Insulation Market Size, Share, Trends, Industry Analysis Report

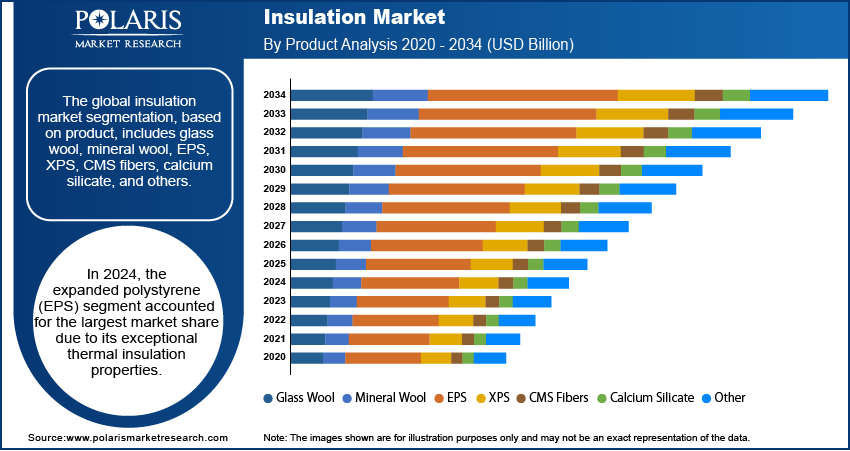

: By Product (Glass Wool, Mineral Wool, EPS, XPS, CMS Fibers, Calcium Silicate, and Other), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1275

- Base Year: 2024

- Historical Data: 2020-2023

Insulation Market Overview

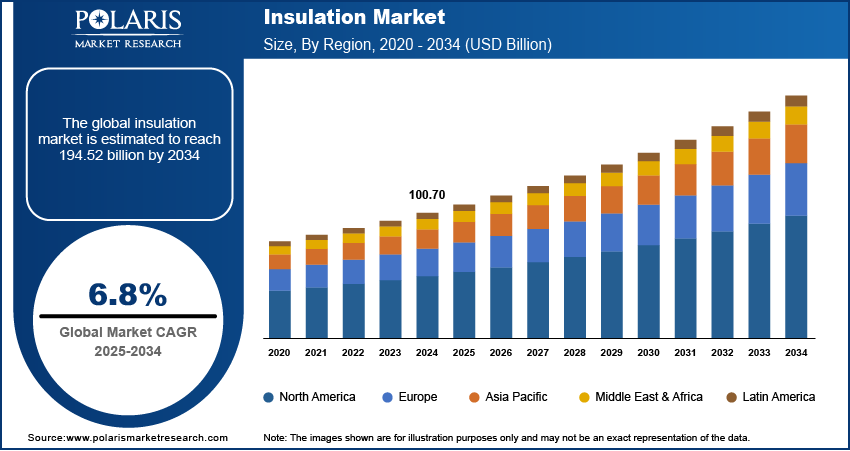

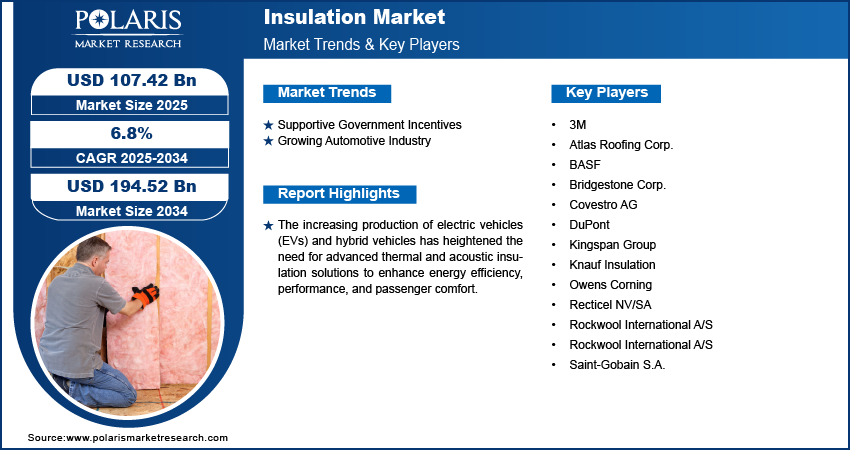

The insulation market size was valued at USD 100.70 billion in 2024. The market is projected to grow from USD 107.42 billion in 2025 to USD 194.52 billion by 2034, exhibiting a CAGR of 6.8% during 2025–2034. The usage of insulation in industrial instruments, pipelines and HVAC systems to sustain maximum temperatures and decrease energy losses is pushing the demand in several sectors involving manufacturing and oil & gas, which is driving the market demand.

