Psoriasis Drug Market Size, Share, Trends, Industry Analysis Report: By Class (Tumor Necrosis Factor Inhibitors, Interleukin Inhibitors, Vitamin D Analogues, Corticosteriods, and Others), Type, Treatment, Route of Administration, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1345

- Base Year: 2024

- Historical Data: 2020-2023

Psoriasis Drug Market Overview

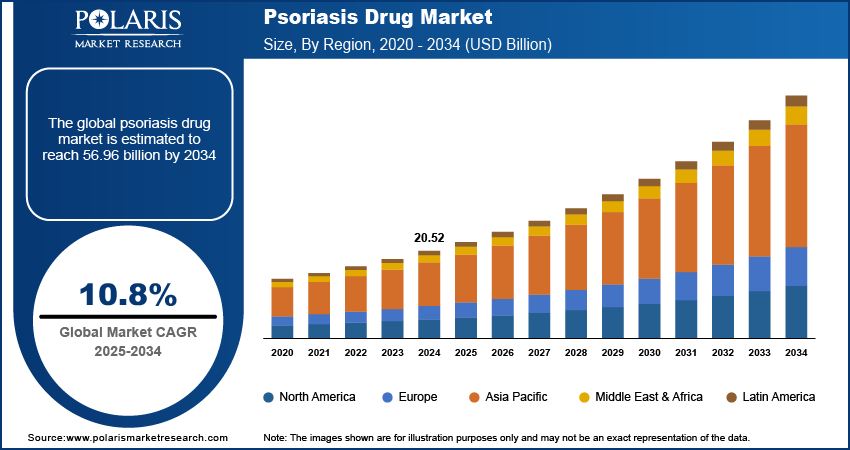

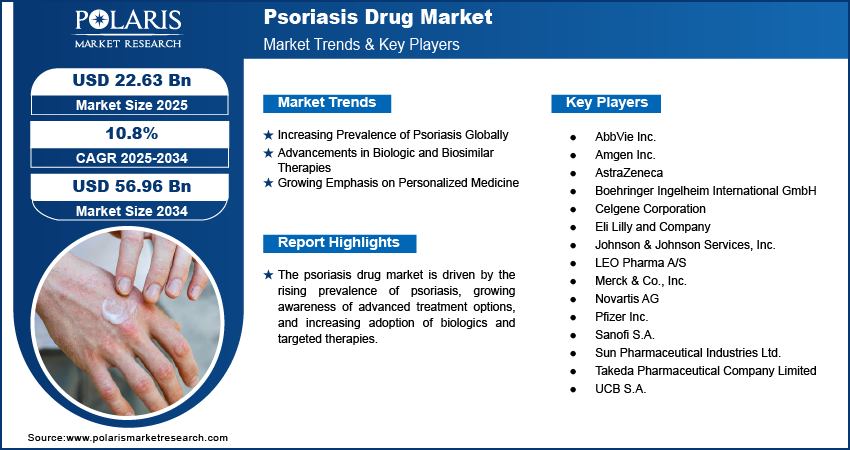

The psoriasis drug market size was valued at USD 20.52 billion in 2024. The market is projected to grow from USD 22.63 billion in 2025 to USD 56.96 billion by 2034, exhibiting a CAGR of 10.8% during 2025–2034.

The psoriasis drug market encompasses the development, production, and sale of medications designed to treat psoriasis, a chronic autoimmune skin condition. The market is driven by an increasing prevalence of psoriasis globally, advancements in biologics and biosimilars, and rising awareness of treatment options. Key trends include the growing adoption of targeted therapies, such as interleukin inhibitors, and the integration of personalized medicine approaches to enhance treatment outcomes. The expansion of regulatory approvals for novel drugs and the introduction of innovative topical therapies further contribute to the psoriasis drug market growth. Additionally, investments in research and development are fueling the pipeline for next-generation treatments.

To Understand More About this Research: Request a Free Sample Report

Psoriasis Drug Market Dynamics

Increasing Prevalence of Psoriasis Globally

The rising prevalence of psoriasis is a major driver for the psoriasis drug market demand. According to the International Federation of Psoriasis Associations (IFPA), approximately 125 million people worldwide, or about 2–3% of the global population, are affected by psoriasis. This chronic condition is associated with significant physical and psychological burdens, driving demand for effective treatment options. The increasing awareness of psoriasis as a systemic inflammatory disease requiring medical intervention further accelerates market growth. Health initiatives and campaigns by organizations such as the World Psoriasis Day program are also instrumental in highlighting the need for accessible and advanced therapeutic solutions.

