Soda Ash Market Share, Size, Trends, Industry Analysis Report, By Density (Light, Dense); By End-Use (Glass & Ceramics, Soaps & Detergents, Paper & Pulp, Metallurgy, Chemicals, Water Treatment, Others); By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1149

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

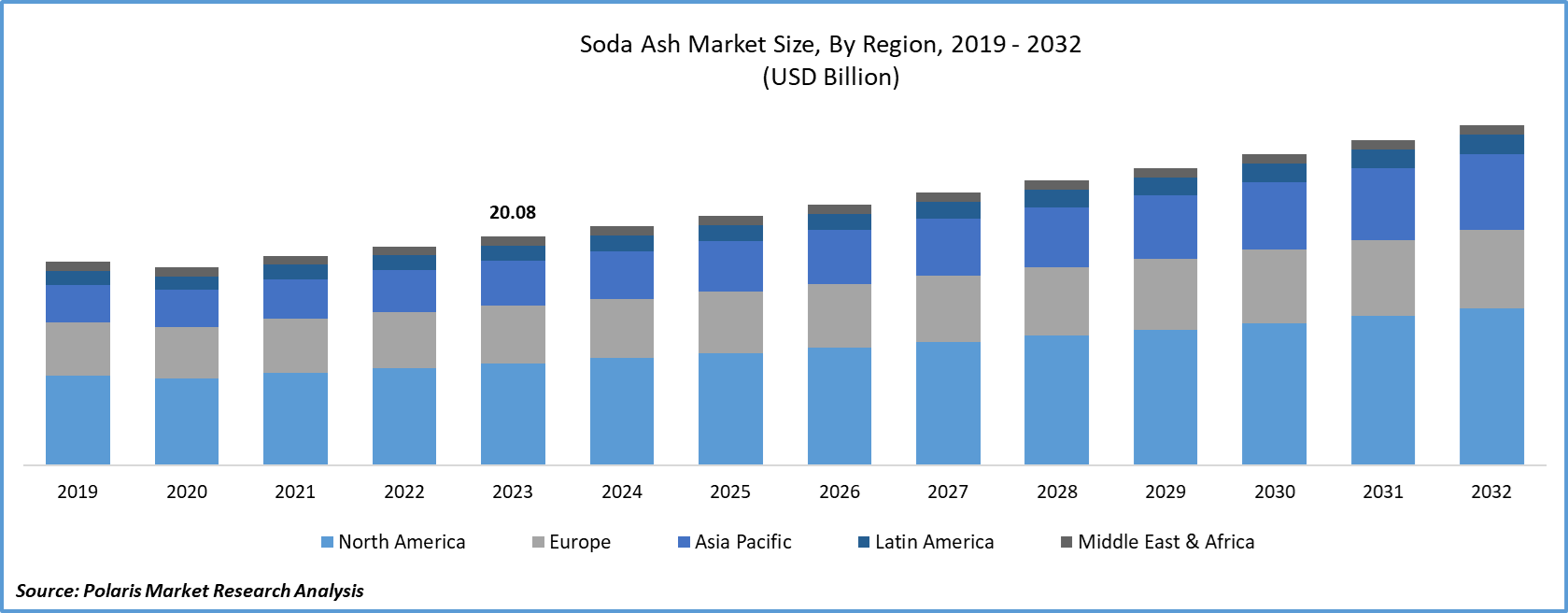

The global soda ash market size was valued at USD 20.08 billion in 2023. The market is anticipated to grow from USD 20.96 billion in 2024 to USD 29.79 billion by 2032, exhibiting the CAGR of 4.5% during the forecast period.

The use of the industry as an essential material in glass production, mainly the flat glass and container glass coating, has driven the growth of the industry.

Know more about this report: Request for sample pages

It is seeing rapid growth in usage to manufacture soda-lime-silica glass, flat glass for (automotive and construction) and glass containers (food and drink), among other glass industries. Therefore, demand for flat glass for the housing, automotive, and commercial building industries and container glass for consumer products has driven demand for the industry.

