Due to the development of easier diagnosis methods, Celiac disease is getting detected rapid rate in developing regions.

The report named "Prevalence of Celiac Disease, Systematic Review, and Meta-analysis," published in 2017, states that celiac disease is more common in developing regions than in developed countries. Also, from the study, the prevalence rate of Celiac disease was 0.6% in Asia and 0.4% in SA (South America). All these factors are anticipated to augment the revenue growth of the target market.

Rising awareness about gluten intolerance and increasing consumer spending on healthy food are anticipated to drive the revenue growth of the global gluten-free products market. Moreover, gluten-free products are getting easier to find in small as well as big stores. The easy availability of these items is anticipated to have a positive impact on the growth of the target market.

Players present in the target market are focusing on the launch of new products to widen their product range. For example, Hy-Vee Inc., a supermarket chain, launched Good Graces, a new private brand with a comprehensive variety of gluten-free items, in November 2021. Good Graces now has 30 gluten-free goods on the industry, with another 60 in the works. Also, the rise in research and development activities to develop easier methods of gluten network replacement during food processing is anticipated to augment the revenue growth of the target market. Rudi introduced 15 new organic & gluten-free goods in September 2021, using a new fermenting technique and packaging that included bread.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, source, form, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Product

The bakery products segment is estimated to garner the largest revenue share. The demand for gluten-free bakery items such as cakes, bread, rolls and buns, cookies and biscuits, dough and ready mixes, doughnuts, muffins, cupcakes, and others are increasing rapidly due to their rising popularity among millennia and generation Z. Population growth is also responsible for the rise in consumption of bakery products.

The survey done by U.S. Census data and Simmons National Consumer Survey (NHCS) found the number of bread consumers in the United States increased from 320 million to 326 Mn in 2020. Also, most bakery product producers and providers have started to add the option of gluten-free products to their product portfolio. These factors are likely to boost the growth of this segment throughout the forecast period.

The ready meals segment is anticipated to grow at a high CAGR during the forecast period. Nowadays, most of the working population prefer ready meals as the traditional cooking method is more time-consuming and hectic. According to a survey done in 2020, it is found that more than 85% of adults in the United Kingdom consume ready-to-cook or ready-meals.

Insight by Distribution Channel

Supermarket and hypermarket segments are estimated to account for the largest share over the forecast period. This is due to the fact that it offers convenient access to a variety of gluten-free products all under one roof. This makes it simple for customers to select products from a large range of options. Gluten-free products are increasingly featured in seasonal displays, resulting in the promotion of new items and thereby expanding the category. Moreover, most companies get high financial returns from their big supermarkets and hypermarkets. Hence, most of the producers try to sell their gluten-free products to this segment.

The E-commerce Platform segment is anticipated to grow at a high CAGR in the years to come. Owing to the rising digitization and use of smartphones, most people prefer online shopping over conventional methods of buying. The online stores provide several rewards and cashback on the purchase of gluten-free products, and this is anticipated to have a positive impact on the growth of this segment.

Geographic Overview

North America is estimated to capture the highest revenue share, as a large portion of the population is already aware of the benefits associated with the consumption of gluten-free products. People from this region are spending more on healthy food products. Also, in this region, these types of products are easily available both online and offline.

Moreover, the incidence and prevalence of celiac disease are increasing at a rapid rate in this region. As per several research reports, up to 83 percent of celiac disease sufferers in the United States are undiagnosed or misdiagnosed with other illnesses. Also, non-celiac gluten sensitivity affects up to 6% of Americans. All these factors are anticipated to have a favorable impact on the growth of the industry.

Over the forecast period, the Asia Pacific region is expected to grow at a high CAGR. Rapid population growth and a rise in the adoption of western eating habits are driving the demand for gluten-free products in this region. The prevalence of the celiac disease is rising at a rapid rate in Asian countries.

The prevalence and seroprevalence of this disease in Asia are 0.5% and 1.6%, respectively. Moreover, most of the people from this region have started consuming gluten-free products as it helps in weight reduction. Also, rising awareness about celiac disease and gluten intolerance treatment options among the people of this region is expected to augment the revenue growth of the Asia Pacific region.

Gluten-free Products Industry Development

July 2024: The Kraft Heinz Company's Ore-Ida and GoodPop flavors teamed up create an innovative frozen treat known as the Fudge n' Vanilla French Fry Pops. The product is made with vanilla oat milk, a chocolate fudge shell, and bits of crispy potato. It is expected to put the companies in a great position to satisfy the growing consumer demand for distinctive and allergy-friendly snacks.

March 2024: Garden Veggie, a brand owned by Hain Celestial Group, launched Flavor Burst Tortilla Chips. These gluten-free tortilla chips will come in flavors like Zesty Ranch and Nacho Cheese, which are vegetable-infused.

Competitive Insight

Some of the key players operating in the global market are Barilla G. e R. Fratelli S.p.A, Conagra Brands, Inc., Ecotone, Freedom Foods Group Limited, General Mills Inc., Hero AG, Kellogg Co., Seitz glutenfrei, The Hain Celestial Group Inc., and The Kraft Heinz Company.

Gluten-free Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.95 billion |

|

Revenue forecast in 2030 |

USD 12.89 billion |

|

CAGR |

9.5 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Barilla G. e R. Fratelli S.p.A, Conagra Brands, Inc., Ecotone, Freedom Foods Group Limited, General Mills Inc., Hero AG, Kellogg Co., Seitz glutenfrei, The Hain Celestial Group Inc., and The Kraft Heinz Company |