Diabetes Drug Market Size, Share, Trends, Industry Analysis Report: By Type (Type-1 and Type-2), Drug Class, Route of Administration, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 117

- Format: PDF

- Report ID: PM1327

- Base Year: 2024

- Historical Data: 2020-2023

Diabetes Drug Market Overview

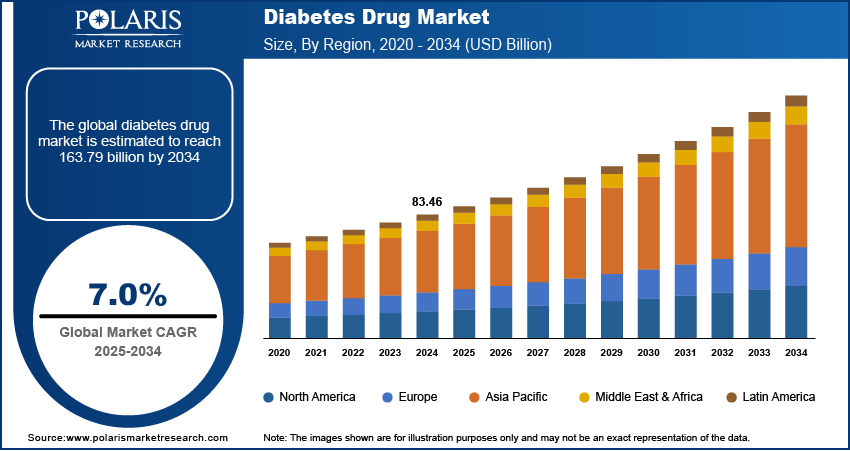

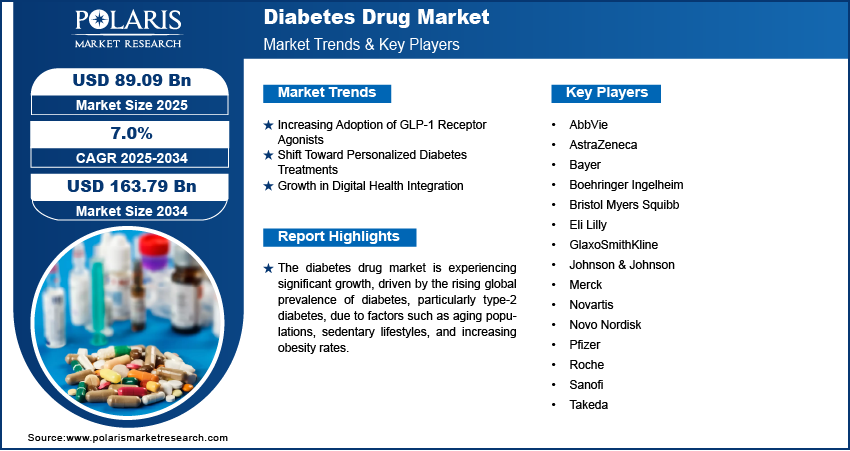

The diabetes drug market size was valued at USD 83.46 billion in 2024. The market is projected to grow from USD 89.09 billion in 2025 to USD 163.79 billion by 2034, exhibiting a CAGR of 7.0% during 2025–2034.

The diabetes drug market refers to the sector involved in the development, manufacturing, and distribution of pharmaceutical products used to manage and treat diabetes, including type-1 and type-2 diabetes. Key drivers in this market include the rising prevalence of diabetes globally, an aging population, and increasing awareness of diabetes management. Additionally, advances in drug formulations, the growth of personalized medicine, and the adoption of digital health technologies are contributing to market expansion. Diabetes drug market trends such as the shift toward biologics, continuous glucose monitoring devices, and the emergence of novel therapies such as GLP-1 receptor agonists and SGLT2 inhibitors are expected to boost market expansion in the coming years.

To Understand More About this Research: Request a Free Sample Report

Diabetes Drug Market Dynamics

Increasing Adoption of GLP-1 Receptor Agonists

Glucagon-like peptide-1 (GLP-1) receptor agonists are gaining significant traction in the treatment of type-2 diabetes due to their ability to improve glycemic control, promote weight loss, and reduce the risk of cardiovascular events. Medications such as semaglutide and liraglutide are becoming first-line treatments for many patients. These drugs mimic the effects of GLP-1, which increases insulin secretion and inhibits glucagon release in response to meals. According to the American Diabetes Association, GLP-1 receptor agonists have shown positive results in glycemic control and weight reduction, leading to their growing preference among healthcare providers. Their continued development and adoption are expected to drive the diabetes drug market demand as patient requirements for more effective, multi-benefit treatments rise.

