Global Leukemia Therapeutics Market Size, Share, Trends, Industry Analysis Report: By Type (Chronic Lymphocytic Leukemia, Acute Lymphoblastic Leukemia, Chronic Myeloid Leukemia, and Acute Myeloid Leukemia), Treatment Type, Mode of Administration, Molecule Type, Gender, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 118

- Format: PDF

- Report ID: PM1341

- Base Year: 2024

- Historical Data: 2020-2023

Leukemia Therapeutics Market Overview

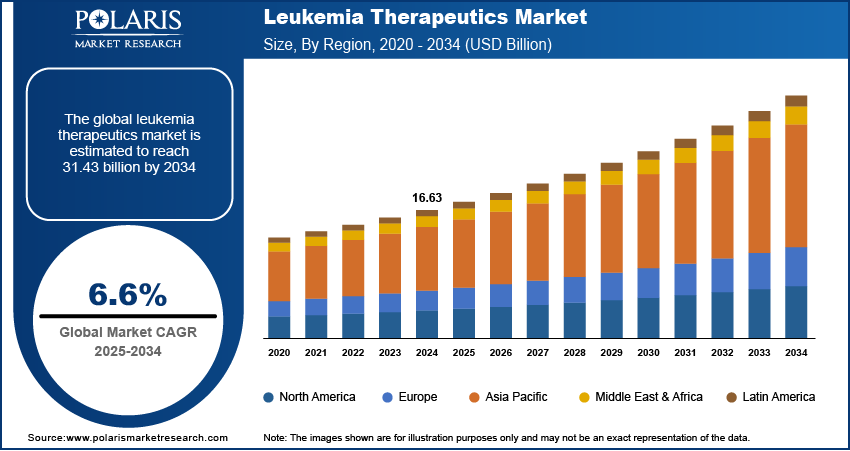

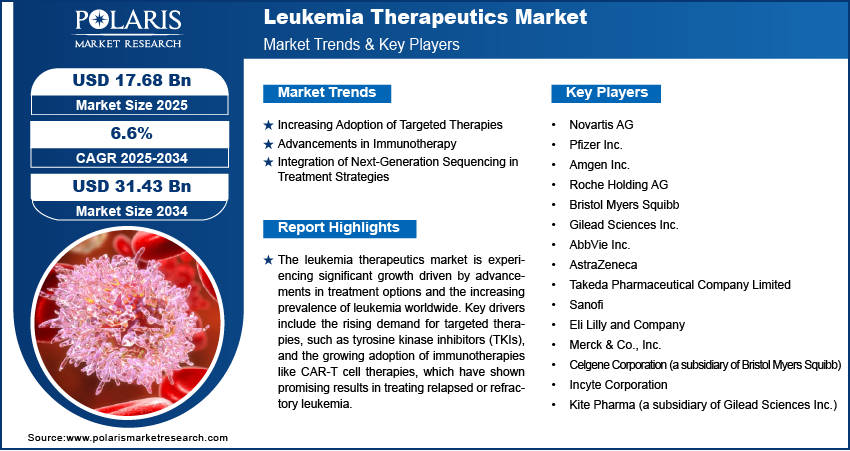

The leukemia therapeutics market size was valued at USD 16.63 billion in 2024. The market is projected to grow from USD 17.68 billion in 2025 to USD 31.43 billion by 2034, exhibiting a CAGR of 6.6% during the forecast period.

The leukemia therapeutics market refers to the industry segment focused on the development, production, and commercialization of treatments for leukemia, a group of cancers affecting blood and bone marrow. The market is driven by increasing leukemia prevalence, advancements in immunotherapies such as CAR-T cell therapy, and the growing adoption of precision medicine approaches. Key trends include tThe leukemia therapeutics market is experiencing growth due to advancements in targeted therapies and CAR-T cell treatments, and increasing approvals of novel drugs. Additionally, the market benefits from strong support through government funding and initiatives aimed at improving oncology care globally.

