Narcolepsy Therapeutics Market Size, Share, Trends, Industry Analysis Report: By Treatment (Narcolepsy with Cataplexy, Narcolepsy without Cataplexy, and Secondary Narcolepsy), Product, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 116

- Format: PDF

- Report ID: PM1304

- Base Year: 2024

- Historical Data: 2020-2023

Narcolepsy Therapeutics Market Overview

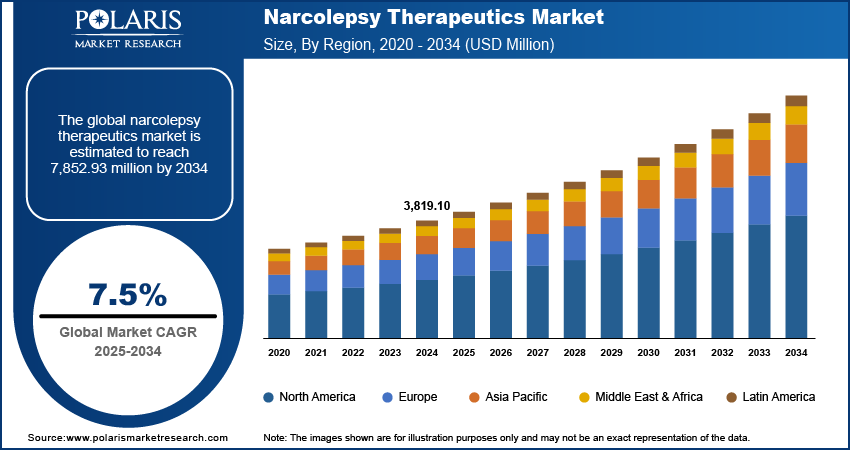

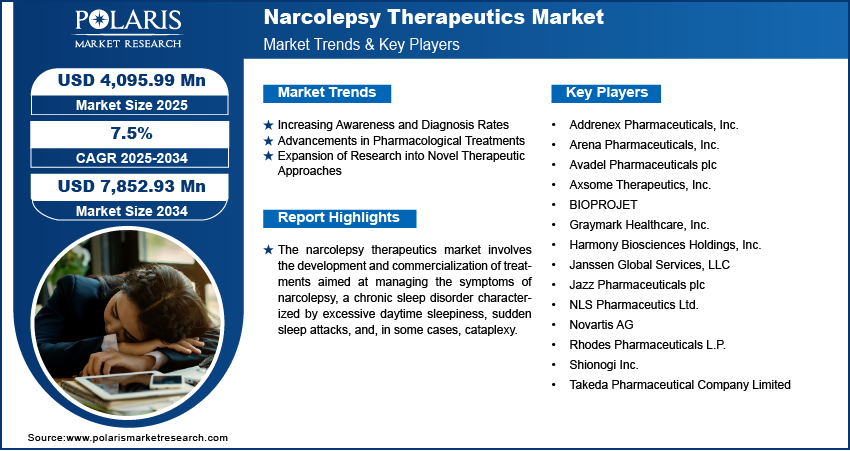

The narcolepsy therapeutics market size was valued at USD 3,819.10 million in 2024. The market is projected to grow from USD 4,095.99 million in 2025 to USD 7,852.93 million by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

The narcolepsy therapeutics market refers to the global industry focused on developing and distributing treatments for narcolepsy, a chronic neurological disorder that affects the brain's ability to regulate sleep-wake cycles. Key drivers of this market include the rising prevalence of narcolepsy, increased awareness and diagnosis rates, and advancements in drug development, particularly in wake-promoting agents and orexin receptor agonists. Additionally, favorable regulatory support and the expansion of research into novel treatment approaches, such as gene therapy and immunotherapy, are contributing to market growth. Narcolepsy therapeutics market trends include a shift toward personalized medicine, the increasing adoption of non-stimulant therapies, and ongoing clinical trials aimed at improving the efficacy and safety of available treatments.

