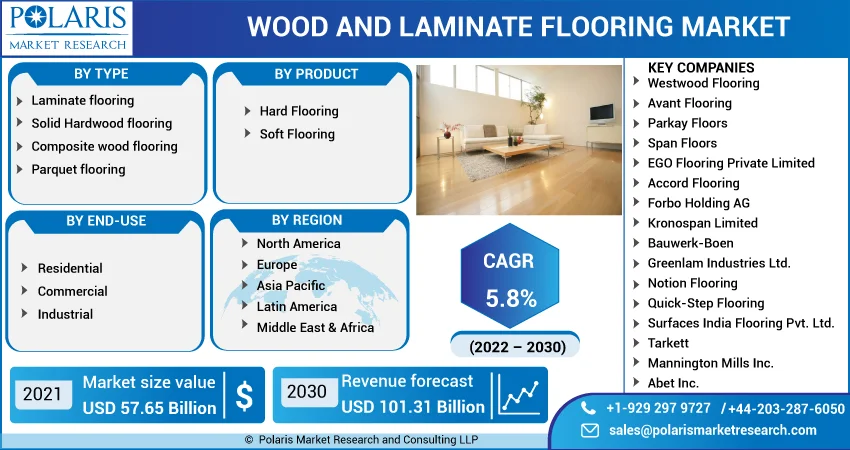

Wood and Laminate Flooring Market Share, Size, Trends, Industry Analysis Report, By Product (Hard Flooring, Soft Flooring), By End-Use (Residential, Commercial, Industrial), By Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 116

- Format: PDF

- Report ID: PM1290

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

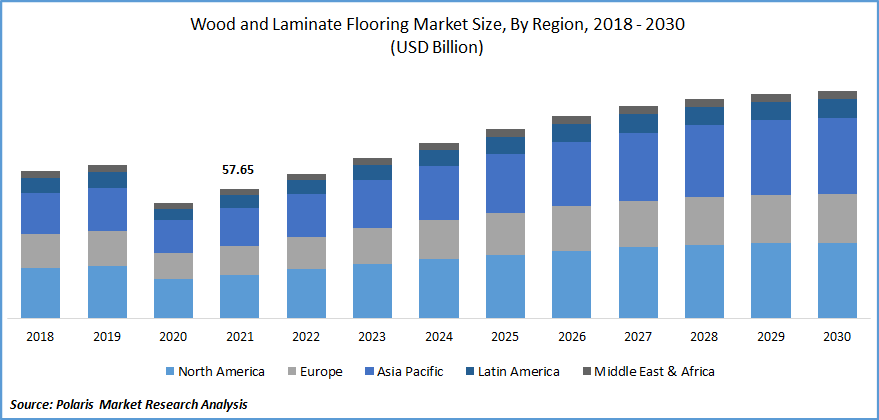

The global wood and laminate flooring market was valued at USD 57.65 billion in 2021 and is expected to grow at a CAGR of 5.8% during the forecast period. The global market has grown rapidly due to advanced designs, easy installation, and relatively easy maintenance.

Know more about this report: Request for sample pages

In addition, high-Pressure Laminates (HPL) maximize operating efficiency over time by providing higher quality, enduring durability, and reduced maintenance costs. The product's eco-friendly flooring option benefits laminate flooring as well. The textural advantage is becoming one of the factors in fueling their sales among the upscale consumer community.

It is a material made from a mixture of natural timber and plastic fibers. It is a natural composite that is environmentally friendly. It is used for indoor and outdoor use owing to its durability and resistance. It has some advantages, including being high-strength, easy to clean, resistant to ultraviolet rays, slip-resistant, and perfect material when used as deck flooring, weather-resistant, and many others. These are produced using recycled plastics at low melting temperatures and at low cost.

In addition, it is made from waste wood and recyclable plastic. It is sustainable and has taken the place of actual wood. A synthetic floor solution called laminate flooring is made to resemble stone or, occasionally, flooring. It has always been a preferred option among DIY enthusiasts. In addition, laminate flooring is a less expensive option. As flooring plays a significant role in enhancing the appearance of homes and other spaces, wood-based flooring and laminate flooring have experienced high demand in the forecast period.

Covid-19 has impacted the industry to a certain extent. It significantly affected both the lives of individuals and businesses. It began as a catastrophe affecting human health but has now become a significant threat to international trade, the financial system, and the economy.

During a pandemic, people could not spend more, which impacted the construction and logistic industries, lowered the demand, and hindered industry growth. It negatively impacted the manufacturing, delivery schedules, and sales of products in the industry.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

High adoption of premium flooring works and cost-effective product is the main factor fueling the expansion of the wood and laminate flooring market. Furthermore, it is economical and has various advantages compared to their alternative option, which is available in the industry. However, because they are robust, water-resistant, low-maintenance, rust-free, and can withstand high temperatures, they are also used for hotels, villas, home furnishings, commercial complexes, etc.