Leukemia Therapeutics Market Dynamics

Increasing Adoption of Targeted Therapies

The adoption of targeted therapies is a significant leukemia therapeutics market trend. Targeted therapies, such as tyrosine kinase inhibitors (TKIs), are designed to specifically inhibit cancer-causing pathways while minimizing damage to healthy cells. Drugs such as imatinib (Gleevec) and dasatinib (Sprycel) have transformed the treatment landscape for chronic myeloid leukemia (CML), significantly improving survival rates. A study published in Blood Advances (2023) reported that over 80% of patients with CML achieve long-term remission with TKI therapy. As research continues, newer targeted therapies, including FLT3 inhibitors for acute myeloid leukemia (AML), are entering clinical use, further driving the market.

Advancements in Immunotherapy

Immunotherapies, particularly chimeric antigen receptor (CAR)-T cell therapies, have emerged as a groundbreaking driver in leukemia treatment. CAR-T therapies, such as tisagenlecleucel (Kymriah), are designed to genetically modify a patient’s T cells to attack leukemia cells. These therapies have shown remarkable efficacy, particularly in relapsed or refractory acute lymphoblastic leukemia (ALL), with response rates exceeding 80% in certain studies (Journal of Clinical Oncology, 2023). Other immunotherapy modalities, including bispecific T-cell engagers (BiTEs) such as blinatumomab, are also gaining prominence due to their ability to enhance immune-mediated targeting of leukemia cells.

Integration of Next-Generation Sequencing in Treatment Strategies

Next-generation sequencing (NGS) is increasingly being integrated into leukemia treatment strategies, allowing for detailed genetic profiling of leukemia subtypes. This technology aids in identifying mutations, such as BCR-ABL or NPM1, which can guide the selection of targeted treatments. A report in Nature Reviews Clinical Oncology (2023) highlighted that the use of NGS in leukemia diagnostics has improved treatment personalization, leading to better patient outcomes. Furthermore, NGS is facilitating the discovery of novel therapeutic targets and resistance mechanisms, contributing to the development of innovative treatment options. As the cost of NGS continues to decrease, its adoption is expected to grow, enhancing its role in clinical decision-making.

Leukemia Therapeutics Market Segment Insights

Leukemia Therapeutics Market Assessment by Type Outlook

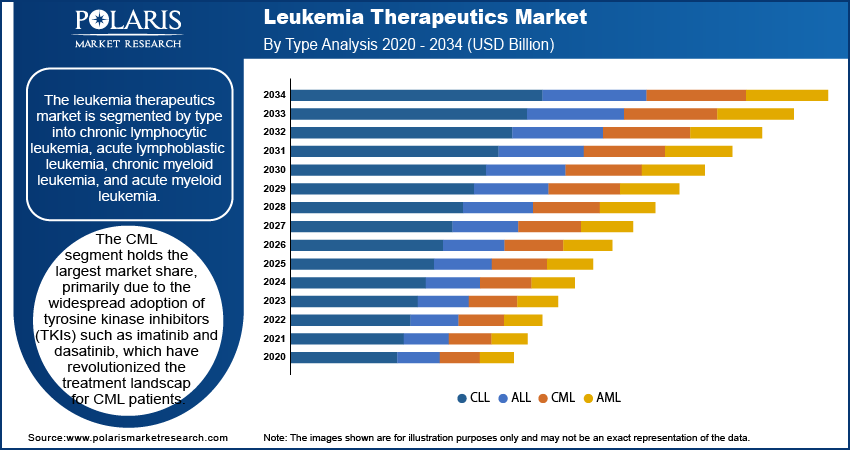

The leukemia therapeutics market is segmented by type into chronic lymphocytic leukemia (CLL), acute lymphoblastic leukemia (ALL), chronic myeloid leukemia (CML), and acute myeloid leukemia (AML). Among these, the CML segment holds the largest market share, primarily due to the widespread adoption of tyrosine kinase inhibitors (TKIs) such as imatinib and dasatinib, which have revolutionized the treatment landscape for CML patients. The availability of established treatment protocols and the relatively higher survival rates associated with targeted therapies contribute to the dominance of this segment. Additionally, extensive ongoing research and the approval of advanced therapies continue to drive market expansion within this category.

