Industrial Fasteners Market Size, Share, Trends, Industry Analysis Report

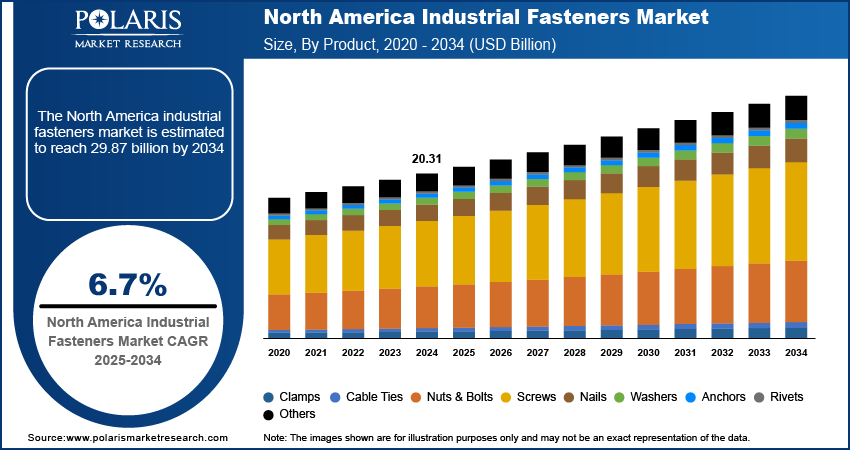

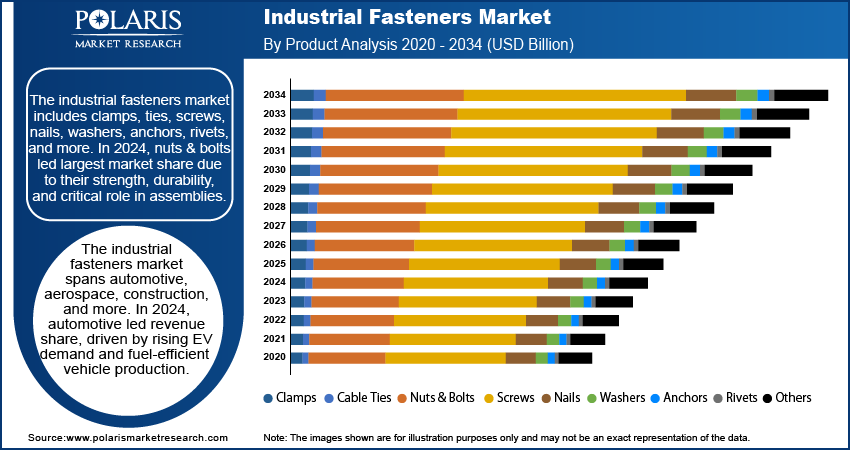

: By Product (Clamps, Cable Ties, Nuts & Bolts, Screws, Nails, Washers, Anchors, Rivets, and Others), Material, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 320

- Format: PDF

- Report ID: PM1274

- Base Year: 2024

- Historical Data: 2020-2023

Industrial Fasteners Market Overview

The global industrial fasteners market size was valued at USD 97.62 billion in 2024 and is expected to reach USD 101.83 billion by 2025 and 146.83 billion by 2034, exhibiting a CAGR of 4.40% during 2025–2034.

The industrial fasteners market growth is attributed to the increasing industrialization in developing nations and heightened demand in the construction and aerospace sectors. As the demand for lightweight vehicles and aircraft is rising among consumers, manufacturers are shifting toward the production of customized fasteners compared to the standard ones. Moreover, the growing need for durable and high-performance fastening solutions across various industries, such as automotive and industrial machinery, is driving the industrial fasteners market demand.

Key trends such as rising focus on sustainability and energy efficiency have led to innovations of fastener materials and designs. Moreover, industrial fasteners are becoming an integral component of modern infrastructure due to the increased construction of prefabricated and modular buildings. Further, these buildings require precision-engineered fasteners that can be easily assembled and disassembled, which improves construction efficiency and reduces labor costs.

Industries such as automotive and aerospace constantly seek lightweight components to reduce the weight of vehicles and spacecraft. Components such as screws, nuts, bolts, anchors, rivets, and washers, are now being re-engineered by combining plastic and metal to provide more durability and sturdiness to the final structures. Moreover, the superior ability of plastic fasteners to withstand UV radiation has garnered demand across the aerospace industry applications. Space agencies such as NASA have been employing re-engineered plastic fasteners to design spacecraft and various space-based observatories. Further, with the advancements in material science technology, plastic fasteners are expected to gain traction, thus influencing the industrial fasteners market trends during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Industrial Fasteners Market Dynamics

Growing Demand for Fasteners in Automotive and Construction Industries

There is a growing demand for fasteners in the automotive sector for assembling components. Fasteners play an essential role in ensuring the proper functionality and structural integrity of the vehicle. Passenger and commercial vehicles rely on various small and large components; anchors; and panel fasteners such as studs, screws, rivets, and nut bolts to connect various parts of the vehicle. Rising demand for fuel-efficient vehicles, including EVs, is further boosting the revenue share of industrial fasteners.