Shift Toward Personalized Diabetes Treatments

Personalized or precision medicine in diabetes management is becoming more prominent, with treatments increasingly tailored to individual genetic profiles, lifestyle factors, and co-existing health conditions. This trend is facilitated by advancements in genomics, biomarker research, and digital health tools. Personalized treatments aim to optimize efficacy and minimize side effects by providing individualized care plans. For instance, genetic testing may help identify patients who are more likely to benefit from specific classes of drugs. This approach has the potential to improve patient outcomes, reduce healthcare costs, and increase patient adherence. The rise of genetic testing and the broader use of continuous glucose monitors (CGMs) are expected to enhance this trend in the coming years.

Growth in Digital Health Integration

The integration of digital health technologies into diabetes management is rapidly expanding, driven by the increasing prevalence of diabetes and the demand for more effective disease management tools. Digital solutions, such as mobile apps, wearable devices, and continuous glucose monitors, are enabling more efficient management of blood sugar levels, medication adherence, and lifestyle choices. These technologies offer real-time monitoring, personalized feedback, and data-driven insights that empower patients and healthcare providers to make more informed decisions. A study published in Diabetes Care found that the use of CGMs in people having type-1 diabetes significantly reduced A1C levels and improved glycemic control. The growing reliance on digital health tools is expected to fuel the diabetes drug market development during the forecast period, providing patients with more control over their condition while enhancing treatment outcomes.

Diabetes Drug Market Segment Insights

Diabetes Drug Market Assessment – Type-Based Insights

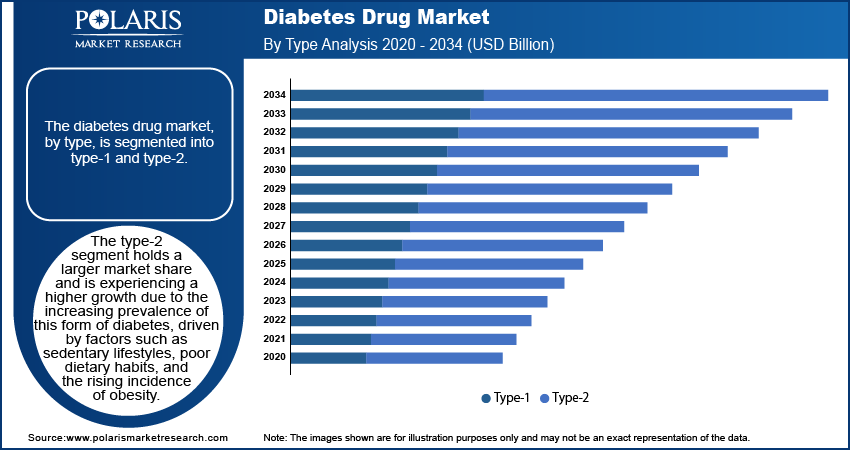

The diabetes drug market, by type, is segmented into type-1 and type-2. The type-2 segment holds a larger market share and is experiencing a higher growth due to the increasing prevalence of this form of diabetes, driven by factors such as sedentary lifestyles, poor dietary habits, and the rising incidence of obesity. Type-2 diabetes, which accounts for approximately 90–95% of all diabetes cases globally, is contributing to the strong demand for medications aimed at managing blood sugar levels and weight and reducing complications associated with the disease. The market for type-2 diabetes drugs is expanding with the adoption of new therapies such as GLP-1 receptor agonists, SGLT2 inhibitors, and DPP-4 inhibitors, which have shown efficacy in improving glycemic control and managing cardiovascular health and weight. Furthermore, the shift toward personalized treatment options and the growth of digital health tools are supporting the segment's growth.