Key Insights

- The expanded polystyrene (EPS) segment dominated the market in 2024.

- The construction segment held the maximum revenue share in 2024 due to the growing demand for energy efficient buildings, speedy urbanization, and a rise in infrastructure advancement globally.

- Asia Pacific insulation market was the dominant region with maximum revenue share in 2024 because of speedy urbanization, augmenting construction ventures, and a robust concentration on energy efficacy.

- North America noticed a notable growth during the forecast period due to growing demand for productive buildings, stringent building codes and growing consciousness of sustainability.

Industry Dynamics

- Tax credits, subsidies, and fiscal incentives provided by governments and regulatory bodies stimulate homeowners, businesses and industries to fund in insulation solutions which improve energy efficacy and decrease ecological influence pushing for market expansion.

- The growing production of EVs and hybrid vehicles have escalated the requirement for progressive thermal and acoustic insulation solutions to improve energy efficacy, performance and passenger comfort driving the market ahead.

- Rising energy prices and the requirement to decrease the energy intake are pushing the acquisition of insulation materials.

- Elevated production prices linked with insulation substances emerge as a restraining factor.

Market Statistics

2024 Market Size: USD 100.70 billion

2034 Projected Market Size: USD 194.52 billion

CAGR (2025-2034): 6.8%

Asia Pacific: Largest Market in 2024.

To Understand More About this Research: Request a Free Sample Report

The insulation market encompasses products and materials designed to reduce heat transfer, enhance energy efficiency, and improve temperature control in buildings, industrial equipment, and transportation systems. Insulation materials include fiberglass, mineral wool, polyurethane foam, cellulose, expanded polystyrene, and others, each tailored for specific applications such as thermal, acoustic, or electrical insulation.

The use of insulation in industrial equipment, pipelines, and HVAC systems to maintain optimal temperatures and reduce energy losses is fueling demand in various sectors, including manufacturing and oil & gas, which is driving the insulation market growth. Furthermore, growing consumer preference for eco-friendly and recyclable insulation materials aligns with global sustainability goals. Innovations in green insulation products, such as natural fibers and bio-based foams, are gaining traction in the insulation market.

Rising energy costs and the need to reduce energy consumption are driving the adoption of insulation materials. Improved energy efficiency in buildings and industrial operations helps lower utility bills and meet stringent energy standards. Moreover, technological advancements in high-performance insulation materials, including aerogels, vacuum insulation panels, and phase change materials, are driving the insulation market development.

Insulation Market Dynamics

Supportive Government Incentives

Government initiatives play a pivotal role in driving the demand for insulation solutions as they encourage the adoption of energy-efficient and sustainable practices. Tax credits, subsidies, and financial incentives offered by governments and regulatory bodies incentivize homeowners, businesses, and industries to invest in insulation solutions that enhance energy efficiency and reduce environmental impact. For instance, in US, the tax credit is available for developments purchased and installed from January 2023 to December 2032. Tax credit sets specific limits on individual installations, with an annual maximum credit of USD 3,200. This includes a cap of USD 1,200 for home envelope improvements (windows, doors, insulation, and more) and HVAC systems such as furnaces and central air conditioners. Hence, supportive government incentives boost the insulation market demand across residential, commercial, and industrial sectors.

