Epilepsy Drugs Market Size, Share, Trends, Industry Analysis Report: By Type (First Generation Anti-epileptics, Second Generation Anti-epileptics, and Third Generation Anti-epileptics), Route of Administration, Antiepileptic Drugs Type, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM1315

- Base Year: 2024

- Historical Data: 2020-2023

Epilepsy Drugs Market Overview

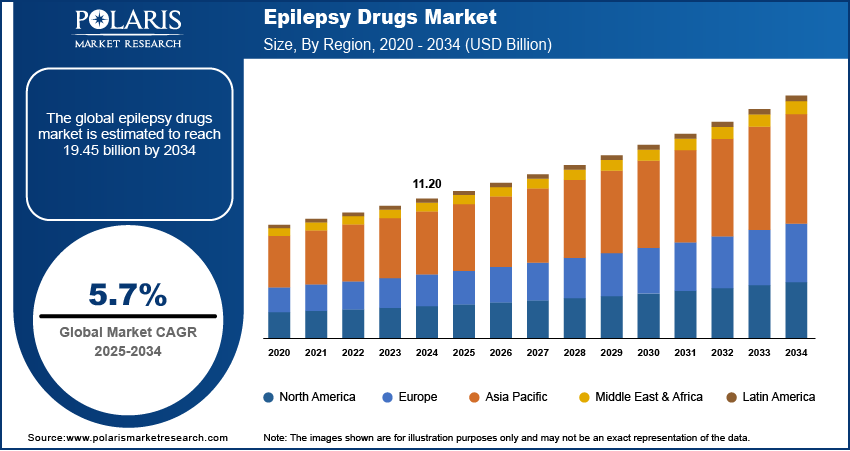

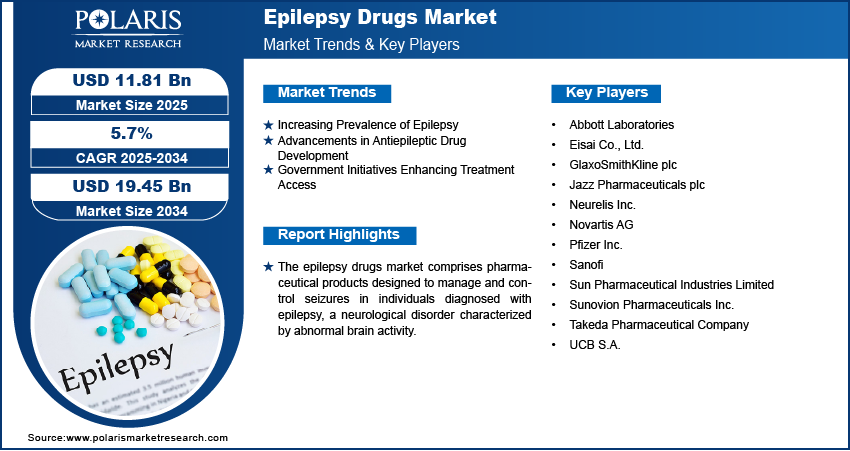

The epilepsy drugs market size was valued at USD 11.20 billion in 2024. The market is projected to grow from USD 11.81 billion in 2025 to USD 19.45 billion by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

The epilepsy drugs market refers to the industry focused on medications designed to manage and treat epilepsy, a neurological disorder characterized by recurrent seizures. These drugs aim to reduce seizure frequency and severity, improving patients' quality of life. The market includes a range of treatment options, from first-generation antiepileptic drugs to newer, more advanced formulations that offer improved efficacy and fewer side effects. With a growing number of epilepsy cases worldwide, the demand for effective medications continues to rise, making this a crucial segment within the broader pharmaceutical industry.