The type-1 segment, while smaller in comparison, is also experiencing growth due to advancements in insulin therapies and the increasing number of diagnosed cases. Insulin remains the primary treatment for type-1 diabetes, but the market is evolving with the introduction of insulin pumps, continuous glucose monitors, and adjunctive therapies. Despite being a smaller segment, type-1 diabetes treatments are gaining attention as the focus shifts toward improving the quality of life for patients through technological integration and innovations in insulin delivery systems. The growing awareness of type-1 diabetes management and advancements in the development of novel therapies contribute to a steady increase in market demand for this segment.

Diabetes Drug Market Evaluation – Route of Administration-Based Insights

The diabetes drug market, by route of administration, is segmented into oral, intravenous, and subcutaneous. The oral segment holds the largest share of the diabetes drug market revenue due to its convenience, ease of use, and patient preference for noninvasive treatment options. Oral medications, such as metformin, DPP-4 inhibitors, and SGLT2 inhibitors, are widely prescribed for the management of type-1 and type-2 diabetes. The growing adoption of these oral therapies is driven by their proven efficacy in controlling blood sugar levels and their established safety profiles. Oral drugs are particularly popular in type-2 diabetes treatment, where patients often require long-term management to control their condition. The segment dominance is further supported by the continuous development of new oral medications that offer additional benefits, such as weight management and cardiovascular protection.

The intravenous (IV) segment is registering notable growth driven by the increasing adoption of advanced therapies such as insulin infusions and biologic treatments. IV therapies are primarily used in hospital settings for patients suffering from severe or uncontrolled diabetes, especially in emergency situations or during initial treatment phases. This segment is benefiting from technological advancements in insulin delivery systems, including insulin pumps and smart infusion devices that provide more precise control of blood glucose levels. Additionally, the growth of biologic drugs and other injectable therapies, combined with the rising incidence of diabetes-related complications, is contributing to the expanding use of intravenous treatments in hospital and clinical settings.

Diabetes Drug Market Outlook – Drug Class-Based Insights

The diabetes drug market, by drug class, is segmented into insulin, sensitizers, SGLT-2 inhibitors, alpha-glucosidase inhibitors, and others. The insulin segment holds the largest market share due to its long-established role as the primary treatment for both type-1 and type-2 diabetes. Insulin therapies, including rapid-acting, long-acting, and premixed formulations, are crucial for managing blood glucose levels in patients having insulin deficiency or resistance. The segment's dominance is driven by the high number of type-1 diabetes patients who rely on insulin for daily management, as well as the increasing need for insulin therapy in advanced type-2 diabetes cases. Technological advancements, such as insulin pumps and continuous glucose monitoring systems, are further enhancing the convenience and effectiveness of insulin administration, supporting the continued growth of this segment.

The SGLT-2 inhibitors segment is registering the highest growth, driven by their dual benefits of improving blood glucose control and offering cardiovascular and renal protection. Drugs, including empagliflozin and canagliflozin, are gaining popularity, particularly in type-2 diabetes management, due to their ability to lower blood sugar by inhibiting sodium-glucose co-transporter-2 in the kidneys, which promotes glucose excretion. These medications are increasingly preferred due to their favorable impact on weight loss and heart health, which aligns with the growing focus on holistic diabetes management. As the clinical evidence supporting SGLT-2 inhibitors' long-term benefits continues to expand, this class is expected to experience significant growth in the coming years.

Diabetes Drug Market Regional Analysis

By region, the study provides diabetes drug market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the diabetes drug market, primarily driven by the high prevalence of diabetes, advanced healthcare infrastructure, and strong healthcare spending in the region. The US, in particular, accounts for a significant portion of the market due to the rising number of diabetes cases, particularly type-2 diabetes, influenced by factors such as obesity and aging demographics. The region also benefits from the presence of leading pharmaceutical companies, continuous advancements in diabetes treatment technologies, and the availability of innovative therapies such as GLP-1 receptor agonists and SGLT-2 inhibitors. Moreover, North America's well-established reimbursement policies and widespread access to healthcare services contribute to its dominance in the global diabetes drug market share.

