Naphtha Market Share, Size, Trends, Industry Analysis Report, End-Use (Petrochemical, Aerospace, Agriculture, Paints, Coatings, Others); By Type; Process; Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM1282

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

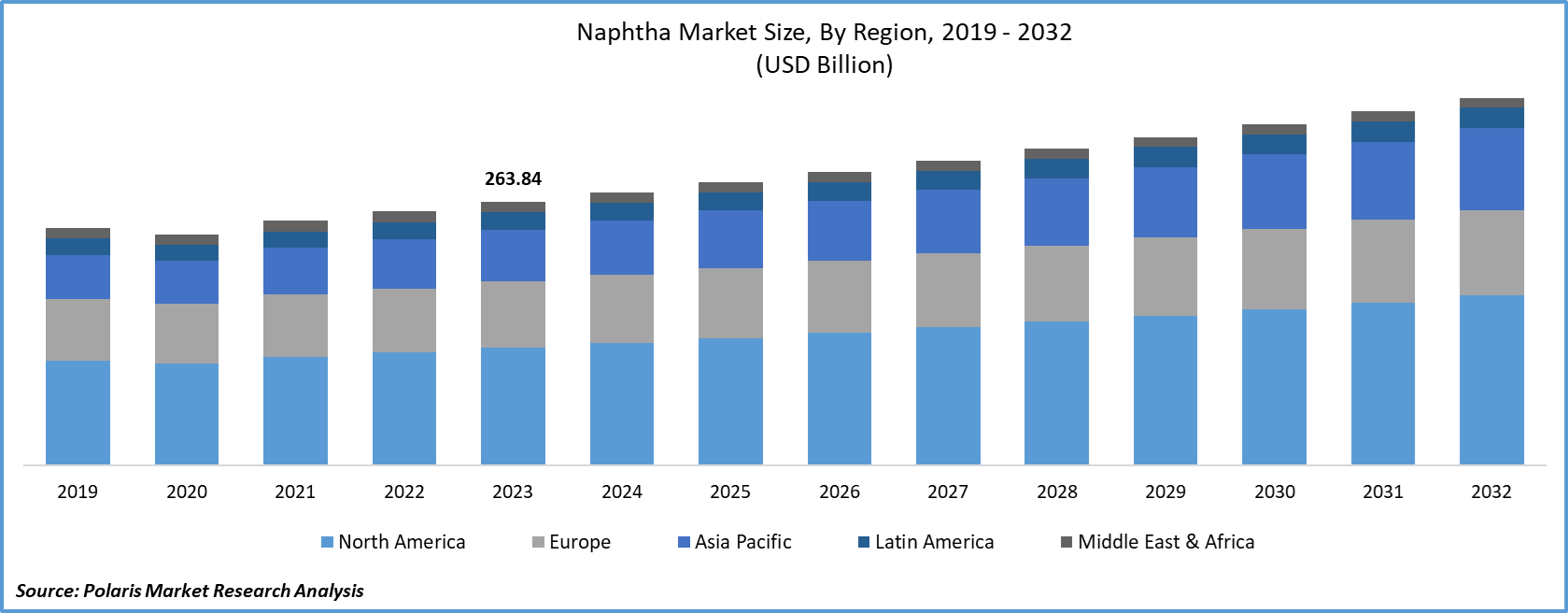

The global naphtha market size was valued at USD 263.84 billion in 2023. The market is anticipated to grow from USD 273.60 billion in 2024 to USD 368.44 billion by 2032, exhibiting the CAGR of 3.8% during the forecast period.

Throughout the study period, the utilization of aromatics in the manufacturing of rubber, oils, edible fats, and personal care product range is forecasted to operate the market growth for naphtha. Olefins prepare the paramount feedstock for polymers, synthetic rubber processing, and chemical intermediates. A rise in demand for plastics in the packaging, electrical & electronics system, and manufacturing plants is predicted to stimulate market growth.

Know more about this report: Request for sample pages

Naphtha is commonly used as a fuel for lanterns, power stoves, and other heating types of equipment in the power and electricity sector by virtue of it having lesser carbon emission levels compared to hydrocarbon fuels such as coal oil, lamp oil, and paraffin. The augmented demand for clean and green energy resources conclusively influences the naphtha market flourishing globally.

Progression in technology criterion contributes to the inception of improved distillation processes, modern furnace substances, coupled with the property of naphtha for fabrication of olefins and aromatics like butadiene, benzene, ethylene, propylene, and toluene is a supreme factor for market development.

Many countries including India have recently lowered the customs duty (taxes) on naphtha which directly impact the flourishing of the naphtha market in the near future. Naphtha has a huge requirement in the petrochemical and chemical-oriented sector. The continuous growth in the demand for petrochemical and chemical-based products is anticipated to promote the growth of the market.

The global naphtha market is critically affected by the COVID-19 pandemic. The pandemic has notably disturbed the heightening of the construction and interconnected sector. The Supply chain module for construction materials was interrupted lockdown was imposed in response to COVID-19 and a shortage of workforce was also detected.

Multiple mega construction projects have been put on hold for a short period of time, which directly shrink the demand for paints, coatings, and their related additives, thus, retard the naphtha market growth rate. Parallelly, strict air travel bans on domestic and international levels reduced air traffic, and minimal demand for new aircraft/planes therefore paints and coatings demand is also reduced cases the downfall of the naphtha market growth during the projection period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Prominent oil organizations in the naphtha market are declared the start of green and clean fuel and aromatics propose a liability regarding the environment's health and security. Industry participants are funding/investing in production expansions to increase naphtha production these factors sectors are responding to the continuous isomerization units, and catalytic reforming, which have an operating capacity nearby of 65,000 barrels per day, proportionately.