To Understand More About this Research:Request a Free Sample Report

The increasing prevalence of epilepsy, coupled with rising awareness about available treatment options such as epilepsy treatment devices and drugs, is a major factor driving the epilepsy drugs market growth. Additionally, advancements in drug development have led to the introduction of innovative medications with enhanced safety profiles, further boosting market demand. Government initiatives aimed at improving access to healthcare, along with growing investments in neurological research, are also contributing to epilepsy drugs market expansion. Moreover, the development of novel drug delivery systems is expected to enhance treatment outcomes, supporting the market forecast for steady growth in the coming years.

Epilepsy Drugs Market Dynamics

Increasing Prevalence of Epilepsy

The rising prevalence of epilepsy significantly contributes to the epilepsy drugs market development. According to the Centers for Disease Control and Prevention, in 2021, approximately 2.9 million US adults aged 18 and older reported having active epilepsy, accounting for about 1% of the adult population. Globally, the number of epilepsy cases reached over 24 million in 2021, with an age-standardized prevalence rate of 307.38 per 100,000 persons. This increasing prevalence underscores the growing need for effective antiepileptic medications, thereby propelling the market growth.

Advancements in Antiepileptic Drug Development

Continuous research and development efforts have led to significant advancements in antiepileptic drug formulations, enhancing treatment efficacy and patient compliance. For instance, in 2022, the US Food and Drug Administration approved 37 new drugs, including novel therapies aimed at various medical conditions. Fintepla (fenfluramine) oral solution received approval in 2020 for the treatment of Dravet syndrome, a type of epilepsy, in patients aged two and older. In 2022, CDER also approved Fintepla for managing Lennox-Gastaut syndrome, another form of epilepsy, in the same age group. Additionally, recent studies have highlighted the introduction of drugs like brivaracetam, cannabidiol, cenobamate, everolimus, and fenfluramine, which have been employed in patients with epilepsy. These advancements in drug development contribute to the epilepsy drugs market growth by offering more effective treatment options.

Government Initiatives Enhancing Treatment Access

Government initiatives aimed at improving access to epilepsy treatment have played a crucial role in creating epilepsy drugs market opportunities. For instance, the US Department of Veterans Affairs has established the Epilepsy Centers of Excellence (ECoE) to provide comprehensive epilepsy care to veterans. A 2024 study concluded that the total number of unique patient clinical visits for therapeutic and diagnostic encounters in these centers rose by 74%, increasing from 10,487 in 2011 to 18,285 in 2023. This growth was nearly double the 39.5% increase in workforce strength, which expanded from 119 in 2011 to 166 in 2022 over a comparable period. Additionally, the Centers for Disease Control and Prevention (CDC) reported that epilepsy and seizures cost the nation at least USD 24.5 billion per year in medical costs, highlighting the economic impact and the need for accessible treatment options. These government efforts enhance patient access to care and stimulate the market growth.

