Skin Care Products Market Size, Share, Trends, Industry Analysis Report: By Product Type, Packaging Type, Distribution Channel (Cosmetic Stores, Convenience Stores, Pharmacy & Drugstore, Supermarkets & Hypermarkets, Online, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1148

- Base Year: 2024

- Historical Data: 2020-2023

Skin Care Products Market Overview

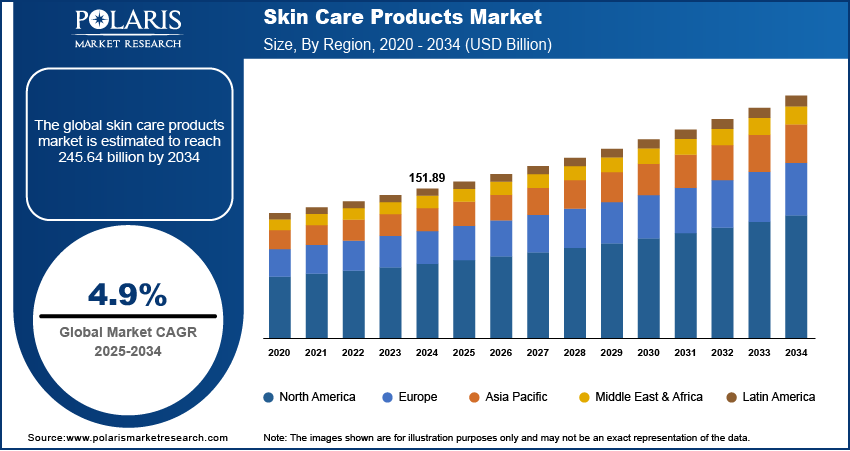

The skin care products market size was valued at USD 151.89 billion in 2024. The market is projected to grow from USD 159.02 billion in 2025 to USD 245.64 billion by 2034, exhibiting a CAGR of 4.9% during the forecast period.

A skin care product is a formulation designed to cleanse, protect, nourish, and enhance the skin's health and appearance. These products include a wide range of items such as cleansers, moisturizers, serums, sunscreens, exfoliants, and anti-aging treatments, each targeting specific skin concerns. Skin care products are formulated with active ingredients, including hydrating agents, antioxidants, vitamins, and botanical extracts, to address issues like dryness, acne, wrinkles, hyperpigmentation, and sun damage

Skincare products have become an essential part of daily routines, contributing significantly to the market expansion by addressing diverse consumer needs such as protecting the skin from environmental damage, combating aging signs, and maintaining hydration. Moreover, the diverse range of skincare commodities, including cleansers, toners, moisturizers, serums, and masks, plays a critical role in contributing to the market expansion.

To Understand More About this Research: Request a Free Sample Report

Increasing awareness about skin health among millennials and heightened consumer expenditure on beauty products is contributing to the skin care product market growth. Furthermore, the rise of online retail channels and digital platforms, along with beauty influencers and social media trends, has significantly boosted market visibility and sales.

Skin Care Products Market Dynamics

Rising Demand for Natural and Organic Products

The growing demand for natural and organic skincare products is a significant driver of market growth. Consumers are increasingly prioritizing formulations that feature natural, organic, and clean-label ingredients, driven by a heightened awareness of the potential risks associated with synthetic chemicals. For instance, Finally All Natural introduced a skincare line that has set a new benchmark in the natural skincare market. The brand emphasizes healing, nourishing, and protecting formulations, redefining skincare routines for greater efficacy and optimal skin health. This shift is further accelerated by the increasing focus on sustainability and eco-friendly practices, positioning environmentally conscious products as a crucial factor in driving the skin care market development.

Focus on Anti-Aging and Preventive Skincare

Increasing awareness of early skin aging is significantly driving the demand for anti-aging skincare products, including serums, moisturizers, and creams enriched with potent active ingredients such as retinol, hyaluronic acid, and peptides. Consumers are becoming more proactive in investing in preventive skincare to address concerns like fine lines, wrinkles, and loss of elasticity before visible signs of aging appear. This shift toward early intervention and prioritizing long-term skin health is contributing to skin care product market growth, thereby expanding the skin care product market demand. For instance, in August 2024, Allergan Aesthetics, a subsidiary of AbbVie, launched the SkinMedica HA5 Hydra Collagen Replenish + Restore Hydrator, which offers exceptional hydration, boosts skin plumpness, and enhances facial radiance with a proprietary blend of hyaluronic acid and collagen-boosting ingredients. This innovation highlights the evolving skin care product market dynamics, creating new market opportunities and further boosting skincare product market expansion in the global beauty and skincare industry.

