Polypropylene Market Size, Share, Trends, Industry Analysis Report: By Polymer Type, Process (Injection Molding, Blow Molding, Extrusion Molding, and Others), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1296

- Base Year: 2024

- Historical Data: 2020-2023

Polypropylene Market Overview

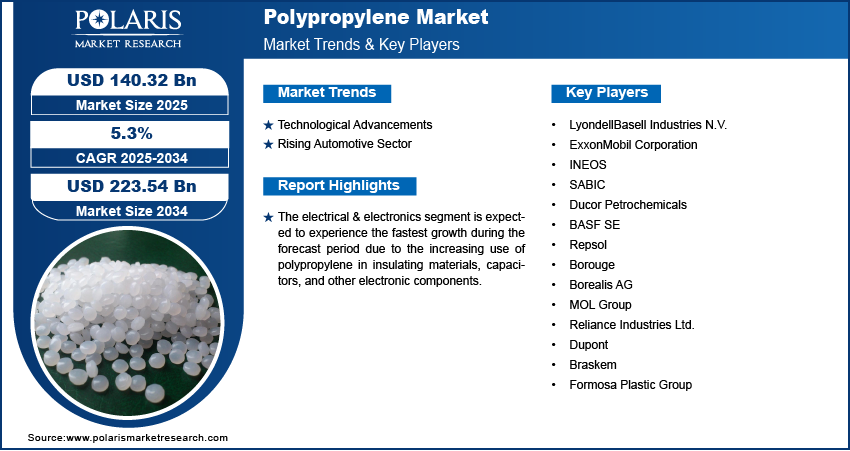

The global polypropylene market size was valued at USD 133.31 billion in 2024. The market is projected to grow from USD 140.32 billion in 2025 to USD 223.54 billion by 2034, exhibiting a CAGR of 5.3% during the forecast period.

Polypropylene is a thermoplastic polymer that is widely used in many industries such as construction, automobiles, packaging, and consumer goods. It is a versatile material with a high melting point, good chemical resistance, and low density. The polymer is widely known and used for its wider essential characteristics favorable for various end-use applications such as medical, electronics, and automobiles. Polypropylene is corrosion resistant and does not absorb water, making it an ideal material for harsh chemical environments.

The polypropylene market growth is driven by its expanding applications in construction, automobiles, packaging, and consumer goods. The increasing preference for effective plastic packaging and lightweight plastics in the automotive, electronics, and consumer goods industries is further enhancing market expansion. Polypropylene's lightweight nature and low density make it an efficient material for handling and transportation, boosting its market demand. Its excellent tensile strength allows it to withstand heavy loads without breaking, while its impact resistance and high melting point make it suitable for high-temperature applications, contributing to its widespread adoption. Furthermore, the ease of processing polypropylene through techniques such as injection molding, extrusion, and blow molding highlights its versatility, driving its use across various industries and solidifying its position in the market.

Market.png)

To Understand More About this Research: Request a Free Sample Report

Polypropylene Market Trend Analysis

Rising Demand for Sustainable and Eco-Friendly Materials

One of the notable polypropylene market trends is the rising adoption of bio-based and recyclable polypropylene as industries move toward sustainable and eco-friendly solutions. In September 2024, Braskem America launched a new Bio-Circular Polypropylene (PP) designed specifically to meet the sustainability challenges faced by the restaurant and snack food sectors. This innovative material leverages renewable feedstocks and incorporates advanced recycling processes, significantly reducing the carbon footprint associated with traditional polypropylene production. This shift aligns with global environmental regulations and corporate sustainability goals. Therefore, the polypropylene market is witnessing significant trends driven by technological advancements, increasing demand for sustainable materials, and shifting consumer preferences.

Rising Automotive Sector

The automotive sector increasingly uses polypropylene as lightweight properties of the polymer help improve fuel efficiency and reduce emissions, aligning with industry trends toward sustainability. According to the Alliance for Automotive Innovation, the automotive ecosystem contributes over USD 1 trillion to the US economy each year, representing around 4.9% of GDP. The increasing adoption of electric vehicles has boosted the expansion of the sector. In EVs, polypropylene is used in battery housings and interiors. Hence, the expanding automotive sector drives the polypropylene market demand.

