Global Glucose Biosensors Market Size, Share, Trends, Industry Analysis Report: Information By Type (CGM (Continuous Glucose Monitoring), SMBG (Self-monitoring Blood Glucose)), By Technology, By Control Method, By End-Use, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 115

- Format: PDF

- Report ID: PM4988

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

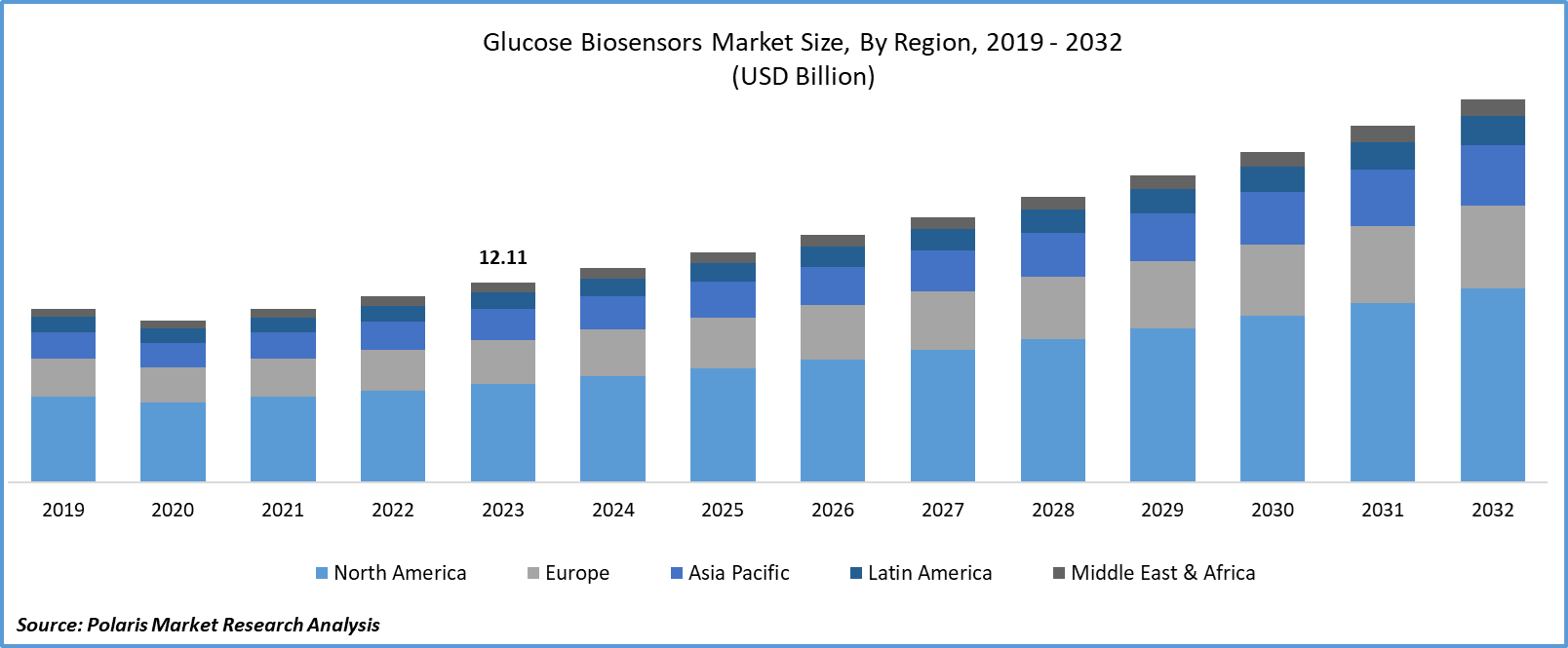

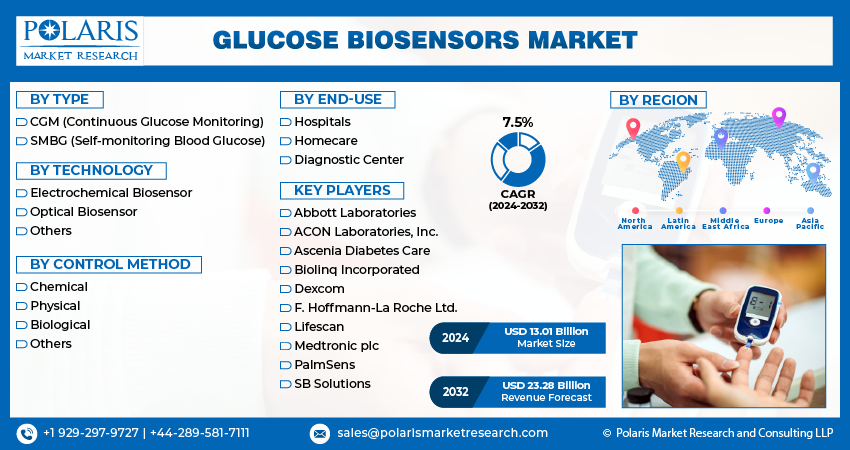

Global glucose biosensors market size was valued at USD 12.11 billion in 2023. The glucose biosensors industry is projected to grow from USD 13.01 billion in 2024 to USD 23.28 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.5% during the forecast period (2024 - 2032).