Epilepsy Drugs Market Segment Insights

Epilepsy Drugs Market Assessment – By Type

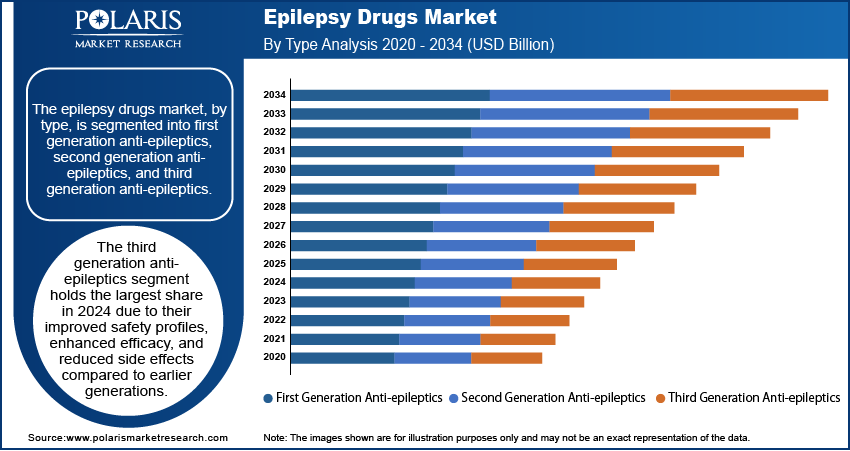

The epilepsy drugs market, by type, is segmented into first generation anti-epileptics, second generation anti-epileptics, and third generation anti-epileptics. The third generation anti-epileptics segment holds the largest market share in 2024 due to their improved safety profiles, enhanced efficacy, and reduced side effects compared to earlier generations. These newer drugs, such as lacosamide, perampanel, and brivaracetam, are designed with advanced mechanisms of action that provide better seizure control, particularly in patients suffering from drug-resistant or refractory epilepsy. Additionally, growing physician preference and patient adherence to these therapies have contributed to their wider adoption. The increasing availability of third-generation drugs through favorable reimbursement policies and expanded regulatory approvals across major markets has further accelerated their uptake. Moreover, rising awareness about epilepsy management and the growing demand for innovative treatment options have supported the segment’s dominance. As healthcare providers increasingly prioritize personalized and precision-based approaches to treatment, third-generation anti-epileptics have emerged as the preferred choice, strengthening their leading position in the market.

The second generation anti-epileptics segment is expected to witness the highest CAGR during the forecast period. These drugs often offer advantages such as reduced side effects, fewer drug interactions, and improved patient compliance. The continuous introduction of innovative therapies within this category has garnered significant attention from both healthcare professionals and patients seeking alternative treatment options. This growing interest, coupled with ongoing research and development efforts, positions the second generation anti-epileptics segment as the fastest growing within the epilepsy drugs market.

Epilepsy Drugs Market Evaluation – By Route of Administration

The epilepsy drugs market, by route of administration, is segmented into oral, intravenous, and intra-muscular. In 2024, the oral segment holds the largest share of the epilepsy drugs market revenue. The segment encompasses medications administered through the mouth, offering a non-invasive and convenient method for managing epilepsy. This route allows for easy self-administration, facilitating better adherence to prescribed regimens. The widespread availability of oral formulations, including tablets and capsules, further enhances accessibility for patients across various healthcare settings.

The intravenous segment involves the administration of antiepileptic drugs directly into the bloodstream, typically used in acute care settings for rapid seizure control. Advancements in intravenous formulations have improved their efficacy and safety profiles, making them more appealing for emergency interventions. The increasing prevalence of epilepsy-related emergencies and the need for immediate therapeutic responses have heightened the demand for intravenous treatments. Consequently, the intravenous segment is experiencing the highest growth rate within the epilepsy drugs market.

Epilepsy Drugs Market Outlook – By Antiepileptic Drugs Type

The epilepsy drugs market, by antiepileptic drugs type, is segmented into narrow-spectrum AEDs and broad-spectrum AEDs. The broad-spectrum AEDs segment secured the largest market share of the market. The broad-spectrum AEDs segment includes medications effective against various seizure types, making them versatile in treating diverse epilepsy forms. These drugs are often preferred due to their ability to manage multiple seizure types within a single patient, simplifying treatment regimens.

The epilepsy drugs market statistics indicate that this narrow-spectrum AEDs segment is experiencing the highest growth rate, driven by advancements in drug development and a better understanding of seizure pathophysiology. The narrow-spectrum AEDs segment comprises drugs tailored to specific seizure types, offering targeted therapeutic effects. The increasing emphasis on personalized medicine and the development of novel narrow-spectrum AEDs have contributed to their growing adoption.