Polypropylene Market Segment Insights

Polypropylene Market Assessment by Process Outlook

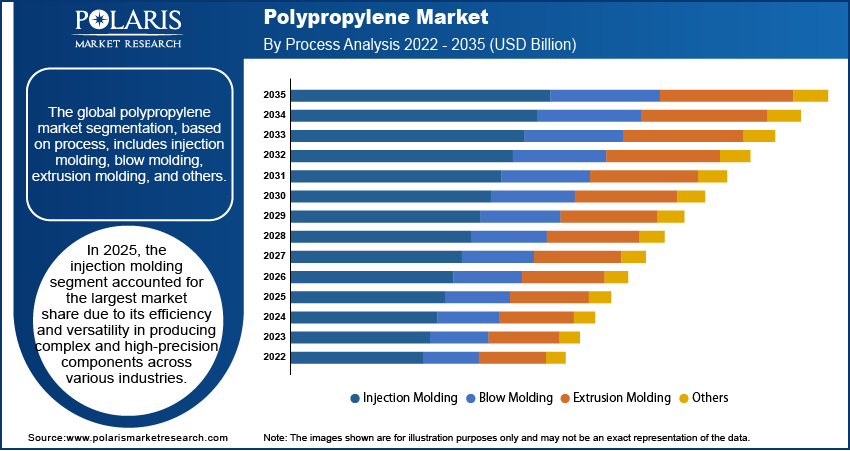

The global polypropylene market segmentation, based on process, includes injection molding, blow molding, extrusion molding, and others. In 2024, the injection molding segment accounted for the largest market share due to its efficiency and versatility in producing complex and high-precision components across various industries. Injection molding is a widely adopted manufacturing process that enables the mass production of polypropylene products with consistent quality, contributing to significant market demand and expansion. This process is particularly advantageous for applications requiring difficult designs, such as automotive parts, consumer goods, and medical devices, where precision and durability are critical. Additionally, the cost-effectiveness and scalability of injection molding make it a preferred choice for manufacturers seeking to optimize production while meeting the growing demand for polypropylene products. The ability to produce lightweight, durable, and customizable components through injection molding has further strengthened its market share, driving its dominance in the polypropylene market.

Polypropylene Market Evaluation by End User Outlook

The global polypropylene market segmentation, based on end user, includes automotive, building & construction, packaging, medical, electrical & electronics, consumer goods/lifestyle, agriculture, and others. The electrical & electronics segment is expected to experience the fastest growth during the forecast period due to the increasing use of polypropylene in insulating materials, capacitors, and other electronic components. Polypropylene’s excellent electrical insulating properties, thermal resistance, and lightweight nature make it an ideal material for ensuring safety and efficiency in electronic applications. The rising demand for consumer electronics, coupled with advancements in renewable energy technologies and the proliferation of electric vehicles, is further driving the demand for polypropylene in this segment.

Polypropylene Market Regional Analysis

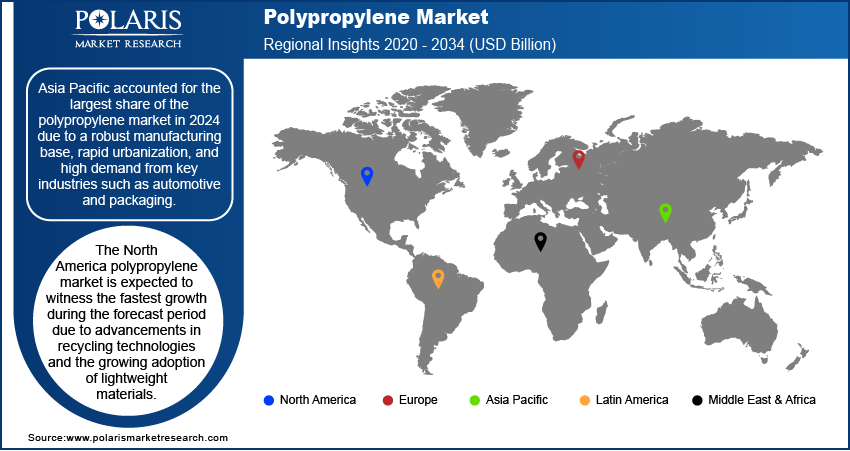

By region, the study provides polypropylene market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the polypropylene market revenue due to the region's robust manufacturing base; high demand from various key industries such as automotive, packaging, and construction; and significant investments in infrastructure development. According to the International Trade Administration, India is the third largest automotive market in the world, following China and the US. In the fiscal year 2023, the industry produced around 26 million vehicles across various segments, including passenger and commercial vehicles, as well as two and three-wheelers. The automotive sector contributes 49% to India's manufacturing GDP and 7% to the national GDP. The presence of major polypropylene producers, coupled with increasing consumption in emerging economies such as China and India, has further strengthened the regional market share. Additionally, the rising population and urbanization in the region are driving demand for durable and cost-effective materials, contributing to the Asia Pacific polypropylene market expansion.

The North America polypropylene market is expected to witness the fastest growth during the forecast period due to increasing demand from the automotive and packaging industries, advancements in recycling technologies, and the growing adoption of lightweight and sustainable materials. Government initiatives promoting eco-friendly practices and significant investments in research and development are further driving market expansion. In November 2024, The Biden-Harris Administration launched a national strategy to tackle plastic pollution, aiming to drive domestic and international efforts to protect communities affected by plastic from production to disposal. Additionally, the rising use of polypropylene in healthcare and consumer goods applications is contributing to the North America polypropylene market growth.