Growing Automotive Industry

The increasing production of electric vehicles (EVs) and hybrid vehicles has heightened the need for advanced thermal and acoustic insulation solutions to enhance energy efficiency, performance, and passenger comfort. According to the International Trade Administration, in 2022, the US recorded sales of ∼11.5 million light vehicle units. Foreign automakers contributed to production in the US with an output of around 4.9 million vehicles by 2023. Effective thermal insulation is crucial to maintaining optimal battery temperatures, which directly impacts performance, safety, and longevity in EVs and hybrid vehicles. As the automotive industry continues to innovate and grow, the demand for thermal and acoustic insulation solutions is expected to rise in the coming years. Therefore, the expanding automotive industry, coupled with advancements in vehicle technologies, is projected to fuel the insulation market expansion during the forecast period.

Insulation Market Segment Insights

Insulation Market Assessment by Product Outlook

The global insulation market segmentation, based on product, includes glass wool, mineral wool, EPS, XPS, CMS fibers, calcium silicate, and others. In 2024, the expanded polystyrene (EPS) segment accounted for the largest share of the insulation market revenue due to its exceptional thermal insulation properties, cost-effectiveness, and versatility across various applications. EPS is widely used in residential, commercial, and industrial construction for insulating walls, roofs, and foundations, as it provides excellent energy efficiency and moisture resistance. Additionally, EPS is highly durable and recyclable, aligning with the growing emphasis on sustainable and eco-friendly building materials. The increasing adoption of energy-efficient building practices and stringent regulations promoting the use of insulation in construction significantly propel the demand for EPS. Moreover, its expanding applications in packaging and cold storage boost its market dominance.

Insulation Market Evaluation by End Use Outlook

The global insulation market segmentation, based on end use, includes industrial, construction, HVAC & OEM, packaging, transportation, and others. In 2024, the construction segment dominated the insulation market share due to the increasing demand for energy-efficient buildings, rapid urbanization, and a surge in infrastructure development worldwide. The growing adoption of green building practices, driven by stringent energy codes and environmental regulations, has significantly boosted the use of insulation in residential, commercial, and industrial construction projects. Additionally, government incentives and subsidies for energy-efficient upgrades have fueled the demand for insulation in the construction sector. Owing to the rising investments in large-scale infrastructure projects, particularly in emerging economies, the construction segment is poised to maintain its leading position in the global insulation market.

Insulation Market Regional Analysis

By region, the study provides insulation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the global insulation market revenue due to rapid urbanization, expanding construction activities, and a strong focus on energy efficiency. The region is experiencing significant infrastructure development, driven by growing populations and the need for residential, commercial, and industrial buildings. According to the Worldometer, as of December 2024, the population of Asia was ∼4.82 billion, reflecting an increase from 4.78 billion in 2023. This marks a population growth of ∼0.84% over the past year. There is a rising demand for energy-efficient solutions to reduce energy consumption and enhance sustainability in the built environment as cities expand. Governments of countries such as China, India, and Japan are increasingly implementing stringent building codes and regulations that require the use of insulation materials in new constructions and renovations, further boosting the regional market growth.

The North America insulation market is expected to witness significant growth during the forecast period due to increasing demand for energy-efficient buildings, stricter building codes, and rising awareness of sustainability. The region's focus on reducing energy consumption in residential, commercial, and industrial sectors, coupled with government incentives for energy-efficient upgrades, is further driving market expansion. Additionally, advancements in insulation technologies and growing investments in infrastructure projects are expected to contribute to the regional market growth in the coming years.

Insulation Market – Key Players and Competitive Analysis Report

The competitive landscape of the insulation market is characterized by a mix of global and regional players, with companies competing on the basis of product innovation, quality, cost-effectiveness, and sustainability. Major players in the market include well-established manufacturers such as Owens Corning, Saint-Gobain, Rockwool International, Kingspan Group, and BASF, who offer a wide range of insulation materials, including fiberglass, mineral wool, foam boards, and cellulose. These companies are focused on expanding their market presence through strategic mergers and acquisitions, product development, and regional expansions. The market is also witnessing increasing competition from newer players and regional companies that are offering innovative, cost-effective, and sustainable insulation solutions. As the demand for eco-friendly and energy-efficient materials rises, many players are investing in research and development to create products that meet stringent environmental standards and provide superior thermal and acoustic performance. Additionally, companies are focusing on expanding their distribution networks and enhancing customer service to stay competitive. The growing emphasis on sustainability, driven by government regulations and consumer demand, is further influencing the competitive dynamics of the market, as manufacturers strive to offer greener, more energy-efficient products. Moreover, the insulation market is becoming more price-sensitive due to rising raw material costs, requiring companies to balance cost-effectiveness with high performance in order to maintain market share.