The AML segment is also registering the highest growth rate, fueled by advancements in precision medicine and the increasing availability of targeted therapies such as FLT3 and IDH inhibitors. AML has historically been associated with high unmet medical needs due to its aggressive nature and limited treatment options. Recent innovations, including combination therapies and personalized approaches leveraging next-generation sequencing, have enhanced treatment efficacy and patient outcomes. Furthermore, the rising incidence of AML, particularly among the aging population, is spurring demand for novel therapeutics, positioning this segment for significant growth in the coming years.

Leukemia Therapeutics Market Evaluation by Treatment Type

The leukemia therapeutics market, segmented by treatment type into chemotherapy and targeted drug therapy. It shows that chemotherapy holds a significant market share due to its long-standing use as a standard treatment for various leukemia types. Despite the growing popularity of newer treatment modalities, chemotherapy remains a cornerstone in clinical practice, particularly for acute leukemias, where aggressive treatment regimens are required. Its widespread accessibility and incorporation into combination therapies with targeted agents have helped maintain its substantial role in the treatment landscape.

Targeted drug therapy is also experiencing the highest growth rate, driven by its ability to improve treatment outcomes with reduced side effects compared to traditional chemotherapy. Therapies such as tyrosine kinase inhibitors (TKIs) for CML and monoclonal antibodies for ALL have demonstrated significant efficacy, fueling their rapid adoption. Additionally, the development of novel targeted agents addressing specific genetic mutations in leukemia has expanded treatment options, particularly for patients with relapsed or refractory disease. The growing emphasis on personalized medicine and advancements in biomarker research further bolster the growth of this segment.

Leukemia Therapeutics Market Assessment by Mode of Administration

The leukemia therapeutics market is segmented by mode of administration into oral and injectable. It shows that the oral segment holds the largest market share. This is primarily attributed to the convenience, ease of administration, and improved patient compliance associated with oral therapies. Key drugs, such as tyrosine kinase inhibitors (TKIs) for chronic myeloid leukemia (CML), are available in oral formulations, which are often prescribed for long-term management. The increasing availability of oral targeted therapies and their integration into treatment protocols for various leukemia types further contribute to the dominance of this segment.

The injectable segment is also registering the highest growth rate, driven by its use in advanced therapies such as immunotherapy and monoclonal antibodies, which require parenteral administration. Injectable formulations, including CAR-T cell therapies and bispecific T-cell engagers, are gaining traction for their efficacy in treating relapsed or refractory leukemia cases. Furthermore, the rising adoption of hospital-based treatments and the development of advanced delivery systems enhance the growth potential of the injectable segment. These innovations address critical unmet needs, particularly in aggressive leukemia subtypes, solidifying the segment’s growing importance in the market.

Leukemia Therapeutics Market Evaluation by Molecule Type

The leukemia therapeutics market segmentation, based on molecule type, includes small molecules and biologics. The small molecules segment holds the largest market share. This dominance is driven by the widespread use of small molecule inhibitors such as tyrosine kinase inhibitors (TKIs) in treating chronic myeloid leukemia (CML) and other leukemia subtypes. These molecules are favored for their targeted action, oral bioavailability, and well-established efficacy. The affordability and ease of manufacturing of small molecules compared to biologics further contribute to their significant presence in the market.

Biologics segment also represents the fastest-growing segment, fueled by advancements in immunotherapy and the rising adoption of therapies such as monoclonal antibodies, bispecific antibodies, and CAR-T cell therapies. Biologics are transforming the treatment landscape for aggressive and refractory leukemia cases by offering innovative mechanisms of action. For example, the success of therapies such as blinatumomab and tisagenlecleucel in achieving high remission rates has significantly driven their demand. Continued research and development, along with increasing regulatory approvals for innovative biologic therapies, support the rapid growth of this segment.

Leukemia Therapeutics Market Assessment by Gender

The leukemia therapeutics market is segmented by gender into male and female. It shows that the male segment holds the largest market share. This is attributed to the higher incidence rates of leukemia among males compared to females, as reported by global cancer registries. Biological factors, environmental exposures, and lifestyle-related risks contribute to this disparity. The male population's larger share in diagnosed cases drives the demand for leukemia treatments within this segment, sustaining its dominance in the market.

The female segment is also expected to register the highest growth rate, primarily due to improving awareness and access to healthcare services for women, particularly in developing regions. Increasing diagnostic efforts and a focus on early detection programs have contributed to identifying leukemia cases at earlier stages among females. Additionally, advancements in treatment options tailored to female patients and ongoing clinical trials exploring gender-specific responses to therapies further support the segment's accelerated growth.

