Specialty Generic Drugs Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Oncology, Inflammatory Conditions, Multiple Sclerosis, Hepatitis C, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 115

- Format: PDF

- Report ID: PM1215

- Base Year: 2024

- Historical Data: 2020-2023

Specialty Generic Drugs Market Overview

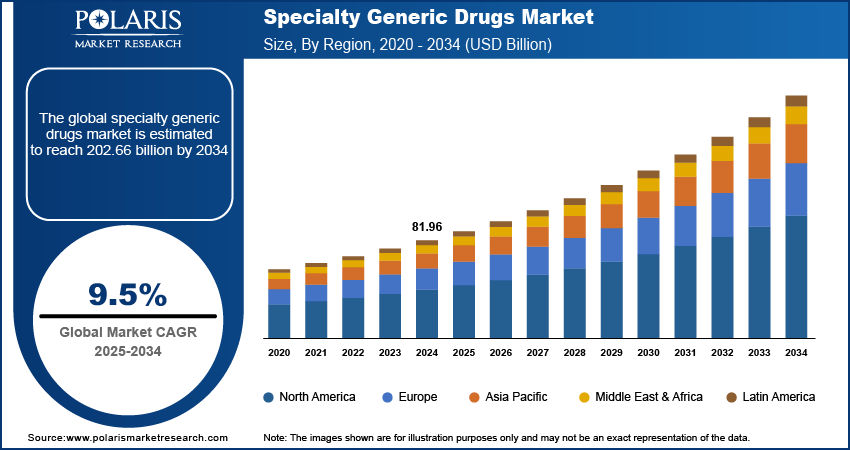

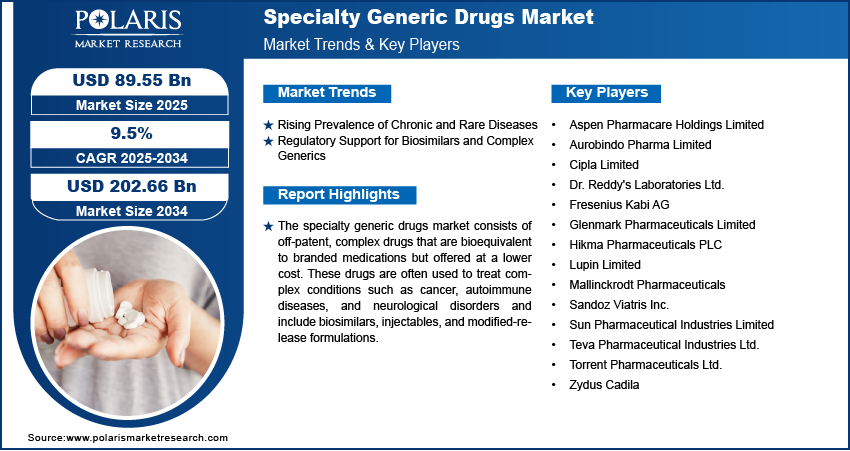

The specialty generic drugs market size was valued at USD 81.96 billion in 2024. The market is projected to grow from USD 89.55 billion in 2025 to USD 202.66 billion by 2034, exhibiting a CAGR of 9.5% during 2025–2034.

The specialty generic drugs market consists of off-patent specialty medications that are more complex than traditional generics, including biologics, injectables, and modified-release formulations. These drugs offer cost-effective alternatives to branded specialty drugs, addressing conditions such as cancer, autoimmune disorders, and rare diseases. Key market drivers include the increasing prevalence of chronic and rare diseases, rising healthcare costs, and the growing demand for affordable treatment options. Regulatory support for biosimilars and complex generics is also facilitating market growth. Specialty generic drugs market trends shaping the market include advancements in drug formulations, expanding pipeline of specialty generics, and increasing competition among manufacturers aiming to reduce drug prices while maintaining therapeutic efficacy.