Passenger and commercial vehicles operate in extreme conditions, which necessitates high-performance fasteners for efficient performance. Further, conditions such as extreme wind speeds, high pressure, and fluctuating temperatures demand innovations in fastener design and materials. As a result, manufacturers are investing in research and development to produce high-quality fasteners that can withstand these harsh conditions. Therefore, such focus on innovation has led to the development of better materials to enhance the operational efficiency and safety of the vehicles.

The expansion of the construction industry, mostly in Asia, is driving the demand for industrial fasteners. Countries such as China and India are witnessing increased demand from construction sectors due to rising disposable incomes and government investments in infrastructure projects. China's ongoing demand for residential, industrial, and commercial expansion has created numerous opportunities for new construction ventures. Further, the growing residential sector in the US is supported by favorable regulatory policies and accessible home loan schemes. According to a report by the Composite Panel Association, construction spending in the US in April 2024 has reached to USD 2.1 trillion, an increase of 10% compared to the same month in the previous year. The rising applications of industrial fasteners in modern infrastructure and industrial development contribute to the increasing demand for industrial fasteners. Thus, growing demand for fasteners in the automotive and construction industries, coupled with growing construction activities and increasing spending power by consumers, is driving the industrial fasteners market development.

Rising Application of Industrial Fasteners in Healthcare Industry

The healthcare sector is witnessing increased utilization of advanced fastening solutions such as threaded inserts for plastics, blind rivets, and self-locking thread systems in medical electronics devices. These fasteners ensure precise and reliable performance in critical medical devices, including surgical lasers, MRI scanners, pacemakers, and stethoscopes. The growing demand for self-locking fasteners in medical applications to provide safety and stability to the devices is boosting the industrial fasteners market expansion. Additionally, India’s medical electronics sector is projected to grow significantly due to rising healthcare awareness and increased government expenditure. For instance, according to the India Brand Equity Foundation report, the Indian Healthcare sector is projected to reach USD 638 billion by the end of 2025. Thus, increased spending from consumers on health and the rising aging population in the country will witness a rise in the demand for healthcare products, which will ultimately boost the demand for industrial fasteners in the healthcare industry.

Industrial Fasteners Market Segment Insights

Industrial Fasteners Market Assessment by Product Outlook

The global industrial fasteners market segmentation, by product, includes clamps, cable ties, nuts & bolts, screws, nails, washers, anchors, rivets, and others. In 2024, the nuts & bolts segment held the largest market share due to their widespread application across various industries such as automotive, aerospace, construction, machinery, and medical device manufacturing.

Nuts and bolts play a crucial role in various industries due to their versatility and durability. Nuts are available in multiple types, such as hex nuts, T-nuts, and flange nuts, which have internal threads and are paired with bolts for secure fastening. Bolts, made from steel, titanium, or plastic, are available in different sizes and head types, such as toggle bolts and U-bolts. Moreover, infrastructure development in developed and developing nations is leading to the widespread demand for nuts & bolts. According to a report by the European Commission, in 2023, Germany has made a significant development in the 5G infrastructure setup, which has reached almost 98.1% of completion. Moreover, the telecommunications sector also requires nuts & bolts for clamping communication devices and setting up a network connection. Further, the increased investments in infrastructure development by countries across different sectors will continue to propel the demand for nuts and bolts during the forecast period.

Industrial Fasteners Market Evaluation by Material Outlook

The global industrial fasteners market, based on material, is bifurcated into plastic and metal. In 2024, the metal segment held a significant market share due to its key features such as durability, strength, and resistance to corrosion and heat. Metal fasteners are manufactured from materials such as stainless steel, bronze, aluminum, copper, and titanium for their large-scale application across various industries such as manufacturing, construction, and industrial applications. Among these, stainless steel fasteners are the most preferred due to their recyclability, affordability, and ability to withstand extreme conditions, including underwater environments. Factors such as advancements in metal alloys to improve metal properties, which include anti-corrosion, superconducting, and ultra-lightweight, have further raised their demand across automotive, industrial, and infrastructure projects.