Skin Care Products Market Segment Insights

Skin Care Products Market Assessment by Product Type Outlook

The global skin care products market segmentation, based on product type, includes cleansers & face wash, body creams & moisturizers, face creams & moisturizers, sunscreen, shaving lotions & creams, and others. In 2024, the face creams & moisturizers segment accounted for the largest skin care products market share, driven by their pivotal role in daily skincare routines. These products cater to a wide range of skin concerns, including hydration, anti-aging, and protection against environmental aggressors such as pollution and UV rays. The growing consumer preference for multifunctional products has further propelled demand, with formulations now incorporating active ingredients such as hyaluronic acid, retinol, and antioxidants to deliver targeted benefits. Additionally, the emphasis on preventive skincare has led to increased adoption of moisturizers with anti-aging properties, appealing to a broad demographic from millennials to older adults. The rise in awareness regarding skin health, coupled with aggressive marketing campaigns and the availability of innovative formulations, has solidified face creams and moisturizers as essential skincare products, contributing significantly to skin care market growth.

Skin Care Products Market Evaluation by Distribution Channel Outlook

The global skin care products market segmentation, based on distribution channel, includes cosmetic stores, convenience stores, pharmacy & drugstores, supermarkets & hypermarkets, online, and others. The convenience stores segment is expected to experience the fastest growth during the forecast period due to their convenience and accessibility. These stores are typically located in high-traffic areas, making them easily reachable for consumers looking for quick, on-the-go purchases. With their extended operating hours, convenience stores cater to busy consumers who prioritize time-saving shopping experiences. Additionally, the growing demand for skincare products that fit into fast-paced lifestyles is driving consumers to seek easy access to essential items such as moisturizers, cleansers, and sunscreen, which are commonly available at convenience stores.

Skin Care Products Market Share Regional Insights

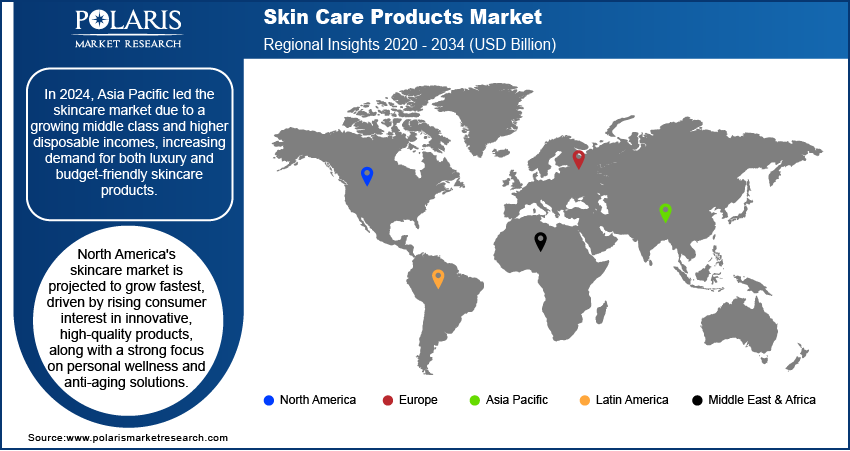

By region, the study provides skin care products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's rapidly expanding middle class and rising disposable incomes are driving increased demand for both premium and affordable skincare products. For instance, according to a report by the World Economic Forum, approximately 2 billion individuals in Asia were classified as middle class in 2020. Projections indicate that this figure could potentially expand to 3.5 billion by 2030, reflecting significant socioeconomic shifts and growth within the region. Additionally, there is a strong cultural emphasis on beauty and personal care in many Asia Pacific countries, where skincare is considered an essential part of daily routines. The growing awareness of the importance of skincare, especially among younger populations, is further fueling market growth. Consumers are becoming more knowledgeable about different skin concerns, such as anti-aging, hydration, and pigmentation, which has led to a higher demand for specialized products such as serums, moisturizers, and sunscreens.

The skin care products market in North America is expected to witness the fastest growth over the forecast period. Increasing consumer demand for innovative, high-quality skincare products and a growing focus on personal wellness and anti-aging solutions is fueling North America skin care product market growth. Furthermore, the growth of e-commerce platforms providing easy access to a wide variety of brands and formulations is driving the expansion of the skin care product market. For instance, in November 2024, the Census Bureau reported that the US retail e-commerce sales for Q3 2024 reached USD 300.1 billion, marking a 2.6% increase from Q2 2024. Additionally, the growing influence of social media and beauty influencers is driving awareness and consumer spending on skincare products in the region.