Advancements in Biologic and Biosimilar Therapies

The introduction of biologics and biosimilars has transformed the psoriasis drug market by offering targeted treatments with higher efficacy and fewer side effects compared to traditional systemic drugs. Biologic therapies, particularly interleukin (IL) inhibitors and tumor necrosis factor-alpha (TNF-α) inhibitors, are gaining widespread acceptance in clinical practice. For instance, IL-17 inhibitors have demonstrated significant improvements in symptom management, with studies showing up to 90% improvement in Psoriasis Area and Severity Index (PASI) scores. The development and approval of biosimilars have further enhanced patient accessibility to these therapies by reducing treatment costs, particularly in developing regions. Hence, the advancements in biologic and biosimilar therapies are expected to boost the psoriasis drug market development during the forecast period.

Growing Emphasis on Personalized Medicine

Personalized medicine is becoming a focal point in psoriasis treatment, driven by advancements in genomics and molecular diagnostics. Researchers have identified various genetic markers and immune pathways associated with psoriasis, enabling the development of tailored therapies. For instance, pharmacogenomic studies are helping predict patient responses to specific drugs, thereby improving treatment outcomes. The American Academy of Dermatology (AAD) has emphasized the importance of integrating personalized approaches in clinical practice to address diverse patient needs effectively. This trend is further supported by collaborations between pharmaceutical companies and academic institutions to innovate precision treatments for psoriasis. Thus, a growing emphasis on personalized medicine is projected to propel the psoriasis drug market growth during the forecast period.

Psoriasis Drug Market Segment Insights

Psoriasis Drug Market Assessment – Class-Based Insights

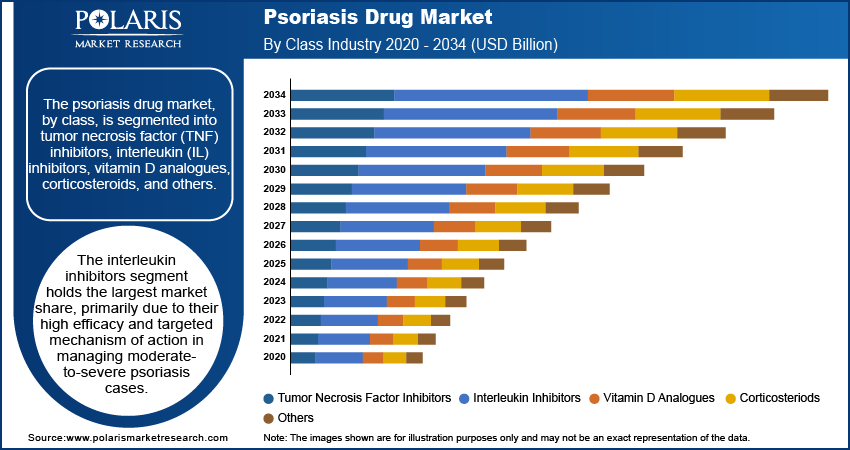

The psoriasis drug market, by class, is segmented into tumor necrosis factor (TNF) inhibitors, interleukin (IL) inhibitors, vitamin D analogues, corticosteroids, and others. The interleukin inhibitors segment holds the largest market share, primarily due to their high efficacy and targeted mechanism of action in managing moderate-to-severe psoriasis cases. These drugs, including IL-17, IL-23, and IL-12/23 inhibitors, have demonstrated significant clinical success in achieving long-term remission and improving patients’ quality of life. The increasing adoption of biologic therapies and consistent advancements in IL inhibitors are key factors contributing to their dominance in the market.

The interleukin inhibitors segment is registering the highest growth rate, driven by the expansion of research and development activities and the approval of new-generation therapies. Growing awareness of these therapies’ superior efficacy and safety profiles is influencing treatment paradigms, particularly in developed markets. Furthermore, the vitamin D analogues and corticosteroids segments remain vital for the treatment of mild-to-moderate psoriasis and as combination therapies, ensuring sustained demand across various regions. The others segment, comprising emerging therapies, is also witnessing innovation, with new drugs in the pipeline aiming to address unmet clinical needs.

