GLP-1 Analogues Market Size, Share, Trends, Industry Analysis Report: By Route of Administration (Subcutaneous Route and Oral Route), Product, Application, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5147

- Base Year: 2024

- Historical Data: 2020-2023

GLP-1 Analogues Market Overview

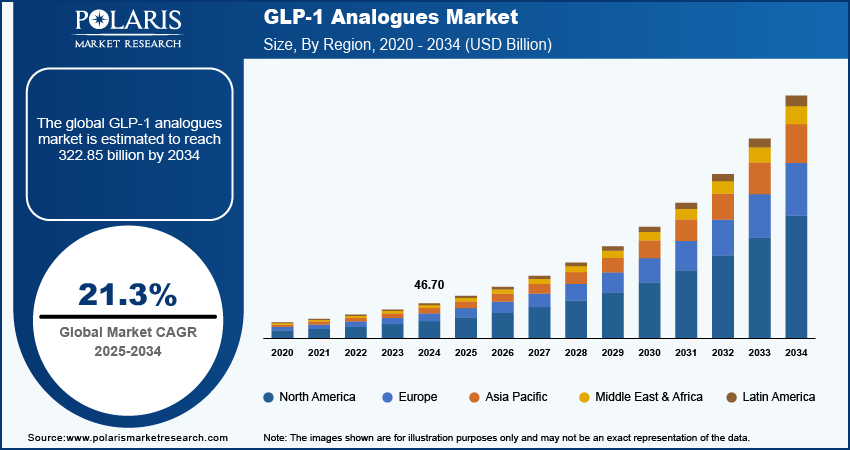

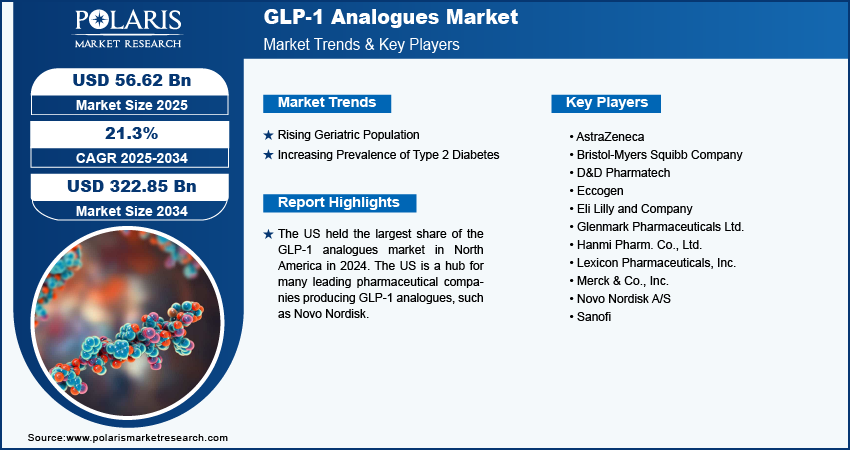

The global GLP-1 analogues market size was valued at USD 46.70 billion in 2024. The market is projected to grow from USD 56.62 billion in 2025 to USD 322.85 billion by 2034, exhibiting a CAGR of 21.3% during 2025–2034.

Glucagon-like peptide-1 (GLP-1) analogues are a class of drugs primarily used in the treatment of type 2 diabetes and obesity. They are synthetic versions of the naturally occurring GLP-1 hormone that plays a crucial role in regulating blood sugar levels by enhancing insulin secretion, suppressing glucagon release, and slowing gastric emptying. This helps lower blood glucose levels and aids in weight management. The clinical guidelines and recommendations from esteemed health organizations such as the American Diabetes Association (ADA) and the European Association for the Study of Diabetes (EASD) consistently endorse the use of GLP-1 analogues for specific patient associates. This support has significantly contributed to the proliferation of GLP-1 analogues. Furthermore, ongoing research and development endeavors are expected to bring advanced inhibitors. Advancements in drug formulations, synergistic combinations with other antidiabetic medications, and improved safety profiles are poised to drive market expansion during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Consumption of highly processed foods and food items containing refined sugars and unhealthy fats is a significant contributing factor leading to the rising incidence of type 2 diabetes. The excessive intake of sugary beverages, fast food, and snacks has been directly linked to weight gain and impaired glucose metabolism, significantly boosting the risk of diabetes development. Furthermore, the rising prevalence of obesity has significantly contributed to the growing utilization of GLP-1 analogs in the treatment of obesity, which is significantly driving the GLP-1 analogues market.

