Remote Patient Monitoring Devices Market Size, Share, Trends, Industry Analysis Report: Information By Device Type, Application, Control Method (Hospitals, Ambulatory Surgical Centers, and Homecare Settings), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025 - 2034

- Published Date:Mar-2025

- Pages: 120

- Format: PDF

- Report ID: PM1332

- Base Year: 2024

- Historical Data: 2020-2023

Remote Patient Monitoring Devices Market Overview

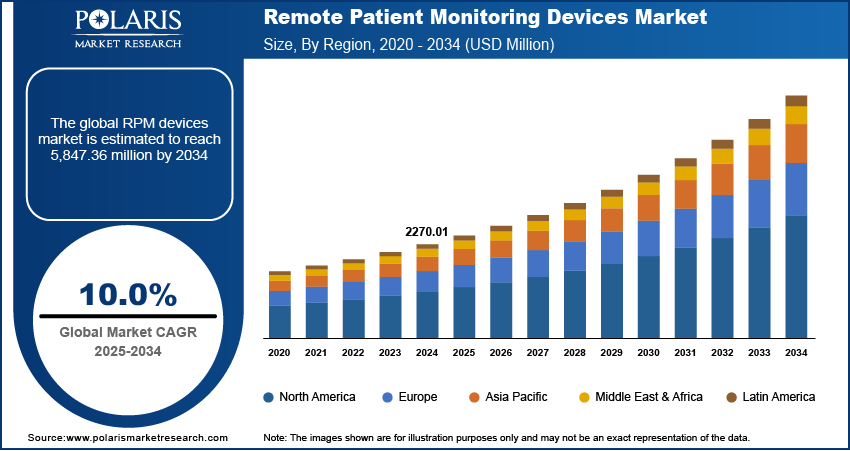

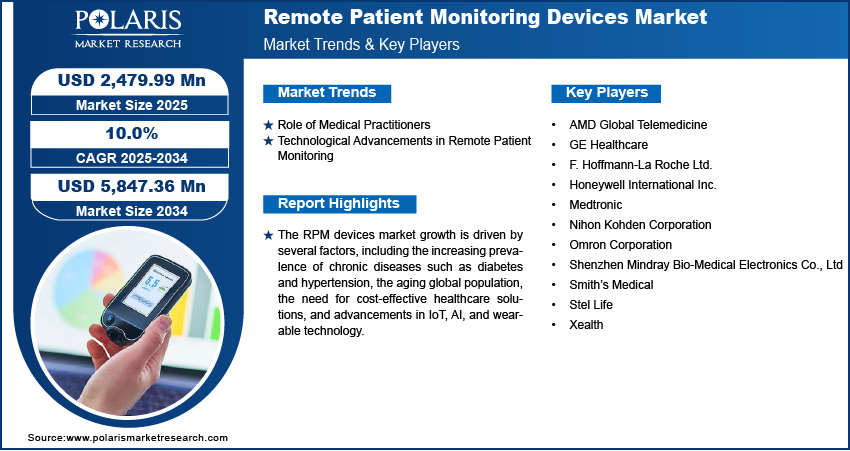

Global remote patient monitoring devices market size was valued at USD 2,270.01 million in 2024. The market is projected to grow from USD 2,479.99 million in 2025 to USD 5,847.36 million by 2034, exhibiting a CAGR of 10.0 % during the forecast period.

The remote patient monitoring (RPM) devices market encompasses the use of technology to monitor patients' health outside of conventional healthcare settings, enabling real-time tracking of vital signs and other health parameters through wearable and non-wearable devices.

The RPM devices market growth is driven by several factors, including the increasing prevalence of chronic diseases such as diabetes and hypertension, the aging global population, the need for cost-effective healthcare solutions, and advancements in IoT, AI, and wearable technology. Additionally, the COVID-19 pandemic accelerated the adoption of RPM, as it allowed for safer, remote management of patients, reducing the strain on healthcare facilities.