The rising awareness regarding the necessity of regular glucose monitoring to prevent diabetes-related complications propels glucose biosensors market growth. Emphasis on early detection and proactive diabetes management stimulates the adoption of glucose biosensors. These real-time monitoring devices empower patients to make informed decisions regarding their medication, diet, and lifestyle.

The growing elderly population, who are more susceptible to diabetes, contributes to higher market demand. Also, the wireless connectivity and smartphone compatibility to glucose biosensors improve user experience and make it easier for medical professionals to monitor patients remotely, driving the market outlook.

To Understand More About this Research: Request a Free Sample Report

The glucose biosensors market is experiencing growth due to the increased acceptance of wearable health monitoring devices, along with a focus on preventative healthcare. More people at risk of diabetes or with prediabetes are recognizing the importance of regular glucose monitoring, contributing to the expansion of the market. In addition, government programs that aim to provide affordable healthcare and promote diabetes management are expected to drive the demand for glucose biosensors further.

Glucose Biosensors Market Trends

Technological Advancements in Glucose Monitoring

The glucose biosensors market CAGR is undergoing significant growth, driven primarily by technological advancements in glucose monitoring devices. Innovations such as continuous glucose monitoring (CGM) systems, non-invasive biosensors, and integration with digital health platforms have enhanced the accuracy, convenience, and efficiency of diabetes management. Further, the introduction of devices that can seamlessly sync with smartphones and wearable technology has enabled users to monitor their glucose levels more efficiently, fostering a more proactive approach to diabetes management.

For instance, researchers at TMOS, the Australian Research Council Center of Excellence for Transformative Meta-Optical Systems, have made significant strides in reducing discomfort associated with glucose monitoring. The team at RMIT University found new characteristics of glucose's infrared signature and developed a miniaturized optical sensor, only 5mm in diameter, for potential continuous non-invasive glucose monitoring. Such innovations are driving technological advancement in the glucose biosensors market.

Rising Prevalence of Diabetes

The rising prevalence of diabetes is a significant growth driver for the glucose biosensors market due to the growing number of individuals diagnosed each year. For instance, the International Diabetes Federation (IDF) estimates that by 2045, approximately 783 million will be living with diabetes. More than 90% of people with diabetes have type 2 diabetes, influenced by socioeconomic, demographic, environmental, and genetic factors.

The growing awareness among individuals about the importance of diabetes management and the role of glucose monitoring in maintaining good health is further boosting the market CAGR. Healthcare providers and organizations emphasize the need for regular monitoring to prevent long-term complications.

The global demographic shift towards an aging population contributes to the rising prevalence of diabetes. Older adults are more susceptible to developing Type 2 diabetes, driving the demand for glucose monitoring devices.

According to the National Institute of Health, global diabetes prevalence was approximately 9.3% in 2019, affecting 463 million people. This figure is expected to rise to 10.2% (578 million) by 2030 and 10.9% (700 million) by 2045. Similarly, impaired glucose tolerance affected an estimated 7.5% (374 million) in 2019, projected to increase to 8.0% (454 million) by 2030 and 8.6% (548 million) by 2045. With nearly half a billion people living with diabetes worldwide, these numbers are anticipated to grow by 25% in 2030 and 51% in 2045. This study highlights growing awareness and underscores the potential for increased glucose biosensors market revenue.

Glucose Biosensors Market Segment Insights

Glucose Biosensors Technology Insights:

The global glucose biosensors market segmentation, based on technology, includes electrochemical biosensors, optical biosensors, and others. In 2023, the electrochemical biosensor segment held the largest market share. Electrochemical biosensors are prominent for their high sensitivity and accuracy in measuring glucose concentrations. They typically use glucose-specific enzymes like glucose oxidase or glucose dehydrogenase, which catalyze reactions generating electrical signals directly proportional to glucose levels. This precise measurement capability is crucial for diabetes management, ensuring accurate readings for timely adjustments in treatment.