GLP-1 Analogues Market Trends

Rising Geriatric Population

Older individuals, due to age-related factors, are at a higher risk of developing type 2 diabetes and related health conditions, resulting in a greater need for GLP-1 analogues inhibitors. According to the UN, the global population of individuals aged 65 years and above is expected to increase significantly, more than doubling from 761 million in 2021 to 1.6 billion by 2050. The demographic of those aged 80 years and above is expanding at an even faster rate. As the elderly population is highly prone to health issues such as Type 2 diabetes, the growing geriatric population is expected to drive the GLP-1 analogues market during the forecast period.

Increasing Prevalence of Type 2 Diabetes

The cases of type 2 diabetes are rising across the world. For instance, according to the International Diabetes Federation, ∼537 million individuals were affected by diabetes worldwide in 2021, with more than 75% of adult diabetes cases occurring in low and middle-income countries. The International Diabetes Federation projected that the number of new diabetes cases is expected to reach 643 million by 2030 and 783 million by 2045. Hence, the rising prevalence of type 2 diabetes is estimated to boost the GLP-1 analogues market during the forecast period.

GLP-1 Analogues Market Segment Insights

GLP-1 Analogues Market Breakdown, by Product Insights

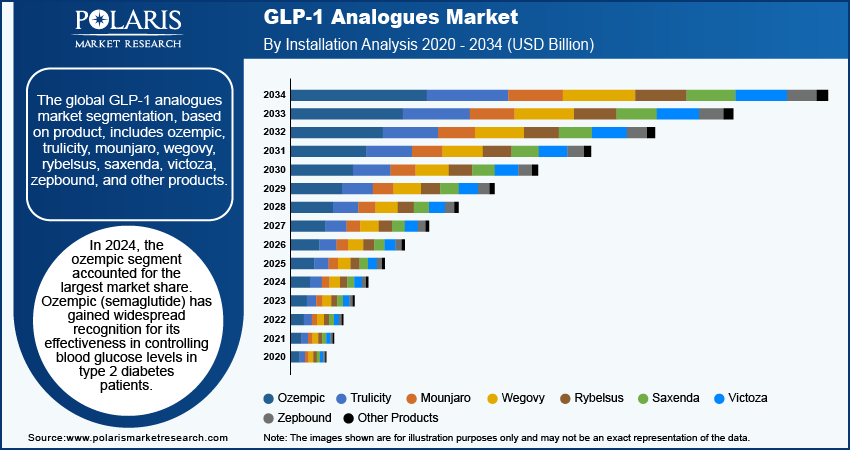

The global GLP-1 analogues market, based on product, is segmented into ozempic, trulicity, mounjaro, wegovy, rybelsus, saxenda, victoza, zepbound, and other products. In 2024, the ozempic segment accounted for the largest market share. Ozempic (semaglutide) has gained widespread recognition for its effectiveness in controlling blood glucose levels in patients affected by type 2 diabetes. Ozempic effectively reduces HbA1c levels, which is a key focus in managing diabetes. Additionally, ozempic has demonstrated substantial benefits in promoting weight loss and lower the risk of kidney disease, making it a preferred choice among healthcare providers and patients. In March 2024, Novo Nordisk A/S stated that ozempic (semaglutide) 1.0 mg shows a 24% lower risk of kidney disease events in type 2 diabetes and chronic kidney disease in the FLOW trial. This dual benefit of glycemic control and weight reduction has driven its popularity, further boosting the segment expansion.

