Gelatin Market Size, Share, Trends, Industry Analysis Report: By Source (Swine Skin, Bovine Skin, Animal Bones, and Others), Application, Type, Function, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1271

- Base Year: 2024

- Historical Data: 2020-2023

Gelatin Market Overview

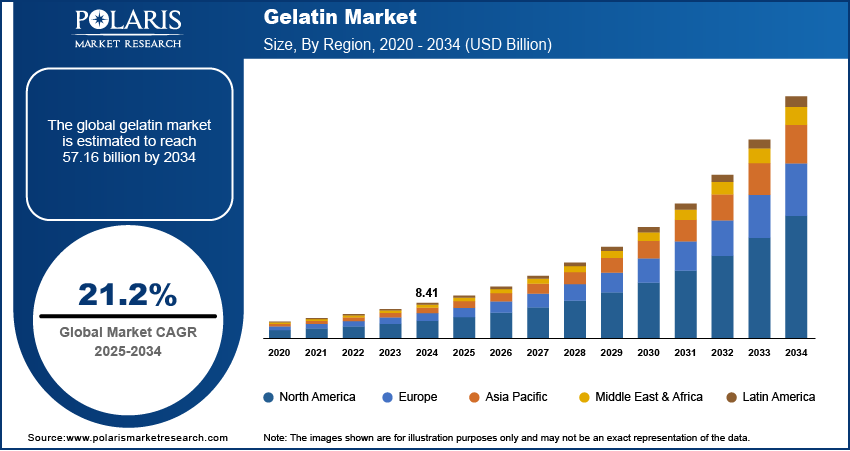

The global gelatin market size was valued at USD 8.41 billion in 2024. The market is projected to grow from USD 10.15 billion in 2025 to USD 57.16 billion by 2034. It is projected to exhibit a CAGR of 21.2% from 2025 to 2034.

Gelatin is a colorless, translucent protein obtained from animal collagen, typically extracted from the bones and skin of pigs or cattle. When mixed with hot water and then cooled, gelatin develops a gel-like texture, making it perfect for achieving smooth consistency in different uses. Due to its gelling abilities, gelatin is commonly used in food items such as jellies, gummy sweets, marshmallows, and desserts. It also finds applications in pharmaceuticals, cosmetics, and photography.

The global gelatin market is growing rapidly, fueled by the rising demand for functional foods, drinks, and pharmaceutical applications. The shifting preference towards clean-label products and their growing application in cosmetics aid market expansion. In addition, improvements in production technologies and the development of alternative gelatins, which address dietary and ethical issues, support the growth of the market.

The rising use of gelatin in gummy supplements highlights how producers are aligning with consumer desires for health-oriented products. This trend is promoting diversification in the gelatin market, enhancing its attractiveness and encouraging ongoing growth in the face of competition. Gelatin manufacturers are also partnering with pharmaceutical firms to address the growing need for personalized medicine, improved nutrients, and novel drug delivery methods. By providing customized solutions, market participants can capitalize on emerging opportunities and enhance their position in health and wellness-oriented markets.

To Understand More About this Research: Request a Free Sample Report

Gelatin Market Dynamics

Rising Pharmaceutical and Nutraceutical Industries

The pharmaceutical and nutraceutical industries are experiencing increased demand for gelatin, where it’s used to make capsules and drug delivery systems. Gelatin finds applications in producing both soft and hard capsules, facilitating effective encapsulation of drugs. Its use in dietary supplements enables easy consumption of vitamins and minerals. The increasing demand for nutraceuticals, including collagen supplements for skin and joint wellness, underscores gelatin's adaptability in addressing health needs, consequently driving the gelatin market expansion.

Growing Demand in Food & Beverage Industry

The increasing demand for gelatin in the food and beverage industry derives from its multifunctional role as a gelling agent, stabilizer, and thickener in items such as desserts, yogurts, and candies. Gelatin allows food producers to achieve the preferred texture in marshmallows and gummy candies and contributes to creaminess and stability in yogurt. The rising preference for processed and convenience foods, driven by busy lifestyles, has led to increased demand for gelatin. Desserts and jellies made from gelatin have become popular as luxurious yet convenient options, meeting the demands of modern consumers. Thus, the rising usage of gelatin in food and beverages boosts the gelatin market revenue.

