Lead-acid Battery Market Share, Size, Trends, Industry Analysis Report, By Application (Stationary, Motive, SLI); By Construction (Flooded, VRLA); By Sales Channel (OEM, Aftermarket); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM1145

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

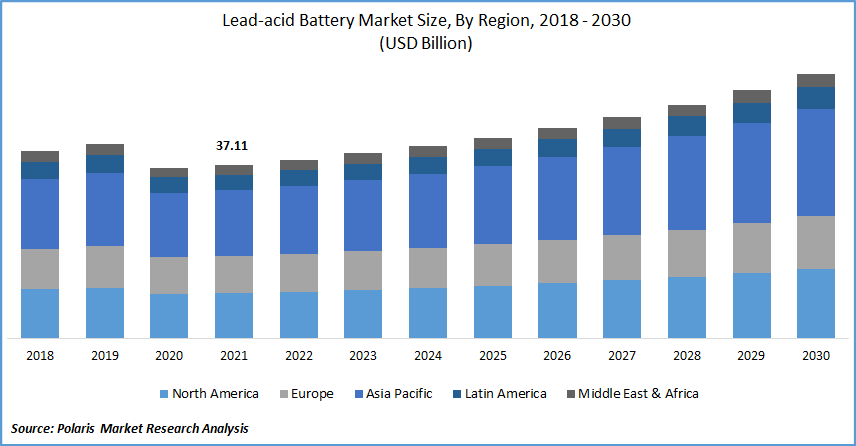

The global lead-acid battery market was valued at USD 37.11 billion in 2021 and is expected to grow at a CAGR of 5.0% during the forecast period. Growing SLI applications in the automobile sector is the factor driving up demand for lead-acid batteries. SLI batteries have a stronghold in the traditional automobile industry, as well as additional applications such as mini hybrid systems and vehicles with start-stop capabilities, which will promote product adoption.

Know more about this report: Request for sample pages

Due to superior cranking power and skyrocketing demand for sophisticated automotive technology, the SLI category is seeing a cyclical demand increase. In the winter, major regions such as North America and Europe are subjected to extreme weather conditions, necessitating the use of a power supply system with high cranking performance. Low cost and operational reliability are two of the most important characteristics that encourage people to use SLI batteries over other options.

Furthermore, as the telecom industry expands in nations like the US, Brazil, India, and the UK, there is a growing demand for UPS systems as a backup power source, resulting in higher usage of lead-acid batteries as a cost-effective energy source.

Growing demand for e-bikes and electric vehicles, cheaper repair and repair costs and a reduction in reliance on traditional fuel technologies are some of the primary factors recognized as drivers of the worldwide lead-acid battery market. However, stringent lead emission laws and the migration to lithium-ion batteries are two major roadblocks to the batteries industry's growth.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rapid technological advancements and innovation in the manufacturing facilities for lead-acid batteries are the factors that are boosting the industry growth during the forecast period. In April 2022, Off-grid Energy Labs announced the launch of their unique ZincGel Battery, which would provide India's EV battery switching industry with long-lasting batteries. In comparison to other batteries, this technology is non-flammable with a lower environmental impact. ZincGel Battery Technology is a cost-effective replacement for the expensive foreign batteries now available in India.

Also, in May 2021, After receiving High Court decisions suspending the Andhra Pradesh Pollution Prevention Board's (APPCB) orders to shut its factories, Amara Raja Batteries (ARBL) resumed production at its manufacturing sites in Andhra Pradesh.

Investors focused on Brookfield-backed ARBL when the APPCB compelled the business to close its facilities in Nunegundlapalli and Karkambadi, both in Andhra Pradesh's Chittoor district. Thus, the technological advancements in the lead-acid battery market by the major players and the innovation in the manufacturing industry in the emerging countries are the factors that are boosting the industry growth during the forecast period.

Report Segmentation

The market is primarily segmented based on product, construction, end-use, sales channel, and region.

|

By Product |

By Construction |

By Sales Channel |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Construction

VRLA segment is expected to be the most significant revenue contributor in the global market. VRLA batteries are more technically advanced, have a longer life span, and provide outstanding performance. They are much more cost-effective than lithium-ion and nickel-cadmium lead-acid battery packs, and they are likely to be the lead-acid battery of choice among end-users.

Because of its rapid rate of discharge combined with a stable and high-power supply, VRLA batteries have seen a significant increase in recent years when compared to flooded batteries. Furthermore, huge power reserves along with ease of operation are two essential benefits supplied by these units across a variety of industries, including automotive and telecommunications, bolstering the industry dominance of lead-acid batteries.

Moreover, based on the sales channel, the aftermarket segment dominates the market growth. Because of the growing lead-acid battery replacement rates after its service, aftermarket services account for the majority of the sales channel market share. Lead-acid battery manufacturers and suppliers would have more potential as a result of this.

The application for which the lead-acid battery is installed, however, has a significant impact on sales channel trends. For instance, aftermarket sales services are quite popular in the automotive industry, and they provide lucrative opportunities for certified automotive spare parts dealers and other vendors.

Geographic Overview

Asia Pacific had the largest revenue share in the global industry. The installation of such units across the region will be fueled by increasing consumer demand for individual transportation and a soaring desire for high-energy-density lead-acid battery units. Increasing demand for efficient and cost-effective power storage units in a variety of industries and applications, such as telecommunications, residential, vehicles, and backup energy systems, will boost product demand in the area.

Further, restricted access to power, a well-established service sector, and growing urbanization are all features of the region. Increased investment in commercial infrastructure development will feed demand for efficient energy storage devices such as UPS and inverters, resulting in increased product adoption across the area. The adoption of new technologies in the Japanese automotive industry aims to reduce maintenance costs, energy usage, and overall costs.

This has opened up new potential for lead-acid battery market sales in the country. As a result of increased demand from businesses such as electric utilities and other sectors, Japan will continue to expand during the predicted period. Moreover, North America is expected to witness a high CAGR in the global market. In terms of both manufacturing and consumption, the US has developed as a lucrative market for lead-acid batteries.

The US is a key region for the electrical and automotive industries, and consumption of lead-acid batteries is likely to remain strong during the projection period. Furthermore, technical improvements in the twenty-first century have enhanced the manufacturing capability of American firms. Lead-acid battery sales in the country are becoming more appealing as a result of research and development activities, the existence of numerous large players, and expanding production capacity.

Competitive Insight

Players operating in the global market include B. B. Battery Camel Group Co., Ltd., C&D Technologies, Inc., Chaowei Power Holdings Limited., Clarios, Crown Battery Corporation, East Penn Manufacturing Co., Enersys, Exide Industries Ltd., Furukawa Electric Co., Ltd., GS Yuasa Corporation, Leoch International Technology Ltd., Narada Power Source Co. Ltd., Shandong Sacred Sun Power Sources Co. Ltd., and Yokohama Batteries Sdn. Bhd.

Lead-acid Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 37.11 billion |

|

Revenue forecast in 2030 |

USD 56.56 billion |

|

CAGR |

5.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Construction, By End-Use, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

B. B. Battery Camel Group Co., Ltd., C&D Technologies, Inc., Chaowei Power Holdings Limited., Clarios, Crown Battery Corporation, East Penn Manufacturing Co., Enersys, Exide Industries Ltd., Furukawa Electric Co., Ltd., GS Yuasa Corporation, Leoch International Technology Ltd., Narada Power Source Co. Ltd., Shandong Sacred Sun Power Sources Co. Ltd., and Yokohama Batteries Sdn. Bhd. |