Continuous advancements in microelectronics, nanotechnology, and sensor design have miniaturized electrochemical biosensors, making them smaller and more portable. These devices provide convenient and discreet glucose monitoring for patients. They seamlessly integrate with digital health platforms and smartphone apps, allowing for wireless data transmission to healthcare providers. Such innovations by key players drive demand and growth in the glucose biosensor market.

For instance, in April 2024, onsemi introduced an advanced electrochemical sensor solution tailored for industrial, environmental, and healthcare applications.

Glucose Biosensors End-Use Insights:

The global glucose biosensors market segmentation, based on end-use, includes hospitals, homes, and diagnostic centers. The hospital category accounted for the largest market share in 2023, primarily due to its critical role in managing acute and chronic conditions, such as diabetes, where accurate and timely glucose monitoring is essential. Hospitals require glucose biosensors that offer high accuracy and reliability to support clinical decision-making and patient management across diverse healthcare settings.

The biosensors are integral in intensive care units (ICUs), surgical wards, emergency departments, and outpatient clinics for continuous monitoring of patients' glucose levels. They enable healthcare providers to promptly adjust treatment plans, optimize insulin therapy, and prevent complications related to hypo- or hyperglycemia. Moreover, glucose biosensors used in hospitals often integrate seamlessly with hospital information systems (HIS) and electronic health records (EHR), enhancing workflow efficiency and ensuring compliance with regulatory standards.

For instance, according to the National Library of Medicine, continuous glucose monitoring (CGM) has transformed diabetes care by enabling proactive management to prevent hypoglycemia and hyperglycemia episodes, making it the standard of care for type 1 diabetes. Expanding CGM use to include type 2 diabetes can enhance therapy effectiveness, reduce complications, and lower hospitalization rates, thereby cutting healthcare costs. Additionally, CGM benefits pregnant women with diabetes and supports acute care for hospital inpatients dealing with treatment-related insulin resistance or reduced insulin secretion post-surgery. This comprehensive support for critical care management, coupled with their proven clinical effectiveness and regulatory approvals, drives the hospital segment in the glucose biosensor market.

Global Glucose Biosensors Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Glucose Biosensors Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American glucose biosensors market accounted for the largest share in 2023 due to increasing technological innovation in healthcare, including the development of advanced glucose monitoring devices. Continuous glucose monitoring (CGM) systems and other technologically advanced biosensors are increasingly adopted due to their accuracy, convenience, and ability to integrate with digital health platforms.

The robust healthcare infrastructure in North America supports the widespread adoption of glucose biosensors. Hospitals, clinics, and healthcare providers across the region prioritize advanced medical technologies to enhance patient care and improve health outcomes.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The glucose biosensors market in the United States holds a significant market share due to the increasing number of individuals being diagnosed with diabetes. This rise in prevalence is attributed to factors such as obesity, sedentary lifestyles, and aging populations. The high prevalence necessitates continuous monitoring of glucose levels, leading to a growing demand for effective glucose biosensors. In the U.S., the competitive landscape among healthcare technology companies drives continuous innovation in glucose biosensors. The major companies constantly strive to develop more accurate, user-friendly, and cost-effective devices to meet the evolving needs of healthcare providers and patients.

For instance, in September 2020, Abbott advanced its continuous glucose monitoring (CGM) technology beyond diabetes with a new wearable. This CE-marked biosensor is the world's first glucose sport biosensor tailored specifically for athletes.

Further, the Canadian glucose biosensors market is experiencing notable growth due to the strong emphasis on diabetes management and patient education in Canada, which promotes the use of glucose biosensors for effective disease management. The key players drive innovation and product development in glucose biosensors, offering a variety of choices for healthcare providers and patients.

For instance, in October 2023, Dexcom, Inc. introduced its latest Dexcom G7 Continuous Glucose Monitoring (CGM) System in Canada, designed for individuals aged two and older with all types of diabetes, including pregnant women. This launch brought the most accurate CGM system available to Canadians, providing a new avenue for enhanced diabetes management.

The Asia-Pacific glucose biosensors market is expected to experience significant growth during the forecast period. This growth is attributed to the increasing prevalence of diabetes in the region, driven by factors such as urbanization, sedentary lifestyles, and changes in dietary habits. The demographic shift towards a higher prevalence of diabetes necessitates greater adoption of glucose biosensors for effective diabetes management.

The Japanese glucose biosensors market is making ongoing advancements in sensor technology, miniaturization, and connectivity, which are enhancing the accuracy, convenience, and usability of glucose biosensors. Innovations such as continuous glucose monitoring (CGM) systems are becoming more accessible in the Asia-Pacific region, meeting the growing demand for real-time monitoring.