To Understand More About this Research: Request a Free Sample Report

Narcolepsy Therapeutics Market Dynamics

Increasing Awareness and Diagnosis Rates

The recognition and diagnosis of narcolepsy have improved in recent years, contributing to the narcolepsy therapeutics market growth. Studies indicate that narcolepsy affects approximately 37.7 among 100,000 individuals in the US, equating to about 126,191 people nationwide. Increased awareness regarding the condition has led to more individuals seeking medical attention and receiving appropriate treatments, thereby propelling market demand.

Advancements in Pharmacological Treatments

Significant progress in pharmacological interventions has boosted the narcolepsy therapeutics market demand. Recent developments include the approval of medications such as pitolisant and solriamfetol, which offer new options for managing excessive daytime sleepiness and cataplexy. Additionally, ongoing research into novel treatment approaches, such as orexin receptor agonists, aims to address the underlying causes of narcolepsy, potentially offering more effective and targeted therapies in the future.

Expansion of Research into Novel Therapeutic Approaches

The narcolepsy therapeutics market development is attributed to increased research into innovative treatment methods. For instance, the development of orexin receptor agonists represents a promising area of study, as these agents aim to restore orexin signaling in the brain, directly addressing a key deficiency in narcolepsy patients. Such advancements have the potential to improve patient outcomes and expand the range of available treatment options.

Narcolepsy Therapeutics Market Segment Insights

Narcolepsy Therapeutics Market Assessment by Treatment

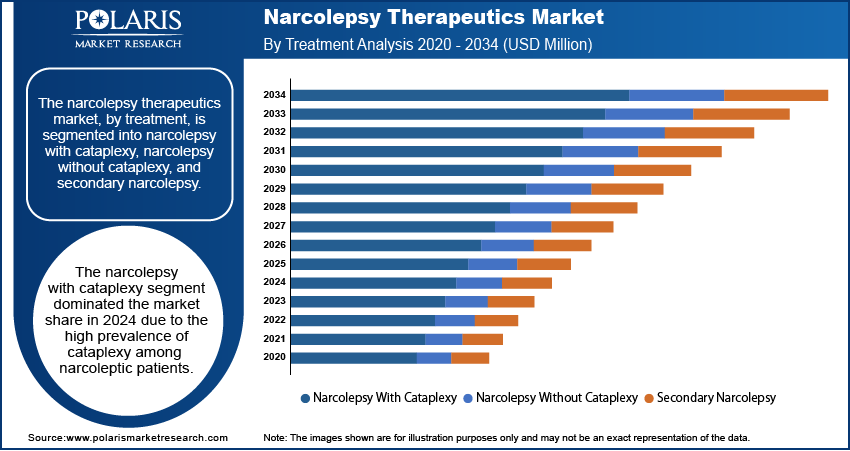

The narcolepsy therapeutics market, by treatment, is segmented into narcolepsy with cataplexy, narcolepsy without cataplexy, and secondary narcolepsy. The narcolepsy with cataplexy segment dominated the narcolepsy therapeutics market share in 2024 due to the high prevalence of cataplexy among narcoleptic patients and the adoption of novel drugs such as WAKIX, Xyrem, and Xywav for treatment. In October 2020, Harmony Biosciences Holdings, Inc. received US FDA approval for WAKIX to treat adult cataplexy associated with narcolepsy.

The narcolepsy without cataplexy segment is anticipated to experience the fastest growth during the forecast period. This growth is driven by the high prevalence of the disease and increased public awareness through campaigns conducted by organizations such as the US Narcolepsy Network and the Europe Narcolepsy Network. The rising awareness and subsequent increase in diagnosis rates are expected to lead to a higher treatment rate within this segment.