To Understand More About this Research: Request a Free Sample Report

Regulatory support and growing reimbursement policies have also contributed to remote patient monitoring devices market expansion, alongside the rising demand for personalized, home-based healthcare services. These factors will be further complemented by trends such as improved patient engagement, real-time data analytics, and a shift towards preventative care, positioning RPM devices as an essential part of modern healthcare systems.

RPM Devices Market Dynamics

Role of Medical Practitioners

Medical practitioners, including doctors, nurses, and specialists, are increasingly recognizing the benefits of RPM devices in managing chronic conditions, reducing hospital readmissions, and improving patient outcomes. By utilizing RPM devices, healthcare providers can remotely monitor patients' vital signs and health metrics, allowing them to make real-time decisions, provide timely interventions, and ensure continuous care outside of traditional clinical settings. This enhances patient engagement, empowers patients to take an active role in their health, and reduces the burden on in-person consultations. Moreover, medical practitioners’ trust and familiarity with RPM solutions, along with their ability to personalize treatment plans based on real-time data, drive the adoption and acceptance of these devices, which in turn fuels the RPM devices market growth.

Technological Advancements in Remote Patient Monitoring

Technological advancements are a significant driver of the remote patient monitoring devices market. Continuous innovations such as wearable technology, the Internet of Things (IoT), Artificial Intelligence (AI), and data analytics enhance the functionality and accuracy of RPM devices. These advancements allow for more precise and real-time tracking of a patient’s health metrics, such as heart rate, blood pressure, glucose levels, and oxygen saturation. For instance, in August 2023, GE HealthCare received FDA Clearance for Portrait Mobile. The company stated that Portrait Mobile is first-of-its-kind, wireless monitoring solution aiding early detection of patient deterioration. Improved sensors, longer battery life, wireless connectivity, and integration with mobile applications have made RPM devices more user-friendly, accessible, and effective in managing chronic diseases. As technology continues to evolve, RPM devices will become even more advanced, supporting early disease detection, predictive analytics, and more efficient, cost-effective care delivery.

Remote Patient Monitoring Devices (RPM) Market Segment Insights

Remote Patient Monitoring Devices Market Assessment by Device Type

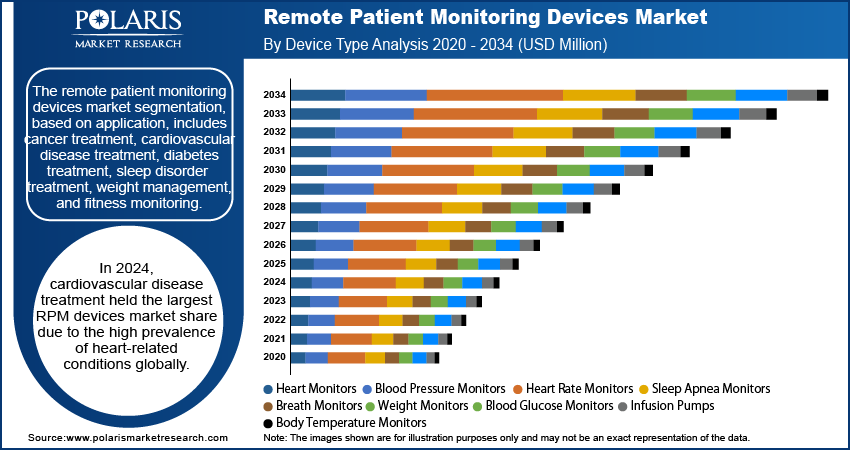

The global remote patient monitoring devices market segmentation, based on device type, includes heart monitors, blood pressure monitors, heart rate monitors, sleep apnea monitors, breath monitors, weight monitors, blood glucose monitors, infusion pumps, and body temperature monitors. The heart rate monitors is expected to dominate the market due to its fundamental role in tracking cardiovascular health, which is a primary concern for patients with heart diseases, hypertension, and other related conditions. Heart rate monitoring is also a critical tool for assessing a patient’s overall health, detecting irregularities such as arrhythmias or sudden spikes in heart rate, and ensuring timely interventions. With the rise in cardiovascular diseases globally, the demand for continuous and non-invasive heart rate monitoring devices has increased, especially as patients seek remote solutions for managing their conditions. Additionally, advancements in wearable technology, such as smartwatches and fitness trackers, that offer heart rate monitoring have made these devices more accessible, accurate, and user-friendly.

