Wood Plastic Composites Market Share, Size, Trends, Industry Analysis Report, By Application (Building & Construction Products, Automotive Components, Industrial & Consumer Goods, Others); By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1287

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

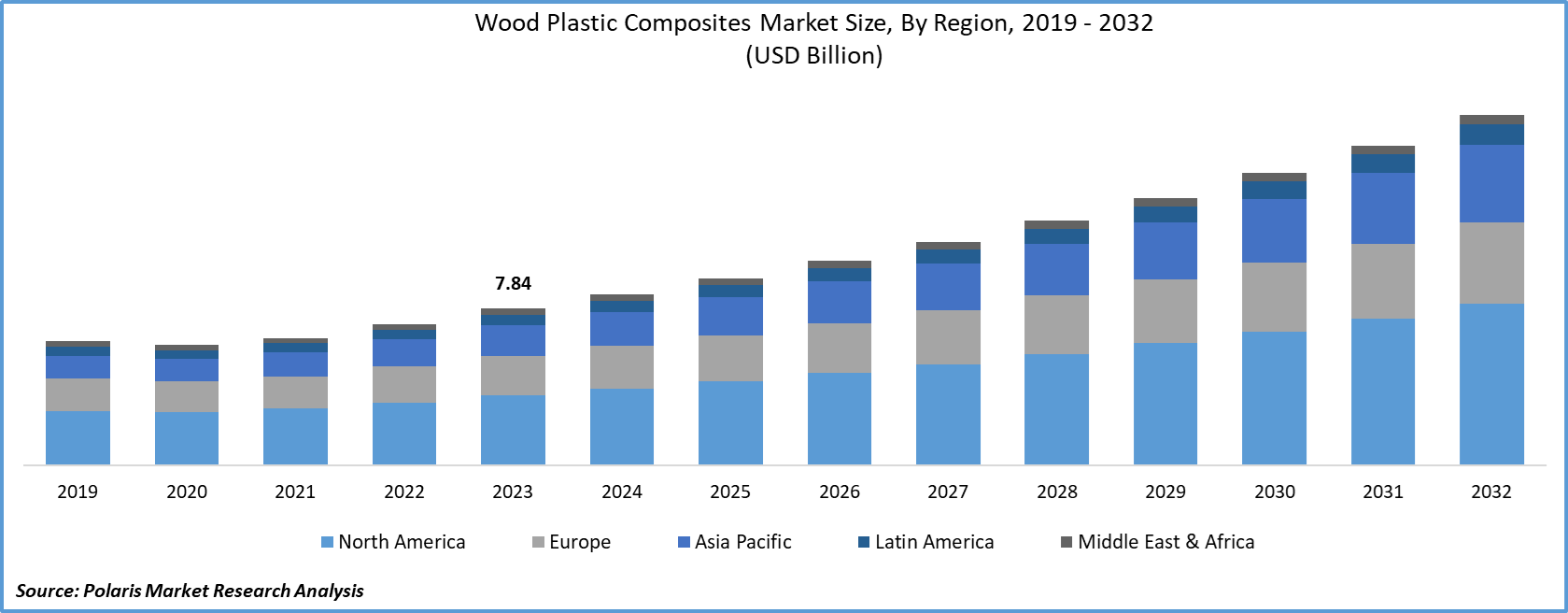

The global wood plastic composites market size was valued at USD 7.84 billion in 2023. The market is anticipated to grow from USD 8.57 billion in 2024 to USD 17.54 billion by 2032, exhibiting the CAGR of 9.4% during the forecast period.

A wood plastic composite is a material made from a mixture of natural wood and plastic fibers. It is made from recycled plastic and discarded wood. It has replaced natural wood and is sustainable.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Wood Plastic Composites Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Know more about this report: Request for sample pages

It is created by mixing plastic powder with waste materials from various projects, including sawdust, bamboo, pulp, peanut hulls, and unused woodworking materials. It is widely used in outdoor decking floors, cornices, railings, fences, outdoor landscapes, cladding, door and window frames, indoor and outdoor furniture, etc.

It is a natural composite that is environmentally friendly. It is used for indoor and outdoor use owing to its durability and resistance. It has some advantages, including being high-strength, easy to clean, resistant to ultraviolet rays, slip-resistant, and very good material when used as deck flooring, weather-resistant, and many others. They are produced using recycled plastics at low melting temperatures and at low cost.

The novel coronavirus has spread quickly across international borders and is still doing so. It had a significant impact on people's lives as well as the community at large. It started out as a human health crisis but has since become a serious threat to global trade, the financial system, and the economy.

Originating as a crisis for human health, it now poses a substantial threat to worldwide trade, the economy, and finance. Amid a pandemic, people were not capable of spending more, which impacted the construction industry, lowering demand for the material and hindering industry growth. It negatively impacted the manufacturing, delivery schedules, and sales of products in the global market.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising prevalence of construction works and the automotive sector is the main factor fueling the expansion of the wood plastic composites market. Furthermore, it is economical and has various advantages compared to their alternative option, which is available in the market.

However, because they are robust, water-resistant, low-maintenance, rust-free, and can withstand high temperatures, it is also used for automobile interiors, home furnishings, interior decoration, and household appliances. As a result, such factors have driven a higher demand worldwide for the industry.