Furthermore, India's glucose biosensors market held a significant market share in 2023, driven by the increasing prevalence of diabetes in the country. This trend is contributing to the growing demand for continuous glucose monitors (CGMs) and point-of-care testing devices, which collectively support market growth during the forecast period.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and others.

Global Glucose Biosensors Market Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Glucose Biosensors Key Market Players & Competitive Insights

Leading market players are continuously striving to enhance the accuracy, usability, and connectivity of glucose monitoring devices, catering to the increasing global demand for effective diabetes management solutions. These market players only focused on technological innovation in market developments, including launches, agreements, mergers, and acquisitions, but also on expanding their geographical presence and strengthening their product portfolios to maintain a competitive edge, which meets the diverse needs of the glucose biosensors industry.

Manufacturing locally to reduce operating expenses is one of the key business tactics used by manufacturers in the global glucose biosensors industry to benefit clients and increase the market sector. In recent years, the glucose biosensors industry has offered some technological advancements. Major players in the glucose biosensors market, including Abbott Laboratories, ACON Laboratories, Inc., Ascenia Diabetes Care, Biolinq Incorporated, Dexcom, F. Hoffmann-La Roche Ltd., Lifescan, Medtronic plc, PalmSens, and SB Solutions.

Abbott develops, produces, and markets a wide and diverse range of medical products. It functions through the following divisions, including pharmaceutical, diagnostic, pharmaceutical, and medical device products. It offers advanced and cutting-edge technologies for cardiovascular, diabetes care, neuromodulation, and other specialties, enhancing patient outcomes and quality of life. In September 2020, Abbott introduced the world's first glucose sport biosensor, the Libre Sense Glucose Sport Biosensor, designed for athletes to constantly calculate glucose levels and better understand the correlation between glucose and athletic performance.

Medtronic plc is the major provider of medical equipment, solutions, and products. Founded in 1949, Medtronic currently provides products and solutions to medical institutions, physicians, professionals, and patients in over 150 countries worldwide. The company's operating segments principally develop, produce, sell, and market device-based healthcare medicines and solutions. In January 2024, Medtronic plc declared CE clearance for the 780G MiniMed system with Simplera Sync, a disposable all-in-one constant glucose monitor (CGM) that removes the necessity for overtape.

Key Companies in the Glucose Biosensors market include

- Abbott Laboratories

- ACON Laboratories, Inc.

- Ascenia Diabetes Care

- Biolinq Incorporated

- Dexcom

- F. Hoffmann-La Roche Ltd.

- Lifescan

- Medtronic plc

- PalmSens

- SB Solutions

Glucose Biosensors Industry Developments

- May 2024: Trinity Biotech plc announced a strategic partnership with PulseAI company to enhance its recently acquired continuous glucose monitor (CGM) biosensor technology.

- June 2020: LifeScan, a global player in blood glucose monitoring, has announced the launch of the OneTouch Verio Reflect in the U.S.

- September 2019: ACON Laboratories, Inc. announced the release of the On Call Express Voice in the U.S. This system is an affordable, convenient, and fully audible blood glucose monitoring solution.

Glucose Biosensors Market Segmentation

Glucose Biosensors Type Outlook

- CGM (Continuous Glucose Monitoring)

- SMBG (Self-monitoring Blood Glucose)

Glucose Biosensors Technology Outlook

- Electrochemical Biosensor

- Optical Biosensor

- Others

Glucose Biosensors, Control Method Outlook

- Chemical

- Physical

- Biological

- Others

Glucose End-Use Outlook

- Hospitals

- Homecare

- Diagnostic Center

Glucose Biosensors Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Glucose Biosensors Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 12.11 billion |

|

Market size value in 2024 |

USD 13.01 billion |

|

Revenue Forecast in 2032 |

USD 23.28 billion |

|

CAGR |

7.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global glucose biosensors market size was valued at USD 12.11 billion in 2023 and is projected to grow to USD 23.28 billion by 2032.

The global market is projected to grow at a CAGR of 7.5% during the forecast period, 2023-2032.

North America had the largest share of the global market

The key players in the market are Abbott Laboratories, ACON Laboratories, Inc., Ascenia Diabetes Care, Biolinq Incorporated, Dexcom, F. Hoffmann-La Roche Ltd., Lifescan, Medtronic plc, PalmSens, and SB Solutions.

In 2023, the electrochemical biosensor segment held the largest market share

The hospital category accounted for the largest market share in 2023.