To Understand More About this Research: Request a Free Sample Report

Specialty Generic Drugs Market Dynamics

Rising Prevalence of Chronic and Rare Diseases

The increasing incidence of chronic diseases such as cancer, autoimmune disorders, and neurological conditions is propelling the specialty generic drugs market demand. According to the World Health Organization (WHO), cancer accounted for nearly 10 million deaths in 2020, with cases expected to rise due to aging populations and lifestyle factors. Similarly, autoimmune diseases, including rheumatoid arthritis and multiple sclerosis, affect millions globally, leading to higher demand for cost-effective treatment options. Specialty generic drugs provide a more affordable alternative to branded specialty drugs, helping to improve patient access and reduce the economic burden of these diseases.

Regulatory Support for Biosimilars and Complex Generics

Regulatory agencies are facilitating the entry of specialty generic drugs through streamlined approval pathways, particularly for biosimilars and complex generics. The U.S. Food and Drug Administration (FDA) has implemented initiatives such as the Biosimilar Action Plan to accelerate the approval of biosimilars, leading to increased competition and lower prices. As of 2023, the FDA has approved more than 40 biosimilars, significantly reducing costs for biologic treatments. Similarly, the European Medicines Agency (EMA) has been proactive in providing regulatory clarity for complex generics. These regulatory efforts are expected to enhance the accessibility and affordability of these drugs, driving further adoption of specialty generic drugs.

Specialty Generic Drugs Market Segment Insights

Specialty Generic Drugs Market Assessment by Application

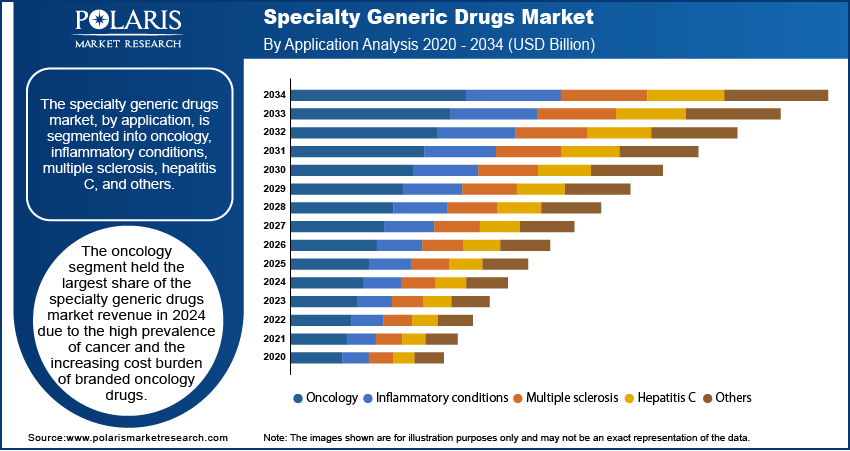

The specialty generic drugs market, by application, is segmented into oncology, inflammatory conditions, multiple sclerosis, hepatitis C, and others. The oncology segment dominated the market share in 2024, driven by the high prevalence of cancer and the increasing cost burden of branded oncology drugs. According to the World Health Organization (WHO), cancer cases are projected to reach 30 million annually by 2040, necessitating cost-effective treatment options. Specialty generic drugs in oncology, including biosimilars for monoclonal antibodies and chemotherapy agents, are gaining adoption as healthcare systems focus on reducing expenditures. Additionally, regulatory approvals for oncology biosimilars, such as trastuzumab and bevacizumab, have increased competition, leading to price reductions and greater accessibility.

The multiple sclerosis segment is registering the fastest growth due to advancements in disease-modifying therapies and the expiration of patents on key biologics. The increasing incidence of multiple sclerosis, with over 2.8 million people affected globally, according to the Multiple Sclerosis International Federation, is driving demand for affordable treatment alternatives. The approval of biosimilar versions of drugs such as natalizumab is expanding patient access, while ongoing research into novel formulations is further supporting market expansion. Additionally, healthcare policies promoting biosimilar adoption in key regions, including North America and Europe, are accelerating growth in the segment.