Psoriasis Drug Market Outlook – Treatment-Based Insights

The psoriasis drug market, by treatment, is segmented into topicals, systemic, and biologics. The biologics segment holds the largest market share, driven by their advanced mechanism of action targeting specific immune pathways associated with psoriasis. These treatments, particularly interleukin inhibitors and tumor necrosis factor (TNF) inhibitors, have become the standard for managing moderate-to-severe cases due to their high efficacy and long-term safety. The increasing adoption of biologics is further supported by a growing number of regulatory approvals, enhanced accessibility through biosimilars, and expanded usage in emerging markets.

The biologics segment is also registering the highest growth rate within the psoriasis drug market, propelled by ongoing innovations and the introduction of next-generation therapies. These advancements are meeting the demand for more personalized and effective treatments, with physicians increasingly recommending biologics for patients unresponsive to conventional therapies. Meanwhile, topical treatments remain integral to managing mild cases and as part of combination regimens, maintaining steady demand. Systemic treatments, including traditional oral drugs, continue to serve as a critical option for patients with moderate disease severity or those who prefer non-injectable solutions, ensuring their relevance across various patient demographics.

Psoriasis Drug Market Evaluation – Route of Administration-Based Insights

The psoriasis drug market segmentation, by route of administration, includes oral, parenteral, and topical. The parenteral segment holds the largest market share, driven by the widespread adoption of biologic therapies, which are predominantly delivered through injections. This route offers high bioavailability and ensures precise targeting of immune pathways, making it a preferred choice for managing moderate-to-severe psoriasis cases. The increasing availability of biosimilars and patient-friendly delivery systems, such as pre-filled syringes and auto-injectors, further boosts the adoption of parenteral treatments.

The parenteral segment is also experiencing the highest growth rate in the psoriasis drug market, supported by continuous advancements in biologic drugs and expanding regulatory approvals worldwide. Meanwhile, topical treatments maintain consistent demand, particularly for mild psoriasis cases and combination regimens. Oral administration remains relevant for patients preferring noninvasive options and for systemic treatments such as immunosuppressants, which are integral to managing specific patient populations. Together, these segments ensure diverse therapeutic options tailored to varying disease severities and patient preferences.

Psoriasis Drug Market Assessment – Distribution Channel-Based Insights

The psoriasis drug market, by distribution channel, is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment holds the largest market share due to their pivotal role in dispensing advanced therapies such as biologics and managing patients with moderate-to-severe psoriasis. These settings provide comprehensive care, including specialized consultations and access to injectable treatments that require professional administration. The presence of hospital-linked specialty pharmacies further enhances patient adherence to prescribed regimens, supporting the dominance of this segment.

The hospital pharmacies segment is also registering the highest growth rate, driven by the increasing prevalence of severe psoriasis cases requiring biologic treatments and the rising number of healthcare facilities globally. Retail pharmacies maintain significant relevance for the distribution of topical therapies and oral medications, catering to patients suffering from mild-to-moderate disease severity. The others segment, which includes online pharmacies, is witnessing gradual growth due to the convenience and accessibility they offer, particularly in urban areas and regions with well-established digital infrastructures. This diverse distribution network ensures the availability of psoriasis treatments across different patient needs and geographies.