Gelatin Market Segment Insights

Gelatin Market Outlook Based on Source

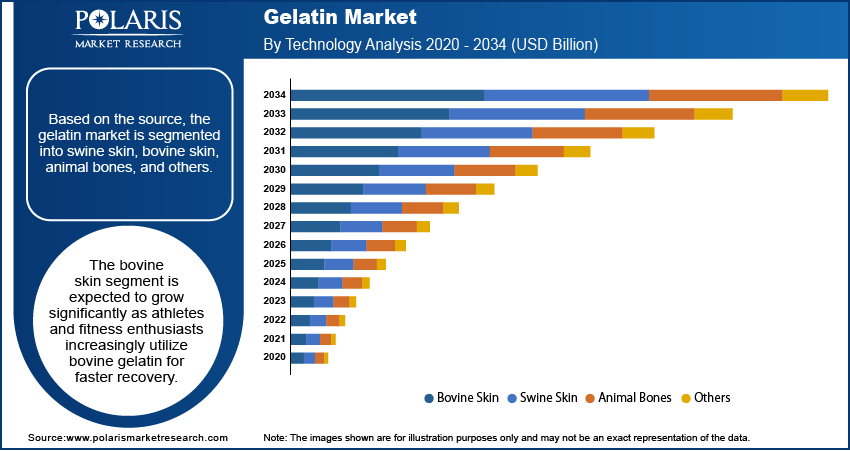

The gelatin market, based on source, is segmented into swine skin, bovine skin, animal bones, and others. The bovine skin segment is anticipated to witness significant growth from 2025 to 2034 as athletes and fitness enthusiasts are increasingly turning to bovine gelatin for quicker recovery. The amino acids in bovine gelatin enhance endurance and performance during exercise and athletic activities. Offered in capsules, tablets, and powder forms, the gelatin is especially preferred due to its easy swallowing and absence of a bitter aftertaste. Gelatin derived from bovine is utilized in food, pharmaceuticals, and cosmetics as a flexible gelling agent, further contributing to the segment’s robust growth.

Gelatin Market Assessment Based on Type

The gelatin market, based on type, is segmented into Type A and Type B. The Type A segment is projected to witness the fastest growth during the projection period. Type A gelatin, mainly derived from pig skin, provides better storage stability than Type B gelatin, which is generally obtained from beef skin. This excellent storage stability of Type A gelatin makes it the favored option for many end users. Also, Type A gelatin is experiencing significant demand from the food industry, where it is used for its functional attributes and flexibility.

Gelatin Market Regional Analysis

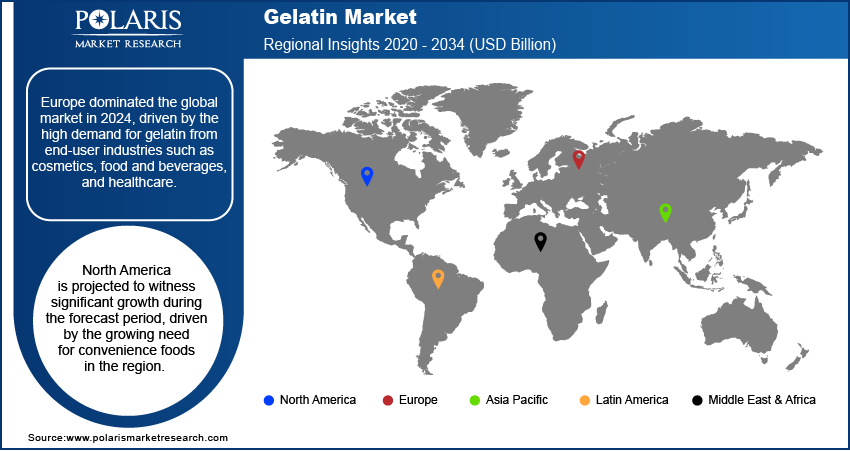

By region, the report offers the gelatin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe led the global market with the largest revenue share of 41% in 2024, driven by the high demand for gelatin from various end-use industries such as cosmetics, food & beverages, and healthcare. In addition, the presence of leading gelatin manufacturers, including Biogel AG, Prowico, and Gelita, contributes to the region’s leading position in the global market.