Report Segmentation

The market is primarily segmented based on by type, process, application, end-use, and Regions.

|

By Type |

Process |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Naphtha Market, By Application

By application, the naphtha market was led by the chemical segment, which includes benzene, toluene, petrochemicals, and xylene holding higher market share in 2021. The segment is anticipated to sustain its dominance over the next years. The fuel and energy section captured the second-largest share of the market in 2021, however, there is a minimal drop in position by the end of 2030.

Naphtha has turned up as a chief mainstream chemical with a variety of applications. A major field of application includes the usage of naphtha as an industrial solvent. Naphtha is prominently used in processes such as household oil paints, detergents, gasoline manufacturing, cigarette lighter, stain removers, and footwear polish constituent.

Naphtha Market, By End-Use

The rising demand for naphtha by the key end-user petrochemical industry is expected to boost the market over the forecast period. Due to brisk industrialization and urbanization in emerging as well as big economies, the demand for cheap fuel is rising, which is anticipated to drive the huge demand for Naphtha, further boosting the market in near future.

The healthy initiative to establish a set of chemical plants in the APAC region is projected to fabricate various plastics material, in addition to other petrochemical products used in multiple end-use industries, likely electronics automotive, paint industry, battery vehicles, and others projected to enhance the Naphtha market during the forecast period 2022-2030.

Asia Pacific dominates the market with a significant revenue share in 2021

Asia Pacific region is the major market for naphtha holding higher volume share. Additionally, PAC is presumably to pursue its superiority in the naphtha market owing to the flourishing chemical sector and enlarging end-use businesses such as automotive, construction, and plastic in developing countries like South Korea, Taiwan, and India. Asia Pacific is forecasted to expand at an excessive CAGR rate over the projection period due to the booming demand for naphtha globally.

The Asia-Pacific designates the paramount naphtha market owing to the rise in automobile trade in the region, and the increase in plastic consumption in the construction segment also gives rise to the growth of the naphtha market. Moreover, the topographical advantages of the Middle East and the strong consolidation of oil refineries provide considerable opportunities for the chemical and energy division in the region.

On the contrary, a strict governmental structure in North America and reduced production of petroleum-related products may impede the development of the market. Additionally, the North American petrochemical business, majorly in the United States, prefers lower-cost alternatives such as LPG, which is expected to obstruct the naphtha market growth.

The shale gas cacophony in North America has transfigured the petrochemical sector in the US, Canada, and Mexico from costly producers of major petrochemicals and resins to some of the most cost-effective producers worldwide. North America is the second top market for naphtha next to the Asia Pacific and is forecasted to attend intermediate growth due to the high cost of naphtha and repositioning trends towards economical alternatives.

Europe to witness a nimble growth rate owing to costly crude oil majorly needed for the distillation of naphtha. Although, the Latin American naphtha market will showcase optimistic growth due to the surging end-use sector, distinctly in Mexico and Brazil. Accrescent chemical sector in RoW (Rest of the World) primarily in the Middle East its topographical benefit and the impendence of oil refineries will introduce new opportunities to the RoW naphtha market over the projection period.

Competitive Insight

Some of the key players operating in the global naphtha market include Formosa Petrochemical Corporation, LG Chem, Mangalore Refinery, China Petrochemical Corporation, Lotte Chemical Corporation, Mitsubishi Chemical Corporation, Chevron Corporation, Shell Chemicals, Reliance Industries Limited, Indian Oil Corporation Ltd, Exxon Mobil Corporation, BP PLC, Novatek, Petrochemicals Limited, Saudi Arabian Oil Co., and Others.

Recent Developments

June 2021-Axens alliance Sulzer Chemtech’s GTC Technology, a prominent licensor of petrochemical operations, to authorize an ingenious methodology for FCC naphtha processing. The association proposal will be build on Axens' retained Prime-G+ hydrodesulfurization automation additionally Sulzer Chemtech’s ultra-modern GT-BTX PluS extraction system.

In May 2021-A eminent Japanese manufacturer of petrochemicals, Mitsui Chemicals indorsed a conciliation to acquire bio-naphtha from Neste, a Finland-based biofuels producer, and Toyota Tsusho, a Japanese business company, to speed up their aim to reach its 2050 decarbonization target.

In July 2019, PDV LLC, a Venezuela-located oil and gas producer has declared its program to construct small pipelines to manage the scarcity encountered by imported naphtha which has given rise to hindrance in the export and production of heavy crude materials.

Naphtha Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 273.60 billion |

|

Revenue forecast in 2032 |

USD 368.44 billion |

|

CAGR |

3.8% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

Type, Process, Application, End-User, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Formosa Petrochemical Corporation, LG Chem, Mangalore Refinery, China Petrochemical Corporation, Lotte Chemical Corporation, Mitsubishi Chemical Corporation, Chevron Corporation, Shell Chemicals, Reliance Industries Limited, Indian Oil Corporation Ltd, Exxon Mobil Corporation, BP PLC, Novatek, Petrochemicals Limited, Saudi Arabian Oil Co., and Others. |