Organic Food and Beverage Market Share, Size, Trends, Industry Analysis Report, By Product (Organic Beverages, Organic Food); By Distribution Channel; By Region; Segment Forecast, 2024 – 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM1140

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

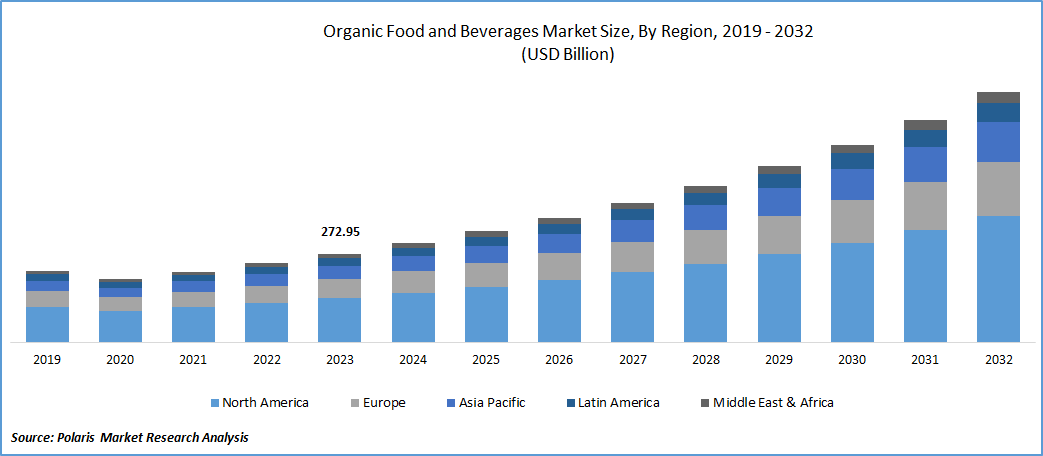

The global organic food and beverage market was valued at USD 243.62 billion in 2023. The organic food and beverage market industry is projected to grow from USD 272.95 billion in 2024 to USD 690.92 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.3% during the forecast period (2024 - 2032).

The organic food and beverage market is experiencing growth primarily due to increased awareness of the health benefits associated with the consumption of organic products. Changes in consumer purchasing behavior are expected to contribute to a rise in sales of organic food and beverages. Furthermore, the growing preference for non-GMO products among consumers is a key driver of market expansion. The organic food and beverage market has seen significant growth owing to the broader availability of organic foods and beverages, which are no longer limited to niche stores or farmers’ markets.

Readily available in mainstream supermarkets, online retailers, and even fast-food chains, organic options seamlessly integrate into consumers’ regular shopping habits. Furthermore, growing awareness and concern about the environmental impact associated with conventional agricultural practices—contributing to issues like soil degradation, water pollution, and biodiversity loss—prompt a shift. In contrast, organic farming methods prioritize sustainable practices, focusing on enhancing soil health, conserving water resources, and preserving wildlife habitats. This commitment to environmental sustainability resonates with an expanding consumer base actively seeking products aligned with their values of sustainability and ethical consumption.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for organic ingredients in recent years is driven by consumers' pursuit of enhanced overall health and heightened awareness of the adverse effects of synthetic ingredients. Conventional foods pose various health risks due to the presence of synthetic chemicals, including pesticides in plants and antibiotics in animals. Moreover, governmental efforts to educate consumers about distinguishing falsely labeled products from legitimate ones have played a role in the overall development of the organic food and beverage market. In some regions, governments have issued guidelines prohibiting the use of chemicals, pesticides, growth hormones, and other synthetic substances to encourage the cultivation of organic products.

The intensification of traditional farming practices has underscored the necessity for organic farming methods to ensure long-term soil health. Nevertheless, the anticipated constraints on market growth in the forecast years include the high costs associated with production and operations as well as a shorter shelf life. Additionally, the market faces hindrances such as premium pricing impeding widespread customer acceptance and a limited range of options in product assortments. High packaging, logistics, and distribution costs aimed at extending shelf life further pose restrictions on organic food and beverage market growth.

Industry Dynamics

Growth Drivers

Growing Interest in Clean Label Products

The organic food and beverage market is on the brink of substantial growth, propelled by the escalating demand for clean-label food and beverage products. Today's consumers, being increasingly conscious about the origins and composition of what they consume, actively seek information about ingredients, their sources, and government certifications to ensure adherence to organic and sustainable practices. Responding to evolving lifestyles and a heightened awareness of health, consumers are increasingly opting for organic food and beverages, shunning conventional alternatives. Moreover, organic animal-based products, such as meat and chicken, guarantee freedom from genetic modification. The upsurge in demand for organic food is evident in the mounting sales figures, driven by consumers' preference for natural, chemical-free alternatives.