Remote Patient Monitoring Devices Market Evaluation by Application

The remote patient monitoring devices market segmentation, based on application, includes cancer treatment, cardiovascular disease treatment, diabetes treatment, sleep disorder treatment, weight management, and fitness monitoring. In 2024, cardiovascular disease treatment held the largest RPM devices market share due to the high prevalence of heart-related conditions globally. RPM devices play a critical role in managing these conditions by allowing continuous monitoring of vital cardiovascular metrics such as heart rate, blood pressure, and ECG, enabling early detection of abnormalities and timely interventions. For instance, The Centers for Disease Control and Prevention (CDC) reports that over 100 million Americans have hypertension, which heightens the risk of heart disease. With the growing burden of cardiovascular diseases, the demand for remote monitoring solutions that provide real-time data and improve patient outcomes has surged.

Remote Patient Monitoring Devices Market Regional Insights

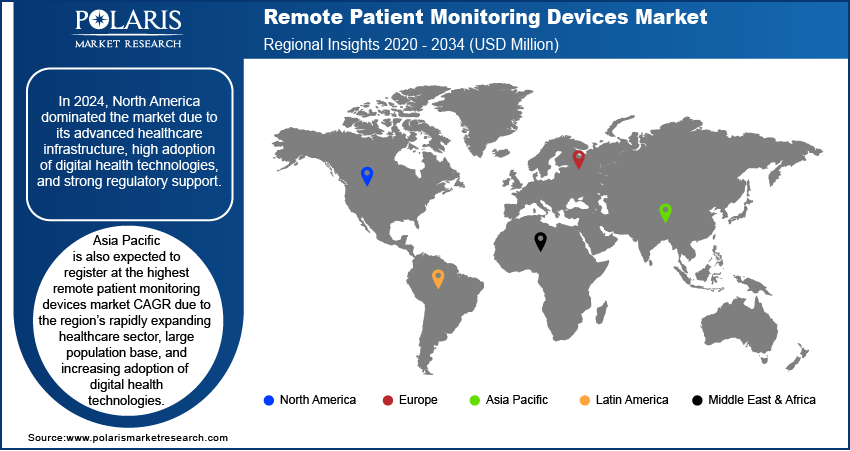

By region, the study provides remote patient monitoring devices market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America dominated the market due to its advanced healthcare infrastructure, high adoption of digital health technologies, and strong regulatory support. The United States, in particular, has been at the forefront of RPM adoption, driven by factors such as a growing aging population, rising prevalence of chronic diseases, and increasing healthcare costs. Additionally, government initiatives and favorable reimbursement policies, including those from Medicare and private insurers, have made RPM solutions more accessible and cost-effective for patients. The presence of leading technology companies and a well-established telemedicine ecosystem further boosted the market growth in the region. As a result, North America continues to lead the global market in both RPM device usage and innovation.

Asia Pacific is also expected to register at the highest remote patient monitoring devices market CAGR due to the region’s rapidly expanding healthcare sector, large population base, and increasing adoption of digital health technologies. Countries such as China, India, and Japan are witnessing significant improvements in healthcare access and infrastructure. At the same time, rising healthcare costs and the growing prevalence of chronic diseases are driving the need for more efficient, cost-effective solutions. The increasing focus on preventive care, coupled with government initiatives to promote telemedicine and remote monitoring, is also fueling market growth. Furthermore, the widespread use of smartphones and wearables in the region, along with advancements in IoT and AI, is making RPM devices more accessible and attractive to both healthcare providers and patients.