Narcolepsy Therapeutics Market Evaluation by Product

The narcolepsy therapeutics market, by product, is segmented into central nervous system stimulants, sodium oxybate, selective serotonin reuptake inhibitors, tricyclic antidepressants, and others. The sodium oxybate segment dominated the narcolepsy therapeutics market revenue share in 2024 due to high prescription rates, favorable reimbursement policies, and increased awareness of narcolepsy treatments. The American Academy of Sleep Medicine recommends sodium oxybate, marketed as Xyrem, as a standard treatment for excessive daytime sleepiness and cataplexy associated with narcolepsy, contributing to segment dominance. Insurance providers, including Medicare and Medicaid, often cover this medication, and manufacturers offer assistance programs for patients lacking insurance or financial means, leading to high adoption.

The central nervous system stimulants segment is expected to grow at a rapid pace during the forecast period owing to their widespread prescription to enhance wakefulness in narcoleptic patients. Ongoing research and development activities focusing on CNS stimulants for rare neurological disorders are anticipated to drive growth in the segment further.

Narcolepsy Therapeutics Market Regional Outlook

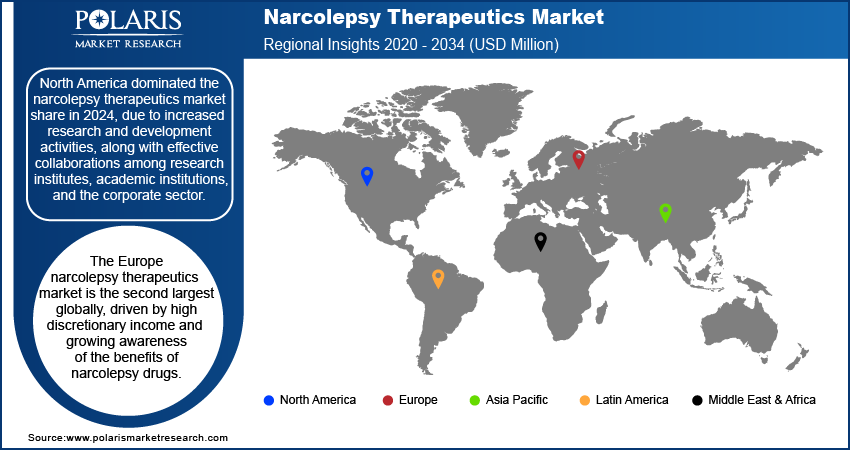

By region, the report provides narcolepsy therapeutics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the narcolepsy therapeutics market share in 2024, due to increased research and development activities, along with effective collaborations among research institutes, academic institutions, and the corporate sector. The availability of a wide range of therapeutic products, coupled with favorable government initiatives and ongoing research studies, has further propelled market demand in the region. A study published by Stanford Medicine in September 2021 highlighted that an extended-release of sodium oxybate significantly reduced muscle weakness attacks in patients, underscoring the region's commitment to advancing narcolepsy treatment.

The Europe narcolepsy therapeutics market is the second largest globally, driven by high discretionary income and growing awareness of the benefits of narcolepsy drugs. The region's well-established healthcare infrastructure and increased focus on sleep disorders contribute to the narcolepsy therapeutics market expansion. Additionally, supportive government initiatives and the presence of key pharmaceutical companies enhance the availability and development of narcolepsy treatments in the region.

The Asia Pacific narcolepsy therapeutics market is anticipated to experience rapid growth due to economic development, rising awareness among populations, higher disposable incomes, and increased investments in the pharmaceutical and biotechnology sectors. Supportive government initiatives and improvements in healthcare facilities further contribute to the market's expansion in the region.

Narcolepsy Therapeutics Market – Key Players and Competitive Analysis Report

The narcolepsy therapeutics market comprises several active pharmaceutical companies dedicated to developing and providing treatments for this sleep disorder. Key players include Jazz Pharmaceuticals PLC, known for its product Xyrem; Teva Pharmaceutical Industries Ltd., offering various central nervous system stimulants; and Takeda Pharmaceutical Company Limited, which is advancing its drug TAK-861 in late-stage trials. Other notable companies are Avadel Pharmaceuticals plc, recognized for its once-nightly formulation Lumryz; Harmony Biosciences Holdings, Inc., with its medication Wakix; and Axsome Therapeutics, Inc., focusing on innovative therapies for central nervous system disorders.