A few key major players are DuPont, BASF, Rockwool International A/S, Owens Corning, Atlas Roofing Corp., Rockwool International A/S, Saint-Gobain S.A., Kingspan Group, Knauf Insulation, Recticel NV/SA, Covestro AG, Bridgestone Corp., and 3M.

3M Company is a global technology services provider with operations spanning the US and international markets. Organized into four main segments such as transportation and electronics, safety and industrial, healthcare, and consumer segment which includes a variety of products designed for home improvement, office organization, and personal care.The transportation and electronics segment focuses on ceramic solutions, tapes, films, and products for temperature management in vehicles as well as graphic films for advertising. 3M also provides interconnection and packaging solutions, and reflective signage for safety applications.

BASF SE, is a global chemical corporation, operates through seven segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, Agricultural Solutions, and Others. The Chemicals segment provides petrochemicals and intermediates, while the Materials segment offers industrial precursors such as isocyanates and polyamides. Additionally, the company supplies advanced materials, inorganic basic products, and specialty solutions for the plastics and plastic processing industries.

List of Key Companies in Insulation Market

- 3M

- Atlas Roofing Corp.

- BASF

- Bridgestone Corp.

- Covestro AG

- DuPont

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Recticel NV/SA

- Rockwool International A/S

- Rockwool International A/S

- Saint-Gobain S.A.

Insulation Industry Developments

In July 2025: Saint-Gobain Weber introduced its new weberfloor acoustic systems. According to Saint-Gobain Weber, the systems have been developed in collaboration with REGUPOL and use advanced technology to improve insulation.

In March 2025: Sherwin-Williams introduced the Heat-Flex Advanced Energy Barrier (AEB). According to Sherwin-Williams, the coating prevents corrosion under insulation. It also serves as a replacement for the bulky mineral-based insulation that’s traditionally used on process vessels, storage tanks, and piping for the retention of process heat.

In September 2024, Armacell, a company offering flexible foam for equipment insulation, launched an advanced aerogel technology.

In May 2024, PPG launched the PPG PITT-THERM 909 spray-on insulation coating, a silicone-based solution for high-temperature applications in the oil & gas, chemical, and petrochemical industries. This advanced coating improves safety, asset protection, and operational efficiency, surpassing traditional thermal insulation materials.

In May 2024, Saint-Gobain partnered with TimberHP to offer advanced wood fiber insulation solutions in North America. This alliance combines TimberHP's sustainable materials expertise with Saint-Gobain's distribution network to enhance energy efficiency and thermal performance in buildings.

Insulation Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Glass Wool

- Mineral Wool

- EPS

- XPS

- CMS Fibers

- Calcium Silicate

- Other

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Industrial

- Construction

- Residential

- Non-Residential

- HVAC & OEM

- Packaging

- Transportation

- Other

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Insulation Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 100.70 billion |

|

Market Size Value in 2025 |

USD 107.42 billion |

|

Revenue Forecast by 2034 |

USD 194.52 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion; Volume in Kilotons; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global insulation market size was valued at USD 100.70 billion in 2024 and is projected to grow to USD 194.52 billion by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to rapid urbanization, expanding construction activities, and a strong focus on energy efficiency.

A few key players in the market are DuPont, BASF, Rockwool International A/S, Owens Corning, Atlas Roofing Corp., Rockwool International A/S, Saint-Gobain S.A., Kingspan Group, Knauf Insulation, Recticel NV/SA, Covestro AG, Bridgestone Corp., and 3M.

In 2024, the expanded polystyrene (EPS) segment accounted for the largest market share due to its exceptional thermal insulation properties.

In 2024, the construction segment accounted for the largest market share due to the increasing demand for energy-efficient buildings.