Leukemia Therapeutics Market Regional Insights

By region, the study provides leukemia therapeutics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regional analysis of the market indicates that North America holds the largest market share. This dominance is driven by the region’s advanced healthcare infrastructure, high prevalence of leukemia, and significant investment in research and development activities. The US, in particular, leads the market due to the widespread adoption of innovative therapies, the strong presence of key pharmaceutical companies, and the availability of government funding for oncology research. Additionally, favorable reimbursement policies and high awareness about early diagnosis and treatment further boost the market in North America. Other regions, such as Europe and Asia Pacific, are also experiencing growth, but North America remains the leader due to these factors.

The leukemia therapeutics market in Europe is driven by well-established healthcare systems and strong government support for oncology research. Countries such as Germany, France, and the UK lead the region due to their advanced medical infrastructure and high investment in clinical trials for innovative therapies. The region also benefits from the growing adoption of targeted therapies and personalized medicine approaches. Additionally, increasing awareness campaigns and access to advanced diagnostic tools contribute to improved early diagnosis and treatment outcomes in Europe.

Asia Pacific is witnessing rapid growth in the leukemia therapeutics market, fueled by rising leukemia prevalence and improving healthcare infrastructure. Countries such as China, India, and Japan are at the forefront due to their large patient populations and increasing government initiatives to enhance oncology care. The growing presence of international pharmaceutical companies, along with rising investments in research and development, further accelerates market growth. Additionally, the adoption of advanced treatments, supported by the expanding availability of diagnostic technologies, drives demand in this region.

Leukemia Therapeutics Market – Key Market Players and Competitive Insights:

Key players actively operating in the leukemia therapeutics market include Novartis AG; Pfizer Inc.; Amgen Inc.; Roche Holding AG; Bristol Myers Squibb; Gilead Sciences Inc.; AbbVie Inc.; AstraZeneca; Takeda Pharmaceutical Company Limited; Sanofi; Eli Lilly and Company; Merck & Co., Inc.; Celgene Corporation (a subsidiary of Bristol Myers Squibb); Incyte Corporation; and Kite Pharma (a subsidiary of Gilead Sciences Inc.). These companies are involved in developing innovative treatments, including targeted therapies, immunotherapies, and combination regimens, addressing both acute and chronic leukemia subtypes.

Competition in the market is primarily driven by advancements in therapeutic options and strategic collaborations. Many companies focus on expanding their product pipelines by investing in research and development or acquiring novel technologies. For instance, the growing presence of CAR-T cell therapies and monoclonal antibodies in treatment protocols has prompted companies such as Novartis and Gilead Sciences to enhance their offerings. Several players also engage in licensing agreements and partnerships with smaller biotech firms to leverage emerging innovations in leukemia treatments.

Companies differentiate themselves based on their ability to introduce effective therapies with fewer side effects and their focus on personalized medicine. The competition is further shaped by the patent landscape and regulatory approvals, with leading players often leveraging exclusivity periods to maximize market penetration. As the demand for advanced therapeutics continues to rise, these companies emphasize affordability and global accessibility, particularly in regions with expanding healthcare infrastructure like Asia Pacific.

Novartis AG is a major player in the leukemia therapeutics market, focusing on developing treatments for both chronic and acute leukemia. The company has made significant contributions with its drug imatinib (Gleevec), a key treatment for chronic myeloid leukemia (CML). Novartis continues to invest in expanding its oncology portfolio, including therapies targeting new genetic mutations associated with leukemia.

Pfizer Inc. is another key player in the leukemia therapeutics market. It is particularly known for its advancements in targeted therapies and biologics. Pfizer’s drug bosutinib (Bosulif) is used for treating CML, and the company is also focused on expanding its portfolio in leukemia immunotherapies.

Key Companies in Leukemia Therapeutics Market

- Novartis AG

- Pfizer Inc.

- Amgen Inc.

- Roche Holding AG

- Bristol Myers Squibb

- Gilead Sciences Inc.

- AbbVie Inc.

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Sanofi

- Eli Lilly and Company

- Merck & Co., Inc.