Additional contributors in the narcolepsy therapeutics market are Arena Pharmaceuticals, Inc., engaged in developing novel treatments; BIOPROJET, involved in the research and development of narcolepsy drugs; and Graymark Healthcare, Inc., providing healthcare solutions for sleep disorders. Companies such as Addrenex Pharmaceuticals, Inc.; NLS Pharmaceutics Ltd.; and Shionogi Inc. are also active in the development of narcolepsy therapeutics. Furthermore, Novartis AG, Rhodes Pharmaceuticals L.P., and Janssen Global Services, LLC are involved in offering treatments that address symptoms associated with narcolepsy.

In terms of competitive insights, these companies are investing in research and development to introduce novel and more efficient drugs to the market. For instance, Jazz Pharmaceuticals has expanded its portfolio by acquiring Sunosi (solriamfetol), a medication used to treat excessive daytime sleepiness in adults with narcolepsy or obstructive sleep apnea. Avadel Pharmaceuticals has gained attention with its innovative once-nightly formulation, Lumryz, which has been approved by the US FDA for treating narcolepsy symptoms in both adults and children aged 7 and older. Additionally, Axsome Therapeutics has reported positive results in late-stage trials for its sleep disorder therapy, indicating a promising future in the narcolepsy therapeutics market.

Jazz Pharmaceuticals plc is a global biopharmaceutical company dedicated to developing and commercializing products that address unmet medical needs, particularly in sleep medicine and oncology. The company is known for its narcolepsy treatments, including Xyrem and Xywav, which are approved for managing cataplexy and excessive daytime sleepiness in patients suffering from narcolepsy. Jazz continues to invest in research to enhance its sleep medicine portfolio.

Avadel Pharmaceuticals plc is a specialty pharmaceutical company focused on developing and commercializing innovative therapies for sleep disorders, particularly narcolepsy. Headquartered in Dublin, Ireland, with operations in the US, Avadel is dedicated to improving the lives of patients having sleep-related conditions through its proprietary drug delivery technologies and novel formulations. The company’s flagship product is LUMRYZ, an extended-release formulation of sodium oxybate designed for the treatment of excessive daytime sleepiness (EDS) and cataplexy in adults with narcolepsy. This innovation addresses a critical unmet need by eliminating the need for patients to wake up in the middle of the night to take a second dose, thereby enhancing sleep quality and overall treatment adherence. Avadel has focused heavily on narcolepsy therapeutics, leveraging its expertise in drug formulation and clinical research to offer a differentiated product in a competitive market.

List of Key Companies in Narcolepsy Therapeutics Market

- Addrenex Pharmaceuticals, Inc.

- Arena Pharmaceuticals, Inc.

- Avadel Pharmaceuticals plc

- Axsome Therapeutics, Inc.

- BIOPROJET

- Graymark Healthcare, Inc.

- Harmony Biosciences Holdings, Inc.

- Janssen Global Services, LLC

- Jazz Pharmaceuticals plc

- NLS Pharmaceutics Ltd.

- Novartis AG

- Rhodes Pharmaceuticals L.P.

- Shionogi Inc.

- Takeda Pharmaceutical Company Limited

Narcolepsy Therapeutics Industry Developments

-

October 2024: The US Food and Drug Administration expanded the approval of Avadel Pharmaceuticals' drug, Lumryz, to include children aged 7 and older with narcolepsy symptoms.

-

May 2023: Zevra Therapeutics, Inc., a rare disease therapeutics company, announced the acceptance of an Investigational New Drug application by the U.S. Food and Drug Administration to begin a Phase 1 clinical trial of KP1077 in narcolepsy.