In addition, urbanization and industrialization are driving the market in the forecasted period. The materials used in this composite can be used for various tasks and are made of premium, high-quality wood. As a result, the market for wood components is suffering. Additionally, greenwood polymers are expected to offer new growth opportunities for the industry. The popularity of eco-friendly composites is on the rise. Henceforth, there is an increase in demand for environmentally conscious composite materials in various applications.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Polyethylene segment is expected to witness fastest growth.

In 2021, the polyethylene segment accounted for the largest revenue share in the wood plastic composites market. One of the most widely used plastics in the world is polyethylene, also referred to as polyethylene or polyethylene. It is abbreviated as PEX. Additional polymers known as polyethylenes typically have a linear structure. The primary use of these synthetic polymers is in packaging. Additionally, it is often used to make bottles, plastic bags, containers, plastic films, and geomembranes.

Due to their numerous benefits, including biodegradability, low density, low cost, high stiffness, and the availability of renewable natural resources, polyethylene composites have also garnered much interest in the research and industrial fields.

Building and construction accounted for the second-largest market share in 2021

It is anticipated that during the forecast period, the building and construction segment will hold the second-largest market share in the global market. During the forecast period, thus materials are expected to be used more frequently in construction and building applications due to their exceptional mechanical strength, reduced weight, and energy efficiency properties.

Among the applications for wood-plastic composite cladding are garden greenery, expanded living areas, and the replacement of stone-based characteristics on residence decks with kitchens, eateries, and furniture. In addition, the rapid infrastructure development in emerging economies and a growing desire for aesthetically pleasing flooring and furniture are driving the growth of the industry.

The demand in Asia Pacific is expected to witness significant growth

Asia Pacific is estimated to hold the highest CAGR in the wood plastic composites market during the forecast period. There are a number of nations in the region, including Australia, China, India, South Korea, Japan, and the rest of Asia-Pacific. The region's expansion is primarily attributable to the rapid economic development of nearby developing nations like China, Malaysia, Indonesia, and India.

It is associated with rising industrial growth and consumer spending power. Additionally, the shift in consumer behavior in China and India toward a more realistic home appearance, heightened competition in the market, fragmented distribution, and an increase in the proportion of dual-income households create lucrative positions for industry players.

The market for wood-plastic composites will expand in these nations thanks to government initiatives to support manufacturing growth. As a result of economic reforms, construction activity and individual per capita incomes have increased in Asian countries like India, China, and Japan.

The rising demand is mainly due to industrial development. The market has developed industries related to urbanization, expansion, and construction. After North America, Europe is the market with the world's highest urbanization rate. There is more opportunity for these regions during the forecast period because Europe is home to several automotive behemoths, which increases demand.

Competitive Insight

Some of the major players operating in the global market include., Seven Trust., Advanced Environmental Recycling Technologies, Inc. (AERT)., Meghmani Group, Teknor Apex Co., UFP Industries, Inc., Josef Ehrler GmbH & Co KG., Croda International Plc., CertainTeed, AIMPLAS, TAMKO Building Products, Trex Company, Inc., Axion International Inc., TimberTech, Fiberon LLC, Dow.

Recent Developments

- August 2018: The BSW Group bought Alvic Plastics Limited. With this new agreement, BSW would be able to increase both its product offering and production capabilities. Additionally, it would allow the business to diversify and broaden its product offering.

- August 2019: Dow introduced the AMPLIFY Si Silicone Enhanced Polymer Systems (SEPS), a hybrid silicone-polyethene system that improves performance and reduces landfill waste. In addition to the AMPLIFY Si PE 1000, Dow launched another product under the upgraded SEPS platform.

- February 2021: Teknor Apex Co., a plastic compounding company, introduced the incredibly weatherable complex for external coatings of material decks. Wood-plastic composite flooring, which combines wood dust and polyolefin plastics, is becoming more popular in older, treated wood. By extending their lifespan, requiring less maintenance, and improving their appearance, an innovative compound gives the material a significant advantage over wood.

- January 2023: UFP Retail Solutions showcased new product innovations at IBS 2023. It included products from two leading brands, Deckorators and UFP-Edge.

- September 2023: UFP Global Holdings Ltd. announced the acquisition of controlling interest in Palets Suller Group. Palets Suller is a leader in machine-built wood pallets, serving the region’s ceramic tile industry as well as other sectors.

Wood Plastic Composites Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.57 billion |

|

Revenue forecast in 2032 |

USD 17.54 billion |

|

CAGR |

9.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Seven Trust., Advanced Environmental Recycling Technologies, Inc. (AERT)., Meghmani Group, Teknor Apex Co., UFP Industries, Inc., Josef Ehrler GmbH & Co KG., Croda International Plc., CertainTeed, AIMPLAS, TAMKO Building Products, Trex Company, Inc., Axion International Inc., TimberTech, Fiberon LLC, Dow |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports:

Laboratory Freezers Market Size, Share 2024 Report

Single-Use Bioreactors Market Size, Share 2024 Report

Amniotic Products Market Size, Share 2024 Report

Protein Characterization And Identification Market Size, Share 2024 Report