Due to its affordability, low maintenance requirements, and ability to resist high traffic, laminate flooring is likely to be adopted by a sizable portion of the commercial sector, including hotels, cafes, theatres, museums, sporting venues, and executive offices. Future industry development is predicted to take new paths because of rising construction projects in numerous nations. It will lead the industry to growth in the forecast period. As a result, such factors have driven a higher demand for wood and laminate flooring market.

Report Segmentation

The market is primarily segmented based on type, product, end use, and region.

|

By Type |

By Product |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Laminate Flooring Segment is Expected to Witness Fastest Growth

In 2021, the laminate flooring segment accounted for the largest revenue share in wood and laminate flooring market. In order to manufacture laminate flooring, a high-density fiberboard core is used, along with a moisture-resistant bottom layer and a photograph of natural timber that is protected with an overlay. This is one of the most widely used flooring materials in the world due to its many advantages.

The material has a higher resale value, looks more natural than natural wood, and is more comfortable to walk on. Nonetheless, it is less efficient in moist environments due to its low moisture resistance. Due to their many benefits, easy to clean, soft and comfortable, low cost, and high stiffness give the edge over other products. But also, It is cheaper than others, but also it is harder to repair.

Soft Flooring Accounted for the Second-Largest Market Share in 2021

Soft flooring segment will hold the second-largest market share in the global market. It is highly flexible layer reduces footfalls and dampens the noise to a great extent in comparison to hard floors. It is quite popular and widely used as it provides a high level of comfort. During the forecast period, soft flooring is expected to be used more frequently and drive industry growth.

Among the applications for the industry, flooring cladding is garden greenery, expanded living areas, and the replacement of stone-based characteristics on residence decks with kitchens, eateries, and furniture. In addition, the rapid infrastructure development in emerging economies and a growing desire for aesthetically pleasing flooring and furniture are driving the growth of soft flooring.

The Residential Segment is Expected to Witness the Fastest Growth

As the world’s population is increasing and living standards have risen, particularly in emerging economies, the demand for contemporary housing has surged, greatly boosting the market’s growth. Additionally, it is anticipated that an increase in residential building floor replacement and renovation activities will raise demand in the residential end-use market.

The increasing construction activity will further accelerate the growth rate of the laminate flooring industry. The industry’s expansion is also anticipated to be aided by the growing use of laminate flooring to mimic other materials, including tiles, stones, and wood.

The Demand in Asia Pacific is Expected to Witness Significant Growth

Asia-Pacific is estimated to hold the highest CAGR in the market during the forecast period. The region’s expansion is primarily attributable to the rapid economic development of nearby developing nations like China, Malaysia, Indonesia, and India. It is associated with an increase in the construction of residential buildings and commercial complexes and consumer spending power.

Additionally, the shift in consumer behavior in China and India toward a more realistic home appearance, heightened competition in the industry, fragmented distribution, and an increase in the proportion of dual-income households create lucrative positions for industry players. The wood and laminate flooring market will expand in these nations thanks to government initiatives to support manufacturing growth. As a result of economic reforms, construction activity and individual per capita incomes have increased in Asian countries like India, China, and Japan.

The rising demand is mainly due to industrial development. It was an early adopter of the industry benefits from the leading player’s expansion. The industry has developed industries related to urbanization, expansion, and construction. After North America, Europe is the market with the world’s highest urbanization rate.

Competitive Insight

There are several major players in the global market, such as Westwood Flooring, Avant Flooring, Parkay Floors, Span Floors, EGO Flooring, Accord Flooring, Forbo Holding, Kronospan Limited, Bauwerk-Boen, Greenlam Industries, Notion Flooring, Quick-Step Flooring, Surfaces India Flooring, Tarkett, Mannington Mills, and Abet Inc.

Recent Developments

In May 2022, Bauwerk Group acquired Somerset Hardwood Flooring. The company culture and product assortment complement Bauwerk Group’s offering. It has tremendous potential for the future. The two companies' highly complementary natures serve as a defining feature of the merger. In the USA, Somerset Hardwood Flooring has a strong presence in the necessary sales channels, a well-established brand, and a dominant market position.

In April 2021, an exciting and innovative range of 3-in-1 laminate flooring was unveiled by Span Floors, an Indian manufacturer of wooden flooring. It is made at a cutting-edge facility in Europe and has a premium natural wood look and feel. This will enable the business to increase its market share.

Wood and Laminate Flooring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 57.65 billion |

|

Revenue forecast in 2030 |

USD 101.31 billion |

|

CAGR |

5.8% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Product, By End User By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Westwood Flooring, Avant Flooring, Parkay Floors, Span Floors, EGO Flooring Private Limited, Accord Flooring, Forbo Holding AG, Kronospan Limited, Bauwerk-Boen, Greenlam Industries Ltd., Notion Flooring, Quick-Step Flooring, Surfaces India Flooring Pvt. Ltd., Tarkett, Mannington Mills Inc., Abet Inc. |