Narcolepsy Therapeutics Market Segmentation

By Treatment Outlook (Revenue – USD Million, 2020–2034)

- Narcolepsy with Cataplexy

- Narcolepsy without Cataplexy

- Secondary Narcolepsy

By Product Outlook (Revenue – USD Million, 2020–2034)

- Central Nervous System Stimulants

- Sodium Oxybate

- Selective Serotonin Reuptake Inhibitor

- Tricyclic Antidepressants

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Narcolepsy Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3,819.10 million |

|

Market Value in 2025 |

USD 4,095.99 million |

|

Revenue Forecast by 2034 |

USD 7,852.93 million |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The narcolepsy therapeutics market has been broadly segmented on the basis of treatment and product. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the narcolepsy therapeutics market focus on expanding their product portfolios through research and development, regulatory approvals, and strategic partnerships. Marketing strategies include increasing awareness through patient education programs, physician engagement initiatives, and collaborations with healthcare organizations. Companies also invest in digital marketing and targeted advertising to reach potential patients and healthcare providers. Geographic expansion into emerging markets and improving access to treatment through reimbursement programs further support market growth. Additionally, acquisitions and licensing agreements help strengthen market presence and enhance product offerings.

FAQ's

The narcolepsy therapeutics market size was valued at USD 3,819.10 million in 2024 and is projected to grow to USD 7,852.93 million by 2034.

The market is projected to register a CAGR of 7.5% during the forecast period.

North America held the largest share of the market in 2024.

A few key players include Addrenex Pharmaceuticals, Inc.; Arena Pharmaceuticals, Inc.; Avadel Pharmaceuticals plc; Axsome Therapeutics, Inc.; BIOPROJET; Graymark Healthcare, Inc.; Harmony Biosciences Holdings, Inc.; Janssen Global Services, LLC; Jazz Pharmaceuticals plc; NLS Pharmaceutics Ltd.; Novartis AG; Rhodes Pharmaceuticals L.P.; Shionogi Inc.; and Takeda Pharmaceutical Company Limited.

The narcolepsy with cataplexy segment accounted for the largest share of the market in 2024.

The sodium oxybate segment accounted for the largest share of the market in 2024.

Narcolepsy therapeutics refers to the medications and treatments used to manage and alleviate the symptoms of narcolepsy, a chronic sleep disorder characterized by excessive daytime sleepiness, sudden episodes of sleep, and, in some cases, cataplexy (a sudden loss of muscle control). The therapeutics focus on improving the quality of life for individuals by reducing these symptoms. Common treatment options include central nervous system stimulants (e.g., modafinil), sodium oxybate (for managing cataplexy and excessive sleepiness), selective serotonin reuptake inhibitors (SSRIs), and tricyclic antidepressants. These medications help patients stay awake during the day, manage cataplexy, and regulate sleep patterns.

A few key trends in the market are described below: Advancement of Personalized Treatments: Development of individualized therapies targeting specific symptoms of narcolepsy, such as excessive daytime sleepiness and cataplexy. Increasing Focus on Pediatric Treatments: Expansion of treatment options for children and adolescents with narcolepsy, addressing an underserved patient population. Use of Digital Health Technologies: Integration of mobile apps and wearable devices to monitor patient symptoms and medication adherence, improving patient management. Shift Toward Combination Therapies: Exploration of combination treatments to address multiple narcolepsy symptoms more effectively.

A new company entering the market could focus on developing innovative, patient-friendly treatments, such as once-daily formulations or drugs with fewer side effects, to differentiate itself from existing offerings. Focusing on underrepresented regions with rising healthcare needs, particularly in Asia Pacific and Latin America, could provide significant growth opportunities. Building strong relationships with healthcare providers and engaging in educational initiatives to increase awareness of narcolepsy will also be essential. Additionally, investing in digital health solutions, such as mobile apps to monitor symptoms or track medication adherence, could appeal to both patients and physicians.

Companies manufacturing, distributing, or purchasing narcolepsy therapeutics-related products and other consulting firms must buy the report.