- Celgene Corporation (a subsidiary of Bristol Myers Squibb)

- Incyte Corporation

- Kite Pharma (a subsidiary of Gilead Sciences Inc.)

Leukemia Therapeutics Industry Developments

- November 2024: Pfizer received FDA approval for a new immunotherapy targeting a specific leukemia subtype. This approval marks a significant step in providing more options for patients with hard-to-treat forms of the disease and further strengthens Pfizer’s position in the leukemia treatment market.

- October 2024: Novartis announced the approval of a new targeted therapy for CML in Europe. This therapy aims to improve outcomes for patients who are resistant to existing treatments.

Leukemia Therapeutics Market Segmentation

By Type Outlook

- Chronic Lymphocytic Leukemia

- Acute Lymphoblastic Leukemia

- Chronic Myeloid Leukemia

- Acute Myeloid Leukemia

By Treatment Type Outlook

- Chemotherapy

- Targeted Drugs Therapy

By Mode of Administration Outlook

- Oral

- Injectable

By Molecule Type Outlook

- Small Molecules

- Biologics

By Gender Outlook

- Male

- Female

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Leukemia Therapeutics Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.63 billion |

|

Market Size Value in 2025 |

USD 17.68 billion |

|

Revenue Forecast in 2034 |

USD 31.43 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

? The leukemia therapeutics market size was valued at USD 16.63 billion in 2024 and is projected to grow to USD 31.43 billion by 2034.

? The market is projected to register a CAGR of 6.6% during the forecast period 2024-2034.

? North America had the largest share of the market.

? Key players actively operating in the leukemia therapeutics market include Novartis AG; Pfizer Inc.; Amgen Inc.; Roche Holding AG; Bristol Myers Squibb; Gilead Sciences Inc.; AbbVie Inc.; AstraZeneca; Takeda Pharmaceutical Company Limited; Sanofi; Eli Lilly and Company; Merck & Co., Inc.; Celgene Corporation (a subsidiary of Bristol Myers Squibb); Incyte Corporation; and Kite Pharma (a subsidiary of Gilead Sciences Inc.).

? The CML segment accounted for the largest share of the market.

? The chemotherapy segment accounted for the largest share of the market.

? Leukemia therapeutics refers to the medical treatments and therapies used to manage and treat leukemia, a type of cancer that affects the blood and bone marrow. These treatments aim to target and eliminate cancerous cells while improving survival rates and quality of life for patients. Leukemia therapies include chemotherapy, targeted drug therapies, immunotherapies, and biologic treatments, which are tailored to specific types and subtypes of leukemia. The goal is to either induce remission, manage symptoms, or potentially cure the disease, depending on the leukemia’s stage and type. These therapies have evolved significantly over the years, offering more effective and personalized treatment options.

? A few leukemia therapeutics market trends are described below: Rise of Immunotherapies: The increasing use of immunotherapies, such as CAR-T cell therapy and monoclonal antibodies, is transforming treatment options, particularly for relapsed or refractory leukemia. Advancement of Targeted Therapies: Targeted therapies, including tyrosine kinase inhibitors (TKIs), are becoming more prevalent, offering precise treatments with fewer side effects compared to traditional chemotherapy. Growth of Precision Medicine: The adoption of personalized treatments based on genetic profiling and biomarkers is improving patient outcomes and enabling tailored therapies. Emergence of Combination Therapies: Combining traditional treatments like chemotherapy with newer therapies (e.g., targeted drugs, immunotherapies) is showing promising results in improving remission rates and survival.

? A new company entering the leukemia therapeutics market should focus on developing innovative treatments that address unmet needs, particularly in aggressive or resistant leukemia subtypes. Investing in research for personalized medicine, including biomarker-driven therapies, could offer a competitive edge by providing tailored treatment options for patients. Additionally, exploring the potential of combination therapies integrating both traditional and newer approaches such as immunotherapies could enhance therapeutic efficacy. Collaborations with biotech firms or academic institutions to access cutting-edge technologies, along with a focus on improving patient accessibility and affordability, would be key strategies to differentiate the company in the market.

? Companies manufacturing, distributing, or purchasing leukemia therapeutics and related products, and other consulting firms must buy the report.