Report Segmentation

The organic food and beverage market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Organic Food Segment Held the Largest Revenue Share in 2023

The trend of organic vegetables, which originated in developed regions like North America and Europe, has expanded to emerging economies such as India and China. North America and Europe stand as the primary consumers of organic foods. The consumption of organic meat, fish, and poultry products is expected to experience the highest CAGR during the forecast period. Rising concerns about artificial preservatives and additives are expected to boost product demand in the forecast years.

The organic beverages sector is set for significant growth in the organic food and beverage market as consumers choose natural drinks over carbonated beverages, driven by various health benefits. Non-dairy beverages dominated the segment in 2022. The growing adoption of a vegan lifestyle is expected to further enhance the segment growth. Sales of coffee and tea are projected to experience the highest CAGR, attributed to the increased consumption of flavored tea and coffee.

By Distribution Channel Analysis

The Supermarket/Hypermarket Segment Accounted for the Highest Market Share

The supermarket/hypermarket segment accounted for the highest market share in 2023. These supermarkets/hypermarkets offer a wide range of both branded and locally produced items. The presence of brick-and-mortar stores within this distribution channel, coupled with their capability to carry popular brands, has contributed to the expansion of this segment. The growing prevalence of supermarket and hypermarket chains, along with changes in the retail landscape, especially in developing economies, is enhancing product sales through this channel.

The online distribution channel segment is projected to attain a significant CAGR during the forecast period. The segment’s anticipated growth in the organic food and beverage market is driven by the expanding internet penetration and strategic marketing initiatives by companies to connect with diverse customer touchpoints. The surge in online sales and the popularity of subscription boxes for organic produce in the past two years have significantly contributed to the positive expansion of the market. The swift adoption of smartphones, coupled with the rapid penetration of online grocery services and food delivery platforms, further accelerates the growth of this segment in the organic food and beverage market.

Regional Insights

North America Dominated the Market In 2023

The availability of farmlands conducive to organic farming in the U.S., Australia, and Argentina has compelled regulators to formulate supportive policies aimed at boosting the production of organic foods. This, in turn, is expected to positively impact the demand for organic food and beverages in the market over the forecast period. The North American organic food and beverages market has significantly contributed to the global market. This is attributed to the unique advantages associated with products that are eco-friendly, free of chemicals and residues, and deemed healthier compared to conventional food. The increasing consumer awareness regarding the benefits of consuming non-genetically modified or engineered products is anticipated to further drive the North American market in the near future.

Asia Pacific is expected to experience the highest growth rate in the organic food and beverage market, driven by the increasing popularity of ready-to-eat foods among the working-class population and the substantial millennial demographic in countries like India. China, India, and Japan have emerged as major markets concerning consumer expenditure on food. Additionally, the significant surge in the demand for frozen food, attributed to time constraints for preparation and cooking, is creating new opportunities for the regional market in the organic frozen food sector.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global organic food and beverage market include:

- Amy’s Kitchen, Inc.

- Conagra Brands, Inc.

- Dairy Farmers of America, Inc.

- Danone

- Dole Food Company, Inc.

- Eden Foods

- General Mills Inc.

- Gujarat Cooperative Milk Marketing Federation (Amul)

- Hain Celestial

- Nestlé

- Organic Valley

- SunOpta

- The Hershey Company

- United Natural Foods, Inc.

- Whole Foods Market L.P.

Recent Developments

- In May 2022, Organic India, a prominent brand in the organic tea and wellness sector, introduced two fresh options in tea and infusion: Tulsi Detox Kahwa and Peppermint Refresh. These teas are certified as organic and vegan, and they come in loose-leaf and teabag formats. The introduction of these new tea varieties is in line with Organic India's commitment to providing consumers with wholesome and sustainable wellness products.

- In February 2022, Amul, an Indian dairy company, ventured into the organic food sector with the introduction of organic rice, flour, honey, chocolates, and potato products. Additionally, they have outlined plans to establish a "green college" aimed at educating young farmers about natural and organic farming practices, along with the creation of "organic haats" dedicated to selling organic products.

Organic Food and Beverage Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 272.95 billion |

|

Revenue forecast in 2032 |

USD 690.92 billion |

|

CAGR |

12.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The organic food and beverage market size is estimated to be worth USD 690.92 billion by 2032.

The top market players in the organic food and beverage market include Amy’s Kitchen, Conagra Brands, Dairy Farmers of America, Danone, and Dole Food Company.

The North America region contributes notably towards the organic food and beverage market growth.

The global organic food and beverage market is expected to grow at a CAGR of 12.3% during the forecast period.

The key segments covered in the organic food and beverage market report are product, distribution channel, and region.