Polypropylene Market – Key Players and Competitive Analysis

The competitive landscape of the polypropylene market is characterized by the presence of numerous key players, intense competition, and continuous innovations to provide diverse end-use industries. Leading companies in the market focus on strategic initiatives such as mergers and acquisitions, partnerships, and joint ventures to strengthen their market share and expand their global reach. They are heavily investing in research and development to enhance product performance, improve sustainability, and develop bio-based polypropylene alternatives, contributing to market growth. Moreover, advancements in manufacturing technologies and the expansion of production capacities are enabling companies to meet the increasing market demand effectively. Key players are also leveraging digitalization and process optimization to reduce costs and improve supply chain efficiency, further driving market expansion. The growing focus on sustainability has led to significant investments in recycling infrastructure and the development of circular economy solutions, creating a competitive edge for companies that prioritize eco-friendly practices.

Prominent companies such as LyondellBasell Industries, SABIC, ExxonMobil, Borealis AG, and TotalEnergies SE dominate the polypropylene market, with a strong presence in major polypropylene-producing regions. These companies are actively engaged in catering to the automotive, packaging, construction, and consumer goods industries, ensuring their products align with evolving customer needs and regulatory requirements. This dynamic competitive environment continues to shape the polypropylene market outlook, fostering innovation and market growth.

A few key major players are LyondellBasell Industries N.V., ExxonMobil Corporation, INEOS, SABIC, Ducor Petrochemicals, BASF SE, Repsol, Borouge, Borealis AG, MOL Group, Reliance Industries Ltd., Dupont, Braskem, and Formosa Plastic Group.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the US. ExxonMobil is headquartered in Irving, Texas. Exxon Mobil is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries. In December 2022, Exxon Mobil Corporation established its new polypropylene production unit in Baton Rouge, Louisiana, to meet the growing demand for high-performance products.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries, designed to enhance durability, flexibility, and sustainability in various industrial applications. In August 2021, BASF SE provided its non-discoloring processing stabilizer, Irgastab, to LOTTE Chemical to produce the polypropylene (PP) required for medical applications.

List of Key Companies in Polypropylene Market

- LyondellBasell Industries N.V.

- ExxonMobil Corporation

- INEOS

- SABIC

- Ducor Petrochemicals

- BASF SE

- Repsol

- Borouge

- Borealis AG

- MOL Group

- Reliance Industries Ltd.

- Dupont

- Braskem

- Formosa Plastic Group

Polypropylene Industry Developments

In June 2024, LyondellBasell launched a new production line at its Dalian facility in the Advanced Polymer Solutions division, enhancing its presence in China. This line will manufacture a range of high-performance polypropylene compounds for the automotive industry.

In June 2024, Stratasys Ltd. announced the commercial availability of its new material, SAF Polypropylene (PP) for use on the Stratasys H350 printer. Stratasys SAF PP, in partnership with BASF Forward AM, is designed for superior part quality in Powder Bed Fusion technologies and cost efficiency. This advanced material offers a lower cost-per-part and enhanced surface aesthetics, meeting the rigorous demands of high-volume production while maintaining exceptional quality.

In January 2022, INEOS Olefins & Polymers joined the NEXTLOOPP initiative, a UK collaboration aimed at producing circular food-grade recycled polypropylene from Post-Consumer Recycled (PCR) packaging. Over two years, INEOS developed a demonstration plant designed to produce 10,000 tonnes annually of food-grade recycled polypropylene, advancing sustainability in the food sector.

Polypropylene Market Segmentation

By Polymer Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Homopolymer

- Copolymer

By Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Injection Molding

- Blow Molding

- Extrusion Molding

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Fiber

- Film & Sheet

- Raffia

- Others

By End User Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Automotive

- Building & Construction

- Packaging

- Medical

- Electrical & Electronics

- Consumer Goods/Lifestyle

- Agriculture

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 133.31 billion |

|

Market Size Value in 2025 |

USD 140.32 billion |

|

Revenue Forecast by 2034 |

USD 223.54 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in Kilotons; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global polypropylene market size was valued at USD 133.31 billion in 2024 and is projected to grow to USD 223.54 billion by 2034.

• The global market is projected to register a CAGR of 5.3% during the forecast period.

• In 2024, Asia Pacific accounted for the largest market share due to the region's robust manufacturing base; high demand from key industries such as automotive, packaging, and construction; and significant investments in infrastructure development.

• A few key players in the market are LyondellBasell Industries N.V., ExxonMobil Corporation, INEOS, SABIC, Ducor Petrochemicals, BASF SE, Repsol, Borouge, Borealis AG, MOL Group, Reliance Industries Ltd., Dupont, Braskem, and Formosa Plastic Group.

• In 2024, the injection molding segment dominated the polypropylene market share due to its efficiency and versatility in producing complex and high-precision components across various industries.

• The electrical & electronics segment is expected to experience the fastest growth during the forecast period due to the increasing use of polypropylene in insulating materials, capacitors, and other electronic components.