Europe holds a significant share of the diabetes drug market revenue, driven by the increasing prevalence of diabetes and an aging population. The region is witnessing a steady rise in the number of diabetes cases, particularly type-2 diabetes, due to lifestyle changes, sedentary habits, and poor dietary patterns. European countries with advanced healthcare systems, such as Germany, the UK, and France, lead in the adoption of innovative diabetes treatments, including insulin therapies, GLP-1 receptor agonists, and SGLT-2 inhibitors. Additionally, the region is experiencing growth in the adoption of personalized medicine and digital health tools for diabetes management, further boosting the Europe diabetes drug market expansion. The region also benefits from strong regulatory support and public health initiatives aimed at managing diabetes, which contributes to the market's positive outlook.

Asia Pacific is one of the fastest-growing markets for diabetes drugs, driven by the rising prevalence of diabetes, particularly in countries such as China, India, and Japan. The region is experiencing significant demographic shifts, including urbanization and an aging population, which are contributing to the increasing prevalence of type-2 diabetes. In addition to lifestyle changes, factors such as rapid economic growth and growing healthcare access are driving the demand for diabetes medications. The market is also benefiting from increased awareness of diabetes management and the introduction of newer, more effective drug therapies. However, challenges such as varying healthcare infrastructure across countries and affordability issues may impact market growth in certain areas. Despite this, Asia Pacific is expected to continue expanding due to its large patient population and increasing adoption of advanced diabetes treatments.

Diabetes Drug Market – Key Players and Competitive Insights

Key players in the diabetes drug market include major pharmaceutical companies such as Novo Nordisk, Sanofi, Eli Lilly, Merck, and Boehringer Ingelheim. These companies are actively involved in the development, production, and distribution of a wide range of diabetes treatments, including insulin therapies, GLP-1 receptor agonists, and SGLT-2 inhibitors. Other notable players include AstraZeneca, Johnson & Johnson, Novartis, Bayer, GlaxoSmithKline, and Takeda. Additionally, companies, including AbbVie, Bristol Myers Squibb, Pfizer, and Roche, are contributing to the market with their innovative treatments for managing type-1 and type-2 diabetes. Companies, such as Insulet Corporation, are focusing on insulin delivery systems and devices, further expanding their presence in the market.

In terms of competition, market players are constantly striving to innovate and introduce new therapies that offer better control of blood glucose levels, improved patient outcomes, and fewer side effects. While large players such as Novo Nordisk and Sanofi dominate the insulin market, the rise of newer therapies such as GLP-1 receptor agonists and SGLT-2 inhibitors has led to increased competition, particularly from companies such as Eli Lilly, Boehringer Ingelheim, and AstraZeneca. As more patients seek treatments that provide multiple benefits, such as cardiovascular protection and weight management, the competition to develop drugs that meet these needs is intensifying.

Despite the growing number of competitors, market players are focusing on strategic partnerships, acquisitions, and collaborations to strengthen their position in the market. Many are also investing in research and development to explore new drug classes and improve the effectiveness of existing therapies. Companies are increasingly adopting personalized medicine approaches, utilizing digital health tools, and expanding their presence in emerging markets to cater to the rising demand for diabetes medications. However, pricing pressures, particularly in regions with strict healthcare regulations, and the challenge of managing diverse patient needs remain key factors influencing the competitive landscape.

Novo Nordisk is a major player in the diabetes drug market, primarily known for its insulin products and other diabetes medications. The company focuses on diabetes treatment, as well as obesity and rare diseases. Novo Nordisk's portfolio includes a variety of insulin products, GLP-1 receptor agonists, and other therapies aimed at managing blood glucose levels. The company has a strong presence globally, with significant market share in developed and emerging markets.

Sanofi is another prominent player in the diabetes drug market, with a diverse range of treatments for both type-1 and type-2 diabetes. The company is involved in the development of insulin therapies, GLP-1 receptor agonists, and other diabetes management medications. Sanofi has been working on expanding access to diabetes care and has a significant presence in established and developing markets. In November 2023, Sanofi revealed a new collaboration with a digital health company to integrate smart insulin pens with mobile apps, allowing patients to track their medication and blood sugar levels more effectively, showcasing their efforts to integrate technology into diabetes care.

List of Key Companies in Diabetes Drug Market

- AbbVie

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol Myers Squibb

- Eli Lilly

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Novo Nordisk

- Pfizer

- Roche

- Sanofi

- Takeda

Diabetes Drug Industry Developments

- In August 2024, Novo Nordisk announced the launch of a new insulin therapy that aims to provide better blood sugar control with fewer injections, reflecting the company’s continued focus on improving patient experience.