Skin Care Products Market – Key Players and Competitive Analysis Report

The competitive landscape of the skin care products market is highly dynamic, featuring a mix of established multinational companies and emerging brands competing for market share. Key players such as L'Oréal, Estée Lauder, and Procter & Gamble dominate the market, leveraging their strong brand presence, extensive distribution networks, and significant investments in research and development. These companies offer a wide range of skincare products, from anti-aging creams to moisturizers and cleansers, catering to diverse consumer needs. Additionally, emerging players such as The Ordinary and Drunk Elephant are gaining traction by offering innovative, clean-label products that appeal to health-conscious and environmentally aware consumers. E-commerce has become a significant factor in the competitive landscape, with platforms including Amazon and Sephora providing easy access to an extensive variety of skincare brands, further intensifying competition. The growing trend of personalized skincare, driven by advancements in AI technology, is also shaping the market as brands develop customized products to meet individual skin needs. Consumer preferences shift towards clean, sustainable, and effective solutions; brands are continually adapting their product offerings to stay competitive in the evolving skin care products industry. A few key major players are Avon Products Inc.; Procter & Gamble; Beiersdorf AG; L'Oréal S.A.; Johnson & Johnson; Unilever PLC; The Estee Lauder Companies Inc.; Revlon Incorporation; Shiseido Company, Limited; and Colgate-Palmolive Company.

Johnson & Johnson Services, Inc., a multinational corporation based in New Brunswick, New Jersey, USA, is a key player in the retail sector of skincare products. Known for its diverse product offerings, the company operates through various segments, including pharmaceuticals, medical devices, and consumer health products. In the skincare market, Johnson & Johnson provides a range of products designed to promote skin health, including moisturizers, cleansers, and baby care items. Their well-established presence in the retail sector allows them to reach a broad consumer base, with their skincare products widely available in pharmacies, supermarkets, and online platforms.

Procter & Gamble Company is engaged in consumer packaged goods, diverged into five segments: grooming, health care, beauty, fabric & home care, and baby, feminine & family care. In the health care segment, P&G offers a range of products, including oral care solutions like Crest and Oral-B toothbrushes and toothpaste. The portfolio also features gastrointestinal aids (Metamucil), pain relief (Pepto-Bismol), respiratory products (Vicks), and nutritional support (Neurobion and vitamins), highlighting the company's focus on effective healthcare solutions.

Key Companies in Skin Care Products Market Outlook

- Avon Products Inc.

- Procter & Gamble

- Beiersdorf AG

- L'Oréal S.A.

- Johnson & Johnson

- Unilever PLC

- The Estee Lauder Companies Inc.

- Revlon Incorporation

- Shiseido Company, Limited

- Colgate-Palmolive Company

Skin Care Products Market Developments

April 2024: Beiersdorf and Rubedo formed a multi-year partnership to advance innovative anti-aging formulations, focusing on advanced research to tackle the complexities of skin aging at a molecular level.

February 2024: Beiersdorf launched its first Epigenetic Serum under the Eucerin brand. The serum offers a revolutionary approach to skin rejuvenation. It features Epicelline, an active ingredient that reactivates youth genes to combat signs of aging.

May 2024: Dove, the UK's body wash brand, launched a new tiered portfolio featuring the Dove Advanced Care Body Wash range. This innovation aims to enhance the brand's market position and drive category growth by meeting the evolving needs of consumers seeking superior skin cleansing benefits.

Skin Care Products Market Segmentation

By Product Type Outlook (Revenue, USD Billion; 2020–2034)

- Cleansers & Face Wash

- Body Creams & Moisturizers

- Face Creams & Moisturizers

- Sunscreen

- Shaving Lotions & Creams

- Others

By Packaging Type Outlook (Revenue, USD Billion; 2020–2034)

- Tube

- Bottle

- Jar

- Others

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Cosmetic Stores

- Convenience Stores

- Pharmacy & Drugstore

- Supermarkets & Hypermarkets

- Online

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Skin Care Products Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 151.89 billion |

|

Market Size Value in 2025 |

USD 159.02 billion |

|

Revenue Forecast by 2034 |

USD 245.64 billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global skin care products market size was valued at USD 151.89 billion in 2024 and is projected to grow to USD 245.64 billion by 2034.

• The global market is projected to register a CAGR of 4.9% during the forecast period.

• In 2024, Asia Pacific accounted for the largest skin care products market share due to the region's rapidly expanding middle class and rising disposable incomes are driving increased demand for both premium and affordable skincare products.

• A few key players in the market are Avon Products Inc.; Procter & Gamble; Beiersdorf AG; L'Oréal S.A.; Johnson & Johnson; Unilever PLC; The Estee Lauder Companies Inc.; Revlon Incorporation; Shiseido Company, Limited; and Colgate-Palmolive Company.

• In 2024, the face creams & moisturizers segment accounted for the largest market share in the skin care products market driven by their pivotal role in daily skincare routines.

• The convenience stores segment is expected to experience the fastest growth during the forecast period due to their convenience and accessibility.