Remote Patient Monitoring Devices Market Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the RPM devices market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the industry to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the remote patient monitoring devices industry include F. Hoffmann-La Roche Ltd.; AMD Global Telemedicine; Honeywell International Inc.; Omron Healthcare; Smiths Medical; Medtronic; Shenzhen Mindray Bio-Medical Electronics Co., Ltd; Nihon Kohden Corporation; Omron Corporation; GE Healthcare; Xealth; and Stel Life.

F. Hoffmann-La Roche Ltd is a leading biotech and in-vitro diagnostics company that excels in remote patient monitoring devices. Roche pioneers personalized healthcare by integrating innovative diagnostics and data-based insights, enhancing patient care and outcomes globally. Roche remains dedicated to scientific advancements and sustainability. In July 2024, Roche's acquisition of LumiraDx's point-of-care technology boosts the remote patient monitoring devices market. By integrating advanced diagnostics into primary care, Roche expands access to timely healthcare, driving growth in the RPM sector.

AMD Global Telemedicine: AMD Global Telemedicine specializes in advanced remote patient monitoring solutions, delivering cutting-edge telehealth technology to over 10,000 endpoints across 100+ countries. AMD drives innovation in virtual care and remote patient assessment. On July 11, 2023, AMD Global Telemedicine and Collain Healthcare announced a strategic partnership. This partnership aims to enhance remote patient monitoring and telehealth services, integrating advanced technologies to improve patient care and outcomes.

Key Companies in Remote Patient Monitoring Devices Market

- AMD Global Telemedicine

- GE Healthcare

- F. Hoffmann-La Roche Ltd.

- Honeywell International Inc.

- Medtronic

- Nihon Kohden Corporation

- Omron Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Smith’s Medical

- Stel Life

- Xealth

Remote Patient Monitoring Devices Market Developments

May 2024: Digital health platform provider Xealth announced its alliance with Stel Life, a major player in health monitoring device connectivity. Through the new partnership, the companies aim to optimize remote patient monitoring by enabling speedy and more secure integration of patient vital data.

January 2024: Apollo Hospital, a famous multi-specialty hospital, announced a strategic partnership with LifeSigns, a global leader in AI-powered health monitoring technology. The collaboration will provide the hospital with a continuous wireless and remote patient monitoring system. The alliance marks a major advancement in proactive patient management for the hospital.

Remote Patient Monitoring Devices Market Segmentation

By Device Type Outlook

- Heart Monitors

- Blood Pressure Monitors

- Heart Rate Monitors

- Sleep Apnea Monitors

- Breath Monitors

- Weight Monitors

- Blood Glucose Monitors

- Infusion Pumps

- Body Temperature Monitors

By Application Outlook

- Cancer Treatment

- Cardiovascular Diseases Treatment

- Diabetes Treatment

- Sleep Disorder Treatment

- Weight Management

- Fitness Monitoring

By Control Method Outlook

- Hospitals

- Ambulatory Surgical Centers

- Homecare Settings

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Remote Patient Monitoring Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,270.01 million |

|

Market Size Value in 2025 |

USD 2,479.99 million |

|

Revenue Forecast in 2034 |

USD 5,847.36 million |

|

CAGR |

10.0% from 2024 – 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global remote patient monitoring devices market size was valued at USD 2,270.01 million in 2024 and is expected to reach to USD 5,847.36 by 2034.

The global market is projected to register at a CAGR of 10.0% during the forecast period.

North America had the largest share of the global market.

The key players in the market are F. Hoffmann-La Roche Ltd.; AMD Global Telemedicine; Honeywell International Inc.; Omron Healthcare; Smiths Medical; Medtronic; Shenzhen Mindray Bio-Medical Electronics Co., Ltd; Nihon Kohden Corporation; Omron Corporation; GE Healthcare; Xealth; and Stel Life.

The heart rate monitors segment dominated the market in 2024.

The cardiovascular disease treatment had the largest share in the global market.