Industrial Fasteners Market Outlook by Industry Outlook

The global industrial fasteners market, based on industry, is segregated into automotive, aerospace, building & construction, industrial machinery, home appliances, lawn & garden, motors & pumps, furniture, plumbing, and others. The aerospace segment is expected to witness the highest growth rate during the forecast period due to increasing demand for lightweight and high-strength fasteners in aircraft manufacturing.

The industrial fastener market demand in aerospace sector is projected to grow during the forecast period, due to increasing aircraft production, advancements in material science, and the demand for high-performance fastening solutions. Aerospace fasteners, including bolts, nuts, and high-strength alloys, play a critical role in ensuring the structural integrity of aircraft. The increasing preference for lightweight and corrosion-resistant materials is further accelerating the market growth. Additionally, clamps are widely used in various aerospace applications, including supporting essential systems such as ventilation, air management, water, and waste evacuation.

Aluminum fasteners, being lightweight and cost-effective, also contribute to the industrial fasteners market expansion. Since the aerospace sector is witnessing a shift toward high-performance superalloys, the demand for metal fasteners in this segment is projected to foresee high growth during the forecast period.

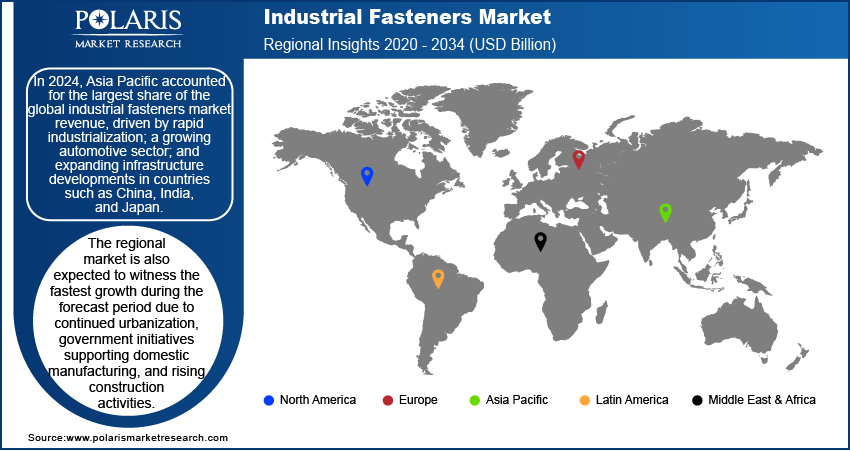

Industrial Fasteners Market Regional Analysis

By region, the study provides industrial fasteners market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the global industrial fasteners market revenue share. Factors such as the presence of an improved automotive manufacturing base in countries such as China, Japan, and India is promoting the demand for industrial fasteners. The region is also experiencing increased sales of passenger and commercial vehicles for Mid-Range & Compact SUVs and Light Commercial Vehicles (LCVs), respectively, leading to the growth of the automotive sector. Furthermore, favorable FDI regulations and the “Make in India” policy implemented by the Government of India are generating opportunities for the automobile industry in the country, which will aid in industrial fastener industry expansions.

The industrial fasteners market in China is showcasing increasing growth, driven by government support and rising investments in the manufacturing sector. Favorable policies, such as China’s 13th Five-Year Plan (2016-20), have boosted infrastructure development, leading to increased demand for fasteners in residential, commercial, and transportation projects. China’s position as the world’s largest automotive manufacturing hub further fuels demand. Volkswagen’s expansion and rising domestic vehicle sales, which grew by 7.4% in October 2022 (CEIC Data), contribute to the sector’s growth potential. Additionally, the country’s low manufacturing costs and abundant raw materials have attracted foreign direct investments, strengthening the domestic automotive industry.

The industrial fasteners market in India is growing rapidly, driven by favorable government policies and expanding end-use industries. India’s “Make in India” initiative has attracted investments in the automotive, energy, and metals sectors, boosting industrial output. The country's automotive industry, which became the fourth-largest globally in 2022, continues to expand, driving demand for fasteners. Decentralization of government-owned metal companies such as BALCO and HINDALCO is expected to increase raw material availability, boosting the industrial fasteners market expansion in India. Moreover, rapid urbanization, population growth, and rising disposable incomes have fueled automobile manufacturing, which is fueling the demand for industrial fasteners in the country.

The European industrial fasteners market held the second-largest market share in 2024, driven by the region’s strong automotive and construction industries. Europe remains a dominant player in automobile manufacturing, with the presence of major brands such as Audi, BMW, Volkswagen, and Ferrari, fueling demand for industrial fasteners. The European Commission’s initiatives to attract foreign direct investment (FDI) from Asian automakers, including Honda and Toyota, will further boost the market during the forecast period. Germany, a key contributor, produces over six million vehicles annually and holds 29% of the European automobile market, reinforcing fastener demand.