During the Covid-19 pandemic, the demand for the industry declined significantly owing to the disruption in supply chains. For instance, in October 2021, Tata Chemicals Ltd., an Indian global company with significance in crop protection, chemicals, and specialty chemical products, planned a $1 billion sale of its U.S. soda ash unit. According to the company's annual report, the production in North America fell 18% in the 12 months through March 2021, mainly due to a drop in demand during the Covid-19 pandemic.

Industry Dynamics

Growth Drivers

The growth of the soda ash market is mainly driven by increasing glass and ceramics production. In the past few years, increased sales of automobiles and growing construction activities have created demand for glass. For instance, according to the Ministry of Statistics and Program Implementation in India, the construction sector is expected to grow in double digits at 10.7% in the financial year 2022 due to the increased focus of the government on infrastructure projects and residential as well as commercial construction segments.

In addition, the demand for the industry in the manufacturing of soaps, detergents, and shampoos due to their effectiveness in maintaining the pH level of water is projected to boost the growth of the global market. Moreover, emerging applications of the industry, such as rechargeable batteries and metallurgical processes, have driven the growth of the industry. In rechargeable batteries, they are used for the extraction and smelting of various metals.

On the other hand, demand for the industry in the pharma companies is expected to create lucrative growth opportunities for the industry during the forecast period. It is rapidly being used as an excipient in medicinal products. Furthermore, the business expansion strategies of key market players are opportunistic for the growth of the global market. For instance, in May 2022, Solvay acquired the 20% minority stake of AGC.

Know more about this report: Request for sample pages

Report Segmentation

The global soda ash market is primarily segmented on the basis of density, type, end-use, and region.

|

By Density |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Density

The dense segment dominated the global market. This is mainly attributed to the fact its high density and quality product. These types have become prominent raw materials in various areas such as the glass industry and detergent and paper production.

However, the light segment is expected to witness the highest growth rate during the forecast period owing to the emerging application in soap & detergents. For instance, light ash is an essential basic industrial alkali chemical used in the manufacture of paste, powdered, and soap detergents.

Insight by Type

The synthetic segment dominated the global market. However, the natural soda ash segment is expected to contribute significant revenue in 2021 as the production of soda ash from natural sources is less expensive as compared with synthetic production. In addition, this type of ash uses less energy and contains fewer impurities. Such advantages are primarily fueling the demand for the industry.

Insight by End-Use

The soaps & detergents segment is expected to witness the highest CAGR during the forecast period. Acting as a compound builder, soda ash prevents the hard water from bonding with the detergent while concurrently removing alcohol and grease stains from clothing.

They are the prominent constituent of soaps and powdered detergents owing to their surfactant qualities and high alkalinity, which enables it to improve the effectiveness and the solvency of the detergent in removing stains while using less water. The significance of the industry in soaps & detergents end-user industry drives the growth of this segment.

Geographic Overview

North America is the largest revenue contributor in the global market, owing to the fact that the U.S. is the world's largest producer of natural soda ash due to large deposits of Trona. Trona is a gray-white or yellowish-white monoclinic mineral and a sodium carbonate compound that is processed into ash. In addition, this region is seeing huge demand for favorable ash demand in the detergent and glass industry. The expansion of global market players in this region is opportunistic for the growth of the market. For instance, in December 2021, Sisecam, the Turkish glassmaker, announced to acquire 60% of Ciner's soda business in the U.S.

However, Asia Pacific is expected to witness the highest growth rate during the forecast period. Thriving chemicals, construction, soaps & detergents industries in this region have primarily driven the growth of the soda ash market. In addition, China and India are the major consumers of soda ash in this region due to demand from sectors such as construction, paper textiles, glass, and cleaning chemicals.

Competitive Insights

Some of the major players operating in the market include Ciech SA, DCW Limited, FMC Corporation, GHCL Limited, Nirma Limited, OCI Chemical, Oriental Chemical, Soda Sanayii, Solvay SA, and Tata Chemicals.

Soda Ash Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 20.96 Billion |

|

Revenue forecast in 2032 |

USD 29.79 Billion |

|

CAGR |

4.5% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 to 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Density, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Ciech SA, DCW Limited, FMC Corporation, GHCL Limited, Nirma Limited, OCI Chemical, Oriental Chemical, Soda Sanayii, Solvay SA, and Tata Chemicals |