GLP-1 Analogues Market Breakdown, by Distribution Channel Insights

The global GLP-1 analogues market segmentation, based on distribution channel, includes hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacies is expected to be the fastest-growing segment due to its unparalleled convenience, allowing patients to order their medications from the comfort of their homes. GLP-1 analogues are often prescribed for chronic conditions such as type 2 diabetes and obesity, which require ongoing, long-term management. Online pharmacies are well-suited to serve these patients by providing continuous access to necessary medications, supporting adherence, and reducing the hassle of frequent pharmacy visits. The ability to have medications delivered directly to their doorsteps, often with the option of automatic refills, appeals to many patients and contributes to the growth of this segment. Furthermore, the growth of telemedicine, especially accelerated by the COVID-19 pandemic, has led to an increase in online consultations and prescriptions. Patients who receive prescriptions for GLP-1 analogues via telehealth platforms are more likely to use online pharmacies to fill these prescriptions.

Regional Insights

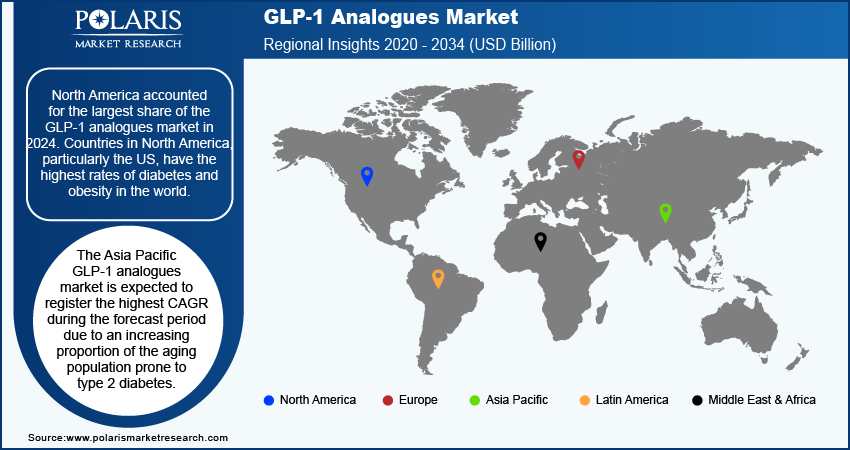

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the GLP-1 analogues market in 2024. Countries in North America, particularly the US, have the highest rates of diabetes and obesity in the world. According to the American Diabetes Association, in 2021, the prevalence of diabetes in the US was 11.6%, affecting 38.4 million Americans. Among them, 2 million people had type 1 diabetes, with ∼304,000 being children and adolescents. The rising prevalence of these chronic conditions has led to an increased demand for effective treatments, including GLP-1 analogues, to control diabetes and weight. Thus, the increasing demand for GLP1 analogue in North America is contributing to the market growth.

The US held the largest share of the GLP-1 analogues market in North America in 2024. The US is a hub for many leading pharmaceutical companies producing GLP-1 analogues, such as Novo Nordisk. These companies have a strong presence in the region, with extensive distribution networks and robust marketing strategies, which support market growth in the country.

The Asia Pacific GLP-1 analogues market is expected to register the highest CAGR during the forecast period due to an increasing proportion of the aging population. According to the Asia Development Bank, in May 2024, Asia Pacific is projected to experience a significant demographic shift, with the population of individuals aged 60 and above nearly doubling to reach 1.2 billion by 2050. This demographic group is anticipated to constitute ∼25% of the total population in the region. The older adults are at higher risk of developing type 2 diabetes. Thus, the rising geriatric population prone to diabetes across Asia Pacific would propel the demand for effective treatments such as GLP-1 analogues during the forecast period.

The India GLP-1 analogues market is expected to grow significantly during the forecast period due to the growing middle-class population in countries that are driving increased healthcare spending. Owing to the rising disposable incomes, patients are able to afford advanced diabetes and obesity treatments, contributing to the rapid growth of the market in the country.