Specialty Generic Drugs Market Evaluation by End Use

The specialty generic drugs market, by end use, is segmented into specialty pharmacy, retail pharmacy, and hospital pharmacy. The specialty pharmacy segment held the largest share in 2024, driven by the increasing demand for high-touch patient care and the management of complex therapies. Specialty pharmacies play a critical role in dispensing specialty generics, particularly for conditions such as cancer, autoimmune disorders, and multiple sclerosis, where patient support programs and adherence monitoring are essential. The expansion of specialty pharmacy networks, coupled with payer-driven initiatives to control specialty drug spending, is further strengthening the segment’s dominance. Additionally, strategic collaborations between manufacturers and specialty pharmacies are contributing to segment dominance.

The hospital pharmacy segment is registering the fastest growth, supported by the rising adoption of specialty generics in inpatient settings for critical care treatments. Hospitals are increasingly incorporating specialty generics into their formularies to reduce procurement costs and enhance affordability for patients requiring long-term therapies. The growing prevalence of hospital-administered biologics and injectables, particularly for oncology and immunology, is further driving demand. Additionally, regulatory efforts promoting biosimilar use within hospitals, along with reimbursement policies favoring cost-effective treatment alternatives, are accelerating growth in this segment.

Specialty Generic Drugs Market Regional Outlook

By region, the report provides specialty generic drugs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the specialty generic drugs market share in 2024 due to high healthcare expenditures, favorable regulatory policies, and the strong presence of key market players. The US, in particular, accounts for a significant portion of the market due to the increasing adoption of biosimilars and complex generics, supported by the U.S. Food and Drug Administration (FDA) initiatives such as the Biosimilar Action Plan. The growing burden of chronic diseases, including cancer and autoimmune disorders, is further driving demand for cost-effective specialty generic drugs. Additionally, payer-driven cost containment measures and the expansion of specialty pharmacy networks are accelerating specialty generic drugs market expansion in the region.

The Europe specialty generic drugs market is estimated to grow at a rapid pace in the coming years, owing to strong regulatory support for biosimilars and cost-containment initiatives by healthcare systems. The European Medicines Agency (EMA) has established clear guidelines for biosimilar approval, leading to increased market penetration of specialty generic drugs. Countries such as Germany, the UK, and France are key contributors to the market growth, with well-established reimbursement frameworks encouraging the adoption of cost-effective alternatives to branded specialty drugs. Additionally, government-led initiatives promoting generic substitution and price control measures are further accelerating market growth. The rising prevalence of chronic diseases, particularly cancer and autoimmune disorders, continues to drive demand for specialty generics across the region.

The Asia Pacific specialty generic drugs market is experiencing the fastest growth, supported by expanding healthcare infrastructure, increasing generic drug production, and regulatory advancements. The market in countries such as China, India, and Japan is growing rapidly due to rising healthcare expenditures and the growing burden of chronic diseases. India, a major pharmaceutical manufacturing hub, is strengthening its position in the specialty generics sector with the production of cost-effective biosimilars and complex generics for both domestic and international markets. Additionally, regulatory agencies in the region are streamlining approval processes to enhance accessibility and affordability. The increasing presence of multinational pharmaceutical companies and rising investments in research and development are further supporting specialty generic drugs market expansion.

Specialty Generic Drugs Market – Key Players and Competitive Insights

The specialty generic drugs market comprises several key players actively contributing to its growth and development. Teva Pharmaceutical Industries Ltd., headquartered in Israel, is recognized as the world's largest generic pharmaceutical manufacturer, producing approximately 76 billion tablets and capsules annually. Sun Pharmaceutical Industries Limited, based in India, stands as the fourth-largest specialty generic pharmaceutical company globally, offering a diverse range of products across multiple therapeutic segments. Sandoz, a division of Novartis, operates as a global leader in generic pharmaceuticals and biosimilars, providing a broad portfolio of specialty generics. Viatris Inc. formed through the merger of Mylan and Upjohn, focuses on providing access to medicines, including a significant portfolio of specialty generics. Mallinckrodt Pharmaceuticals' Specialty Generics business unit is noted as the largest domestic producer of active pharmaceutical ingredients in the US.