Psoriasis Drug Market Regional Insights

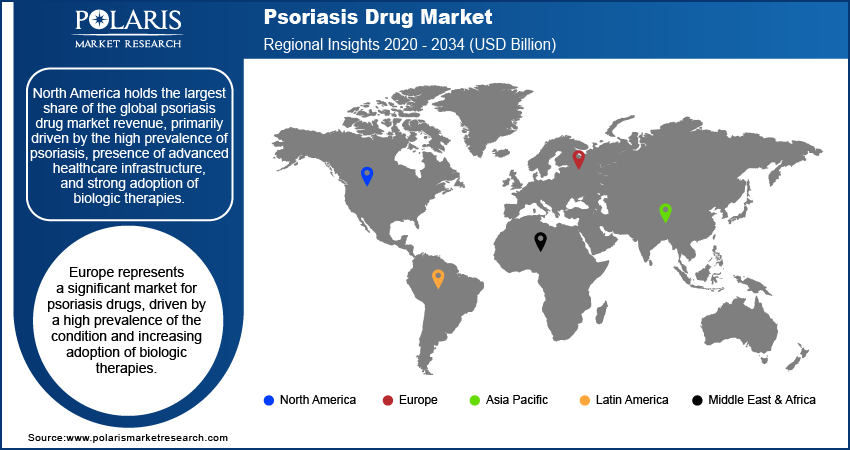

By region, the study provides psoriasis drug market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global psoriasis drug market revenue, primarily driven by the high prevalence of psoriasis, advanced healthcare infrastructure, and strong adoption of biologic therapies. The region benefits from significant investments in research and development, leading to the rapid approval and commercialization of innovative treatments. Additionally, the presence of key market players and favorable reimbursement policies support the dominance of North America. The US, in particular, accounts for a substantial portion of the regional market due to its well-established dermatology sector and high patient awareness regarding advanced treatment options.

Europe represents a significant market for psoriasis drugs, driven by a high prevalence of the condition and increasing adoption of biologic therapies. Countries such as Germany, the UK, and France lead the Europe psoriasis drugs market share, supported by robust healthcare systems and government initiatives to improve access to advanced treatments. The region's strong focus on research and development, particularly in biologics and biosimilars, further fuels market growth. Additionally, rising patient awareness and growing emphasis on personalized medicine contribute to the expanding adoption of innovative therapies in Europe.

The Asia Pacific psoriasis drug market is experiencing rapid growth due to increasing healthcare expenditure and a rising prevalence of psoriasis, particularly in densely populated countries such as China and India. Improved access to healthcare services and the growing presence of pharmaceutical companies in the region are key drivers. Moreover, a shift toward biologics and targeted therapies, supported by expanding regulatory approvals, is enhancing treatment options for patients. Government initiatives to improve dermatology care and growing awareness campaigns about psoriasis are further strengthening the market in this region.

Psoriasis Drug Market – Key Players and Competitive Insights

The psoriasis drug market features several key players actively developing and marketing treatments for psoriasis. A few companies include AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services, Inc.; Novartis AG; Eli Lilly and Company; AstraZeneca plc; Celgene Corporation (a subsidiary of Bristol-Myers Squibb); UCB S.A.; Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Pfizer Inc.; LEO Pharma A/S; Biogen Inc.; Dr. Reddy's Laboratories; and Takeda Pharmaceutical Company Limited.

These companies offer a range of therapeutic options, including biologics, oral systemic treatments, and topical agents, catering to varying patient needs. For instance, AbbVie's Skyrizi has shown significant sales growth, indicating strong market acceptance. Johnson & Johnson's Tremfya has expanded its indications, enhancing its market presence. Novartis AG continues to be a significant player with its portfolio of psoriasis treatments. The competitive landscape is characterized by continuous research and development efforts, leading to the introduction of innovative therapies aimed at improving efficacy and patient quality of life.

Strategic initiatives such as mergers and acquisitions, partnerships, and collaborations are common as companies seek to expand their market share and global reach. The focus on personalized medicines and targeted therapies is driving competition, with firms investing in advanced biologics and biosimilars to meet the evolving demands of psoriasis treatment. Additionally, efforts to improve patient access through affordability programs and navigating regulatory landscapes are critical components of competitive strategies in this market.

AbbVie Inc. is a significant participant in the psoriasis drug market, with a strong portfolio that includes Skyrizi (risankizumab) and Humira (adalimumab). These drugs are widely used for the treatment of moderate-to-severe psoriasis. Skyrizi, in particular, has shown notable success, with sales reaching $3.21 billion in the third quarter of 2024, marking a 51% year-over-year increase. This performance underscores its growing preference among patients and healthcare providers.

Johnson & Johnson is another prominent company in the psoriasis drug market, with products such as Tremfya (guselkumab) being key contributors to its portfolio. Tremfya is an interleukin-23 inhibitor approved for the treatment of moderate-to-severe plaque psoriasis. In September 2024, the company received FDA approval to expand Tremfya's use for treating ulcerative colitis, highlighting its commitment to addressing broader inflammatory conditions.

List of Key Companies in Psoriasis Drug Market

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Celgene Corporation (a subsidiary of Bristol-Myers Squibb)

- Eli Lilly and Company

- Johnson & Johnson Services, Inc.