GLP-1 Analogues Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the GLP-1 analogues market growth during the forecast period. Market participants are also undertaking a variety of strategic activities, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations, to expand their global footprint. To expand and survive in a more competitive and rising market climate, the market players must offer cost-effective items.

In recent years, the GLP-1 analogues industry has offered some technological advancements. A few major players in the market are AstraZeneca; Bristol-Myers Squibb Company; D&D Pharmatech; Eccogen; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Hanmi Pharm. Co., Ltd.; Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Novo Nordisk A/S; and Sanofi.

AstraZeneca PLC is a biopharmaceutical company that researches, develops, manufactures, and sells prescription drugs. The company's products include tagrisso, lynparza, imfinzi, calquence, orpathys, truqap, enhertu, zoladex, and others. In November 2023, AstraZeneca and Eccogene signed an exclusive license agreement for ECC5004, an investigational oral once-daily GLP-1RA for treating obesity, type 2 diabetes, and other cardiometabolic conditions.

Glenmark Pharmaceuticals Limited is engaged in the development, manufacturing, and marketing of pharmaceutical products across various regions, including India, North America, Latin America, Europe, Japan, and internationally. The company provides branded and generic formulations in therapeutic areas such as dermatology, respiratory, and oncology, along with a range of active pharmaceutical ingredients. For instance, in January 2024, Glenmark Pharmaceuticals Ltd. launched a biosimilar of the popular anti-diabetic drug Liraglutide in India, marketing it as Lirafit after obtaining approval from the Drug Controller General of India (DCGI).

Key Companies in GLP-1 Analogues Market

- AstraZeneca

- Bristol-Myers Squibb Company

- D&D Pharmatech

- Eccogen

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Hanmi Pharm. Co., Ltd.

- Lexicon Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Novo Nordisk A/S

- Sanofi

GLP-1 Analogues Industry Developments

In November 2023, Eli Lilly 's Zepbound (tirzepatide) received the US Food and Drug Administration (FDA) approval for chronic weight management. It represents a potent new treatment option for individuals affected by obesity or overweight and weight-related medical issues.

In May 2023, the FDA approved Mounjaro (tirzepatide) injection by Eli Lilly and Company for adults suffering from type 2 diabetes to improve glycemic control. The drug is not intended for use in patients with type 1 diabetes or a history of pancreatitis.

In September 2019, Novo Nordisk received approval from the FDA for Rybelsus (semaglutide tablets) as an adjunct to diet and exercise for improving glycaemic control in adults having type 2 diabetes mellitus.

GLP-1 Analogues Market Segmentation

By Route of Administration Outlook

- Subcutaneous Route

- Oral Route

By Product Outlook

- Ozempic

- Trulicity

- Mounjaro

- Wegovy

- Rybelsus

- Saxenda

- Victoza

- Zepbound

- Other Products

By Application Outlook

- Type 2 Diabetes Mellitus

- Obesity

- Others Applications

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

GLP-1 Analogues Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.70 billion |

|

Market Size Value in 2025 |

USD 56.62 billion |

|

Revenue Forecast by 2034 |

USD 322.85 billion |

|

CAGR |

21.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global GLP-1 analogues market size was valued at USD 46.70 billion in 2024.

The global market is projected to register a CAGR of 21.3% during 2025–2034.

North America accounted for the largest share of the global market as it has the highest rates of diabetes and obesity in the world.

A few key players in the market are AstraZeneca; Bristol-Myers Squibb Company; D&D Pharmatech; Eccogen; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Hanmi Pharm. Co., Ltd.; Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Novo Nordisk A/S; and Sanofi.

The ozempic segment dominated the market in 2024 due to its effectiveness in controlling blood glucose levels in patients affected by type 2 diabetes.

The online pharmacies segment accounted for the largest share of the global market in 2024 due to its unparalleled convenience, allowing patients to order their medications from the comfort of their homes.