Fresenius Kabi, a global healthcare company, specializes in lifesaving medicines and technologies, including a substantial range of specialty generic injectables. Aurobindo Pharma Limited, an Indian multinational, offers a wide array of specialty generics, particularly in the areas of antibiotics and antiretrovirals. Cipla Limited, also based in India, is renowned for its extensive portfolio of specialty generic products, with a strong emphasis on respiratory and oncology therapies. Aspen Pharmacare Holdings Limited, headquartered in South Africa, provides specialty generics across various therapeutic areas, including anesthetics and thrombosis. Dr. Reddy's Laboratories Ltd., an Indian pharmaceutical company, delivers a diverse range of specialty generics, focusing on areas such as gastroenterology and cardiovascular diseases. Lupin Limited, another Indian firm, offers specialty generics with a significant presence in the cardiovascular and respiratory segments. Zydus Cadila, part of Cadila Healthcare Limited, provides a broad spectrum of specialty generics, including biosimilars and complex formulations. Hikma Pharmaceuticals PLC, based in the UK, supplies specialty generics, particularly injectable products, across various therapeutic areas. Torrent Pharmaceuticals Ltd., an Indian company, focuses on specialty generics in the cardiovascular and central nervous system segments. Glenmark Pharmaceuticals Limited, also from India, offers a range of specialty generics, with a focus on dermatology and oncology.

In the competitive landscape, these companies leverage their extensive research and development capabilities, global distribution networks, and strategic partnerships to enhance their market positions. For instance, Teva Pharmaceutical Industries Ltd. maintains a significant market share through its vast production capacity and comprehensive product portfolio. Sun Pharmaceutical Industries Limited's diverse therapeutic offerings and strong presence in emerging markets contribute to its competitive edge. Sandoz's integration within Novartis provides it with substantial resources for innovation and market expansion. Viatris Inc.'s formation through the merger of Mylan and Upjohn has enabled it to combine strengths and expand its specialty generic offerings. Mallinckrodt Pharmaceuticals' focus on active pharmaceutical ingredients positions it uniquely within the supply chain. Overall, these companies' strategic initiatives and operational strengths play crucial roles in shaping the specialty generic drugs market.

Teva Pharmaceutical Industries Ltd., headquartered in Petah Tikva, Israel, is one of the largest generic drug manufacturers globally. Founded in 1901, Teva specializes in developing, manufacturing, and marketing generic medicines, specialty pharmaceuticals, over-the-counter (OTC) products, and active pharmaceutical ingredients (APIs). The company operates across North America, Europe, and international markets, reaching nearly 200 million people daily. Its product portfolio includes a wide range of dosage forms, such as tablets, capsules, injectables, liquids, inhalants, ointments, and creams. Teva also offers branded specialty medicines targeting central nervous system (CNS) disorders, respiratory diseases, cancer, and women’s health.

Sun Pharmaceutical Industries Limited is one of the largest pharmaceutical companies globally and the major generic drug manufacturer in India. Founded in 1983, the company has expanded its presence across over 100 countries, offering a wide range of pharmaceutical products, including specialty, generics, over-the-counter (OTC), and active pharmaceutical ingredients (APIs). Sun Pharma specializes in developing, manufacturing, and marketing high-quality, affordable medicines across therapeutic areas such as neurology, cardiology, psychiatry, dermatology, gastroenterology, and ophthalmology. The company has a strong focus on specialty and complex generics, which include differentiated formulations and difficult-to-manufacture drugs that require advanced research and development (R&D) capabilities. Its specialty drug portfolio includes innovative treatments in dermatology, ophthalmology, and oncology, with products such as Ilumya, Cequa, and Odomzo.

List of Key Companies in Specialty Generic Drugs Market

- Aspen Pharmacare Holdings Limited

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Fresenius Kabi AG

- Glenmark Pharmaceuticals Limited

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Mallinckrodt Pharmaceuticals

- Sandoz

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

- Zydus Cadila

Specialty Generic Drugs Industry Developments

- December 2022: Amneal Pharmaceuticals, Inc. announced that it has successfully launched 26 new generic products in 2022, including 8 new generic products in the fourth quarter of 2022.