Gelatin used in the UK is mainly sourced from bovine and porcine due to the high consumption of pork and beef. The demand for gelatin in the country can be attributed to increasing sales of cosmetic products and a solid meat processing industry. The combination of abundant resources and leading market participants is anticipated to enhance gelatin production in the country, supporting its rising demand in various sectors during the forecast period.

North America is projected to witness significant growth during the forecast period, driven by the growing need for convenience foods in the region. In addition, the booming personal care and pharmaceutical industries in North America are expected to contribute to the regional market demand.

Gelatin Market – Key Players and Competitive Insights

The leading players in the market are emphasizing research and development initiatives to improve their product offerings. Key market players are also undertaking various strategic initiatives such as mergers and acquisitions, and collaborations to expand their global reach. To expand and survive in a more competitive and rising market environment, market participants must offer innovative and sustainable solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase the market share. In recent years, the market for gelatin has witnessed several technological and innovation breakthroughs. The gelatin market report offers a market assessment of all the key players, including STERLING GELATIN; PAN Biotech GmbH; Rousselot; Shanghai Al-Amin Biotechnology Co., Ltd.; Junca Gelatines SL; Tessenderlo Group; Nitta Gelatin, Inc.; GELITA AG; Weishardt Holding SA; and PB Leiner.

List of Key Companies in Gelatin Market

- GELITA AG

- Junca Gelatines SL

- Nitta Gelatin, Inc.

- PAN Biotech GmbH

- PB Leiner

- Rousselot

- Shanghai Al-Amin Biotechnology Co., Ltd.

- STERLING GELATIN

- Tessenderlo Group

- Weishardt Holding SA

Gelatin Industry Developments

December 2023: Rousselot, the health brand of Darling Ingredients, announced that it received a U.S. Patent for its new, unique gelatin StabiCaps. According to Rousselot, StabiCaps optimizes the formulation and stability of soft gel capsules, facilitating the release of active ingredients such as medications.

April 2023: GELITA launched CONFIXX, a quick-setting gelatin that transforms the production of fortified gummies. The gelatin, free of starch, provides an equal-quality texture to starch-based techniques. It enables producers to include different active components, simplify manufacturing, cut expenses, and maintain premium gummies, addressing the needs of the expanding supplement industry.

Gelatin Market Segmentation

By Source Outlook

- Swine Skin

- Bovine Skin

- Animal Bones

- Others

By Application Outlook

- Food & Beverages

- Pharmaceuticals

- Health & Nutrition

- Cosmetics

- Personal Care

- Animal Feed

By Type Outlook

- Type A

- Type B

By Function Outlook

- Thickener

- Stabilizer

- Gelling Agent

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gelatin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.41 billion |

|

Market Size Value in 2025 |

USD 10.15 billion |

|

Revenue Forecast by 2034 |

USD 57.16 billion |

|

CAGR |

21.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Gelatin Industry Trends Analysis (2024) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The gelatin market size was valued at USD 8.41 billion in 2024 and is projected to grow to USD 57.16 billion by 2034.

The gelatin market is projected to register a CAGR of 21.2% from 2025 to 2034.

Europe accounted for the largest region-wise market size in 2024.

STERLING GELATIN; PAN Biotech GmbH; Rousselot; Shanghai Al-Amin Biotechnology Co., Ltd.; Junca Gelatines SL; Tessenderlo Group; Nitta Gelatin, Inc.; GELITA AG; Weishardt Holding SA; and PB Leiner are a few key players in the market.

The bovine skin segment is anticipated to register significant growth during the forecast period.

The Type A segment is projected to witness the fastest growth during the projection period.