Industrial Fasteners Market – Key Players and Competitive Analysis Report

The competitive landscape of the industrial fasteners market is characterized by a mix of established players and emerging companies striving to capture market share in a rapidly growing industry. Intense rivalry drives price competition, impacting overall profitability. Leading companies focus on product innovation, strategic partnerships, and R&D to differentiate themselves. However, the presence of local manufacturers offering cost-effective alternatives intensifies competition. Brand preference, scale efficiency, and distribution strategies play a crucial role in sustaining market position. Companies are adopting growth strategies such as product diversification, marketing expansion, and strategic alliances.

Acument Global Technologies (a Fontana Gruppo subsidiary) is a manufacturer of fastening and assembly solutions, serving customers across 35+ countries. The company operates through brands such as Delta PT, Fastite 2000, and MagnaSeal, offering a diverse portfolio that includes blind fastening solutions, lock bolts, structural break stem fasteners, and installation equipment. Acument supplies industrial fasteners to key sectors, including automotive, aerospace, defense, and rail. Their fasteners are available in advanced materials such as A286, 8740, titanium, and Inconel. The company also provides supply chain management, engineering, and logistics services, reinforcing its industry leadership.

Birmingham Fastener is a manufacturer and distributor of industrial fasteners, catering to diverse industries such as structural steel fabrication, waterworks, utilities, OEMs, transportation, MRO, and construction. The company operates in multiple locations across the US. Birmingham Fastener specializes in non-standard and custom fasteners, including T-head bolts, B7 studs, bracing hardware, sealants, and pipe flashing. Its extensive distribution network ensures seamless product availability through physical stores and distribution centers. The company offers tailored solutions, including fasteners to industries such as metal building manufacturing, precast concrete, and industrial distribution.

List of Key Companies in Industrial Fasteners Market

- Acument Global Technologies

- Advanced Cable Ties, Inc.

- BAND-IT IDEX, Inc.

- Birmingham Fastener and Supply Inc.

- Brunner Manufacturing Co., Inc.

- Changhong Plastics Group Imperial Plastics Co. Ltd.

- Decker Industries Corporation

- Dokka Fasteners A.S.

- Eastwood Manufacturing

- Elgin Fastener Group LLC

- Hellermann Tyton

- Hilti Corporation

- Illinois Tool Works, Inc

- KOVA Fasteners Pvt Ltd.

- Manufacturing Associates, Inc.

- MW Industries, Inc.

- Nippon International

- NORMA Group

- Panduit

- Penn Engineering & Manufacturing Corp.

- Sesco Industries Inc.

- SHUR-LOK (Precision Castparts Corp.)

- Slidematic Precision Components

- Standard Fasteners Ltd.

- Stanley Black & Decker

- Wenzhou Longhua Daily Electron

Industrial Fasteners Industry Developments

January 2022: HellermannTyton expanded its factory at the International Medical & Technology Park in Plymouth, UK, to support market growth and increase its capacity.

January 2022: Norwegian Dokka Fasteners announced its expansion in Europe by establishing a manufacturing unit in Klaipėda, Lithuania to increase their product portfolio.

March 2022: Birmingham Fastener and Supply Inc. announced its expansion in Texas under Houston Fastener Manufacturing to provide their services to the oil & natural gas industry.

Industrial Fasteners Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Clamps

- Cable Ties

- Nuts & Bolts

- Screws

- Nails

- Washers

- Anchors

- Rivets

- Others

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastic

- Metal

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Home Appliances

- Lawn & Garden

- Motors & Pumps

- Furniture

- Plumbing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 97.62 billion |

|

Market Size Value in 2025 |

USD 101.83 billion |

|

Revenue Forecast by 2034 |

USD 146.83 billion |

|

CAGR |

4.40% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 97.62 billion in 2024 and is projected to grow to USD 146.83 billion by 2034.

The global market is projected to register a CAGR of 4.40% during the forecast period.

In 2024, North America accounted for the largest market share, driven by the presence of key industry players and a rising focus on sustainable and high-performance fasteners.

A few of the key players in the market are Penn Engineering & Manufacturing Corp.; SHUR-LOK (Precision Castparts Corp.); Slidematic Precision Components; Sesco Industries Inc; Stanley Black & Decker; Standard Fasteners Ltd.; Hellermann Tyton; Panduit; Advanced Cable Ties, Inc.; and BAND-IT IDEX, Inc.

In 2024, the nuts & bolts segment held the largest market share due to the high demand for durable and reliable fastening solutions in structural applications.

The plastic segment is expected to witness a higher growth rate during the forecast period due to its low cost and high durability.