Inulin Market Share, Size, Trends, Industry Analysis Report, By Source (Chicory, Agave, Jerusalem artichokes, Asparagus, Others); By Application; By Region; Segment Forecast, 2024 – 2032

- Published Date:Feb-2024

- Pages: 120

- Format: PDF

- Report ID: PM1276

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

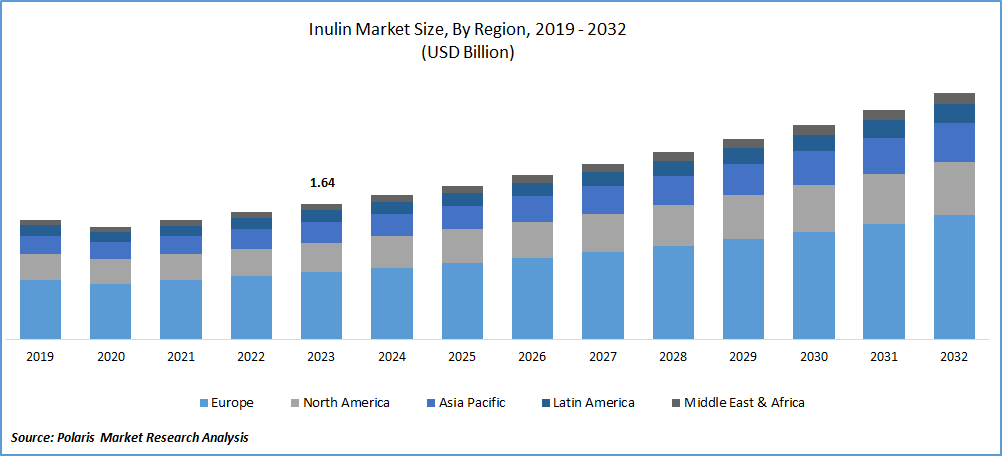

The global inulin market was valued at USD 1.64 billion in 2023. The inulin market industry is projected to grow from USD 1.74 billion in 2024 to USD 2.98 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.9% during the forecast period (2024 - 2032).

Inulin, a naturally occurring polysaccharide, is often extracted from plants like chicory roots. It belongs to the fructan group and consists of chains of fructose molecules linked together by β (2-1) glycosidic bonds. One of its key characteristics is its ability to function as a prebiotic, promoting the growth of beneficial gut bacteria, which is a significant factor contributing to its increasing use in the food and beverage industry. Inulin serves as a soluble fiber, offering a range of functional properties, such as its texturizing and gelling abilities, making it a sought-after ingredient in the formulation of various food products.

The growing popularity and diverse applications of this versatile carbohydrate characterize the inulin market. The use of inulin extends beyond the food sector, finding applications in pharmaceuticals and dietary supplements due to its potential health benefits. It is known to support digestive health, enhance calcium absorption, and contribute to weight management, aligning with the growing consumer demand for functional ingredients that promote overall well-being.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 outbreak has resulted in an increased demand for inulin due to its role in improving gut health, diabetes, and cholesterol. Consumers are purchasing immunity-boosting and nutritional supplements. The pandemic has increased consumer health awareness regarding the purchase of sustainable and organic food products. Also, the rising prevalence of lifestyle-related health issues, such as obesity and digestive disorders, has led to an upsurge in demand for functional ingredients like inulin. The growing trend of clean-label and natural products has boosted the market, as inulin is often perceived as a natural and plant-derived alternative.

Nevertheless, the high production costs associated with extracting inulin, especially from chicory roots, act as a restraining factor. Also, the limited availability of raw materials and fluctuations in their prices may impact the overall cost dynamics of inulin production. Regulatory complexities and standards about health claims associated with inulin products pose challenges for market players.

Growth Drivers

The Increased Geriatric Population and Disposable Income of Consumers have Aided the Market Growth

The growth of the inulin market has been significantly influenced by two key factors, i.e., the increasing geriatric population and the rise in disposable income among consumers. The expanding geriatric demographic has played an important role as older individuals are increasingly seeking dietary solutions to address health concerns associated with aging. Inulin, with its recognized benefits for digestive health and overall well-being, has gained popularity as a valuable ingredient in products catering to this population.

Simultaneously, the growth in disposable income has allowed consumers to make more informed and health-conscious choices when it comes to their dietary preferences. As disposable income levels rise, individuals are more inclined to invest in products that offer functional benefits and contribute to their overall health. Inulin, being a natural and versatile ingredient with applications in various food and beverage products, has witnessed increased adoption among consumers who are willing to spend on products promoting wellness.