- LEO Pharma A/S

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- UCB S.A.

Psoriasis Drug Industry Developments

- In November 2024, AbbVie reported continued expansion of Skyrizi's indications, further strengthening its position in the market.

- In November 2024, Johnson & Johnson announced that it is advancing its pipeline with innovative treatments, including icotrokinra, an oral drug that met its primary goals in late-stage clinical trials.

Psoriasis Drug Market Segmentation

By Class Outlook

- Tumor Necrosis Factor Inhibitors

- Interleukin Inhibitors

- Vitamin D Analogues

- Corticosteriods

- Others

By Type

- Psoriatic Arthritis

- Plaque Psoriasis

- Others

By Treatment Outlook

- Topicals

- Systemic

- Biologics

By Route of Administration Outlook

- Oral

- Parenteral

- Topical

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Psoriasis Drug Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.52 billion |

|

Market Size Value in 2025 |

USD 22.63 billion |

|

Revenue Forecast by 2034 |

USD 56.96 billion |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The psoriasis drug market has been segmented into detailed segments of class, type, treatment, route of administration, and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The psoriasis drug market growth and marketing strategies focus on innovation, strategic collaborations, and expanding treatment access. Companies are heavily investing in research and development to introduce advanced biologics and targeted therapies, addressing unmet clinical needs. Strategic partnerships, licensing agreements, and acquisitions are being leveraged to enhance market presence and accelerate product pipelines. Additionally, expanding patient awareness campaigns and providing financial assistance programs aim to improve treatment accessibility and adherence. Geographic expansion into emerging markets further supports long-term growth by addressing underserved patient populations.

FAQ's

The psoriasis drug market size was valued at USD 20.52 billion in 2024 and is projected to grow to USD 56.96 billion by 2034.

The market is projected to register a CAGR of 10.8% during the forecast period.

North America held the largest share of the market in 2024.

A few notable companies include AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services, Inc.; Novartis AG; Eli Lilly and Company; AstraZeneca plc; Celgene Corporation (a subsidiary of Bristol-Myers Squibb); UCB S.A.; Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Pfizer Inc.; LEO Pharma A/S; Biogen Inc.; Dr. Reddy's Laboratories; and Takeda Pharmaceutical Company Limited.

The interleukin inhibitors segment accounted for the largest share of the market in 2024.

The biologics segment accounted for the largest share of the market in 2024.

Psoriasis drugs are pharmaceutical treatments designed to manage and alleviate the symptoms of psoriasis, a chronic autoimmune condition characterized by the rapid buildup of skin cells, leading to scaling, inflammation, and redness. These drugs target various aspects of the disease, including immune system modulation and skin cell turnover reduction. Psoriasis drugs are available in multiple forms, such as topical treatments (e.g., corticosteroids and vitamin D analogues), systemic medications (e.g., immunosuppressants), and biologics (e.g., tumor necrosis factor inhibitors and interleukin inhibitors). They aim to reduce flare-ups, control symptoms, and improve the quality of life for patients.

A few key trends in the market are described below: Shift Toward Biologic Therapies: Increasing adoption of biologics, such as interleukin inhibitors, for their targeted approach and higher efficacy in treating moderate-to-severe psoriasis. Rising Focus on Personalized Medicine: Growing emphasis on tailoring treatments based on genetic, immune, and patient-specific factors to improve outcomes. Expansion of Biosimilars: Development and approval of biosimilars to enhance affordability and accessibility of biologic treatments in various regions. Advancements in Drug Delivery Systems: Introduction of patient-friendly delivery methods, such as auto-injectors and topical sprays, to improve convenience and compliance.

A new company entering the psoriasis drug market could focus on developing innovative biologics or biosimilars to address the growing demand for targeted therapies. Prioritizing research in emerging areas, such as oral biologics or small molecules with fewer side effects, could provide a competitive edge. Additionally, leveraging advanced drug delivery systems to improve patient convenience and compliance can differentiate offerings. Collaborating with digital health platforms for remote monitoring and personalized treatment solutions could enhance patient engagement. Expanding access in underserved regions and providing cost-effective alternatives, such as biosimilars, can further help capture market share.

Companies manufacturing, distributing, or purchasing psoriasis drugs and related products and other consulting firms must buy the report.