- August 2022: Amneal Pharmaceuticals, Inc. announced that it has received Abbreviated New Drug Application (ANDA) approval from the US Food and Drug Administration for four generic products, including vasopressin injection 1mL (single-dose).

Specialty Generic Drugs Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Injectables

- Oral Drugs

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Oncology

- Inflammatory Conditions

- Multiple Sclerosis

- Hepatitis C

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Specialty Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Generic Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 81.96 billion |

|

Market Value in 2025 |

USD 89.55 billion |

|

Revenue Forecast by 2034 |

USD 202.66 billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The specialty generic drugs market has been broadly segmented on the basis of type, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The specialty generic drugs market growth and marketing strategies focus on expanding product portfolios, increasing market penetration, and enhancing distribution channels. Companies are prioritizing the development of biosimilars and complex generics, driven by patent expirations of high-cost branded drugs. Strategic partnerships and collaborations with healthcare providers, payers, and specialty pharmacies are crucial for expanding access to these drugs. Additionally, firms are investing in research and development to improve the formulation and delivery of generics, ensuring that they meet evolving regulatory standards and patient needs. Marketing efforts also emphasize cost-effectiveness and patient access to encourage widespread adoption.

FAQ's

The specialty generic drugs market size was valued at USD 81.96 billion in 2024 and is projected to grow to USD 202.66 billion by 2034.

The market is projected to register a CAGR of 9.5% during the forecast period.

North America accounted for the largest share of the market in 2024.

The specialty generic drugs market comprises several key players such as Aspen Pharmacare Holdings Limited, Aurobindo Pharma Limited, Cipla Limited, Dr. Reddy's Laboratories Ltd., Fresenius Kabi AG, Glenmark Pharmaceuticals Limited, Hikma Pharmaceuticals PLC, Lupin Limited, Mallinckrodt Pharmaceuticals, Sandoz, Sun Pharmaceutical Industries Limited, Teva Pharmaceutical Industries Ltd., Torrent Pharmaceuticals Ltd., Viatris Inc., and Zydus Cadila.

The oncology segment accounted for the largest share of the market in 2024.

The specialty pharmacy segment accounted for the largest share of the market in 2024.

Specialty generic drugs are off-patent medications that are more complex than traditional generic drugs, often involving biologics, injectables, or modified-release formulations. These drugs are designed to treat complex or chronic conditions such as cancer, autoimmune diseases, and neurological disorders. Specialty generics are bioequivalent to their branded counterparts but are typically offered at a lower cost, providing an affordable alternative while maintaining therapeutic efficacy. They often require specialized manufacturing processes and regulatory approvals, such as biosimilars (generic versions of biologic drugs). These drugs aim to increase access to life-saving therapies while reducing overall healthcare costs.

A few key trends in the market are described below: Growth in Biosimilars: Increasing adoption of biosimilars as alternatives to expensive biologic drugs. Regulatory Support: Favorable policies from regulatory bodies such as the FDA and EMA to accelerate the approval of specialty generics and biosimilars. Advancements in Drug Formulations: Development of more complex generics, including injectables and modified-release formulations, to treat a broader range of diseases. Cost-Containment Focus: Growing emphasis on reducing healthcare costs by encouraging the use of specialty generics over branded drugs.

A new company entering the specialty generic drugs market could focus on developing biosimilars and complex generics in high-demand therapeutic areas such as oncology, autoimmune diseases, and neurological disorders, where the market is growing rapidly. Additionally, investing in innovative drug formulations, such as injectables and modified-release versions, could offer a competitive edge. Emphasizing patient support programs and forming strategic partnerships with healthcare providers and specialty pharmacies can improve market access and visibility. Moreover, leveraging cost-efficient manufacturing technologies and adhering to evolving regulatory standards would help ensure product quality and compliance while keeping costs competitive. Focus on emerging markets with expanding healthcare infrastructure could further drive growth opportunities.

Companies manufacturing, distributing, or purchasing specialty generic drugs and related products and other consulting firms must buy this report.