Report Segmentation

The market is primarily segmented based on source, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

Chicory Source of Inulin Accounts for a Significant Market Share Over the Forecasted Period

Inulin derived from the chicory root is renowned for its various health benefits, making it a most preferred ingredient in the food and beverage industry. Inulin serves as a prebiotic fiber, promoting the growth and activity of beneficial bacteria in the gut, which contributes to digestive health and overall well-being. As awareness of the gut-brain connection and the importance of a healthy microbiome continues to grow, the demand for inulin from chicory as a natural prebiotic also increases at a significant rate. Chicory inulin is utilized as an ingredient in various functional food products, such as yogurts, cereals, and energy bars, as well as in dietary supplements. Its addition enhances the nutritional profile of these products by providing dietary fiber without significantly impacting taste or texture. As a result of these factors, manufacturers are seeking chicory as a feasible source of inulin and thus holding a higher market share within the global inulin market.

By Application Analysis

Food And Beverage Segment is Estimated to Dominate the Market Over the Forecasted Period

The dominance of the food and beverage segment in the inulin market is because of inulin's inherent qualities, such as its ability to serve as a soluble dietary fiber and prebiotic that have positioned it as a highly preferred ingredient in the formulation of various food and beverage products. One of its primary applications lies in enhancing the nutritional profile of food items without compromising taste or texture. In the food industry, inulin is frequently utilized as a fat or sugar replacement, contributing to the development of healthier, reduced-calorie alternatives and aligning with the trend of healthier lifestyles.

Inulin's natural origin from sources like chicory roots, asparagus, and soybean resonates well with the growing consumer preference for natural and clean-label products. As consumers become increasingly health-conscious and seek functional ingredients in their diets, the demand for inulin in the food and beverage sector has surged. The prebiotic properties of inulin, supporting gut health and overall well-being, further enhance its appeal in the food and beverage market. With an aging population and increased awareness of digestive health, there's a growing market for products that incorporate functional ingredients like inulin.

Regional Insights

Europe Region Accounted for the Highest Market Share In 2023

The Europe region led the market in 2023 due to a combination of several factors that collectively contribute to the robust demand for inulin in this region. Europe has witnessed a growing emphasis on healthy and functional foods, driven by an increasingly health-conscious consumer base. Inulin, with its recognized prebiotic and dietary fiber properties, aligns well with the health and wellness trends, forcing food and beverage manufacturers to incorporate it into a diverse range of products.

Along with this, the European consumer demographic has shown a strong preference for natural and clean-label products, and inulin, derived from sources like chicory roots, asparagus, and oats, is perceived as a natural and plant-based ingredient. The European market has witnessed significant investments in research and development, leading to innovations in product formulations that incorporate inulin.

The Asia Pacific region is poised to showcase the fastest CAGR in the inulin market over the forecast period. The region is experiencing a notable shift in dietary preferences and lifestyles, with an increasing focus on health and wellness. As awareness of the benefits of dietary fibers and prebiotics like inulin grows, consumers in the Asia Pacific are showing an interest in functional foods and ingredients that promote digestive health and overall well-being. The expanding middle class, particularly in densely populated countries like China and India, is driving demand for functional ingredients, contributing to the rapid growth of the inulin market in the region. Also, the prevalence of lifestyle-related health issues, including gastrointestinal problems and obesity, has intensified the demand for dietary solutions that address these concerns.

Key Market Players & Competitive Insights

The leading players in the inulin market are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Some of the major players operating in the global Inulin Market include:

- BENEO

- Cargill

- Ciranda

- COSUCRA

- FENCHEM

- Jarrow Formulas, Inc

- Nova Green Inc.

- Sensus BV (Royal Cosun)

- The Ingredient House

- The Tierra Group

Recent Developments

- In April 2023, the European Association of Chicory Inulin Producers announced the launch of a new website. This new website provides scientific evidence to support the health benefits of prebiotic chicory fibers, including digestive health, blood glucose management, bone health, weight management, immunity, and more.

- In March 2020, Beneo, a producer of functional ingredients from natural sources, invested USD 56.0 million in the expansion of its chicory inulin production facility that aims at bridging the fiber gap.

Inulin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.74 billion |

|

Revenue Forecast in 2032 |

USD 2.98 billion |

|

CAGR |

6.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

The inulin market size is anticipated to grow to USD 2.98 billion by 2032.

The global key players in the inulin market include BENEO, Cargill, Ciranda, COSUCRA, FENCHEM, Jarrow Formulas, Inc. Nova Green Inc.

The Europe region contribute notably towards the inulin market growth.

The global inulin market is expected to grow at a CAGR of 6.9% during the forecast period.

The key segments covered in the inulin market report are source, application, and region.