- In November 2023, Sanofi announced a global collaboration with Glooko to integrate SoloSmart, a connected device for SoloStar and DoubleStar insulin injection pens, with Glooko's digital platform.

Diabetes Drug Market Segmentation

By Type Outlook

- Type-1

- Type-2

By Route of Administration Outlook

- Oral

- Intravenous

- Subcutaneous

By Drug Class Outlook

- Insulin

- Sensitizers

- SGLT-2 Inhibitors

- Alpha-Glucosidase Inhibitors

- Others

By Distribution Channel

- Retail Pharmacies

- Online Pharmacies

- Hospital Pharmacies

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Diabetes Drug Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 83.46 billion |

|

Market Size Value in 2025 |

USD 89.09 billion |

|

Revenue Forecast by 2034 |

USD 163.79 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The diabetes drug market has been segmented on the basis of type, route of administration, drug class, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The diabetes drug market growth and marketing strategies focus on innovation, expanding access to treatment, and enhancing patient outcomes. Companies are investing heavily in research and development to introduce new therapies, such as GLP-1 receptor agonists and SGLT-2 inhibitors, that offer additional benefits such as weight loss and cardiovascular protection. Strategic collaborations, partnerships, and acquisitions are also key to expanding product portfolios and market reach. Additionally, increasing the availability of digital health solutions, such as continuous glucose monitors and mobile apps, is helping companies improve patient engagement and adherence. Market players are focusing on expanding their presence in emerging markets to capitalize on the rising diabetes prevalence globally.

FAQ's

? The diabetes drug market size was valued at USD 83.46 billion in 2024 and is projected to grow to USD 163.79 billion by 2034.

? The market is projected to register a CAGR of 7.0% during 2025–2034.

? North America had the largest share of the market in 2024.

? A few key players in the diabetes drug market include major pharmaceutical companies such as Novo Nordisk, Sanofi, Eli Lilly, Merck, and Boehringer Ingelheim. These companies are actively involved in the development, production, and distribution of a wide range of diabetes treatments, including insulin therapies, GLP-1 receptor agonists, and SGLT-2 inhibitors.

? The type-2 segment accounted for the larger share of the market in 2024.

? The oral administration segment accounted for the largest share of the market in 2024.

? A diabetes drug refers to any pharmaceutical product used to treat or manage diabetes, a condition where the body is unable to properly regulate blood sugar levels. These drugs help control blood glucose levels, manage symptoms, and reduce the risk of complications associated with diabetes. They include insulin (for type-1 and advanced type-2 diabetes), oral medications such as metformin, sulfonylureas, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT-2 inhibitors, and other classes of drugs. These medications work through various mechanisms, such as enhancing insulin sensitivity, increasing insulin secretion, or blocking glucose absorption, and are prescribed based on the type of diabetes and the individual patient’s needs.

? A few key trends in the market are described below: Rise of GLP-1 Receptor Agonists: Increasing adoption of GLP-1 receptor agonists due to their ability to improve glycemic control and offer additional benefits such as weight loss and cardiovascular protection. Shift Toward Personalized Medicine: Growing focus on tailoring diabetes treatments to individual patient needs, leveraging genomics, biomarkers, and digital health tools. Integration of Digital Health Technologies: Increased use of digital tools such as mobile apps, continuous glucose monitors, and insulin pumps for better diabetes management and real-time data monitoring. Focus on Combination Therapies: Growing preference for combination therapies that target multiple aspects of diabetes, such as insulin resistance and glucose reabsorption.

? A new company entering the diabetes drug market must focus on developing innovative therapies that offer multiple benefits beyond just blood glucose control, such as cardiovascular protection, weight loss, and renal benefits. Focusing on the growing demand for personalized medicine, leveraging genomics and digital health tools to provide tailored treatment plans, could differentiate the company. Additionally, investing in noninvasive drug delivery systems, such as oral medications or smart insulin pens, could appeal to patients seeking more convenient options. The company could also target emerging markets with rising diabetes prevalence, ensuring accessibility and affordability through strategic partnerships and local market understanding.

? Companies manufacturing, distributing, or purchasing diabetes drugs and related products and other consulting firms must buy the report.