Epilepsy Drugs Market Regional Insights

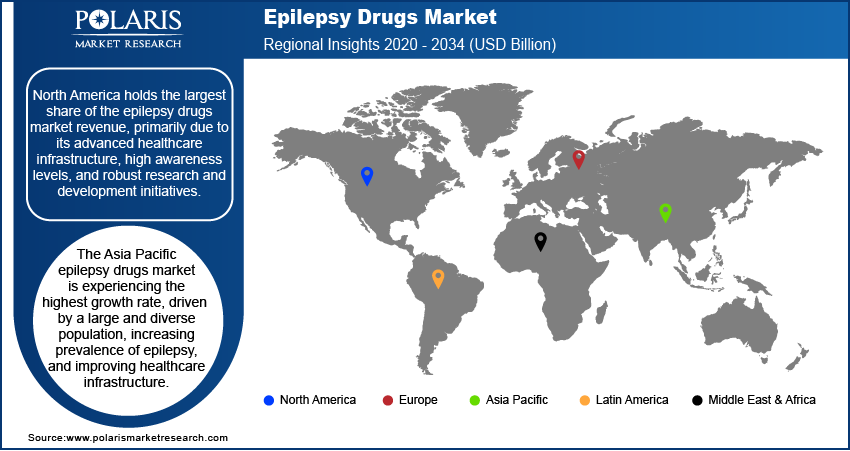

In terms of region, the epilepsy drugs market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region exhibits distinct market dynamics influenced by factors such as healthcare infrastructure, prevalence of epilepsy, governmental policies, and ongoing research and development activities. Understanding these regional variations is crucial for stakeholders aiming to navigate the global landscape of epilepsy treatment effectively.

North America holds the largest share of the epilepsy drugs market revenue, primarily due to its advanced healthcare infrastructure, high awareness levels, and robust research and development initiatives. The US, in particular, leads in drug innovation, with numerous pharmaceutical companies developing new antiepileptic drugs and expanding treatment options. Favorable reimbursement policies and widespread access to healthcare contribute to increased drug adoption. The growing number of diagnosed epilepsy cases, along with an aging population, further boosts the demand for effective epilepsy treatments, thereby strengthening North America's dominant market position.

The Asia Pacific epilepsy drugs market is experiencing the highest growth rate, driven by a large and diverse population, increasing prevalence of epilepsy, and improving healthcare infrastructure. Countries such as China and India are witnessing rapid urbanization and enhanced access to medical services, leading to higher diagnosis and treatment rates. Government initiatives aimed at improving healthcare access and affordability, along with rising awareness about neurological disorders, are further propelling market growth in this region.

Epilepsy Drugs Market – Key Players and Competitive Insights

The epilepsy drugs market features several major companies actively involved in developing and providing treatments for epilepsy. A few key players include UCB S.A.; Sanofi; Pfizer Inc.; Eisai Co., Ltd.; Abbott Laboratories; Novartis AG; GlaxoSmithKline plc; Sunovion Pharmaceuticals Inc. (a subsidiary of Sumitomo Pharma); Jazz Pharmaceuticals plc; Neurelis Inc.; Takeda Pharmaceutical Company; and Sun Pharmaceutical Industries Limited. These companies are dedicated to advancing therapeutic options for epilepsy patients, offering a range of products and services tailored to manage and treat various forms of the condition.

The competitive landscape of the epilepsy drugs market is characterized by robust research and development initiatives, strategic partnerships, and a focus on expanding product portfolios. Companies strive to innovate and introduce novel therapies to address unmet medical needs and improve patient outcomes. Collaborations, such as the one between Stoke Therapeutics and Biogen Inc. for the development of treatments targeting severe childhood epilepsy, exemplify the industry's commitment to advancing care through combined expertise and resources. Additionally, mergers and acquisitions, such as H. Lundbeck A/S's agreement to acquire Longboard Pharmaceuticals, underscore the dynamic nature of the market as companies seek to strengthen their positions and enhance their offerings.

UCB S.A. is a global biopharmaceutical company specializing in neurology and immunology. The company offers several antiepileptic drugs, including Keppra (levetiracetam), Briviact (brivaracetam), and Vimpat (lacosamide), which are widely used in the management of various seizure types. UCB's commitment to epilepsy care is evident through its continuous investments in research and development to improve treatment options and patient quality of life.

Eisai Co., Ltd. is a pharmaceutical company with a strong focus on neurology and oncology. In the epilepsy market, Eisai offers Fycompa (perampanel), a medication approved for the treatment of partial-onset seizures and primary generalized tonic-clonic seizures in epilepsy patients. Eisai's dedication to addressing neurological disorders is reflected in its ongoing research efforts and commitment to providing innovative solutions for epilepsy management.

List of Key Companies in Epilepsy Drugs Market

- Abbott Laboratories

- Eisai Co., Ltd.

- GlaxoSmithKline plc

- Jazz Pharmaceuticals plc

- Neurelis Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- Sun Pharmaceutical Industries Limited

- Sunovion Pharmaceuticals Inc. (a subsidiary of Sumitomo Pharma)

- Takeda Pharmaceutical Company

- UCB S.A.

Epilepsy Drugs Industry Developments

- February 2025: Stoke Therapeutics Inc. and Biogen Inc. announced a collaboration to develop and commercialize zorevunersen, a treatment for Dravet syndrome, a severe form of childhood epilepsy. Under the agreement, Stoke retains rights in the US, Canada, and Mexico, while Biogen will manage markets in the Rest of world.

- April 2024: Eisai Co., Ltd. officially launched the intravenous (IV) formulation of its internally developed antiepileptic drug (AED), Fycompa (perampanel hydrate), in Japan. This novel injection formulation is designed to enhance patient management in epilepsy treatment.

Epilepsy Drugs Market Segmentation

By Type Outlook (Revenue-USD Billion, 2020–2034)

- First Generation Anti-epileptics

- Second Generation Anti-epileptics

- Third Generation Anti-epileptics

By Route of Administration Outlook (Revenue-USD Billion, 2020–2034)

- Oral

- Intravenous

- Intra-muscular

By Antiepileptic Drugs Type Outlook (Revenue-USD Billion, 2020–2034)

- Narrow-Spectrum AEDs

- Broad-Spectrum AEDs

By Distribution Channel Outlook (Revenue-USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Epilepsy Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.20 billion |

|

Market Size Value in 2025 |

USD 11.81 billion |

|

Revenue Forecast by 2034 |

USD 19.45 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The epilepsy drugs market has been segmented into detailed segments of type, route of administration, antiepileptic drugs type, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The epilepsy drugs market growth and marketing strategy focuses on expanding product portfolios, increasing market penetration, and leveraging strategic partnerships. Companies invest in research and development to introduce novel therapies with improved efficacy and safety profiles. Expanding geographic reach, particularly in emerging markets, is a key approach to tapping into underserved patient populations. Additionally, digital marketing, patient awareness programs, and collaborations with healthcare providers play a crucial role in enhancing brand visibility and driving drug adoption. Regulatory approvals and fast-track designations also support epilepsy drugs market expansion by accelerating the introduction of new treatments.

FAQ's

The epilepsy drugs market size was valued at USD 11.20 billion in 2024 and is projected to grow to USD 19.45 billion by 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the epilepsy drugs market include UCB S.A.; Sanofi, Pfizer Inc.; Eisai Co., Ltd.; Abbott Laboratories; Novartis AG; GlaxoSmithKline plc; Sunovion Pharmaceuticals Inc. (a subsidiary of Sumitomo Pharma); Jazz Pharmaceuticals plc; Neurelis Inc.; Takeda Pharmaceutical Company; and Sun Pharmaceutical Industries Limited.

The oral segment accounted for the largest share of the market in 2024.

Epilepsy drugs, also known as antiepileptic drugs (AEDs), are medications used to manage and prevent seizures in individuals diagnosed with epilepsy. These drugs work by stabilizing electrical activity in the brain, reducing excessive nerve signaling that leads to seizures. AEDs are categorized into narrow-spectrum and broad-spectrum types, depending on whether they target specific seizure types or a wider range of epileptic conditions. They are administered through various routes, including oral, intravenous, and intramuscular methods, depending on the severity and urgency of treatment. While AEDs do not cure epilepsy, they help control seizure frequency and severity, significantly improving the quality of life for patients.